Apr 05, 2022

CF Benchmarks Recap - Issue 47

-

Hashdex plants flag on Web 3.0 with CF Benchmarks-driven ETF

-

LMAX Digital becomes CF Benchmarks Constituent Exchange

-

CF Digital Culture Index makes ‘fun’ protocols investible

What Price Digital Culture?

Brazil’s Hashdex launched its latest ETF referencing a freshly minted CFB portfolio; we added LMAX Digital as a Constituent Exchange; and Bitcoin is drifting higher. BRTI skimmed $48,210.77 on 28/03/2022, at 19:33:58 UTC, as BTC enters a fourth month of meandering upwards. The 3-month high coincided with exchange balances at a 2-year low and inflows below 180-day average. This is large-cap crypto habituating to recent stressors. Bewildering from outside looking in, maybe, but the acquisition of one major NFT studio by its rival has been focal. ApeCoin, airdropped soon after, swiftly neared a free float market cap of $4bn, with stunning notional NFT gains a powerful attraction for corporate, HNW, and institutional participants. It makes the need for a battened down NFT asset classification all the more pressing. CF Digital Asset Classification Structure (CF DACS) and new regulated benchmarks informed by it, step into the breach. CF Digital Culture Index is the latest, covering investible digital arts and entertainment protocols. (See below for more). Meanwhile Hashdex’s WEB311 became first pure-play Web3 ETF (details further down) referencing CF WEB 3.0 Smart Contract Platforms Index, which in turn is rooted in CF DACS’s Settlement category and Programmable sub-category). CF DACS’s remarkably aesthetic tripartite design shows we’re just getting started.

Hashdex’s WEB311 is future net ETF Number 1

Long-time CFB partner Hashdex launched the latest in a series of first-of-their-kind ETFs based on the growing line of our portfolios informed by CF Digital Asset Classification Structure, the only regulated crypto taxonomy. The Brazilian asset manager now plants its flag on the rapidly emerging Web 3.0 sector, with WEB311 ETF. With BRL29.42m in net assets, as of March 31, it’s also the first ETF to reference CF Web 3.0 Smart Contract Platforms Index. Both fund and portfolio are vital steps in demarcating settlement and programmable protocols eligible for institutional investment. And, given CF DACS’s evolvability by design, Both WEB311 and its reference index are primed to adapt to an industry in creative flux. (Read more on The Block.)

CF Digital Culture Index maps the future of fun

The Culture sub-category of CF DACS’s Sectors segment underpins another recently formulated CFB portfolio, CF Digital Culture Composite Index. It captures returns from protocols for “digitization and tokenization of cultural experiences and artefacts”. Like CF DeFi Composite Index—rooted in CF DACS’s Finance sub-category—CF Digital Culture comprises 3 sub-portfolios of fixed weight. With the metaverse, NFTs, digitized music and block-chain based video games within its remit, CF Digital Culture is another timely benchmark bringing investible cogency to a digital asset category growing at prodigious rate. (Article excerpt below.)

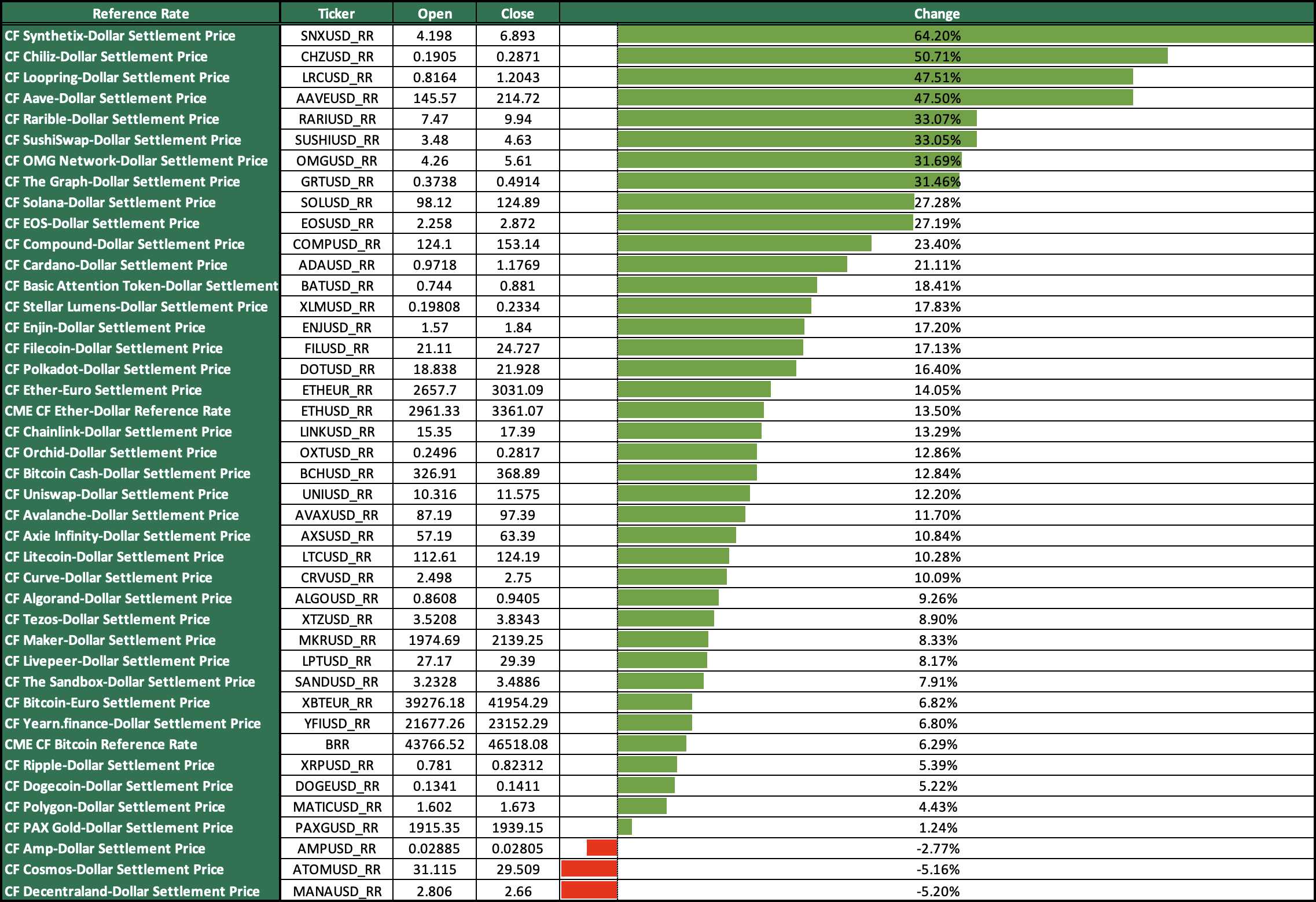

The Returns: March Reference Rate returns

The launch of SNX trading on Binance.US helps explain its March outperformance, whilst token-specific news also aided other coins. More mundanely, easing pressures on established markets encompassed digital assets too, unleashing typical high-beta short-term returns for alts. Meanwhile, CFB’s expanding range of regulated benchmarks leaves fewer and fewer protocols without an institution-ready pricing solution.

Featured benchmarks: CME CF Bitcoin Reference Rate, CF Digital Culture Composite Index

CF Benchmarks adds LMAX Digital as Constituent Exchange

London, 31 March 2022 - CF Benchmarks has announced it is adding market data from LMAX Digital, the leading institutional spot cryptocurrency exchange and custodian, to some of its most liquid and referenced benchmarks.

From early May, LMAX Digital will contribute market data to six CF Benchmarks crypto indices.

These include CME CF Bitcoin Reference Rate and CME CF Bitcoin Real Time Index, CME CF Ether-Dollar Reference Rate and CME CF Ether-Dollar Real Time Index among others.

(Read the full announcement on our website.)

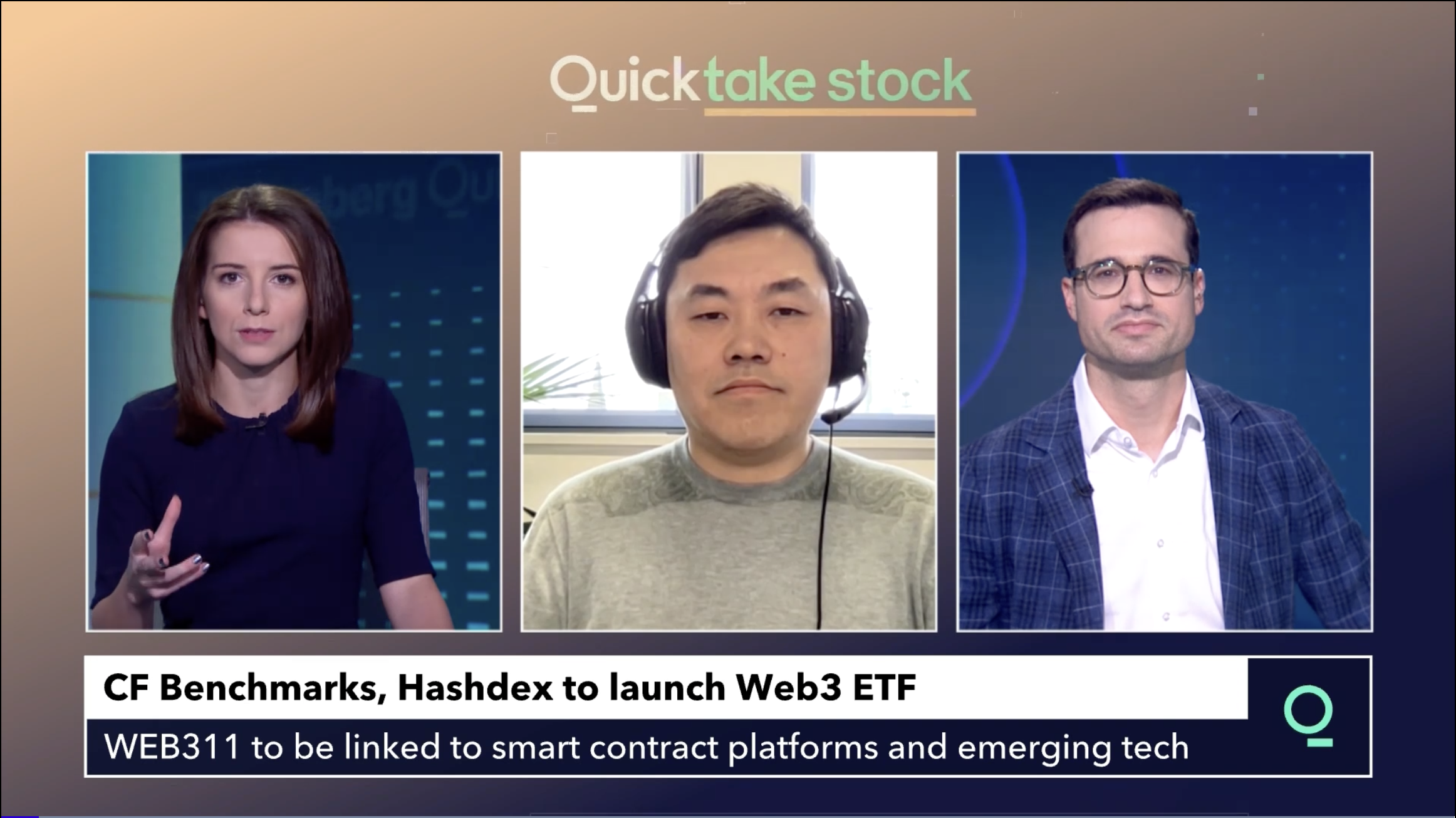

Video: How CF Smart Contract Platforms Index makes sense of Web 3.0

CF Benchmarks’ CEO, Sui Chung explains how CF Web 3.0 Smart Contract Platforms Market Cap Index helps define the rapidly evolving digital asset segment of Web 3.0, thereby providing an investible basis for regulated products, like Hashdex’s WEB311 ETF, the first pure-play Web 3.0 ETF. Click here to watch.

CF Digital Culture Index benchmarks protocols of fun

The latest portfolio index to emerge from CF Digital Asset Classification Structure (CF DACS) maps the investible digital arts and entertainment world of today and tomorrow

The logical extension of CF DACS is representation of its components through replicable and investible benchmark indices directly informed by the structure.

CF DeFi Composite Index was among the first, and it saw initial assets under reference in February, with the launch of Hashdex’s DEFI11, the world’s first pure-play DeFi ETF. CF Web 3.0 Smart Contract Platforms Index, which captures returns of eligible protocols under the Settlement category and Programmable sub-category of CF DACS, followed soon afterwards.

The sequence continues with CF Digital Culture Composite Index.

It’s the investible benchmark of protocols categorised under the Culture sub-category of CF DACS’s Sectors segment.

The index is comprised of three sub-portfolios of fixed weight, representing the blockchain architecture components required to deliver digitized culture:

- Digital Culture Applications (DApps)

- Services

- Settlement Blockchains

(Read the full article on our website.)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Ken Odeluga

Ken Odeluga