Harness the liquidity complexes surrounding CF Benchmarks indices that allow banks to deliver crypto exposure to clients through derivatives and structured products whilst being able to hedge those exposures with fully capital markets regulated products, eschewing the need to hold physical crypto.

Regulatory certainty

The CME CF Bitcoin Reference Rate and CME CF Ether Dollar Reference Rate are being used by major banks and financial institutions to create derivatives and lending products that are offered to institutions.

Accessible Liquidity and Perfect Hedging

The CME CF Bitcoin Reference Rate and CME CF Ether Dollar Reference Rate are the settlement indices for CFTC regulated futures and options listed by CME Group providing banks with fully cleared and regulated hedging instruments.

Comprehensive Ecosystem of Products

The CME CF Bitcoin Reference Rate and CME CF Ether Dollar Reference Rate are referenced by ETFs, NDFs and centrally cleared futures and options that enable the creation of the most sophisticated structures to respond to client demand.

Access a comprehensive complex of regulated instruments

Harness the industry standard benchmark for digital assets and leverage its liquidity complex to deliver comprehensive solution for clients.

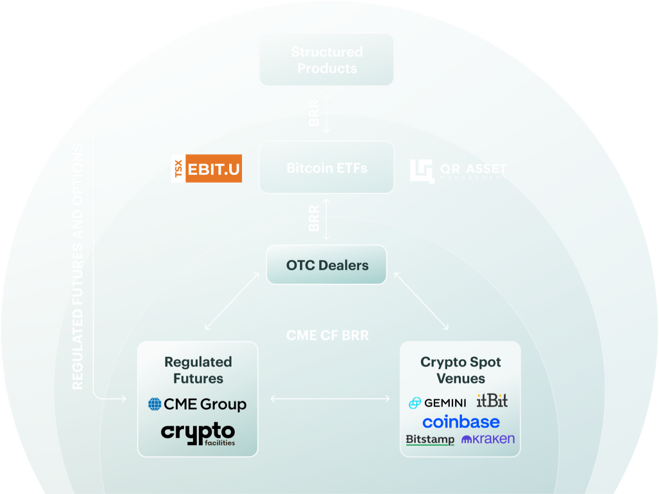

Centrally cleared futures and options settling to the CME CF BRR allow for physical Bitcoin to be bought and sold in unlimited quantities at BRR by OTC dealers creating abundant liquidity for regulated instruments that reference the BRR.

- Multiple product types settle and replicate BRR, giving any products that reference it perfect hedging to the most liquid centrally cleared and regulated bitcoin derivatives complex and delta one instruments opening up a world of opportunity to deliver client needs.

- Fully regulated and Liquid futures, options and physical ETFs that provide perfect tracking allow for the creation and risk management of multiple product and payoff types.

- BRR ETF NAVs track the Bitcoin price perfectly by being 100% invested acquiring and divesting Bitcoin at BRR can be used as Delta-One components.

Learn more

Learn more about the CME CF Ether Dollar Reference Rate

Readily available data through major data vendors

CF Benchmarks provides key index analytics on its website in real time to give index users an up to date picture of price action dynamics and volume flows.

CME CF BRR is published and disseminated through major vendor platforms

- Bloomberg: BRR GO

- Refinitiv: .BRR

- CME MDP and DataMine

Highlighted products

- CF Large Cap Index

The CF Large Cap Index (CFFLCLDN_RR_TR) is a liquid investible benchmark portfolio index designed to track the performance of large-cap digital assets.

$LCAP The Large Cap Index DTF ($LCAP) is a fully collateralized token tracking the CF Large Cap Index and offers a transparent, efficient way to gain exposure to the index that brings the benefits of tokenization

The Large Cap Index DTF ($LCAP) is a fully collateralized token tracking the CF Large Cap Index and offers a transparent, efficient way to gain exposure to the index that brings the benefits of tokenization

- CME CF Bitcoin Reference Rate (BRR)

The CME CF Bitcoin Reference Rate (BRR) is a once a day benchmark index price published at 1600 London time for Bitcoin that aggregates trade data from multiple Bitcoin-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria.

ETFs

- CME CF Bitcoin Reference Rate - New York Variant (BRRNY)

The CME CF Bitcoin Reference Rate - New York Variant (BRRNY) is a once a day benchmark index price published at 1600 New York time for Bitcoin that aggregates trade data from multiple Bitcoin-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria.

ETFs

- CME CF Ether-Dollar Reference Rate

The CME CF Ether-Dollar Reference Rate (ETHUSD_RR) is a once a day benchmark index price published at 1600 London time for Ether that aggregates trade data from multiple Ether-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria.

ETFs

- CME CF Ether-Dollar Reference Rate - New York Variant

The CME CF Ether-Dollar Reference Rate (ETHUSD_NY) - New York Variant is a once a day benchmark index price published at 1600 NY time to synchronise with US equity market close for Ether that aggregates trade data from multiple Ether-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria. Index .

ETFs

- CF Bitcoin Interest Rate (BIRC)

The CF Bitcoin Interest Rate Curve (BIRC) is intended to measure the underlying economic reality of cryptocurrency borrowing and lending, whether outright or implied in traded instruments.

- CME CF Bitcoin Volatility Index (BVX)

The CF Bitcoin Volatility Real Time Index (BVX) is a once a second benchmark representing a forward looking, 30-day constant maturity measure of implied volatility based on CFTC regulated Bitcoin option contracts traded on the CME.

- CF Broad Cap Index

The CF Diversified Broad Cap Index (CFDBCLDN_RR_TR) is a liquid investible benchmark portfolio index designed to track the performance of diversified exposure to a broad portfolio of the digital asset class.

- CF Rolling CME Bitcoin Futures Index

The CF Rolling CME Bitcoin Futures Index (CFCMBTCF_BTC) is a means of replicating the USD returns of holding physical Bitcoins through Bitcoin-USD futures contracts that allow investors to seek USD price exposure to Bitcoin.

- CF Staking Series

The CF ETH Staking Series and CF SOL Staking Series serve as a transparent and representative indicator of the daily realised reward associated with the staking of digital assets. They serve investors in providing an accurate measure of the economic incentives associated with a specific PoS network.

- CF Digital Asset Classification Structure (CF DACS)

The CF DACS classifies coins and tokens based on the services that the associated software protocol delivers to end users, grouping assets by the role they play in delivering services to end users.

Tariff Tensions & Stagflation Signals Spark Sell-off

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby

Digital Assets Decline Despite Regulatory Thaw

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby

Market Recap: Fed Pivot DeFi(es) Historically Weak September

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby