Digital Asset Allocation made easy

CF Benchmarks helps pensions, sovereign wealth funds, insurance companies and other institutional investors navigate the digital asset class and make more informed investment decisions through comprehensive frameworks, tools and price benchmarks to construct, manage and assess their portfolios

Navigate the Blockchain Economy and Understand Exposures of Digital Assets

The Digital Asset universe is constituted of a diverse range of Assets with differing characteristics, use cases and applications. The lack of a coherent classification system by which to segment this universe, understand its constitution and map exposures of digital assets to real world use cases and differing economic activities severely limited any quantitative analysis of the asset class. The CF Digital Asset Classification Structure (CF DACS) gives investors a simple, comprehensive and evergreen framework by which to attribute performance to real world activities and adoption.

Benchmark Digital Asset Pricing

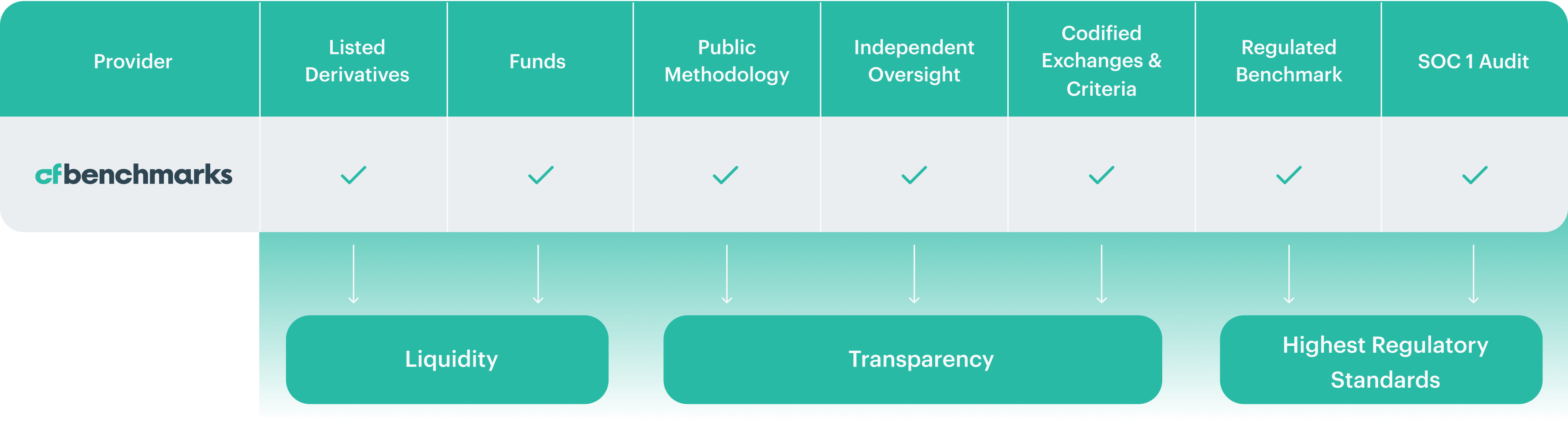

Regulated price benchmarks for all liquid digital assets where underlying transaction data is sourced from multiple reputable crypto exchanges that conform to strict criteria that cover market surveillance, AMLKYC and legal compliance to deliver high integrity price benchmarks that can stand up to the most stringent scrutiny.

Benchmark Portfolio Index Families

Regulated portfolio benchmarks that measure the price performance of specific digital asset exposures including; capitalization ranges, economic sectors and blockchain ecosystem categories utilising portfolio construction techniques that drive comprehensive exposure and weighting techniques that mitigate liquidity, operational and concentration risks.

Readily available data through major data vendors

CF Benchmarks provides key index analytics on its website in real time to give index users an up to date picture of price action dynamics and volume flows.

CME CF BRR is published and disseminated through major vendor platforms

- Bloomberg: BRR GO

- Refinitiv: .BRR

- CME MDP and DataMine

Highlighted products

- CF Large Cap Index

The CF Large Cap Index (CFFLCLDN_RR_TR) is a liquid investible benchmark portfolio index designed to track the performance of large-cap digital assets.

$LCAP The Large Cap Index DTF ($LCAP) is a fully collateralized token tracking the CF Large Cap Index and offers a transparent, efficient way to gain exposure to the index that brings the benefits of tokenization

The Large Cap Index DTF ($LCAP) is a fully collateralized token tracking the CF Large Cap Index and offers a transparent, efficient way to gain exposure to the index that brings the benefits of tokenization

- CME CF Bitcoin Reference Rate (BRR)

The CME CF Bitcoin Reference Rate (BRR) is a once a day benchmark index price published at 1600 London time for Bitcoin that aggregates trade data from multiple Bitcoin-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria.

ETFs

- CME CF Bitcoin Reference Rate - New York Variant (BRRNY)

The CME CF Bitcoin Reference Rate - New York Variant (BRRNY) is a once a day benchmark index price published at 1600 New York time for Bitcoin that aggregates trade data from multiple Bitcoin-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria.

ETFs

- CME CF Ether-Dollar Reference Rate

The CME CF Ether-Dollar Reference Rate (ETHUSD_RR) is a once a day benchmark index price published at 1600 London time for Ether that aggregates trade data from multiple Ether-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria.

ETFs

- CME CF Ether-Dollar Reference Rate - New York Variant

The CME CF Ether-Dollar Reference Rate (ETHUSD_NY) - New York Variant is a once a day benchmark index price published at 1600 NY time to synchronise with US equity market close for Ether that aggregates trade data from multiple Ether-USD markets operated by major cryptocurrency exchanges that conform to the CME CF Constituent Exchange Criteria. Index .

ETFs

- CF Bitcoin Interest Rate (BIRC)

The CF Bitcoin Interest Rate Curve (BIRC) is intended to measure the underlying economic reality of cryptocurrency borrowing and lending, whether outright or implied in traded instruments.

- CME CF Bitcoin Volatility Index (BVX)

The CF Bitcoin Volatility Real Time Index (BVX) is a once a second benchmark representing a forward looking, 30-day constant maturity measure of implied volatility based on CFTC regulated Bitcoin option contracts traded on the CME.

- CF Broad Cap Index

The CF Diversified Broad Cap Index (CFDBCLDN_RR_TR) is a liquid investible benchmark portfolio index designed to track the performance of diversified exposure to a broad portfolio of the digital asset class.

- CF Rolling CME Bitcoin Futures Index

The CF Rolling CME Bitcoin Futures Index (CFCMBTCF_BTC) is a means of replicating the USD returns of holding physical Bitcoins through Bitcoin-USD futures contracts that allow investors to seek USD price exposure to Bitcoin.

- CF Staking Series

The CF ETH Staking Series and CF SOL Staking Series serve as a transparent and representative indicator of the daily realised reward associated with the staking of digital assets. They serve investors in providing an accurate measure of the economic incentives associated with a specific PoS network.

- CF Digital Asset Classification Structure (CF DACS)

The CF DACS classifies coins and tokens based on the services that the associated software protocol delivers to end users, grouping assets by the role they play in delivering services to end users.

Building Bitcoin Capital Market Assumptions

Bitcoin’s institutional adoption demands robust, pragmatic CMA frameworks that integrate quantitative modeling, macro analysis, and valuation to guide strategic and tactical allocations across market cycles and investment horizons.

Gabriel Selby

CF Benchmarks Quarterly Attribution Reports - December 2025

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category, and segment levels during the course of each portfolio rebalance period.

Gabriel Selby

Sell-Off Intensifies Amid Fed Uncertainty

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby