Apr 18, 2024

Decoding Bitcoin Sentiment Ahead of the Halving

A Deep Dive into Price Dynamics, Investor Interest, and Volatility

The market is a pendulum that forever swings between unsustainable optimism and unjustified pessimism.

-Benjamin Graham, The Intelligent Investor

The Bitcoin landscape has undergone a significant transformation, driven by accelerated investor adoption and the innovative spirit that defined its inception. As we approach the fourth Bitcoin halving, which will slash the block rewards earned by miners in half, investors may find it helpful to revisit the notable shifts in investor sentiment. Many investors may be questioning whether the recent recovery in price action is sustainable or if we are about to see another market shift in Bitcoin's mood. This analysis delves into three key sentiment indicators in the Bitcoin market: price, investor interest, and volatility, to help us understand how far we have come and what we should expect going forward.

Price Dynamics: The Central Indicator of Market Sentiment

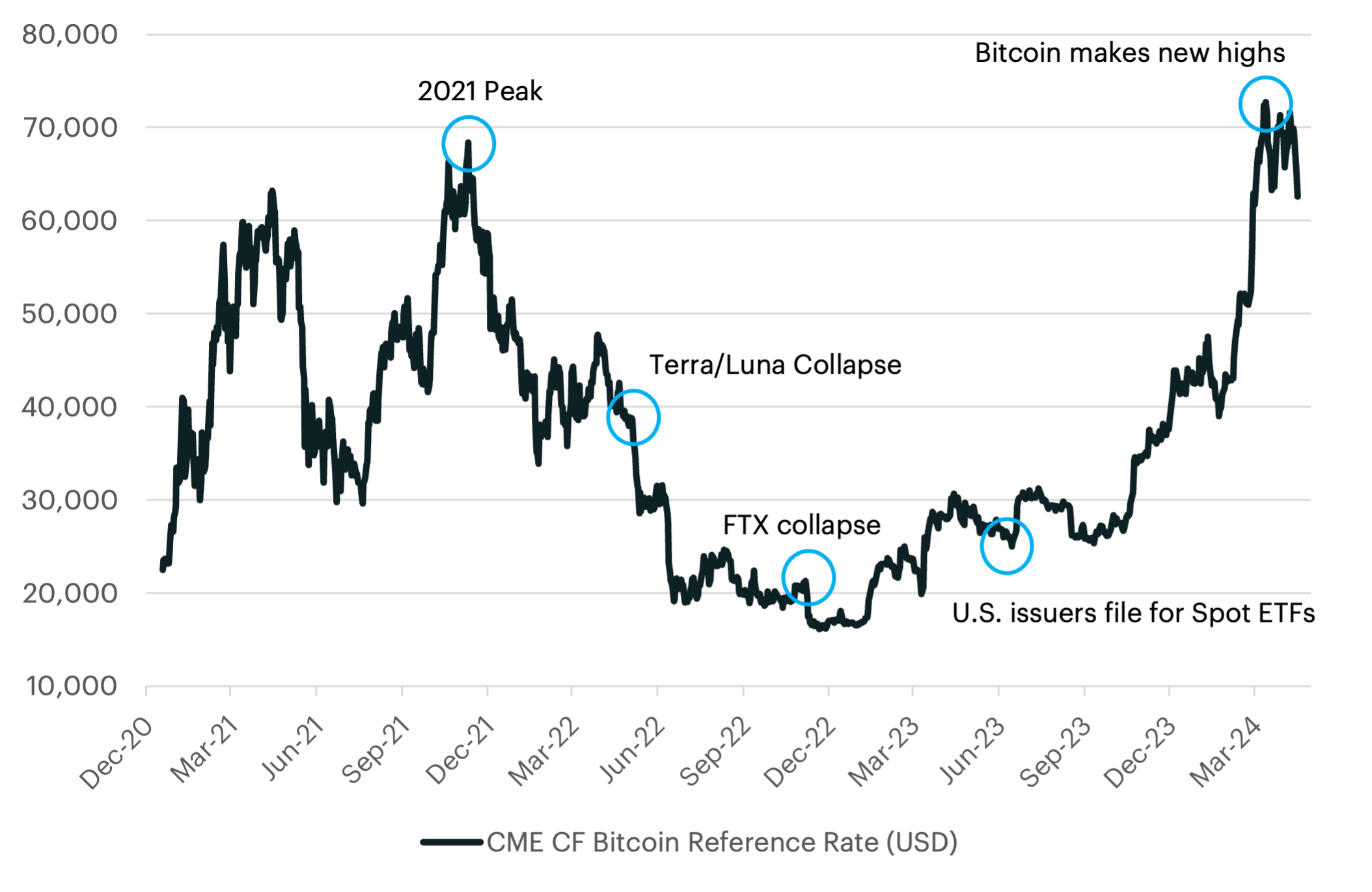

Price is the most overt indicator of market sentiment and has historically driven the overarching market mood. The Bitcoin price, as tracked by the CME CF Bitcoin Reference Rate (BRR), has undertaken notable fluctuations over the past few years:

- The 2021 Peak: Bitcoin reached an all-time high in November 2021, coinciding with the Federal Reserve's acknowledgment that the inflation pressures previously described as "transitory" were indeed persistent. This period also foreshadowed the onset of one of the most aggressive rate-hiking cycles in history, which applied considerable downward pressure on Bitcoin prices.

- The Terra/Luna Collapse: In May 2022, the dramatic crash of the Terra/Luna stablecoin catalyzed a sharp sell-off in Bitcoin prices, significantly disrupting DeFi activities and causing the BRR to plummet below $30,000 for the first time since January 2021.

- The FTX Collapse: November 2022 saw the collapse of the FTX exchange, marking a trough in the recent bear market with Bitcoin's valuation dropping to around $16,000, greatly eroding trust within the cryptocurrency ecosystem.

- An ETF-Driven Revival: The narrative shifted in June 2023, with major asset managers proposing Bitcoin ETFs. The momentum culminated in January 2024 when the SEC approved spot Bitcoin ETFs, propelling the BRR to new heights of $72,749 by March 2024.

Deciphering Bitcoin Sentiment Through Open Interest and Fund Flows

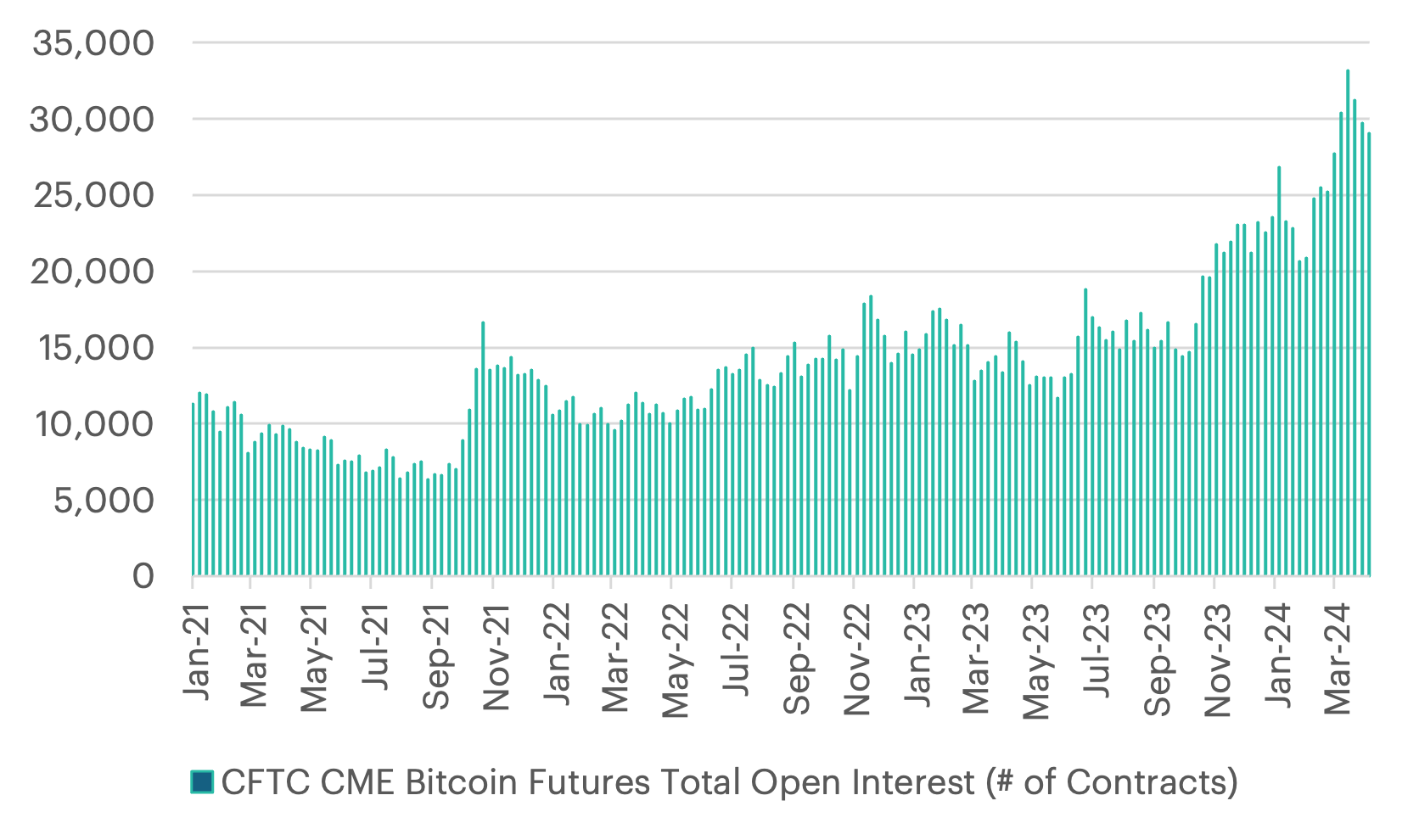

Open interest in Bitcoin futures contracts, particularly those traded on the Chicago Mercantile Exchange (CME), serves as a crucial barometer for institutional sentiment. This metric, reflecting the total unsettled contract positions, has been significantly influenced by various key events. The launch of Bitcoin ETFs marked a pivotal moment, dramatically impacting investor sentiment.

- Impact of Spot Bitcoin ETFs on Open Interest: Following the submission of Bitcoin ETF applications by asset managers in June 2023, there was a palpable resurgence in investor interest. When the SEC approved spot Bitcoin ETFs in January 2024, open interest soon surged to a record high of over 33,000 contracts by March 2024. This spike coincided with new peaks in Bitcoin's price, underscoring the profound impact of ETFs on institutional sentiment.

- 2022 Bear Market Cycle: It is also worth highlighting that institutional interest remained in a gradual uptrend over the course of the most recent bear market. This gives credence to the narrative that Bitcoin's market infrastructure continued to mature as institutional adoption remained intact throughout the last bear market.

Global Bitcoin Fund Flows: A Broader Investor Interest Indicator

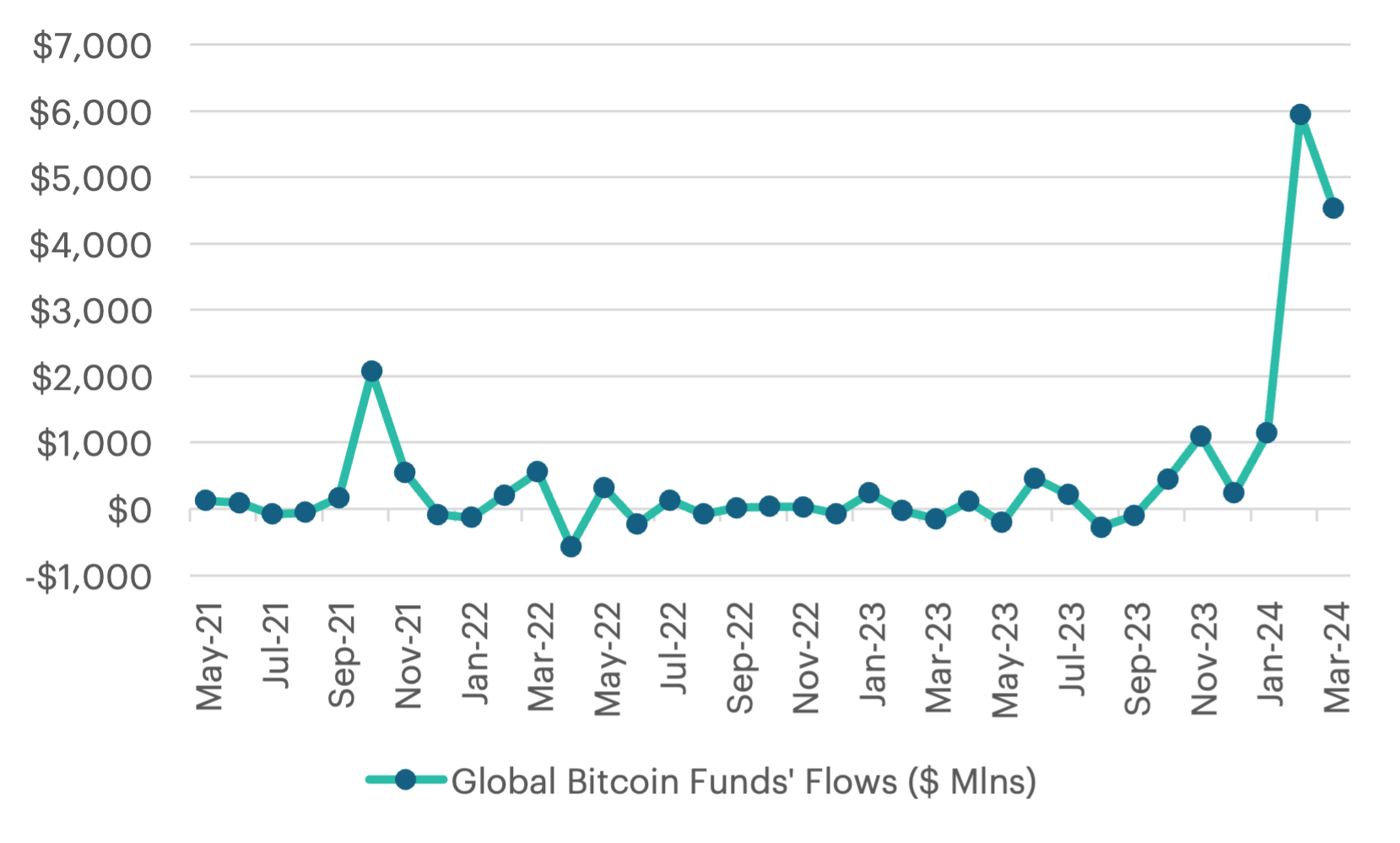

In addition to open interest, global fund flows into Bitcoin may offer a more expansive view of investor sentiment and market participation. Before the approval of spot Bitcoin ETFs, fund flows saw considerable fluctuations. For example, the cycle high in November 2021 attracted an influx of approximately $2 billion, signaling strong bullish sentiment. However, events such as the Terra/Luna collapse and the FTX debacle triggered significant outflows, reflecting bearish sentiment and a loss of investor confidence.

The approval of spot Bitcoin ETFs in January 2024 marked a significant turning point, with fund flows experiencing an impressive inflow of $1.15 billion in the subsequent month. This upward trend continued with record inflows of $5.94 billion in February and $4.53 billion in March 2024. The accessibility and perceived legitimacy provided by regulated ETFs have been instrumental in attracting both institutional and retail investors.

Given that the current Assets Under Management (AUM) in U.S. Spot Bitcoin ETFs now exceeds $50 billion, this still represents just 0.35% of the total ETF market, indicating significant room for growth. As more investors become aware of the potential benefits of including Bitcoin in their portfolios, such as its low correlation with traditional assets and its potential as a hedge against inflation, the adoption of spot Bitcoin ETFs is likely to continue expanding. Furthermore, the increasing regulatory clarity and the growing acceptance of Bitcoin as a mainstream investment option should drive even greater inflows in the coming years.

Revisiting Bitcoin's Volatility: Bull-Bear Regimes Highlight Asymmetry

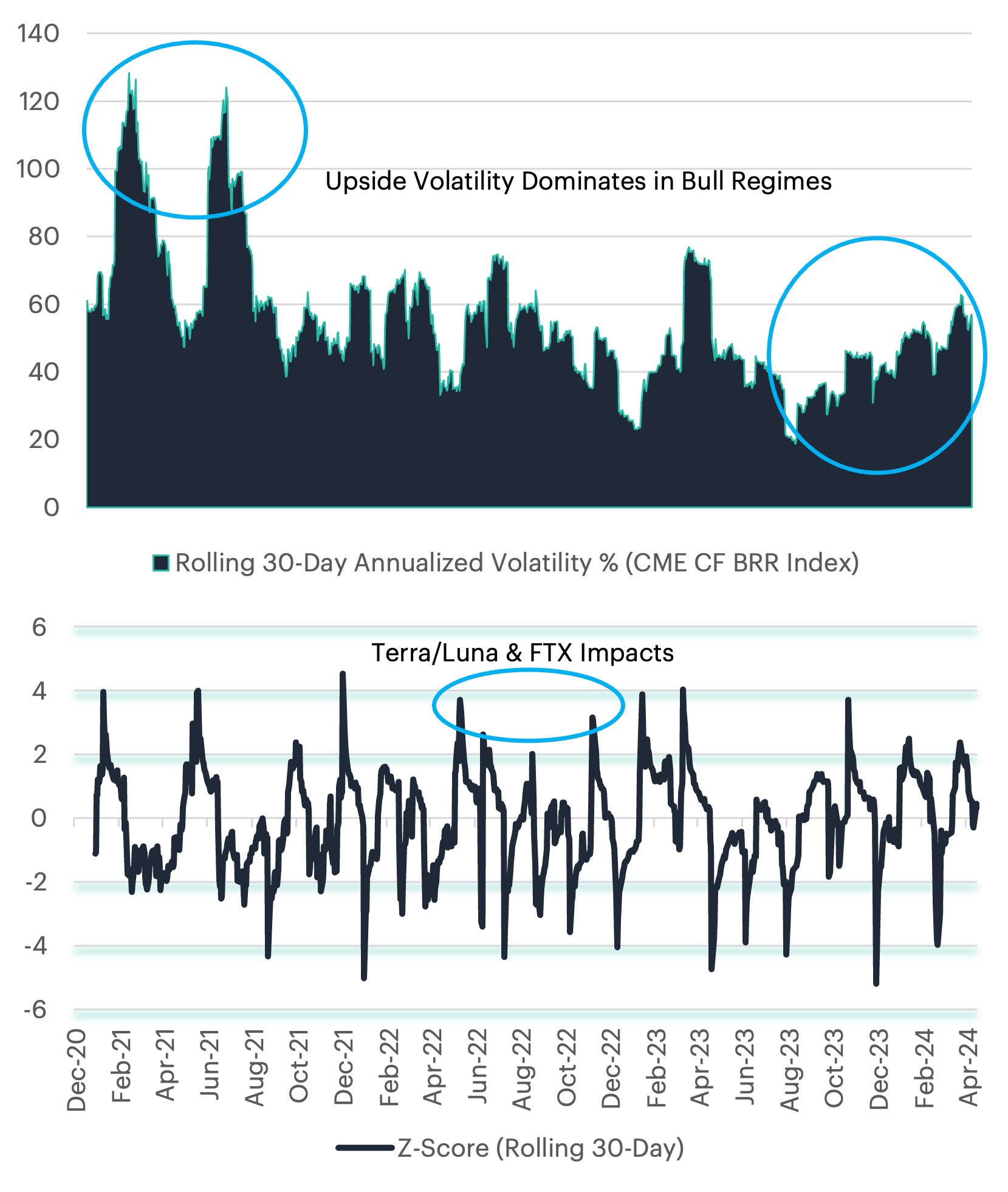

Volatility in the Bitcoin market, which measures the extent of price variations over a specific period, can provide deep insights into market uncertainty and investor behavior. By examining the CME CF Bitcoin Reference Rate (BRR) alongside 30-day rolling volatility and Z-scores (or standard deviation score), we can assess how significant events have shaped investor sentiment.

Timeline of Volatility Shifts:

- Pre-2022 Market Dynamics: Before 2022, during the peak of the previous cycle in November 2021, volatility remained elevated, with upside volatility driving 30-day values as high as 120% annualized.

- Uncertainty in 2022: Triggered by events like the Terra/Luna collapse and the FTX debacle, volatility spiked, with Z-scores hitting outer band levels between 3.0 and 4.0, marking a period of heightened uncertainty and fear, despite overall volatility remaining on a downward trend.

- Post-ETF Approval Period: In the lead-up to the SEC's approval of spot Bitcoin ETFs in January 2024, there was an initial decline in 30-day rolling volatility, with Z-scores moving from positive to negative values, indicating growing optimism about the stabilizing impact of ETFs. However, we have seen that upside volatility has overwhelming driven overall price deviation higher. This is quite similar to the early stages of the prior bull-market cycle.

Lastly, with regards to Bitcoin's volatility profile, it is clear to see that upside price-action resulted in an outsized increase in overall pricing volatility. This dynamic mostly remains unique to Bitcoin, as this is largely due to its overwhelmingly asymmetrical return profile. We believe that this positive asymmetry in Bitcoin's price returns remains one of its key attributes for its overall investment thesis as a universal store of value in the digital age.

Insights from the CF Bitcoin Volatility Index Settlement Rate (BVXS)

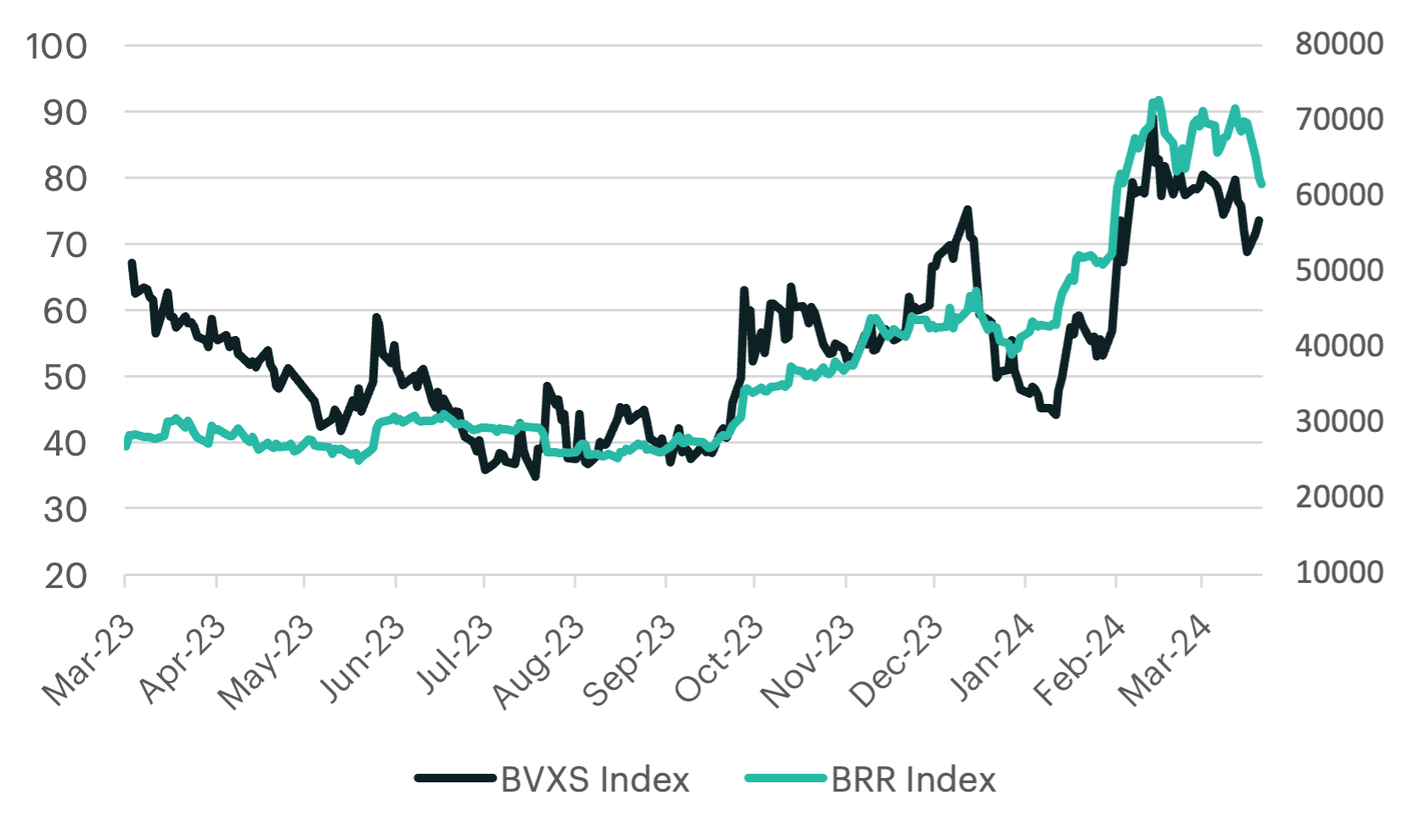

The BVXS, a forward-looking, 30-day measure of implied volatility derived from Bitcoin options on the CME, provides additional insights into future market expectations. Our institutional barometer of implied volatility is meant to build investor confidence, by allowing market participants to ultimately create and access products that can be utilized to hedge active risk or take on a tactical view. As the market continues to mature and gain mainstream acceptance, understanding this relationship can be vital for investors and analysts.

The BVXS serves as a key tool for gauging future market expectations and sentiment, offering a forward-looking perspective on Bitcoin's volatility that is essential for informed decision-making and effective risk management in this dynamic cryptocurrency landscape.

From March 2023 onwards, there was a noticeable decline in the BVXS, from the mid-60s to the mid-40s, with Bitcoin price action consolidating around the $30K level. This trend ended immediately after a swath of asset managers filed for spot Bitcoin ETFs in June 2023.

Anticipation and Impact of ETF Approvals. As the market anticipated the ETF approvals, the BVXS continued to trend higher, reaching the mid-60s by mid-October 2023, reflecting an optimistic outlook. This trend continued, with the BVXS rising to the mid-70s by late December 2023. Following the ETF approvals, the BVXS and Bitcoin saw an initial retracement in the opening weeks of trading as market participants likely bought into the "sell the news" narrative.

Post-ETF Launch Stability: After the successful launch of the ETFs, the Bitcoin Volatility Index (BVXS) stabilized in the low 80s to low 70s range, indicating that Bitcoin still retained some inherent volatility or upside optimism. This stability was supported by the Bitcoin Reference Rate (BRR) maintaining elevated levels, driven by increased mainstream adoption and perceived legitimacy through a fully regulated vehicle.

This interplay between the BVXS and BRR from June 2023 to the launch of spot Bitcoin ETFs illustrates the interesting relationship between forward looking volatility sentiment and price momentum, which also corroborates the empirically asymmetric price volatility and price return profiles of Bitcoin.

Looking Ahead: What is Likely to Drive Sentiment Even Higher?

The Bitcoin Halving: A Catalyst for Investor Optimism

At the top of this post, we highlighted a widely known quote from renowned investor and professor, Benjamin Graham, which was featured in his seminal work, "The Intelligent Investor." In this quote, Graham highlights the cyclical nature of the stock market and the importance of being a rational, level-headed investor. While this was written in regards to the equity market, digital assets have exhibited the same characteristics. Next, we will discuss why we believe that although we may have swung out of the extreme pessimism phase, we still see more room for further optimism before we arrive at the euphoric stage.

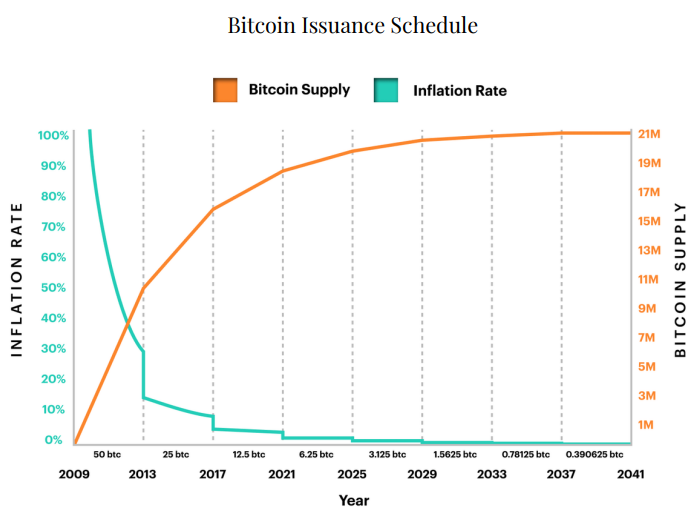

As the adoption of the cryptocurrency market continues to grow, Bitcoin investors now are turning their attention to the upcoming Bitcoin halving event—a pivotal occurrence in the digital currency's monetary framework model. Scheduled approximately every four years, this event significantly reduces the block reward miners receive, effectively tightening Bitcoin's supply. As illustrated below, this programmed scarcity, when paired with sustained or increasing demand, has historically resulted in price increases.

We can start by examining the historical performance of Bitcoin around previous halving events which may offer valuable insights into potential future outcomes:

- 2012 Halving: Leading up to this event, Bitcoin experienced a dramatic return of 140.27%, followed by an even more remarkable 943.24% increase afterward.

- 2016 Halving: This event preceded a 47.70% return and was followed by a 38.20% increase in the ensuing 90 days.

- 2020 Halving: Preceding this event, Bitcoin posted an 18.56% return, with a significant 93.87% gain following.

As we approach the forthcoming halving, Bitcoin has already demonstrated a robust 116.16% return in the 90 days leading up to the event. While past performance is not a guaranteed predictor of future results, this data suggests that halvings can create favorable supply and demand dynamics not only for longer-time horizons, but they can also potentially offer sizable returns closer to the actual event dates.

The inherent volatility of the cryptocurrency market, influenced by regulatory changes, market sentiment, and broader economic conditions, requires careful consideration by investors. However, the predictable nature of the Bitcoin halving provides a rare element of certainty in this unpredictable landscape. The most recent findings from the "Bitwise/VettaFi 2024 Benchmark Survey of Financial Advisor Attitudes Toward Crypto Assets" (dated January 4, 2024) revealed a shift in sentiment around Bitcoin. Despite only 39% of advisors believing in the likelihood of a spot Bitcoin ETF approval in 2024, notably, 88% of advisors expressed interest in investing in Bitcoin post-ETF approval, suggesting potential for significant market demand and a consequential impact on prices upon approval.

Moreover, the survey highlighted strong client interest in cryptocurrency, with 88% of advisors reporting client inquiries about crypto investments last year. Additionally, 59% of advisors noted that their clients were investing in crypto independently, revealing a substantial opportunity for advisors to engage with held-away assets.

For investors considering Bitcoin, the upcoming halving presents a strategic opportunity to leverage the potentially favorable supply and demand dynamics that are systematically engineered into Bitcoin's protocol. By understanding the significance of the halving and its anticipated effects, investors can make well-informed decisions. Staying engaged and adopting a long-term perspective to effectively navigate Bitcoin's price volatility can potentially lead to future opportunities presented by Bitcoin's market cycles and the upcoming halving event, reinforcing Bitcoin's role as a compelling component of a diversified investment portfolio.

Considering all of this, the Bitcoin halving event, coupled with the shifts in investor sentiment, presents a unique call to action for investors to reassess their strategies and position themselves for potential growth. By closely monitoring key indicators such as price dynamics, open interest, fund flows, and volatility, investors can gain valuable insights into the market's mood. As the Bitcoin ecosystem continues to mature and gain mainstream acceptance, the forthcoming halving event serves as a reminder of the asset's unique characteristics and its potential to reshape the financial landscape.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks