Aug 07, 2023

CF Benchmarks Newsletter - Issue 61

- DeFi's latest 'own goal' and benchmark implications

- Ether Futures ETF filings flood follows SEC hint

- ETH/BTC Ratio Futures' first block trade; plus economic insights

Swerve

Curve TVL limps higher

On the face of it, recent days brought improved developments in what’s likely to remain the most watched news in the space for some time: the exfiltration, by software hack, of up $70m from various liquidity pools on Curve Finance. Total Value Locked (TVL) on the protocol had recouped to about $2.35B by the weekend, up from as low as $1.685B at its post-hack lowest, according to DeFiLlama, the largest open-source DeFi data aggregator. (Here’s Kraken’s crash course on Curve, if needed.)

Practically and optically, that’s obviously a preferable direction of travel, even if the ricochet of deposit value is, in Curve’s case right now, multiply composed: comprising of the speculator-driven rebound in asset value, as well as the more abstruse combination of ‘bail-out’ deposits and reimbursements; including—reportedly—some voluntary partial reparations from the hacker, plus ‘white hat’ action too.

Curve’s native token, CRV, tanked as much as 23% in reaction, to as low as $0.56, looking at the regulated CME CF Curve-Dollar Reference Rate. Prices clawed back over the weekend, with CME CF Curve-Dollar Real Time Index standing around $0.61 heading into the new week. CRV traded as high as $1.245 in February.

Meanwhile Curve communities offered a 10% bounty to the hacker, with a 2-day deadline converting the offer to a public one, plus threats of action to the “full extent of the law”. This resulted in the return of around $13m by the end of last week, with chain watchers suggesting more was likely.

Foot shot two

The ‘second shot in the foot’ of the debacle was resurfaced news (and fresh revelations) about a loan to the project’s founder of an initial $70m, secured against about $185m worth of CRV, plus a smaller amount in another token. Participants have long had misgivings about the borrowings which a partial paydown in June barely alleviated. Concerns particularly implicate the rival AAVE platform, the largest of its kind, which has the biggest exposure to the founder’s borrowings, widely reported as $50m. In the wake of the exploit, the founder repaid a further $9.2m of the principal, a portion of the sum received from various backers, according to Decrypt, which cited on-chain observations.

Damage

Regardless of a remedial few days since the initial news, various forms of damage will clearly require far longer to undo. Aside from third-party financial losses, the broader impact of the combined mishap is of course reputational and, for DeFi as a whole, potentially existential. Regardless of the fact that the vulnerability originated not in Curve’s smart contract code itself, but rather in a compiler that reads it, Vyper, impact on DeFi credibility, investibility, and most importantly, for our focus, institutional adoption, remains to be seen. The vector, at least in the short term, seems predictable, unfortunately.

Benchmark impact: none for now

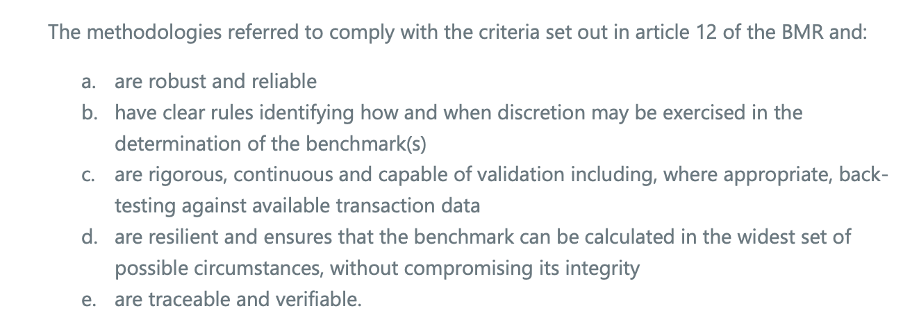

All that said, it’s a given that CF Benchmarks’ transparent, regulated Benchmark Methodologies and governance policies, are as rules-based for our DeFi benchmarks, as they are for all of our other indices.

Succinctly:

So, although ultimately a matter for the CME CF Oversight Committee, given that the above criteria continue to apply, it should be no surprise that there are currently no changes planned for regulated DeFi benchmarks.

For similar reasons, knee jerk ejections of any DeFi constituent from our Multi Asset Series indices are just as unlikely.

Quick fire Ether futures ETF filings

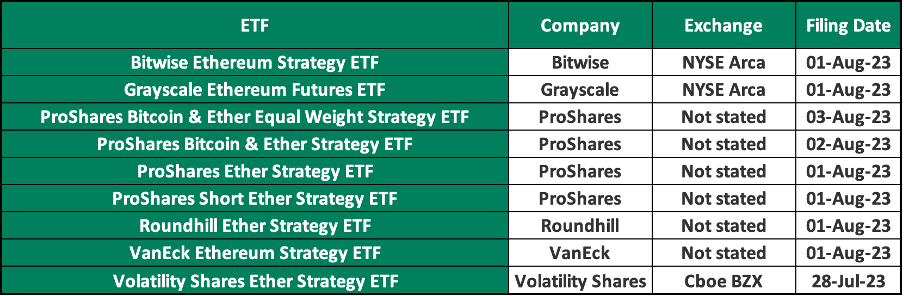

More positively, another bout of crypto ETF optimism has emerged with a fresh raft of futures strategy ETF applications filed in rapid succession. These ETFs propose to track the price of CME Ether Futures which settle to CF Benchmarks’ CME CF Ether-Dollar Reference Rate.

The first U.S. crypto-related ETF to be approved for listing was also a futures strategy vehicle, ProShares’ Bitcoin Strategy ETF (BITO), which launched in October 2021, aiming to provide exposure and excess returns relative to CME Bitcoin Futures (settled by our flagship CME CF Bitcoin Reference Rate). But several attempts to win SEC approval for CME Ether Futures funds have failed.

Unsurprisingly, issuer perceptions of the SEC’s ‘interpretative regime’ for proposed Ether investment funds are as equivocal as they are for Bitcoin funds, so it’s unclear what, if anything, may have changed to prompt applicants to file; or file again, given that many of the current hopefuls have several superseded applications for the same or similar vehicles on file. WSJ.com cites ‘people familiar with the matter’ suggesting the SEC, for some reason, encouraged certain firms to pursue Ether Futures ETF applications at this time.

Current filings are listed in the table below.

Key points

- ProShares provides an added twist with 2 applications riffing on the ETH theme and 2 appearing to propose a vehicle combining exposure already available from BITO with that of an Ether fund

- Like most approved Bitcoin strategy ETFs, the new Ether paperwork is structured under the 1940 Investment Company Act as opposed to the 1933 Act

- Many of the forms N-1 (’40-Act specific) or N1-A (amendments) are incomplete, and therefore preliminary. Many are appended within form 485APOS, which isn’t normally intended for official SEC consideration.

Therefore, for now, the timeline for these filings, looks set to be even longer than for the tranche of spot Bitcoin ETF filings currently under review by the regulator.

Markets

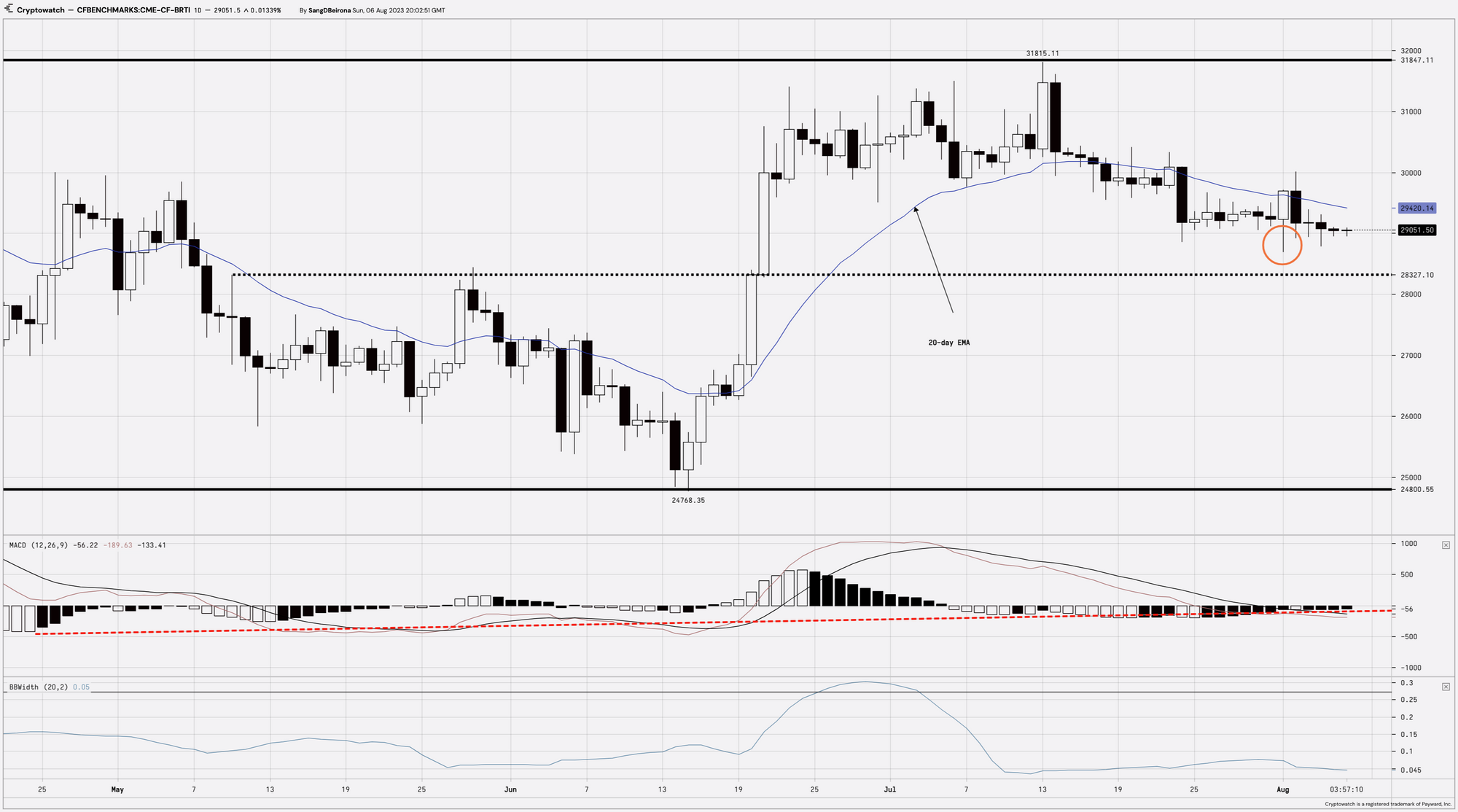

A month that starts with the largest asset in the class in retreat will presumably turn out to be a moderate handicap, given Bitcoin’s drop to its lowest since mid-June in recent days. Perhaps spooked by liminal Curve associations, BTC, measured by its most trusted regulated real-time benchmark, our CME CF Bitcoin Real Time index, traded as low as $28,690.53 on August 1st (circled in the chart below). Short-term sentiment is little changed from a week ago: daily ranges are mostly tight, and prices continue to ail below BTC's 20-day exponential moving average. One positive is that BTC has, so far, found plenty of bids well above $28,327, where we presume offers are piling up, as that was the launch pad for the muscular rally in June that took prices above $30k for the first time this year.

XRP tops alts in July

Meanwhile as our Lead Research Analyst, Gabe Selby, CFA notes, in the latest CF Benchmarks Monthly Market Recap, large caps mostly “took a break”, handing July’s best performance rankings to altcoins. XRP led this cohort’s outsize returns after a New York District Court judge ruled that the Ripple network’s native token was only to be considered a security under specific circumstances. (Get Gabe’s full Monthly Market Recap here).

Ironically, many altcoins, particularly those in the CF DACS Finance category (which pertains chiefly to DeFi) gave back a portion of gains on the final day of the month as the Curve hack began to emerge, therefore gains should be assessed in light of that.

Macro Outlook

By Gabe Selby

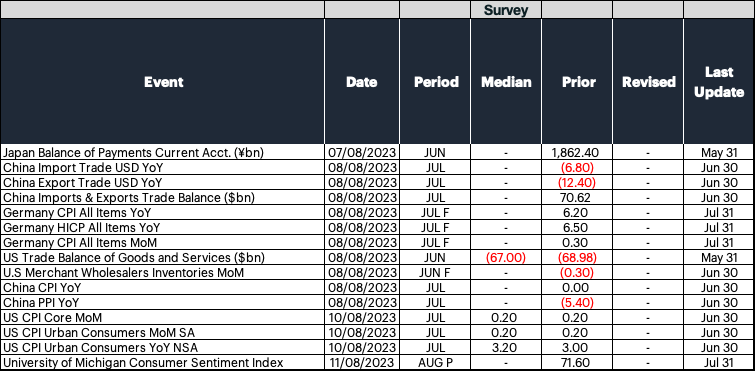

The latest labor market data are likely to add more fuel to the soft-landing narrative. The U.S. added over 187k jobs in July, marking the second consecutive month of negative surprises. This figure is more in line with the pre-pandemic 4-year average of 183k. The Fed is likely to find some relief in the softening yet still overall robust labor market. However, concerns over persistently high wage pressures remain.

In the upcoming week, investors will analyze inflation gauges from Europe's largest economy, as well as their counterparts in China, and the United States. Economists are forecasting a modest uptick in U.S. inflation, with the year-over-year change expected to rise from 3.0% to 3.2%. Higher frequency data suggests that energy costs are likely to boost the headline figure. However, the recent disinflationary trend is anticipated to remain largely intact, with approximately 42% of spending categories now growing above a 4.0% annualized rate, down from over 69% in February. For now, healthy jobs growth and inflation trends continue to provide monetary policymakers with wiggle room, likely leading to a pause in interest rate increases for the foreseeable future.

Featured benchmarks: CME CF Bitcoin Reference Rate • CME CF Ether-Dollar Reference Rate

CME ETH/BTC Futures see first block trade

The CME’s newest cryptocurrency futures contract, Ether/Bitcoin Ratio Futures (EBR), providing exposure to the relative performance of the two largest digital assets by market capitalization, is now live.

Trading was kickstarted with a sizeable block trade by one of the most established institutional liquidity providers, Cumberland, a subsidiary of DRW, and that firm’s counterparty, XBTO Group. The trade contributed to a tally that made July a 2023 peak for CME crypto futures volumes, with open interest not far behind.

Read more details on the recent performance of crypto contract volumes and open interest

The evolution of the Ether/Bitcoin Ratio

Meanwhile Senior CME Group Economist, Erik Norland, has scoped out some factors currently driving the market’s perception of the ETH/BTC balance, objective pivots designating the most dominant asset of the pair, and other determinants of the ratio.

Some of Norland's insights include:

- ETH has been more volatile than either BTC separately, or the ETH/BTC exchange rate itself, a potentially valuable observation for long-term Ether investors seeking ways to fine tune exposure, or indeed the most optimal hedging strategy

- Bitcoin prices are not currently the directional leader of the pair, though they were until 2021

- Tech stocks outperformance is often positively correlated with ETH/BTC; higher USD often appears to be negatively correlated

Read the article by CME Group Senior Economist Erik Norland: ‘Three Factors Driving the Ether-Bitcoin Price Nexus’

Click below to watch CME Group's ETH/Bitcoin Ratio Futures Video:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Ken Odeluga

Gabriel Selby