Aug 01, 2022

CF Benchmarks Recap - Issue 49

- CF Rolling CME Bitcoin Futures Index launched

- CME expands CFB-powered crypto BTIC suite

- CF Diversified Large Cap Index deconstructed – by CF DACS

Was this newsletter forwarded to you? Click here to sign up

Hope Train

Crypto rides surreal risk asset rally • New: CF Rolling CME Bitcoin Futures Index • CME expands CFB-powered BTICs. Crypto’s bonfire of some $2 trillion in value and the S&P 500’s 24.5% collapse from January’s peak leaves participants across established and digital asset classes alert for potential revival signals. BTC and ETH had their best month since October 2021, with BRTI skimming $24,408.77 (timestamp: 29/07/2022 , 06:37:38 UTC), highest in a fortnight, and ETHUSD_RR topping at $1,783.3 (timestamp: 28/07/2022, 20:38:03 UTC) best since June 10th. (See below for concise market and macro commentary from CF Benchmarks Research Lead, Gabe Selby, CFA.) Meanwhile, the influence of CFB clients utilising the only regulated crypto benchmarks with proven institutional liquidity is quietly growing. Bloomberg data confirms $750m crypto fund manager Hashdex raked in the biggest crypto ETP inflows of any provider on Brazil’s B3 exchange, in H1 2022. CME Group widens its cryptocurrency derivative suite further, with more Basis Trade at Index Close (BTIC) instruments tied to BRR and ETHUSD_RR. (More details below). Plus, we’re excited to launch the CF Rolling CME Bitcoin Futures Index. Finally, our deep dive into CF Digital Asset Classification Structure continues—with CF Diversified Large Cap Index as backdrop. (Excerpts below.)

FOMC sticks to plan, for now

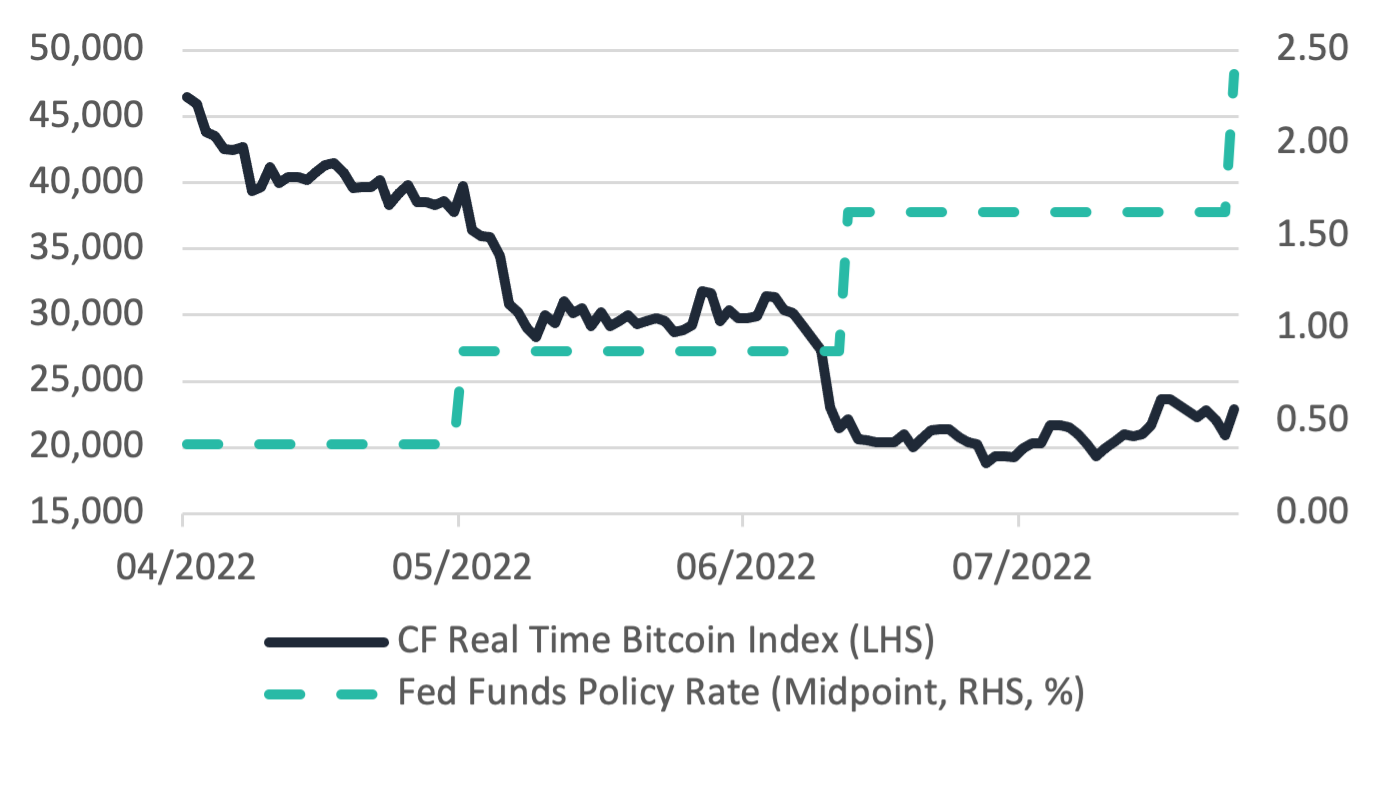

The Fed’s decision to unanimously increase the benchmark rate by another 75bps, setting the target back to the “neutral” 2.25-2.50% range was widely anticipated, yet crypto price reaction was largely positive. BTC and ETH rose approximately 8.6% and 16.2%, respectively. The Fed’s inflation fighting crusade has had a sizeable impact on digital assets (see below), and while the official statement indicated softer spending and production, it also still noted a robust labor market. With the most recent pricing cues indicative of inflation relief, investors must wait for further labor market slack for this hawkish stance to reverse. (By Gabe Selby, CFA)

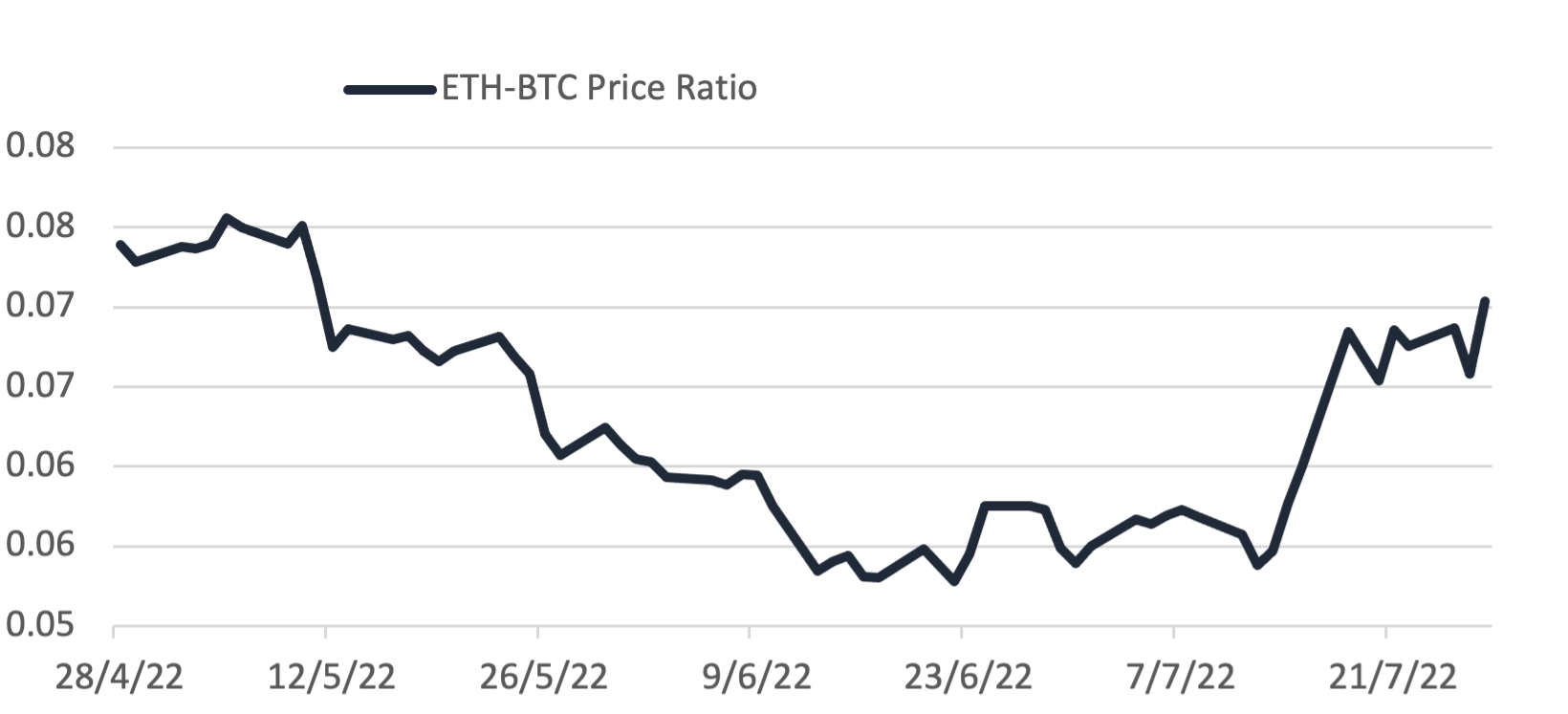

The Returns: Coming ‘Merge’ buoys ETH-BTC

Following delays, developers penciled in September for Ethereum’s long-awaited switch to proof-of-stake. In reaction, investors punched in a nadir on the closely followed ETH-BTC ratio (see below). From a holder’s perspective, price action reflects bullish features expected for the most popular programmable protocol. Validators will have the ability to earn yield on staked ETH, net issuance is anticipated to fall, and higher bandwidth will enable exponentially increased transactions. (By Gabe Selby, CFA)

Featured Benchmarks: CF Rolling CME Bitcoin Futures Index • BRR • ETHUSD_RR • CF Digital Asset Classification Structure

CF Rolling CME BTC Futures Index launched

Responding to the institutional need for constant investment in the most liquid CFTC-regulated BTC futures contracts, CF Benchmarks has launched the first BMR compliant benchmark that replicates serial investment in CME Bitcoin Futures, the CF Rolling CME Bitcoin Futures Index.

The index has been developed to measure returns in a passive strategy of holding CME Bitcoin Futures contracts. (Full announcement.)

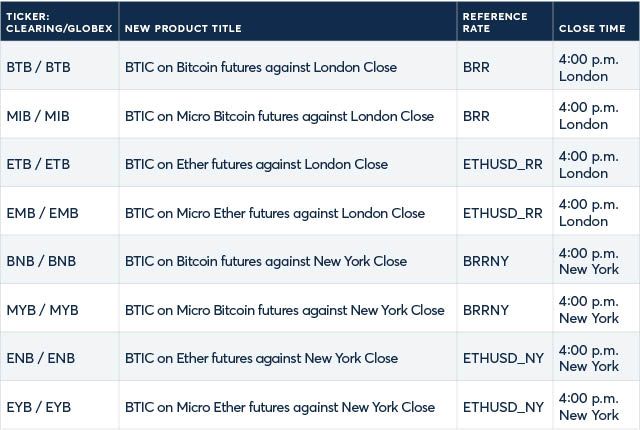

CME crypto BTIC range extended

CME crypto futures BTICs provide increased flexibility in managing costs and risks, for instance during NAV calculation of CME crypto futures-based ETFs. CME has now added Bitcoin and ETH BTICs for Bitcoin contracts settled against CF Benchmarks Reference Rates published at 4:00 p.m. New York time, to existing ones for contracts settled at 4:00pm London time.

(Learn about BTICs here. Full announcement.)

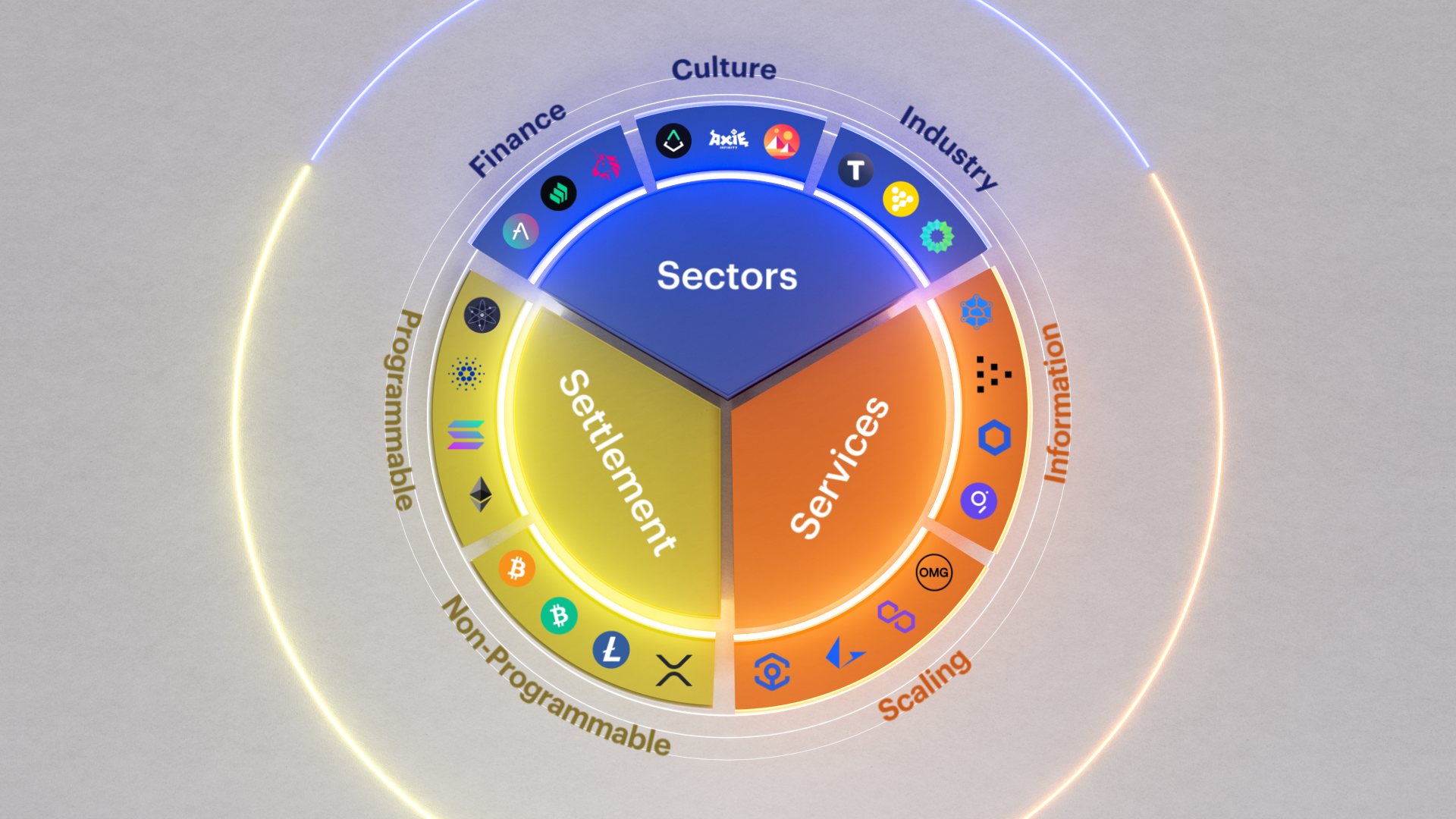

How CF DACS helps crack Diversified Large Cap code

Deconstructing CF Diversified Large Cap Index exposure with CF Digital Asset Classification Structure spotlights portfolio management potential

CF DACS, ICYMI

- CF DACS codifies standards by which digital assets are categorised:

- As Sector applications, Settlement networks or on-chain Services

- Subcategories define the function through which protocols serve outcomes to end users:

- Through an economic Sector - Finance, Culture, or Industry

- Through one of two broad types of Service protocols - Scaling or Information

- Through the Settlement layer – either Programmable or Non-Programmable

Investors can now conduct reliable attribution analyses of cryptoasset portfolios; a process that was all but impossible to undertake before CF DACS existed, and a critical prerequisite for the evolution of institutional digital asset management.

As we showed in our recent outline returns attribution of Nasdaq Crypto Index (NCI), CF DACS provides information and insights into the economic reality engendered by digital asset holdings at a higher-resolution than is possible from an examination of assets and weights alone.

Next let’s apply CF DACS to CF Diversified Large Cap Index - the regulated liquid benchmark representing 95% of the total market capitalisation of the investible digital asset universe. (Continues here.)

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks