Jan 27, 2025

Uncorrelated Crypto Factors = Good

CF Benchmarks recently unveiled what is almost certainly the only public and comprehensive factor-based model for the digital asset class.

Based on an extensive quantitative analysis of validated crypto data sources, our researchers isolated seven factors exhibiting significant risk premia and explanatory power.

(Anyone familiar with factor-based strategies will recognise them. For those less familiar, here's an excellent primer.)

As well as a launch article, and the research paper itself, we also did a podcast about the research, featuring the quant who led this project, Cristian Isac.

Click below to watch.

Or, for a further teaser, how about this.

As any portfolio manager utilizing factor-based approaches knows, uncorrelated is good.

(And that applies to any asset, whether traditional, like equities, or crypto.)

Why? Crash course incoming, for some.

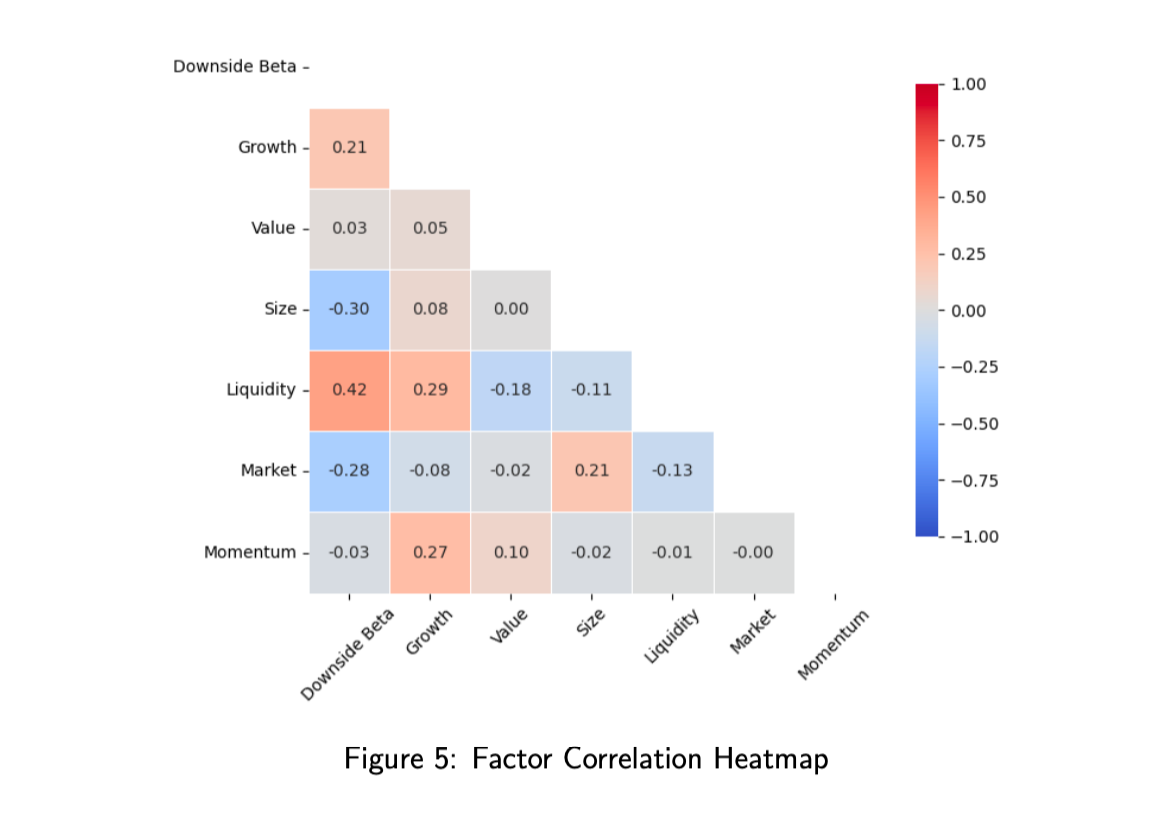

(For those who already know why, you're probably already re-examining the Factor Correlation Heat Map at the top of this article.)

Here are the key reasons, either way:

- Diversification Benefits: Low correlations between factors mean if one underperforms, others may perform better, reducing portfolio risk

- Risk Mitigation: Likewise, portfolios are protected against systemic risks that could hit all factors simultaneously, when weakly correlated factors are deployed

- Improved Sharpe Ratio: Diverse factors (which tend to be poorly correlated) enable higher risk-adjusted returns per factor (as defined by Sharpe Ratio) due to lower volatility for a given expected return

- Enhanced Return Potential: Different factors (if essentially uncorrelated) capitalize more from varied market conditions when low- or non-correlated, potentially leading to more consistent returns over time

So, the remarkably low correlations in our heat map are excellent news for anyone interested in factor-based approaches to digital asset investing.

And this is just the beginning.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks