Sep 22, 2025

Transition of CF Maker-Dollar indices to CF Sky-Dollar indices

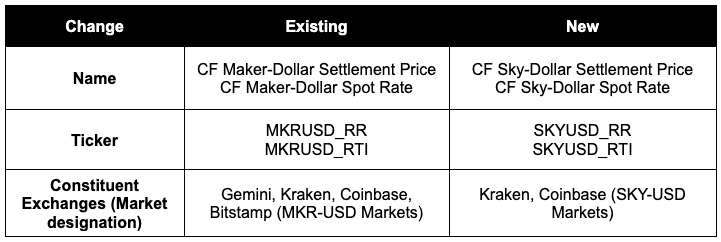

The Administrator announces changes of input data, name and ticker, for the CF Maker-Dollar Settlement Price and CF Maker-Dollar Spot Rate.

These changes follow the rebranding of MakerDAO to Sky Protocol, with the transition scheduled for completion by September 18th, 2025.

The Administrator has been observing SKY-USD markets operated by CF Constituent Exchanges since August, and has determined that, according to the CF Settlement Price Methodology, the correct price of this asset is now represented by the SKY token.

Accordingly, tickers for these benchmarks will transition to the SKY designation. Input data, name and ticker changes are summarized in the table below.

All changes were overseen by the CF Cryptocurrency Index Family Oversight Function.

Implementation Timeline

These changes will be implemented at approximately 10:00:00 London Time on October 6th, 2025. This means the last prices of this asset observing MKR-USD markets will be published on October 5th, 2025.

Questions or queries regarding this process should be directed to [email protected].

Any user wishing to file a complaint regarding this process can do so confidentially by writing to [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks