May 04, 2021

The consultation on changes to the methodology of the CME CF Cryptocurrency Reference Rates is now open

The consultation on proposed changes to the methodology for the CME CF References Rates is now open and will impact the following benchmarks only:

· CME CF Bitcoin Reference Rate (BRR)

· CME CF Ether Dollar Reference Rate (ETHUSD_RR)

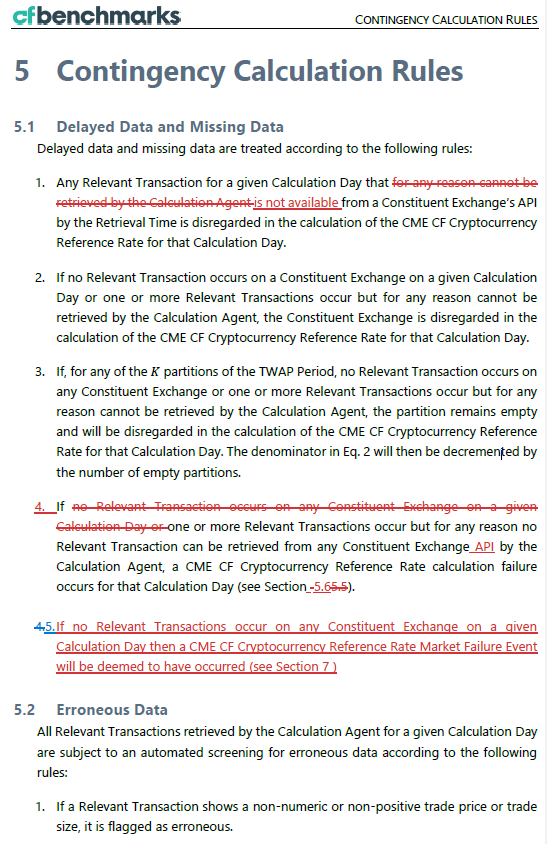

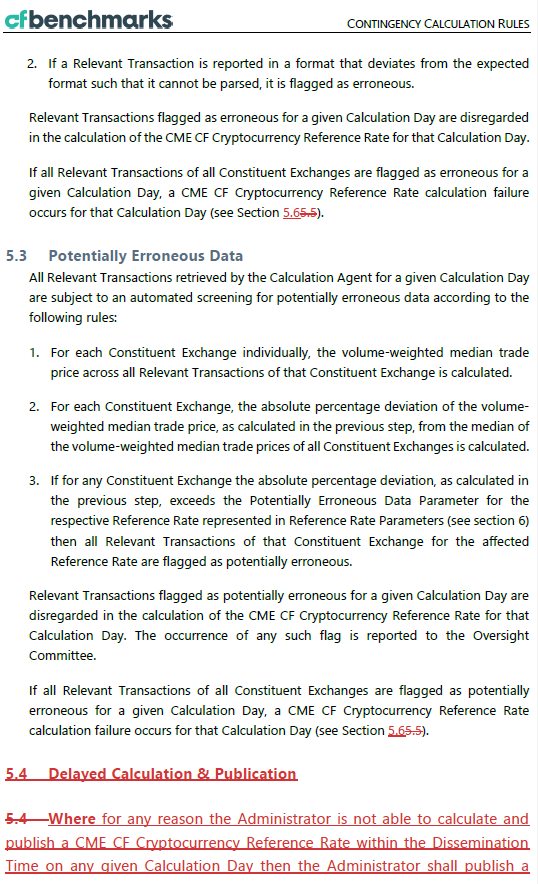

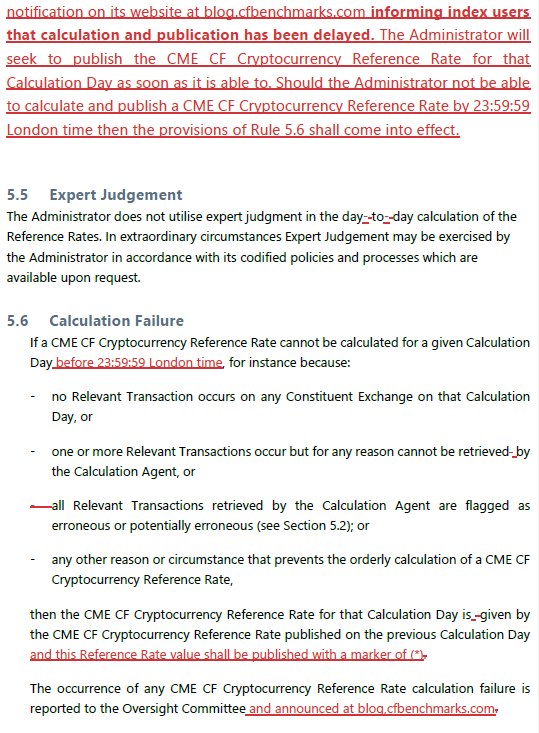

The Administrator proposes changes relating to the below sections of the Methodology only

· Section 5 - Contingency Calculation Rules

· A new Section 6 – Restatement & Republishing

· A new Section 7 – Market Failure Events

The proposed changes are provided below, changes have been underlined and replacement text is shown in mark-up.

Proposed Date of Implementation

The Administrator proposes to implement the proposed changes to the Reference Rates from June 28th 2021 onwards

Rationale

The applications of the CME CF Reference Rates in financial products have increased significantly over the past 6 months. The Administrator proposes these changes to ensure both the integrity of the benchmark and that any potential market disruption it could cause to financial products referencing the benchmarks are sufficiently mitigated.

Likely Impacts

The proposed methodology changes mean that product providers that replicate or utilise the Reference Rates may need to alter the provisions for extraordinary events in their product mechanics and market participants may need to factor these changes into their processes when transacting in instruments that are linked to the Reference Rates.

Consultation Process

The consultation for all aspects of this proposed change and its proposed date of implementation will open at 1000 LDN on May 4th 2021 and close at 1630 LDN on May 18th, 2021. All responses will be treated in confidence unless a respondent specifies that it wishes its identity to be known to the Administrator.

Further to general comments the Administrator will seek to understand from index users what the likely impacts could be in vis a vis:

Timeframe of Proposed Change

Whether the proposed change allows market participants to make the necessary arrangements to potentially alter product mechanics and provisions around extraordinary events

Financial Impact of Proposed Change

The financial value of contracts, instruments, funds that directly reference or are settled according to the benchmark that shall be impacted by the proposed change.

Market Impact of Proposed Change

The number of counterparties and types of counterparties that could be adversely impacted and the scale of the disruption they would face as a result of the proposed change.

Should the consultation result in the Administrator not implementing any of the proposed changes or the implementation date being changed then this and any further shall be announced by the Administrator. Any queries regarding the consultation process should be addressed to [email protected].

Submission of Responses

All responses should be submitted in writing via email to [email protected]. All responses will be treated in confidence unless a respondent specifies that it wishes its identity to be known to the Administrator.

Should the consultation result in the Administrator not implementing any of the proposed changes or the implementation date being changed then this and any further shall be announced by the Administrator.

This consultation process is conducted under the oversight of the CME CF Oversight Committee in accordance with Article 5 of EU and UK Benchmark Regulations.

Any queries regarding the consultation process should be addressed to [email protected]

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Quarterly Attribution Reports - March 2026

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category, and segment levels during the course of each portfolio rebalance period.

Gabriel Selby

Weekly Index Highlights, March 9, 2026

Geopolitical strains kept digital assets on the defensive in the past week, with Bitcoin down 2.1% and Cardano -12.0%. Realized BTC volatility and our BVXS implied vol. index both inched higher, by 5.8 and 1.7 points, but Culture tokens in our CF DACS taxonomy were worst hit on average, at -8.7%.

CF Benchmarks

Factor Friday - March 6, 2026

The market posted its strongest weekly gain of 2026 at +4.3%, trimming YTD losses to -28.0%. Value emerged as the top factor at +1.7% weekly, turning positive YTD. Downside beta posted its first negative week of the year, signaling a potential early shift towards risk.

Mark Pilipczuk