Jan 25, 2023

The CF Bitcoin Interest Rate Curve 'Reality Check'

The CF Bitcoin Interest Rate Curve is now live on cfbenchmarks.com – bringing much needed “economic reality” to crypto lending markets

Who’d be a crypto lender?

Many of crypto’s recent counterparty implosions hinged on the questionable business practices of high-profile crypto lenders.

With concerns there may be potentially more casualties waiting the wings, the relatively poor evolution of crypto’s credit and collateralization sectors has been well and truly exposed.

A qualitative comparison of the development of crypto lending and borrowing with the growth of custody services provision shows some telling contrasts.

There are now several institutional digital asset custodians of a demonstrably high calibre, with many backed by track records based on proven competence in traditional custody. Meanwhile, institutional crypto custody market revenues reportedly reached around $400m in 2022 from a virtual standing start a few years before. The sector is now expected to grow at a CAGR of some 57% before reaching $3.9B by 2027.

By contrast, with new layers of caution discouraging traditional institutions from entering the market for digital asset credit-related products in light of recent crypto lending failures, the dearth of credible benchmark lending rates risks crimping the growth and adoption of crypto’s credit markets even further.

Whilst it would be inaccurate to state that competent, reliable digital asset credit counterparties are non-existent, recent high-profile failures suggest the crypto loans market is less robust and reliable than other crypto service sectors.

It’s also evident that potential participants of a similar calibre to those that have shown interest in entering the digital asset custody market have demonstrated less willingness to become crypto lenders.

Wanted: crypto benchmark rates

One of the biggest disincentives seems to be a prevailing perception that the necessary conditions – services infrastructure, functionality, and more – required to offer full suites of credit and collateral-related services in the crypto world, analogous to those available in TradFi, do not exist yet.

Amongst the most critical facilities that have been absent are high-quality, broadly accepted lending rates. It’s easy to see how the absence of such rates has retarded the maturation of crypto’s credit markets.

This is a key reason why CF Benchmarks has developed the CF Bitcoin Interest Rate Curve (CF BIRC), in partnership with blockchain oracle network Chainlink.

The CF Bitcoin Interest Rate Curve is the first comprehensive interest rate curve for the bitcoin lending market.

It’s also the first to be calculated and published by a registered Benchmark Administrator – CF Benchmarks, which is regulated by the UK FCA under the EU-equivalent UK Benchmark Regulation (UK BMR) regime.

Comprehensive, continuously updated data for all CF Bitcoin Interest Rate Curve tenors are now available on the CF Benchmarks website.

You can read more about the fundamentals of CF BIRC’s construction and uses from our launch article.

The full Methodology Guide for CF BIRC is available here.

Meet the CF Bitcoin Interest Rate Curve

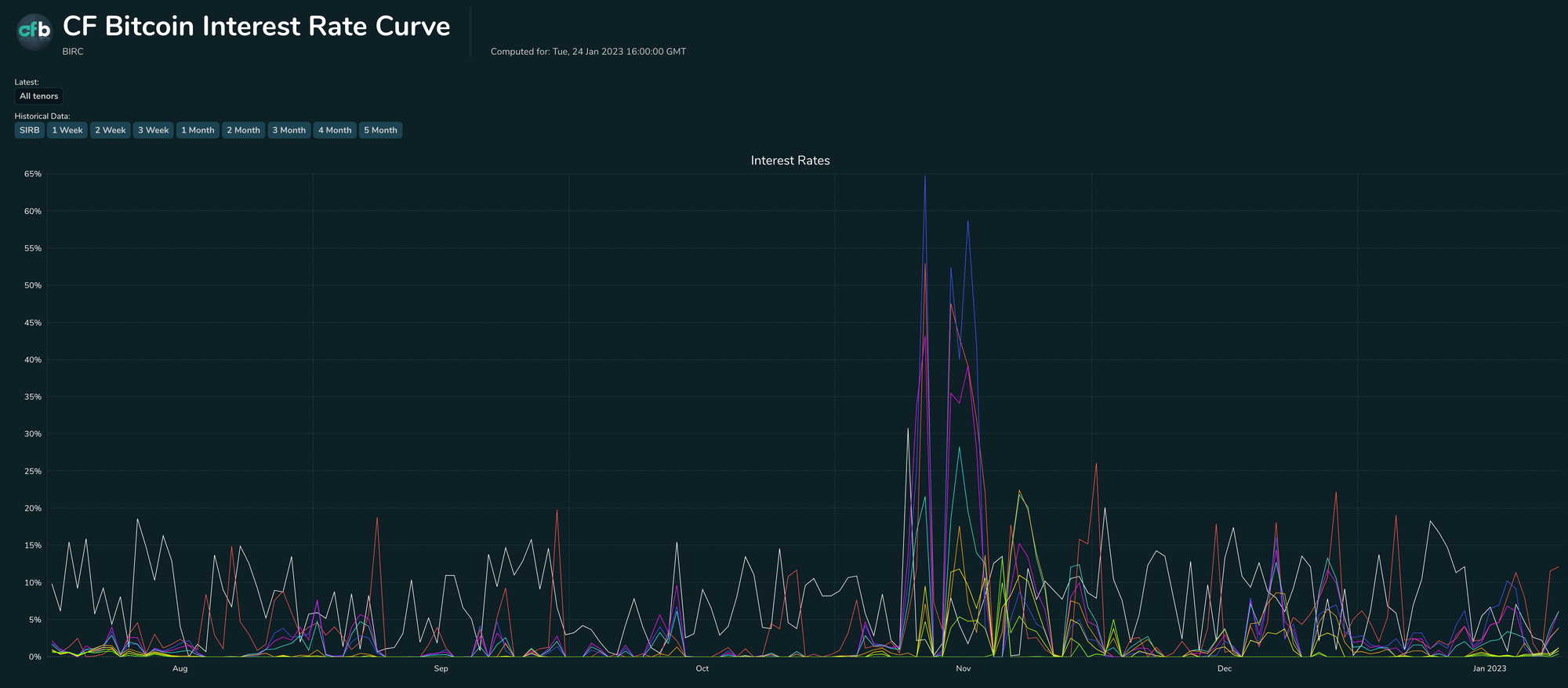

Our new CF Bitcoin Interest Rate Curve page features a configurable price chart, with lines representing each CF BIRC tenor that can be overlaid or examined separately, as pictured below.

Bitcoin rate market participants can now examine and analyze CF BIRC term rate curves—session, 1-week, 2-week, one-month, etc.—in isolation or collectively, in the same way that benchmark rate curves for traditional markets, like the Secured Overnight Financing Rate (SOFR) and Sterling Overnight Index Average (SONIA) interbank rates can be scrutinized, with full confidence in the transparency of their calculation methodology and accuracy.

In this way, the CF Bitcoin Interest Rate Curve helps fulfil one of the critical aims of CF Benchmarks: to progress cryptocurrency adoption, by fostering the professionalisation of cryptocurrency markets of all kinds.

Who needs CF BIRC?

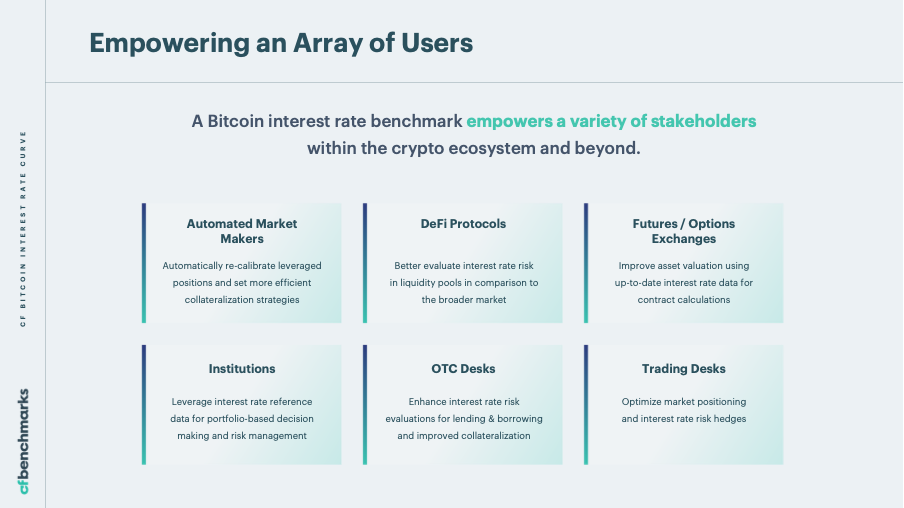

Some of the most salient use cases that would be optimised by attribution of CF Bitcoin Interest Rate Curve as the benchmark bitcoin interest rate are illustrated below.

CF BIRC’s Economic reality vs. pre-meltdown rates

It’s timely to recall that during their heyday, many retail vendors of crypto loans and savings products were notorious for highly favourable rates offered to customers. There was often a puzzling gap between these rates and the perceived economic reality of Bitcoin pricing at the time.

This suggests many of these rates were mispriced to a degree that was deleterious to the providers themselves, markets, and ultimately to the same clients who received such rates, as well as to the detriment of the digital asset ecosystem as a whole.

It’s likely that the consequences of these flawed business models contributed indirectly to the distress many of these businesses have experienced in recent months.

Of course, the availability of a widely accepted, representative, replicable and manipulation-resistant bitcoin interest rate, that measures the “underlying economic reality” of Bitcoin lending and borrowing (to quote the CF BIRC Methodology Guide), by itself, would not have forestalled imprudent behaviour – or worse – by service providers.

But there’s no doubt market facilities like benchmark rates are essential for the evolution and sustainability of a high-quality retail crypto credit service sector.

Likewise, benchmark crypto interest rates are a missing link that can stabilize, standardize and truly institutionalize commercial crypto loan services. For instance, in collateralization, in prime broking, and in capital markets more generally.

Whilst providers’ proprietary rate models may be based on carefully sourced data and robust monitoring systems, significant scope for inaccuracy, bias and inefficient rate pricing remains.

How CF BIRC measures the economic reality of bitcoin borrowing

For a basic understanding of what makes the CF Bitcoin Interest Rate Curve a superior representation of “the underlying economic reality of cryptocurrency borrowing and lending”, we should first consider what a bitcoin interest rate would require, at a minimum, to be fully representative and replicable.

To begin with, it’s clear that such a rate would need to systematically integrate the following types of data:

- Outright lending and borrowing data

- Implied rates calculated from publicly traded market instruments

Logically, these would imply the use of a clearly defined set of market data sources:

- Executed transactions on futures exchanges

- Executed loans from DeFi lending protocols

- Lending quotes from OTC crypto lenders

It follows that a proprietary institutional Bitcoin interest rate model would require access to the best possible sources of the fundamental data types outlined above.

Meanwhile, the CF Bitcoin Interest Rate Curve is constructed from exactly these data types.

From our sources: regulated term futures

Perhaps the most critical source of data utilized for calculation of the CF BIRC, particularly at the shorter end of the curve, are bitcoin term futures transactions, executed on the largest fully regulated global exchange at which bitcoin exposure is available: the CME.

The use of data from the largest regulated bitcoin futures market, combined with CF Benchmarks’ proven record of expertise in establishing representative and replicable benchmarks of high integrity, is one of the unique qualities that sets the stage for BIRC to become the definitive rate for institutional bitcoin lending and borrowing.

Full details of the how each type of transactional input data are currently allocated on the CF Bitcoin Interest Curve are available on the CF BIRC Factsheet.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks