Sep 24, 2025

Reserve Protocol deploys Large Cap Index DTF (LCAP), first institutional-grade, on-chain crypto portfolio

First regulated multi-asset crypto benchmark to be implemented as an investible DTF

Meet the Large Cap Index DTF (LCAP)

CF Benchmarks congratulates our partner, Reserve Protocol, on the successful deployment of their Large Cap Index Decentralized Token Folio (LCAP) — the first ever fully collateralized, on-chain, multi-asset index tracking vehicle; bridging our regulated benchmark methodology with DeFi-native execution.

Designed for institutional allocators, RIAs, and sophisticated DeFi participants, the product brings together CF Benchmarks as the regulated index administrator, Reserve as the protocol infrastructure, MEV Capital as the execution and liquidity operator, and Kraken as the day-one listing venue.

ETFs meet on-chain rails

Passive allocation to crypto has historically meant futures, ETFs, or active vault products — each with constraints: geographic availability, market hours, custody, active-management risk, among others.

Index DTFs represent the on-chain evolution: permissionless, composable, and live 24/7, yet built on institutional standards. This launch is the first ever implementation of a regulated large-cap digital asset index as a DTF, creating a liquid, transparent, and globally accessible benchmark-tracking token.

The Benchmark: CF Large Cap (Diversified Weight) – US – Settlement Price

At the heart of the Large Cap Index DTF is the CF Large Cap (Diversified Weight) – US – Settlement Price, a liquid and investible benchmark designed to track the performance of large-cap digital assets. It captures approximately 95% of the total investible crypto market capitalization, with constituents weighted by a free-float market cap methodology and governed by CF Benchmarks’ Digital Asset Series Ground Rules and Capitalization Series Methodology. Rebalanced and reconstituted quarterly, the index is calculated daily at 4:00 pm U.S. EST. It was incepted on December 1st, 2021, with historical values backfilled through to its launch in February 2023.

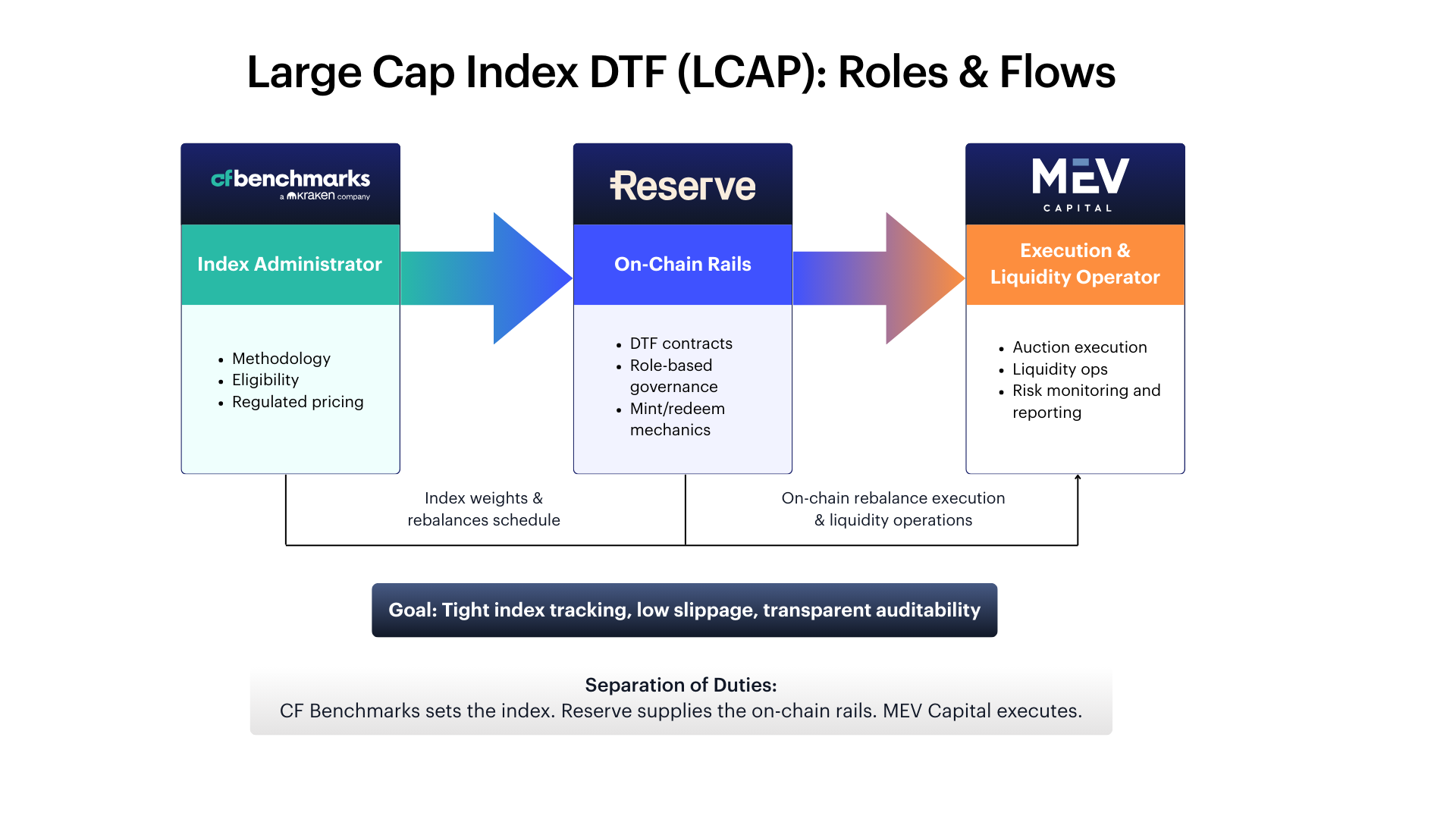

Large Cap Index DTF – Roles and information flow

Given the Large Cap Index DTF’s implementation as a first-of-its-kind Dapp, it is cogent to clearly delineate the role of participant entities and components in the provision of the DTF, as well as to describe, in essence, the information flow between these participants that establishes the existence of the DTF.

The basic process underlying the DTF is depicted in the simplified diagram below.

Read on for a concise outline of each participant’s role.

On-chain architecture via Reserve

The DTF lives on the Reserve Protocol, whose role is to supply the on-chain rails:

- Smart contracts representing the DTF token and its fully collateralized basket of assets

- Permissionless minting and redemption at verifiable on-chain NAV

- Role-based governance for rebalances, fee changes, and risk parameters

- Built-in composability, enabling the token’s use in DeFi primitives without loss of index exposure

MEV Capital: Execution and liquidity operations

Within those governance-defined parameters, MEV Capital acts as the DTF’s execution and liquidity operator:

- Translating CF Benchmarks’ target weights into Dutch-auction rebalances on Reserve

- Coordinating liquidity across approved venues to minimize slippage and maintain tight index tracking

- Running pre- and post-trade risk checks, tracking-error reporting, and incident protocols — all auditable on-chain

Market access: Day-One listing on Kraken

Alongside DTF counterparties and infrastructure partners, Kraken will play just as critical a role: liquidity partner for the Large Cap Index DTF.From launch, the Large Cap Index DTF will trade on Kraken with USD and EUR pairs, offering deep centralized-exchange liquidity alongside its permissionless on-chain market.

As with other ERC-20 instruments, secondary-market liquidity is also expected to develop on decentralized exchanges such as Uniswap, giving investors multiple access routes across both CEX and DEX venues.

Read concise histories and further details about all Large Cap Index DTF partners in the sections below.

CF Benchmarks

CF Benchmarks is the leading UK FCA-regulated and authorized cryptocurrency benchmark administrator. The firm provides transparent benchmark indices — including the CF Large Cap (Diversified Weight) – US – Settlement Price — which are rigorously constructed in conformance with the UK Benchmarks Methodology (BMR) an oversight framework aligned with EU and global regulatory standards. CF Benchmarks indices serve as reference points for regulated financial products, derivatives, and ETFs, powering billions of dollars in investments and derivatives.

Reserve

Reserve Protocol is an open, permissionless system for launching and governing Decentralized Token Folios (DTFs) — on-chain, fully collateralized baskets of digital assets. The protocol powers mint/redeem flows, governance, and Dutch-auction rebalancing, offering composable, transparent, and programmable exposure to diversified asset portfolios.

MEV Capital

MEV Capital is a crypto asset manager specializing in on-chain liquidity, DeFi-native execution, and risk-managed strategies. Legally established in Lithuania (UAB) with relevant LEI credentials, the firm operates sophisticated strategies across EVM chains — including vault curation and managed accounts. In this collaboration, MEV Capital serves as the execution and liquidity operator for the Large Cap Index DTF, delivering auction execution, liquidity sourcing, and tracking-error monitoring on-chain.

Kraken

Founded in 2011, Kraken is one of the world’s leading cryptocurrency exchanges, offering advanced trading tools, custody services, and broad fiat-native support. As the day-one listing partner for the Large Cap Index DTF (LCAP), Kraken provides institutional-grade liquidity via USD and EUR trading pairs across its standard and Pro platforms.

Differentiator in a sparse field

While the Reserve protocol hosts other DTFs, for now in most cases, their AuM and liquidity are relatively limited. The Large Cap Index DTF stands apart from most DTFs for the following reasons:

- Institutional benchmark alignment with a regulated index

- Operational credibility via experienced partners across indexing, protocol, and execution

- Liquidity as a design feature, not an afterthought — spanning on-chain and centralized venues from day one

- Full collateralization with on-chain transparency, auditability, and 24/7 mint/redeem

Strategic use cases

The Large Cap Index DTF is the first ever institutional-grade, on-chain bridge between regulated benchmark methodology and DeFi rails: globally accessible, transparent, and live 24/7.

So, as well as providing a pathway to simple, one-click exposure to a diversified crypto exposure for sophisticated retail participants, these characteristics put the DTF at the forefront of a growing wave of institutional deployment of DeFi, enabling the key strategic use cases outlined below.

- Institutional passive allocation: Transparent exposure without custody or trading-hour constraints – offers streamlined access for RIAs and allocators

- Efficient alternative to perps/futures: lack of funding rate drag or basis risk, carry cost eliminated; Coinbase Qualified Custody removes counterparty risk

- DeFi-native portfolio construction: Composability into lending, yield strategies, and structured products

- Derivatives underpinnings: A liquid, tradable spot reference for future index-linked instruments

- Relative value trading: Unlocks more precise long/short directional or market beta index-based strategies

Conclusion: A structural bridge for the next phase of crypto allocation

The Large Cap Index DTF represents more than a new product: it is the first ever instance of regulated benchmark methodology translated directly into on-chain infrastructure. By combining CF Benchmarks’ regulatory credibility, Reserve’s transparent and composable rails, MEV Capital’s execution discipline, and Kraken’s liquidity, the initiative creates a structural bridge between the standards of traditional finance and the possibilities of decentralized markets. For institutional allocators, RIAs, and DeFi-native investors alike, it establishes a new template for accessing broad-based digital asset exposure: transparent, globally accessible, and built to last.

Explore More

Click the links below to find out more about the Large Cap Index DTF (LCAP), Reserve Protocol, MEV Capital, and CF Benchmarks' CF Large Cap (Diversified Weight) – US – Settlement Price.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks