Feb 02, 2024

Market Recap: Spot ETFs Ignite Fund Inflows as Prices Idle

Key takeaways for the month:

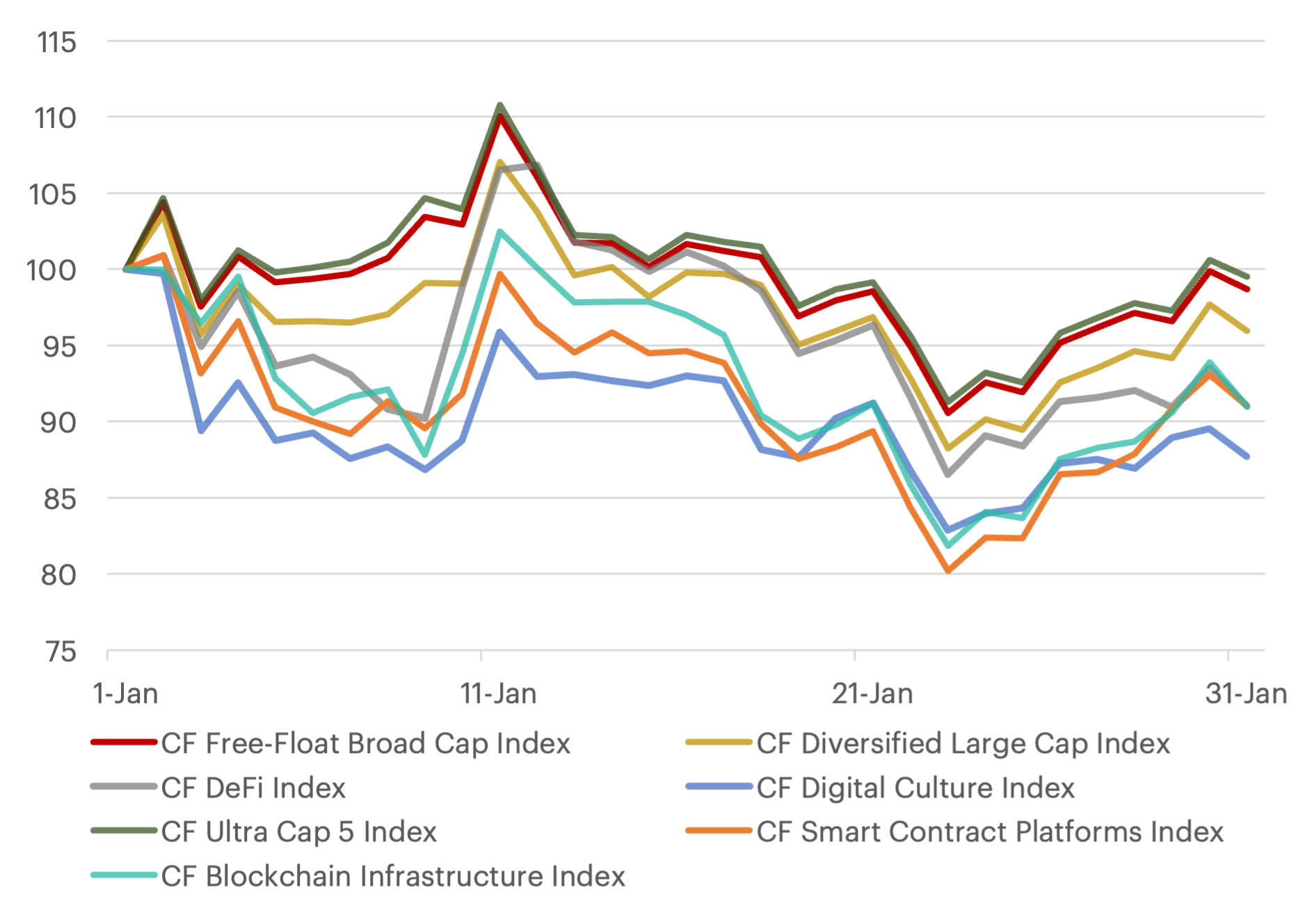

- This month marked a major milestone for digital assets as the SEC approved the first series of spot Bitcoin ETFs in the U.S. market. The initial launch of these products was met with tremendous demand with total net inflows surpassing $1.4 billion and assets under management for the newly launched cohort of funds exceeding $7.3 billion. However, despite the ETFs, Bitcoin prices ended the month relatively flat after already appreciating over 80% since the summer. Overall market performance was subdued, with the CF Free-Float Broad Cap Index nearly unchanged at -1.3%, while the CF Ultra Cap 5 Index of mega caps outperformed. Lagging market segments included the CF Digital Culture Index, down 12.2%, and the CF Blockchain Infrastructure Index, which fell 9.0%.

- The monthly top performing protocols displayed a wide variance in performance, with returns spanning 0.2% to 15.5% across Maker, Ethereum Classic, Chiliz, Stacks and Chainlink. On the flip side, underperformers like Fantom, Curve DAO Token, Filecoin, Synthetix and Algorand posted steep declines that stretched from -25.57% to -31.11% for the month.

- Institutional interest in digital assets continued on its upward climb as evidenced by a near-record of monthly inflows with the launch of the first series of spot Bitcoin ETFs in the U.S. market. Additionally, total open interest for Bitcoin and Ether futures rose 1.3% and 9.2% (respectively) from the previous month. Lastly, CME Bitcoin open interest hit a new all-time high of 26,846 contracts, further underscoring surging institutional demand.

Monthly Index Performance

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Quarterly Attribution Reports - March 2026

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category, and segment levels during the course of each portfolio rebalance period.

Gabriel Selby

Weekly Index Highlights, March 9, 2026

Geopolitical strains kept digital assets on the defensive in the past week, with Bitcoin down 2.1% and Cardano -12.0%. Realized BTC volatility and our BVXS implied vol. index both inched higher, by 5.8 and 1.7 points, but Culture tokens in our CF DACS taxonomy were worst hit on average, at -8.7%.

CF Benchmarks

Factor Friday - March 6, 2026

The market posted its strongest weekly gain of 2026 at +4.3%, trimming YTD losses to -28.0%. Value emerged as the top factor at +1.7% weekly, turning positive YTD. Downside beta posted its first negative week of the year, signaling a potential early shift towards risk.

Mark Pilipczuk