May 04, 2024

Market Recap: Higher Inflation & Rates Bite at ‘Halving’ Hopes

Key takeaways for the month:

- Macroeconomic Developments and Bond Yields: Inflation pressures remain stubbornly high, with both the headline and core figures topping economist estimates for the third straight monthly reading. As a result, bond yields broadly rose, with the 10-year marking a new yearly high of 4.72% as markets continue to price out future monetary policy easing.

- Digital Asset Milestones: Despite these macro headwinds, April saw some notable milestones in the digital asset space. Firstly, the Bitcoin network successfully completed its fourth 'halving', reducing the rewards earned by miners from 6.25 bitcoins to 3.125. Additionally, there was the highly anticipated launch of spot Bitcoin and Ether ETFs in Hong Kong.

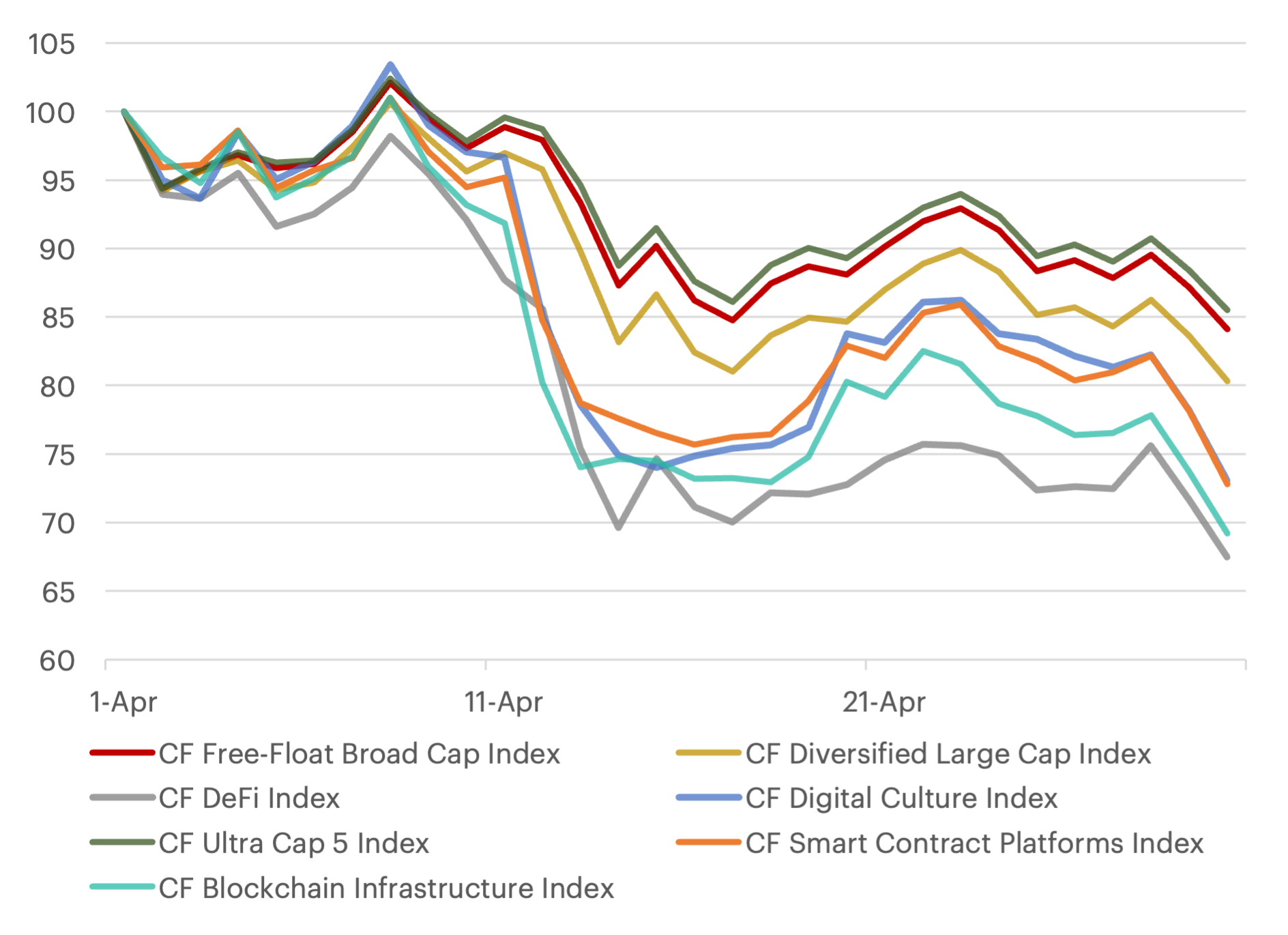

- Market Performance: Ultimately, price action for digital assets was broadly negative, with the relatively more defensive CF Ultra Cap 5 and CF Broad Cap Index indices outperforming the rest, falling just 14.5% and 15.8%, respectively. This month's major laggards included, the CF Blockchain Infrastructure and CF DeFi Composite Index, each falling over 30%.

- Bitcoin and Ether Outperform Altcoins: Bitcoin (-15.5%) and Ether (-18.5%) demonstrated relative outperformance over other altcoins in last month's crypto rout, as investors preferred more defensive positioning in the most established and liquid 'bellwether' tokens.

- Regulatory Concerns Impact DeFi Tokens: Finance tokens led the major crypto pairs lower, with Uniswap's UNI token falling over 46% after the Securities and Exchange Commission issued a Wells notice to the decentralized exchange. This regulatory headline risk spilled over to Synthetix's SNX token, which also posted over a 40% decline.

- Bitcoin Interest Rate Curve (BIRC) Shifts Downward: Despite the anticipation surrounding the recent Bitcoin halving, negative macro headwinds, such as persistent inflation and higher interest rates, have dampened investor sentiment. This has resulted in a broad-based downward shift in the BIRC, with all tenors experiencing declines. The most significant changes were observed in the short-term tenors, with the one-week (1W) and two-week (2W) tenors seeing notable nominal decreases of 21.24% and 14.82%, respectively. Overall, the BIRC's downward trend indicates a cautious market sentiment amid the challenging macroeconomic environment.

- Bitcoin Mining Revenues Decline: As expected, daily mining revenues decreased by over 56% to $26.4 million. The substantial decrease in daily revenue earned by miners was driven by the network's fourth programmatic halving, which slashed the block rewards earned by half, along with simple price depreciation.

- DeFi Total Value Locked (TVL) Falls: Total value locked (TVL) in decentralized finance (DeFi) protocols experienced a significant decline over the past month, falling from $177 billion to approximately $156 billion. This notable decrease in TVL can be largely attributed to the negative impact of the SEC's Wells notice that was given to the world's most widely used Decentralized Exchange, Uniswap, which has led to increased regulatory uncertainty in the sector.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Kraken MTF Lists Large Cap DTF Perp

EU-domiciled institutional investors can now access a perpetual contract based on Reserve Protocol's multi-token LCAP DTF.

CF Benchmarks

Notice of the Demising of Three Indices Within the Token Market Price Benchmarks Series

The Administrator announces that three Token Market Price Benchmarks Series indices are to be demised.

CF Benchmarks

Suspension of Kraken as CF Constituent Exchange from CF Adventure Gold-Dollar Spot Rate

The Administrator announces the suspension of Kraken as a CF Constituent Exchange for the CF Adventure Gold-Dollar Spot Rate.

CF Benchmarks