Oct 02, 2020

Goodbye to Crypto Hold-outs’ last stand

Institutions say manipulation risk is among their last big crypto fears. Exchange data reveal the way forward

‘Mainstreaming’ may not be a word to everyone’s taste, but it’s been music to the ears of the crypto world this year.

Crypto’s year of mainstreaming

- In the summer, the U.S.’s Office of the Comptroller of the Currency (OCC), an arm of the Treasury, confirmed that banks are allowed to custody cryptos for customers. A few months later, the same regulator would issue further guidance that effectively authorised U.S. lenders to hold stablecoins as reserves

- Speaking of banks, the OCC will soon have a new institution to oversee, with Kraken, the crypto exchange operator, this month winning charter to operate an SPDI, a new kind of bank

- It wasn’t just the feds having light bulb moments. A June Fidelity Digital Assets survey of around 800 U.S. and European institutional investors showed 6 out of 10 believed digital assets had a place in their investment portfolios, compared with 36% already invested in them

- Likewise, ZUBR, an institutional derivatives platform, last month published research suggesting clients are increasingly keen to own ‘physical’ Bitcoin underlying the futures contract they already trade. Institutions, which by virtue of their retail clients reflect ‘Main Street’ demand, indicated an intent to hold Bitcoin as a long-term investment

- That trend was partially confirmed by a broader report by researchers at Cambridge University showing there are now almost 100 million individuals worldwide using cryptocurrencies. The Cambridge Centre for Alternative Finance had estimated as recently as 2018 that there were ‘just’ 35 million global identity-verified crypto users

Tipping point ahead

Such data make the road to mainstream crypto adoption look like a one-way street. For sure, there are no guarantees that the path will remain a straight one. But if, as readings suggest, retail client demand is approaching a tipping point, before too long, institutions will have little choice but to play a pivotal role in delivering crypto investment products to individuals on a large scale.

Considering that cryptocurrencies are still widely regarded as ‘unconventional assets’ it is ironic that these coming products are likely to follow tried and trusted forms when they hit mass markets.

Chiefly, it is the advent of regulated exchange traded crypto funds that is beginning to look inevitable. Note that although several exchange traded products tracking digital assets already exist, the class of ETPs authorised by global regulators—like the UK’s FCA and the U.S. SEC—is largely reserved for those designated as ETFs. Given that institutional product and services providers will need regulated assets to properly fulfil broad retail mandates, the first regulated crypto ETF to be approved by regulators is likely to provide the next true watershed in the acceptance trend. (Regulators are likely to demand that such a vehicle must utilise regulated price data such as those underpinning CF Benchmarks' Ultra Cap 5 cryptocurrency benchmark index.)

Speed bumps

Of course, rising demand won’t make the perceived risks for providers disappear. These risks now represent the principal speed bump on the corporate side. Indeed, a look at the comments accompanying the Fidelity Digital Assets survey mentioned above shows the typical risk factor applying brakes for potential product providers remains cryptos’ notorious price volatility.

53% of investors surveyed cited concerns about the frequency and extent of outsize price moves. Still, there's also a rising recognition that crypto market turmoil should rank alongside hazards that beset many risky assets, including certain equity sectors, commodities and others. In other words, the tendency to avoid cryptocurrencies due to price variability alone is fading.

Regulated stands out

The second-highest concern expressed by respondents in Fidelity’s research was market manipulation, a factor cited by 47%. Again, though this specific risk is also not germane to cryptocurrencies, the conventional perception is that it’s more egregious in the digital asset space. Here though, some of the most up-to-date soundings signal that investors recognise that remedies for nefarious price action are already within reach.

- ZUBR, whose research we mentioned above, observed that only two crypto derivatives exchanges saw trading volumes rise since their peak in May. These are CME, which offers cash-settled crypto futures, and Bakkt, the options platform that has latterly added the first ‘physically-settled’ Bitcoin futures to its offer. These exchanges are also the only venues where crypto futures that can be traded regulated by the U.S. Commodity Futures Trading Commission

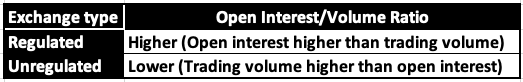

- Regulated exchanges had another distinction, according to ZUBR. It noted similarities between unregulated exchanges in terms of the correlation of trading volume (daily percentage changes) with open interest. The key differences between regulated and unregulated venues with respect to the ratio of contract open interest vs. volume of contracts traded are summarised in the table below

Open Interest vs Volume by Exchange Type

Concluding that traders showed a higher propensity to close positions more quickly on unregulated exchanges than on regulated ones, ZUBR interpreted this as indicating participants were displaying a higher degree of trust in regulated environments than in unregulated environments.

Bad acting and deep pockets

That trust can easily be tied back to the concern institutional investors indicated was the second-biggest deterrent against committing to crypto, the fear of price manipulation. With a higher persistence of open trades on regulated exchanges than on unregulated venues, it’s clear where manipulation risk is perceived to be higher.

In fact, the perceived disparity in manipulation risk is addressed succinctly by CF Benchmarks, the only officially authorised cryptocurrency benchmark provider. Importantly, CF Benchmarks’ methodology underpins cryptocurrency price data adopted by the CME Group for its cash-settled crypto futures contracts. These price feeds are known as CME CF Reference Rates, published once a day, and CME CF Real-Time Rates, published continuously in real-time.

In a submission of comments to the SEC last year, CF Benchmarks noted a number of anti-manipulation features in its Bitcoin pricing methodology. These comments are summarised below.

- Given that CME CF Bitcoin Reference Rate (BRR) only includes Bitcoin-U.S. dollar transactions from carefully selected constituent exchanges, any manipulator would be obliged to use traditional banking mechanisms to transact. As such, normal identification of counterparties would come into play, a natural deterrent to most manipulators

- The stringent one-hour window during which the BRR is calculated also restricts dishonest pricing.

- The hour is divded into 12 discrete five-minute partitions

- The volume weighted median of each partition is then calculated

- The arithmetic mean of the 12 medians becomes CME CF BRR

- Successful BRR price manipulation would therefore require unfeasibly deep pockets! Huge trades would have to be made in all 12 five-minute partitions. CF Benchmarks calculates that a bad actor (or bad actors) would need to account for 50% of the aggregate volume across all five constituent exchanges for at least 35 minutes. The economics of such a scheme don’t make sense, which is the whole point of CF Benchmarks’ anti-manipulation methodology. Further details on CF Benchmarks’ methodology can be found here.

The Takeaway

All told, though price-manipulation fears are among the last remaining misgivings institutional market participants have against investing in digital assets, methodologies are now available that go a long way towards neutralising those concerns.

As we’ve seen, though manipulation remains a worry, major investors are already pointing the way to resolving that worry with a preference for regulated price data and regulated exchanges over unregulated price data and unregulated exchanges.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 97

Crypto prices might be locking into a nervous range, but a new arena of speculation - prediction markets - led by Kalshi, looks unstoppable. Meanwhile, digital asset ETF launches are accelerating.

Ken Odeluga

Kalshi Leads Surging Crypto Event Contract Market, Powered by CF Benchmarks

An exploration of the nature and scope of the crypto prediction market opportunity within the domain of U.S. regulations - where Kalshi is the dominant player.

Ken Odeluga

Re-admission of Kiln as a CF Constituent Staking Provider for the CF ETH Staking Reward Rate Index and related indices

Following a review, the Administrator is satisfied that the performance of Kiln’s Ethereum validators was not compromised by a vulnerability incident impacting a third party in September.

CF Benchmarks