Aug 06, 2024

Expansion of CF Digital Asset Index Family to include CF Institutional Digital Asset Index Settlement Prices and Spot Rate

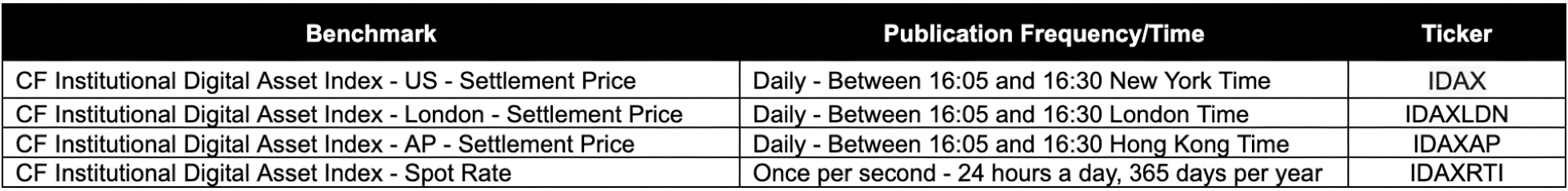

The Administrator announces the addition of the following indices to the CF Digital Asset Index Family - Multi Asset - Capitalization Defined Series:

The indices have been developed to measure the performance of a free float market capitalization weighted portfolio of all assets within the 95th percentile of the CF Liquid Universe that are recognised as being in conformance with prevailing capital markets regulations of major financial jurisdictions.

The portfolio composition is determined by the CF Digital Asset Index Family - Multi Asset Series Ground Rules. The portfolio is denominated in USD and rebalanced on a quarterly basis.

Publication of the CF Institutional Digital Asset Index Settlement Prices, and CF Institutional Digital Asset Index Spot Rate will commence on August 6th, 2024.

For licensing opportunities please contact [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks