Sep 19, 2025

Crypto's Swensen Moment: What Generic Listing Standards Mean for Product Issuers and Allocators

The Securities and Exchange Commission's (SEC) recent move to approve generic listing standards for spot crypto ETFs may seem like regulatory housekeeping to most financial professionals, but in practice, it represents a new paradigm in how digital assets will ultimately intersect with traditional finance. The new framework allows exchanges to list spot crypto ETPs under standardized rules, similar to how commodity ETFs operate, rather than requiring individual SEC approval for each product. For the first time, the SEC has transitioned from granting reluctant, case-by-case approvals toward embedding digital assets into the durable infrastructure of U.S. capital markets.

This change matters for two reasons. First, it massively accelerates product innovation. Under the old regime, each new ETF required a bespoke filing process, rife with regulatory uncertainty and ad hoc decision-making. Now, once an exchange satisfies the standards, additional spot crypto products, beyond Bitcoin and Ether, can come to market with greater speed and predictability. The analogy to equities is instructive: the ETF ecosystem only flourished after regulators standardized listing protocols in the late 1990s. The shift enabled not just index funds, but thematic products, sector plays, and eventually leveraged and inverse structures. Following these protocols, we saw launches accelerate from a trickle in the 1990s to approximately 4,500 ETFs in the US today managing over $12 trillion in assets. The innovation curve steepened, liquidity deepened, and investor choice expanded.

Second, the move tilts the balance of power toward the market rather than the regulator. One of Howard Marks's recurring themes in The Most Important Thing is the pendulum of market psychology—how extremes of fear or exuberance dictate valuations. Regulatory frameworks have their own pendulum. For years, crypto ETFs swung on the side of skepticism, with the SEC acting as gatekeeper. By embedding crypto within generic listing rules, the pendulum has moved closer to neutrality. The SEC is no longer signaling that each launch is an existential referendum; instead, it is allowing the market to determine demand and sustainability.

This shift echoes the alternative asset revolution, more commonly known as the 'Yale Model'—with one critical difference. When Swensen began allocating significant portions of Yale's endowment to alternative assets, he faced similar regulatory hurdles. But alternatives required bespoke structures and private placements. Crypto ETFs, by contrast, will be accessible through standard brokerage accounts, democratizing what alternatives never could: liquid exposure to a new asset class without accreditation requirements or lockup periods.

Institutional investors should recognize the implications. Just as the introduction of gold ETFs in 2004 transformed bullion from a custody-intensive niche holding into a liquid mainstream allocation, the normalization of crypto ETFs could accelerate adoption curves. Despite $917 billion in total ETF flows in 2025, crypto products has captured only $37 billion—a mere 4% of industry inflows. A pension fund CIO who once needed to navigate concerns about custody and board-level questions about regulatory status may now present crypto exposure as simply another fully regulated product allocation, structured no differently than a secular-thematic play or precious metals sleeve.

Yet history counsels caution alongside optimism as standardization invites both innovation and excess. The parallel to structured products is instructive: shelf registration statements under Rule 415 enabled rapid innovation in the early aughts, but also allowed complexity to outpace risk management. Generic listing standards similarly lower barriers—the question is whether market discipline and investor due diligence can keep pace with product proliferation. While the parallel is imperfect, the ETF boom itself saw both passive index tracking and complex leveraged products; the former revolutionizing investing, the latter sometimes magnifying losses during volatility spikes. Therefore, having a partner who deeply understands this space is critical for product issuers to avoid potential pitfalls and ensure positive client outcomes.

The SEC's move doesn't settle every question about crypto's role in portfolios, but it provides the regulatory clarity institutions have long sought. For allocators weighing the risks and rewards of an emerging asset class, the shift to generic standards should be read as a 'regulatory green light' and as a significant milestone.

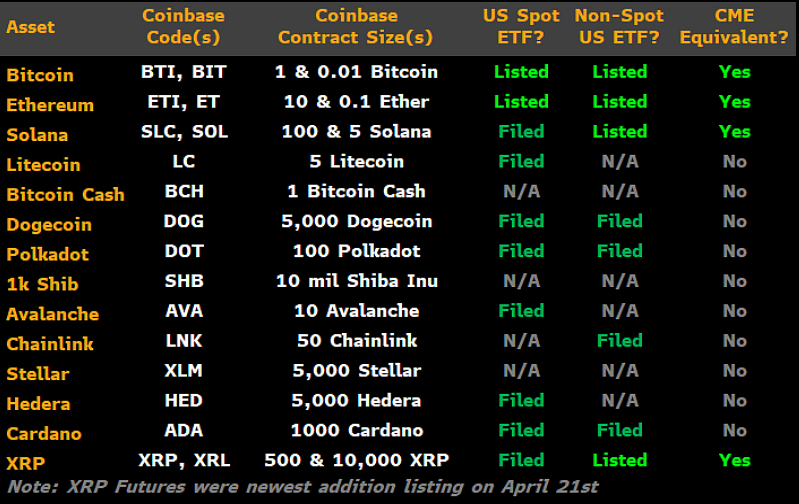

The practical timeline matters: large-cap crypto assets likely represent the next wave, with applications potentially arriving within weeks rather than years. For allocators, this means decision frameworks for digital asset exposure need development now, not when the next wave of products launches. In our view, digital assets are no longer merely tolerated at the margins, but are on the verge of experiencing their ‘Swensen Moment.'

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks