Nov 27, 2020

CF Benchmarks Recap - Issue 10

-

Bitcoin volatility alive and well

-

Ethereum 2.0 sprints over the line

-

Easer-in-Chief for Treasury Chief

Crack landing

Crack landing

Routed, not Rekt

To those for whom the spectacular price moves of the week were completely unforeseen - including Bitcoin’s drop by as much as 16% in about 24 hours - welcome to the wonderful world of crypto. More to the point is the reality that sceptics and some of the curious alike have been handed corroboration of many suspicions after Bitcoin (and other top digital assets) ended an almost three-month uptrend. On Tuesday, the regulated CME CF Bitcoin Reference Rate was up 83.94% from 2nd October’s $10,529.71 one-month low, to a new three year high of $19,368.13. The CME CF Bitcoin Real Time Index then tumbled around $1,000 within an hour of the peak, before printing a bottom of $16,221.10 on Thursday at 17.27.56 UTC. Prices have since inched higher. If (a big ‘if’) that low holds, that would offer some reassurance to buyers, whilst implying a relatively contained ‘crash’, this time. Additionally, prospects that institutional adoption intentions will be dialled sharply back look remote. In a very real sense, it may be too late. VanEck launched the latest tracker in the space, an ETN, on Wednesday. More prosaically, investment rationales remain intact. Fidelity Digital Assets, for example, expects to open its own fund “fairly soon”, said marketing chief Christine Sandler this week. Either way, post-mortems of Bitcoin’s latest failure to reach $20,000 inevitably abound. The more informative ones cite algorithmically-timed profit taking, over-leveraging, OKEx’s resumption of withdrawals and more.

Ethereum staked

As late as Tuesday morning, a soupçon more than 50% of the prescribed Ether (at least 16,384), required to initiate Ethereum’s transition to a proof-of-stake consensus from proof-of-work, had been deposited. Then, demonstrating that multi-million-dollar pledges from co-founder Vitalik Buterin, Dubai’s IBC Group, and Bitcoin Suisse among others, were just the beginning, the Ethereum Foundation signalled an inflection point. “Genesis deposits” were “locked in” at 12pm UTC, the .org announced, a week before 1st December, scheduled date of ‘Phase 0’. Further plot twists remain likely. CF Benchmarks’ Ether indices are unaffected for now, apart from the CME CF Ether-Dollar Reference Rate marking a two-year high of $604.10 on Tuesday, up 285.91%.

“Not a fan”, just new U.S. Treasury Secretary

Janet Yellen’s next incarnation in public life could be on the other side of the table. Aside from a comment in 2018 that she was “not a fan” of Bitcoin, Professor Yellen is known as the architect of ‘QE’. The policy erodes the appeal of yield-bearing assets and is therefore widely seen as a key to the digital asset class investment case.

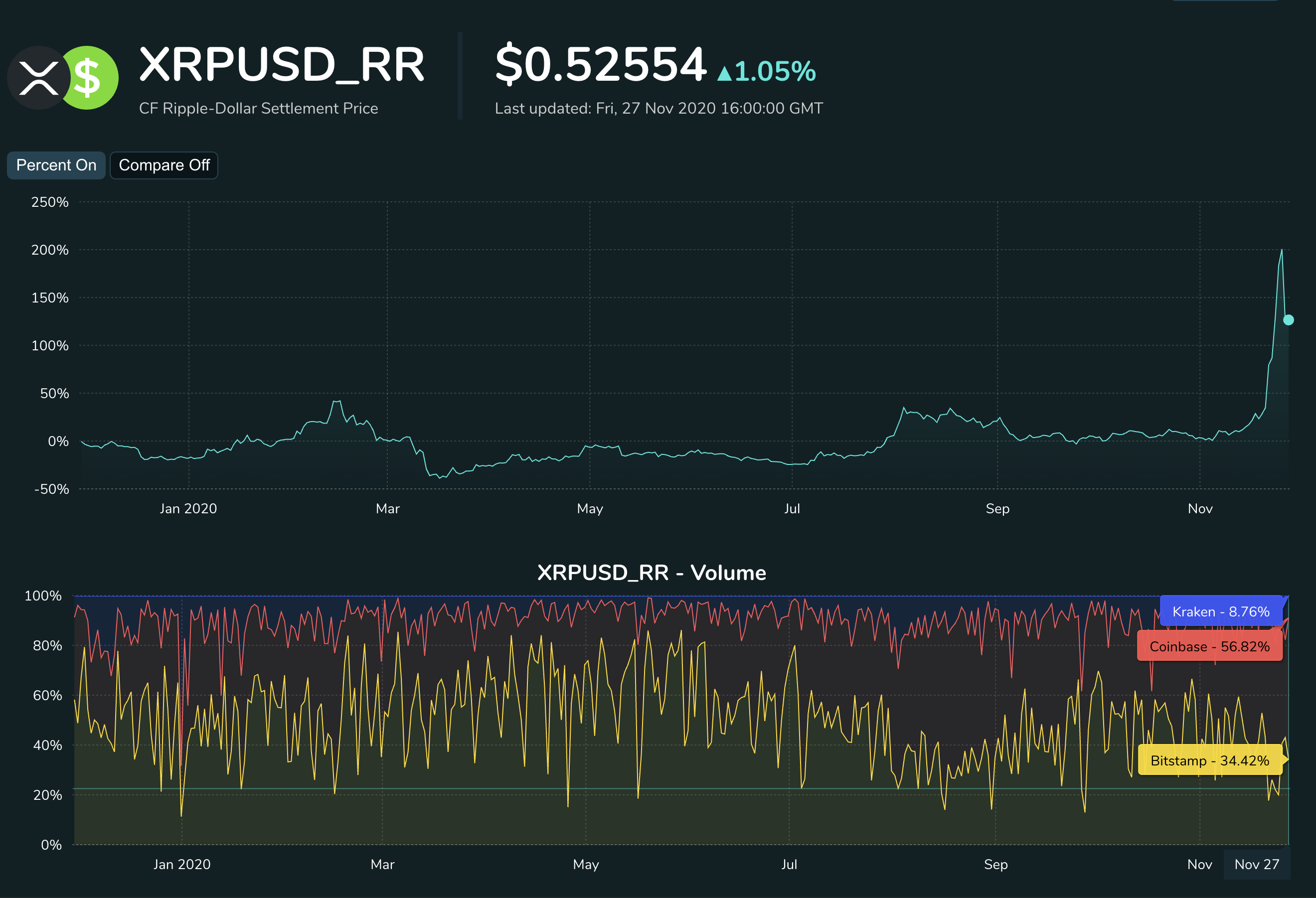

The Returns: XRP

The CF Ripple-Dollar Settlement benchmark saw seen one of the deepest corrections among alts this week, rescinding some of the value made from $0.22541 on 24th September to the year’s $0.69699 high. It closed at $0.52554 on Friday, up 127.09% for the year.

Featured benchmark: Ultra Cap 5

CF Benchmarks Ultra Cap 5 - Constituent Changes and Weights

Announcement

The Administrator announces the final portfolio composition and index weights for the CF Ultra Cap 5 Index.

Additions

ChainLink (LINK)

Removals

Bitcoin Cash (BCH)

Final Portfolio & Weights

• Bitcoin 75.57%

• Ether 15.94%

• Ripple XRP 5.66%

• Litecoin 1.49%

• ChainLink 1.34%

Portfolio and weight changes will be come into effect at the Rebalance Implementation Point - 1600 New York time on Friday, November 27th.

Read more about the addition of ChainLink’s LINK token to the Ultra Cap 5 Index in this article

How Bitcoin Cash’s latest fork contributed to its Ultra Cap 5 exit

More about the Bitcoin Cash benchmark index, CF Bitcoin Cash-Dollar Spot Rate

More about the LINK benchmark index, CF Chainlink-Dollar Settlement Price

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks