Jul 13, 2021

CF Benchmarks Recap - Issue 37

-

NYDIG, NCR bring crypto to Main Street banks

-

Visa signals no turning back

-

VIDEO: CFB joins CAIA webcast on crypto fund performance

Mostly Main Street

Bitcoin slumped again last week, as inflation/Fed-rate/dollar anxieties hampering Wall Street and digital assets alike since May persisted. The seasonal retreat from activity and lack of a typical positive response to exchange balance declines, suggest little change, near term. As detailed by monthly Reference Rate returns (see 'The Returns' section below) June was another loss-making month, though less so than May, confirming persistent ranges. After $40,769.98 on June 14th, BRR marked June’s low at $29,726.14 just a week later, a 27% swing. ETHUSD_RR topped at $2,787.01 on June 3rd before bottoming at $1,755.95 the same day as BTC’s floor, a 36.99% drop from its top. Real-time benchmarks BRTI and ETHUSD_RTI stood at $33,369.94 and $2,083.84, up 1.89% and 0.13% by Saturday, 16.44 UTC. As often noted, lacklustre prices could matter more if adoption was slowing, but there’s little credible evidence of that. The fund space remains replete with fresh filings and launches. The volume of consumer product news was double the newsletter space available. Highlights: NYDIG’s deal with NCR paves the way to crypto for millions of U.S. bank customers; Visa expands on the $1bn in crypto spending it facilitated in H1. Meanwhile, SEC wheels keep grinding slowly. For more, keep reading.

NYDIG, NCR, Visa put the ‘A’ into ‘Adoption’

NYDIG’s partnership with NCR credibly extends ‘crypto adoption’. The custodian and infrastructure arm of Stone Ridge Asset Management and the venerable cash technology group aim to stem an alarming outflow of U.S. retail bank depositors to exchanges, like Kraken and Coinbase. Their 650 bank clients will roll out crypto to up to 24 million customers, according to Forbes. NYDIG will handle the BTC, etc., avoiding the regulatory uncertainty U.S. banks face in an increasingly crypto world. Likewise, Visa’s push—in partnership with CF Benchmarks licensee BlockFi—to expand crypto transactions from an already punchy $1bn in H1 2021, qualifies as 'adoption’ too. Furthermore, Visa’s ramp of crypto hires and deals with 50 crypto card-programme partners, take it further past the point of no return.

Bitcoin ETF trend undimmed; goes a bit ‘lite’

Anthony Scaramucci’s Skybridge Capital is the latest Bitcoin ETF applicant that calculates NAV with a CF Benchmarks index to have its SEC review extended (till August 25th). Enthusiasm undimmed, Skybridge plans a private ETH fund that may later convert into an ETF, plus it’s set to join the ‘Bitcoin-lite’ ETF trend, that sidesteps SEC wariness by investing in crypto firms instead of cryptocurrencies. Invesco, ProShares and others are getting involved after Bitwise’s “Crypto Stocks, Not Coins” ETF grew AuM to $45m in month one. Cathie Wood’s Ark Invest is the latest to file for an actual Bitcoin ETF, in partnership with prolific Swiss crypto ETP group 21Shares.

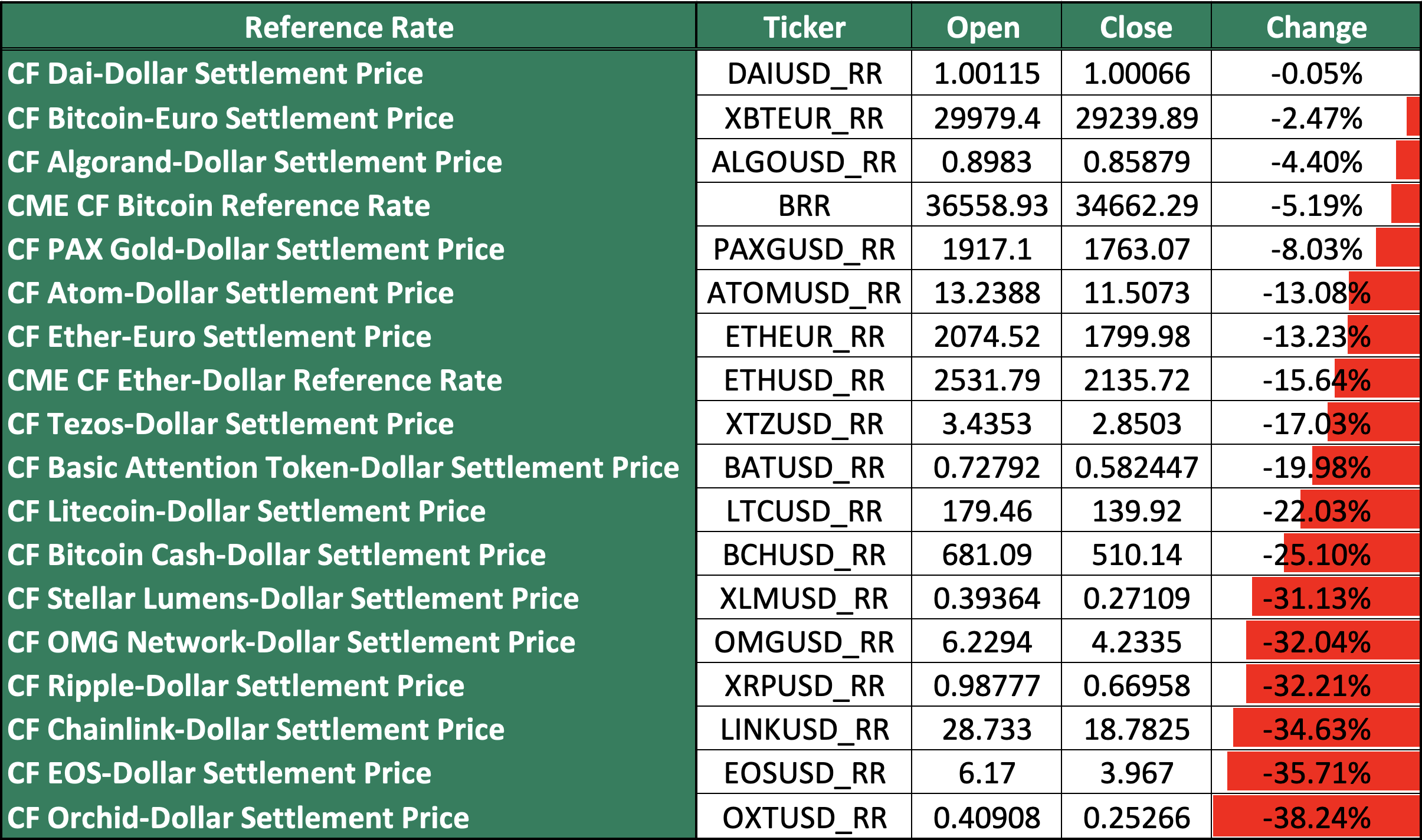

The Returns: June Reference Rate monthly returns

Weak, but better than May. BRR edged 5% lower, OXTUSD_RR’s 38% slump undershot ATOMUSD_RR’s -44% in May.

Featured benchmarks: CME CF Bitcoin Reference Rate

Crypto fund performance analysis needs robust benchmarks

CF Benchmarks joined CAIA’s webcast on cryptocurrency fund performance with the top academics in the field

In an effort to bring more of its members up to speed with cryptocurrencies as investment assets, the CAIA Association brought the top two academics in the field together with CF Benchmarks CEO Sui Chung and Head of Research and Content Ken Odeluga, for an in-depth discussion of crypto fund performance.

The session began with a presentation by Dr Daniele Bianchi, Associate Professor in Finance, School of Economics, Queen Mary University London, summarising his latest paper, ‘On the Performance of Cryptocurrency Funds’. Bianchi’s exhaustive quantitative research essentially concluded that caution is advised in evaluating the alpha of managed cryptocurrency funds, due to their remarkably variable risk and market-adjusted performances. The salient points unearthed by the research were then elaborated upon by Dr Bianchi, Professor Bastien Buchwalter, Associate Professor of Finance at SKEMA Business School in Paris and CF Benchmarks CEO Sui Chung, in a discussion moderated by Ken Odeluga.

Key findings and points raised in the discussion included:

- Contrary to popular perceptions, cryptocurrencies appear to be highly correlated with traditional markets – though that’s largely over the short run

- Impressive average alpha appears to be driven by relatively few funds

- The importance of credible, crypto-specific benchmarks

Watch the full video above, or click here for an exceprt.

Download the slides that accompanied Dr. Daniele Bianchi's presentation here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks