Mar 10, 2024

CF Benchmarks Quarterly Attribution Reports - March 2024

Spot Bitcoin ETFs Awaken Animal Spirits as Fed Policy Shift Looms

Digital assets have shown resilience and growth over our latest rebalance period, bolstered by the historic launch of spot Bitcoin exchange-traded funds (ETFs) in the United States. This development underpins the accelerating mainstream acceptance and adoption of digital assets across the finance industry. Since debuting in January, these products have already accrued over $7.5 billion in new net flows, while total assets under management has reached $48.2 billion. This exponential early growth has significantly eclipsed not only the initial trajectory of gold ETFs but that of any new asset class in ETF history. Denoted by swelling institutional interest and confidence, the introduction of spot Bitcoin ETFs signals a pivotal milestone in the maturation and trajectory of both Bitcoin as an asset and the broader digital asset market. Investors can now fully reap the numerous benefits innate to traditional ETFs - namely liquidity, cost efficiency and ease of trading. These products provide a regulated avenue for institutional and retail investors alike to gain exposure to Bitcoin, streamlining access and substantially expanding its investor base.

On the macro front, robust inflation and income data clash with the case for near-term rate cuts, the Fed seems inclined to dismiss these trends as fleeting, tied to buoyant capital markets. Most market participants anticipate easing to commence by June, as consumer spending tempers amid eroding household balance sheets and creeping labor market slack. Recent economic indicators suggest the lagged impacts of the Federal Reserve's restrictive monetary policy may still be unfolding. This casts doubt on optimistic "no landing" narrative for the economy's trajectory. Lingering strains on regional lending institutions exemplify the credit market's lingering vulnerability to the Fed's hawkish stance. Ultimately, the Fed’s delayed monetary policy effects likely have further to run, despite nascent signs of recovery. However, markets seem poised to dictate upcoming moves based on the sustainability or reversal of the risk asset rally.

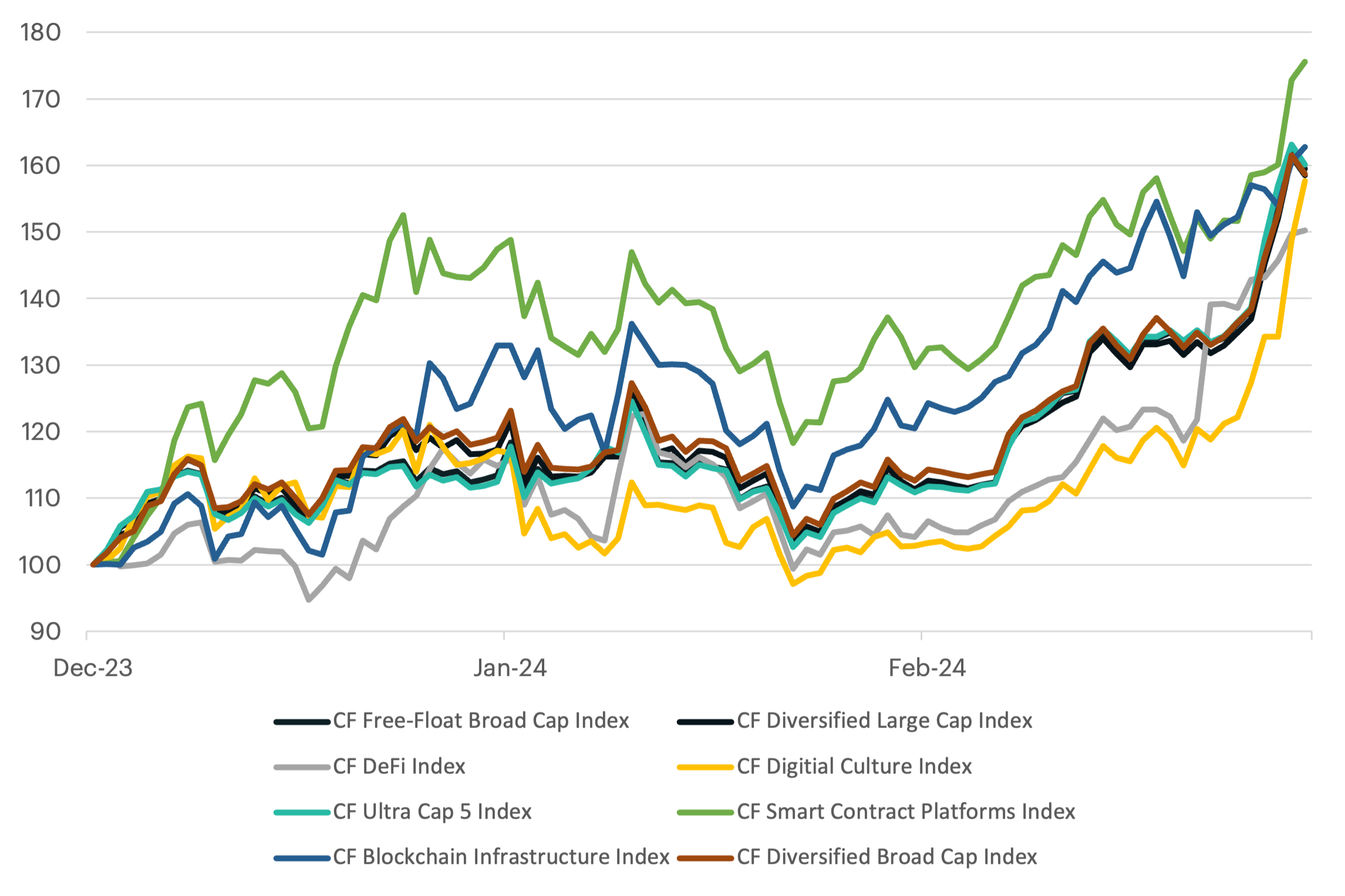

Notwithstanding lingering macroeconomic headwinds, the rise of investor interest surrounding the high-profile launch of spot Bitcoin ETFs has helped increase sentiment across the board for digital assets. All of our flagship portfolio indexes posted robust returns, outperforming traditional risk assets such as equities. The CF Web 3.0 Smart Contract Platforms Index rose by 76%, marking its second consecutive quarter of leading all our flagship portfolio indices, outpacing the overall market (as measured by our CF Broad Cap Index) by nearly 17% in absolute performance. Lastly, the CF DeFi Composite Culture Composite Index lagged behind the rest, despite posting a reasonably impressive 50% gain over our observation period.

Key takeaways:

Equities in Price Discovery, Crypto to Follow?

- S&P 500 and Nasdaq 100 indexes have reached record-high levels, entering their "price discovery" phase.

- The CF Free-Float Broad-Cap Index, our institutional barometer of the cryptocurrency market, still sits approximately 25% below its November 2021 watermark, despite digital assets outperforming equity markets from their respective nadirs.

- Conventional wisdom suggests that digital assets typically lead traditional markets, but a more constructive viewpoint suggests that they may have greater return potential ahead before entering their own price discovery phase.

Strong BTC ETF Demand Bleeds into ETH Futures

- The successful launch of Spot Bitcoin ETFs in the U.S. has led to a significant increase in fund flows, attracting both retail and institutional investors.

- This demand has also influenced the institutionally focused Ether Futures market on the Chicago Mercantile Exchange (CME), with a 27.7% increase from pre-spot Bitcoin ETF launch levels, marking new all-time highs.

- As the cryptocurrency market matures and gains mainstream acceptance, the demand for regulated investment vehicles like ETFs and futures contracts is likely to continue to grow.

Ether's Price Surge Propels Lido's TVL to New Highs

- Total Value Locked (TVL) in DeFi protocols is rapidly approaching levels last seen in May 2022, largely attributed to the growth of Liquid Staking.

- Lido (LDO), a dominant player in the Liquid Staking market, accounts for over 60% of the total market share and has benefited from the 62% appreciation of Ethereum's price.

- The combination of growing interest in liquid staking and Ethereum's dominance in the DeFi ecosystem has positioned Lido as a key beneficiary.

Bitcoin's Next Chapter: Layer-2 Ecosystems

- Stacks (STX) has emerged as the overall constituent leader during the most recent rebalance period, rising over 284.1% due to its innovative approach to enhancing Bitcoin's functionality.

- Stacks represents a Computing Segment protocol that is part of a larger trend of Bitcoin Layer 2 solutions that expand Bitcoin's capabilities beyond its original design as a payments-only chain.

- Stacks offers features that enable developers to build decentralized applications on Bitcoin, and as it continues to develop, investor hopes are pricing in its potential to play a significant role in Bitcoin's future.

Normalized Index Performance

To read the full compilation report or a specific index's report, please click on the respective links below:

- Quarterly Attribution Report (PDF Version)

- CF Broad Cap Index Series

- CF Cryptocurrency Ultra Cap 5 Index

- CF Diversified Large Cap Index

- CF DeFi Composite Index

- CF Web 3.0 Smart Contract Platforms Index

- CF Digital Culture Composite Index

- CF Blockchain Infrastructure Index

Lastly, our Quarterly Attribution Reports are designed to help investors understand the performance of digital assets through a purpose-centric lens called the CF Digital Asset Classification Structure (CF DACS). To learn more about CF DACS, please utilize our interactive CF DACS Token Explorer.

Contact Us

Have a question or would like to chat? If so, please drop us a line to:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks