May 07, 2025

CF Benchmarks offers unique regulatory status and global reach after EU decision threatens availability of regulated crypto indices

By Alise Kane, Head of Compliance, CF Benchmarks

UK FCA maintains crypto benchmark framework after EU change

The European Union has formally approved a significant shift in its regulatory framework for financial benchmarks, a pivotal conclusion to a nearly decade-long debate over the scope of oversight required for benchmark administrators.

With the Council of the European Union’s green light for the partial relaxation of licensing requirements, particularly the removal of the need for administrators of “non-significant” benchmarks (the category all crypto indices fall under) to register; institutions entering the digital asset space may be faced with a dearth of regulated benchmarks. (Here is a link to the minutes of the final reading of the amendment in the European Parliament, confirming its approval.)

This regulatory evolution comes at a time when crypto markets are rapidly expanding across the globe. As new digital asset financial products proliferate and institutional adoption gathers pace, the need for regulated, transparent benchmarks of these assets has never been more important. Fortunately for the digital asset product market, CF Benchmarks is a UK FCA regulated Benchmark Administrator, and the UK has confirmed it will maintain the current regulatory framework for Financial Benchmarks. This means financial institutions can continue to enjoy the support of regulated indices from CF Benchmarks.

Below, we will explore key benefits from the unique combination of CF Benchmarks’ regulatory status in the UK, and its global market coverage, highlighting why financial institutions such as BlackRock, CME Group, ChinaAMC and others, continue to choose CF Benchmarks' FCA regulated indices to power their digital asset products.

Regulatory certainty and global index liquidity

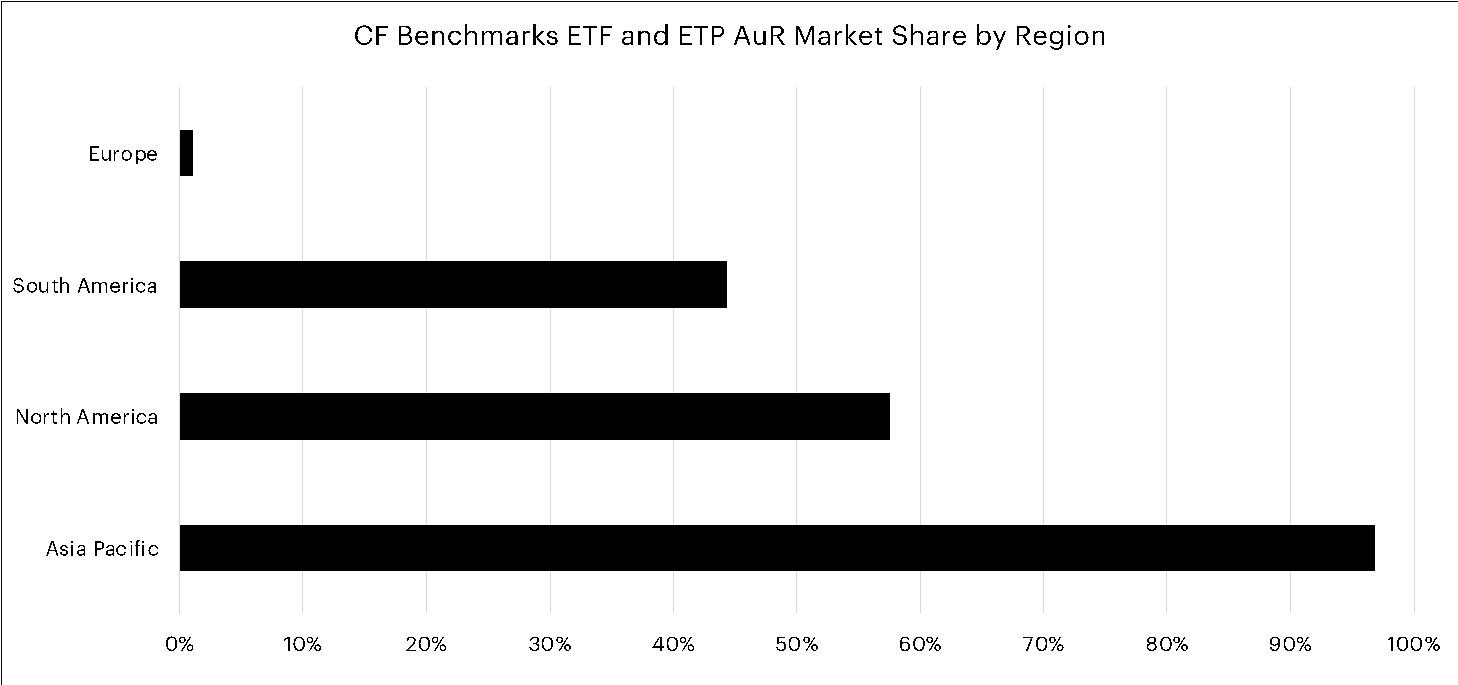

The past year or so has been pivotal for the regulated crypto financial product market, and by extension, for digital asset benchmarks too, especially in the U.S. and Asia-Pacific (APAC). These regions have experienced significant demand for regulated crypto products, with over $100bn now invested in digital asset ETFs/ETPs across both regions, in total.

Of this c.$100bn, over $60bn is benchmarked to CF Benchmarks indices specific to one of those local time zones. In the case of U.S. products, through the New York variants of CME CF Reference Rates for Bitcoin and Ether (BRRNY & ETHUSD_NY. In the case of APAC products, through respective APAC index variants (BRRAP & ETHUSD_AP). As the market for regulated crypto financial products continues to grow, the importance of liquid benchmarks subject to rigorous regulatory oversight becomes ever more critical for ensuring the continued integrity of these products.

The primary concerns that prompted the regulatory regime to be introduced in 2016 were conflicts of interest, administrators relying on methodologies that were not robust, as well as a lack of rigorous governance and questionable audits. One way such risks have been realised in crypto markets, has been when unregulated indices have been based on input data from markets with relatively low liquidity, and the indices have then subsequently been subject to manipulation. This was the case in an incident impacting OKEx, in 2018. In this instance, a single trade was able to significantly influence an index, triggering forced liquidations and market instability.

The incident clearly highlights the fragility of that index's methodology, spotlighting inadequate resistance to manipulation. Conversely, manipulation resistance is a core principle of any robust benchmark methodology, and an overriding principle of all CF Benchmarks indices.

This case underlines the importance of regulated, robust and transparent benchmarks, especially as digital asset markets mature and more capital flows into crypto products.

Crypto regulation advances globally

Against the backdrop of the relaxation of BMR in Europe, regulation of digital asset markets and service providers is crystallizing in other regions, and more broadly in the EU itself, as outlined below.

Hong Kong

In April 2025, Hong Kong’s Monetary Authority (HKMA) and Securities and Futures Commission (SFC) issued new guidance permitting authorized institutions, SFC-licensed virtual asset trading platforms (VATPs), and SFC-authorized virtual asset funds (VA Funds) to offer staking services under strict conditions.

These updates form part of Hong Kong’s broader ASPIRe roadmap, reinforcing its ambition to develop a robust and transparent digital asset ecosystem, while strengthening investor protections. HKMA and the SFC expect index providers to conduct thorough due diligence on data sources, adopt index rules to address material events like 'slashing', and maintain robust governance and oversight frameworks.

UK

The UK is also advancing its regulatory framework for cryptoassets. A comprehensive regime is expected to be implemented by 2026, covering stablecoins, trading, staking, lending, and prudential standards, all with a focus on consumer protection, market integrity, and financial stability. For example, historically, crypto lending platforms operated with minimal regulation, offering high yields on deposited cryptoassets. However, the collapse of several platforms between 2022–2023 through insolvency, poor risk management, and a lack of transparency, triggered global regulatory scrutiny. The Financial Conduct Authority (FCA) appears to be on track with its regulatory timeline: in December 2024, it published Discussion Paper DP24/4, focusing on admissions, disclosures, and market abuse related to cryptoassets. As of April 2025, the UK government was finalizing new rules to bring cryptoasset activities, including lending and borrowing services, firmly within the financial regulatory perimeter.

MiCA (EU)

In early 2025, the European Union activated its Markets in Crypto-Assets (MiCA) regulation, establishing a harmonized framework for cryptoasset issuance and service provision across all member states. MiCA introduces licensing requirements for cryptoasset service providers (CASPs), along with enhanced consumer protection standards and strict operational and reserve requirements for stablecoins. For benchmark administrators, MiCA and the EU Benchmark Regulation (EU BMR) mandate rigorous oversight of data sources, robust disclosure of methodologies, and proactive management of benchmark integrity, particularly for crypto-related indices.

Canada

Canada remains a leading example of early regulatory action. It was among the first jurisdictions to approve Bitcoin and Ether ETFs, providing retail investors with regulated access to digital assets via public markets. Regulatory expectations for crypto platforms include robust custody solutions, clear disclosure practices, and stringent segregation of client assets. Index providers supporting crypto-linked products must maintain rigorous due diligence, particularly around asset verification, and ensure their methodologies address operational risks such as custody failures or liquidity events (as per the Canadian Securities Administrators Staff Notice 81-336).

Singapore

Singapore continues to refine its digital asset regulation through the Monetary Authority of Singapore (MAS). Recognized early for its Payment Services Act licensing regime, MAS introduced stricter measures in 2024 focused on protecting retail investors. These include restrictions on leverage, limitations on trading incentives, and enhanced custody requirements. Crypto fund managers and service providers must demonstrate strong risk management, ensure segregation of client assets, and maintain transparent operational disclosures. Index providers operating in Singapore must therefore implement enhanced due diligence, transparent methodology standards, and resilient controls around price sourcing and validation.

CF Benchmarks: Enabling the Next Generation of regulated crypto products

Across major jurisdictions, regulatory standards for digital asset products are rising. However, in the EU, the regime specifically for crypto benchmarks is being relaxed. This could have negative unintended consequences for the sustained growth of regulated digital asset financial products.

At the core of CF Benchmarks’ offering is a commitment to ensuring indices are robust, resilient to market anomalies, or the actions of bad actors, and based on verifiable, high-quality input data and sources; all as enforced by the UK FCA. We achieve these goals through comprehensive governance frameworks, independent oversight, and regular external audits; all critical in today’s rapidly evolving and growing digital asset market.

CF Benchmarks' unique regulatory status in the UK and the global liquidity complex that revolves around its benchmarks, mean institutions have a proven way of issuing products in a compliant manner while ensuring those products enjoy abundant liquidity - which in turn underpins fair and orderly markets.

Click the links below to learn more about our regulated status and benchmark methodology:

- Regulated Status - entry in the Financial Services Register (UK FCA)

- CME CF Reference Rates Methodology

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks