Jun 17, 2023

CF Benchmarks Newsletter - Issue 54

BlackRock the Maverick

The growth of institutional crypto participation—through the cycle—is a theme we’re not shy of frequently returning to in this newsletter. Now, we’ve seen perhaps the ultimate institutional adoption moment that’s counter to the ‘crypto winter’ narrative. The world's largest asset manager, BlackRock Inc., has filed an application, through its iShares brand, to list a Bitcoin ETF. (Click here to read our detailed blog post, or scroll down for an excerpt)

The proposed ETF will hold spot Bitcoin, rather than holding and rolling crypto futures. For many, the cognitive dissonance intensifies. Seasoned observers (like Bloomberg ETF analyst, Eric Balchunas) had difficulty squaring events of recent weeks and months with this week’s big news, before it was confirmed. (Read the FT article).

The SEC’s opposition to crypto ETFs based on spot prices looms large. (For example, the commission has now rejected all three VanEck applications) Meanwhile, chair Gary Gensler is little short of infamous for an anti-crypto crusade marked by a long-standing prosecutorial animosity, across a number of fronts.

A complete analysis of what may have changed would be entirely speculative and could fill the rest of this newsletter. Still, close attention to key developments of the past several months may provide hints.

'Capricious'

Perhaps the best-known crypto-related lawsuit the SEC is currently embroiled in (brought against the commission) is Grayscale’s complaint that the SEC “acted arbitrarily and capriciously” in its decision to reject Grayscale’s application to convert GBTC into an ETF.

The lawsuit is founded on a contention (not Grayscale's alone) stated in the firm’s opening brief, that having approved bitcoin futures ETFs, “finding that those ETPs did not present an unacceptable risk of susceptibility to fraud or manipulation”, it was unreasonable to reject applications for spot-based BTC ETFs, given that bitcoin futures prices are “subject to the identical risk of fraud and manipulation as is the spot price of bitcoin”.

Hearings continue. Regardless of the outcome, the SEC’s apparent favour of futures- over spot-based crypto ETF’s (the commission approved a fourth futures crypto ETF last year) will continue to raise questions, to say the least.

Surveillance

More specifically, the SEC has long-telegraphed a focus on the lack ‘surveillance sharing’ facilities in spot Bitcoin ETF applications it has consistently rejected. (An example). Meanwhile, a key feature of all successful futures-based crypto ETF applications is that they invest in CFTC-regulated CME Bitcoin or Ether Futures contracts, which are obviously subject to well-established regulatory look through.

Furthermore, the CME’s crypto derivatives are all settled against a regulated CF Benchmarks Bitcoin or Ether index. Some, though not all, utilize a CF Benchmarks index as reference price. But all are implicated in, some way, by CFB’s officially verified, surveillance and surveillance-sharing procedures, which are just one part of the end-to-end oversight evidently recognised by U.S. regulators as preventing the ‘unacceptable risks’ mentioned above. (Here’s CoinDesk’s report spotlighting what it terms surveillance sharing measures in BlackRock’s Bitcoin ETF application).

Markets: another lucky escape

Another week, another ‘lucky escape’ for large cap crypto, from prices that could suggest the loss of escape velocity from the year’s lows. As shown by the technical analysis-style chart for our CME CF Bitcoin Real Time Index (BRTI) below, the market’s optimistic reading of the Fed’s ‘hawkish skip’ coincided with the latest snapback from a price region technicians would judge as establishing support in mid-February and mid-March. However, BRTI clearly broke below the $25k handle for the first time since March, with prices printing as low as $24,768, on the hourly chart. Despite additional impetus from the BlackRock news, price action, according to such analysts, may well have portrayed an unacceptable deviation from patterns typically observed to project continued support.

Further down the food chain, assets more susceptible to the SEC’s increasingly focused attack stance against ‘unregistered securities’ dumped between 25% and around 30% on a 7-day basis, by mid-week.

Macro Outlook

From a “dovish hike” in May to a “hawkish skip” in June, last week's eventful schedule highlighted the disinflationary forces continuing to pave the way for the Federal Reserve to slowly adopt a less hawkish stance. However, the central bank's latest forward guidance indicates that additional rate hikes remain on the table. Traders in the interest rate swaps market are now pricing in a higher peak policy rate of 5.35%, while also completely pricing out any potential cuts through the end of the year.

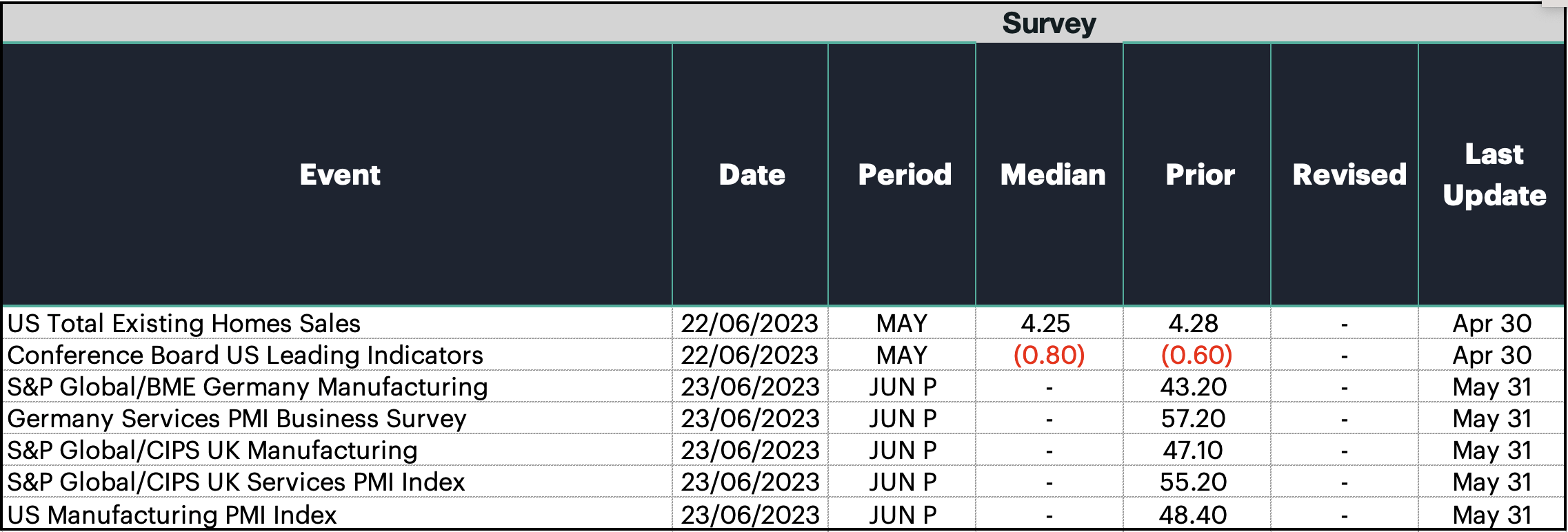

Next week's economic calendar should be more digestible than the week before. Investors will be interested in the latest home sales data, which are expected to show a continued decline to 4.25 million from 4.28 million in May. Plus the Conference Board's updated measure of Leading Economic Indicators is also likely to trend lower, remaining in an area that’s consistent with historical economic contractions. Lastly, manufacturing data across Europe and the U.S. are expected to corroborate continued weakness in that cyclically sensitive sector.

Gabe Selby

Featured Benchmark: CME CF Bitcoin Reference Rate (BRR)

BlackRock’s CFB-powered Bitcoin ETF filing is a vote of confidence

The first mass market U.S. crypto investment product would strike NAV against the CME CF Bitcoin Reference Rate’s New York Variant

Inflection point

BlackRock’s application to list the first U.S. spot-based Bitcoin ETF cuts through the cloud of macroeconomic, regulatory and market uncertainty that has beset the asset class for months, to deliver what’s likely to be one of the most pivotal developments of the year for crypto prices, the digital asset space, and certainly for CF Benchmarks.

Let’s parse the key details, top level implications, and what to watch out for.

Key details

- BlackRock’s main ETF brand, iShares, filed a form S-1 registration statement for iShares Bitcoin Trust around the close of the U.S. business day on Thursday, June 15th. The date is worth noting: just like for all such applications, it could be important for the timing of the application’s progress through the SEC’s review process

- In contrast to existing U.S. futures-based crypto ETFs, iShares Bitcoin Trust will be a spot, or ‘physical’ Bitcoin-based vehicle. According to the filing:

“The assets of the Trust consist primarily of bitcoin”

- NAV will be calculated from CF Benchmarks’ regulated CME CF Bitcoin Reference Rate – New York Variant (BRRNY)

- This index is methodologically identical to our regulated CME CF Bitcoin Reference Rate (BRR), the most liquid and most trusted institutional price of Bitcoin; the only difference being that BRRNY references the price of Bitcoin at the closing time of U.S. markets, rather than the price at 16:00 London time, referenced by the BRR

- Pending regulatory approval, the fund would trade on the Nasdaq stock market

- The filing lists Coinbase Custody as Bitcoin Custodian, and Coinbase Inc. as Prime Broker. However, the filing notes that the trust could “decide to replace”, Coinbase Custody, and/or “terminate” Coinbase Inc. as Prime Broker, if necessary

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks