Nov 15, 2021

CF Benchmarks launches Settlement Prices and Spot Rate indices for AMP, CRV, GRT, MKR, SNX, YFI

CF Benchmarks brings trusted, transparent and regulated price benchmarks for the platforms at the heart of the yield-earning DeFi revolution

In parallel with a resurgent accretion of the DeFi space in terms of total value locked (TVL) and expansion of the ecosystem, CF Benchmarks is continuing to broaden its range of regulated benchmarks for the leading platform tokens, ensuring that the highest standards of price accuracy and governance are in place as institutional volumes approach critical mass.

To that end, we’re launching regulated benchmark indices for five tokens that have rapidly become established as among the most innovative financial protocols and infrastructure platforms in the DeFi space, as reflected in their top 10 TVL rankings. We’re also launching benchmark indices for the token of one of the most ubiquitous distributed platforms that provides an infrastructure service for DeFi platforms.

- AMP Token (AMP), backed by the payments-focused Flexa blockchain, is essentially a widely compatible platform for collateralizing digital asset transfer. Its ERC20-compliant specification is broad enough to encompass fiat and cryptocurrencies, as well as physical and digital non-fungible assets. By deploying such common DeFi functionality as partitions and pools, Amp aims to decentralize transfer risk, underpinned by multiple incentive models

- Curve (CRV) a multiple crypto-supporting decentralised exchange (DEX), is powered by the CRV ERC20 token, for incentivising and storing the inherent value of the Curve DAO, including voting power. As one of the earliest DAO’s, by early 2021 it had $4bn worth of deposits locked, making it almost certainly the largest DEX. It is regarded as the classic smart contract-based liquidity pool, as epitomised by a mention in an overview paper on DeFi published by the St Louis Fed in February. Curve is also among the most fully elaborated DAOs, enabling the essential functions of pooling, trading and yield earning, whilst also providing infrastructure access to users wishing to create pools, provided that the proposal secures a large enough vote

- Maker (MKR) is another Ethereum-based token that was created to support the stability, functionality and development of a DeFi platform, MakerDAO, which in turn is primarily aimed at facilitating the creation of a line of stablecoins. Unlike some DAOs though, MKR is no longer associated with a single native DEX and is now mostly focused on providing the governance aspect of the Maker platform’s purpose-made stablecoin, DAI. DAI recently ranked fourth among dollar-pegged DeFi tokens with a market cap of $8.5bn, whilst MKR was ranked No.1 DeFi platform at the time of writing with about $19.50bn in TVL

- Synthetix (SNX) as its name suggests, facilitates the creation of tokenised assets—originating in the financial world and beyond—known as ‘synths’, which can then be traded on its native permissionless, automated platform. Since early-2020, tokenised margin trading and lending with the Synthetix protocol also became possible on a separate protocol, defined in crypto as a ‘financial primitive’, called bZx. Each synth has the property of an ERC20 token, whilst the overall Synthetix protocol comprises of a system of collateralisation and staking, with fee-based incentivisation, together with an inflationary overarching monetary policy. Synthetix Network Token (SNX) is the platform’s chief asset of exchange, primarily for staking and locking, whilst rewards are distributed in the platform’s sUSD stablecoin. $9.3m in exchange fees was paid out between SNX’s launch in 2018 and August 2020. Synthetix TVL currently stands at around $1.9bn

- yearn.finance (YFI) is a group of Ethereum protocols designed for the decentralised optimisation of yield earning (hence ‘yearn’) on crypto assets. yearn.finance aims to replace as many ‘TradFi’ services and functions as possible with its YFI cryptocurrency as the incentive. yearn.finance has an unusually wide range of independent products established on its platform, aggregating services like staking and the rates available for any given amount of collateral, investment strategies for third-party DeFi projects and of course, the trading of digital assets. Though yearn.finance will remain Ethereum based, the platform last month began to additionally roll out on an alternative smart-contract enabled Layer 1 network, Fantom, potentially broadening YFI’s reach. YFI remains available and compatible with the Balancer DEX on which it first traded within a pool in 2020, at a price of $3. YFI is currently worth over $31,000

CF Benchmarks is also launching Benchmark indices for the leading utility crypto Graph Token (GRT). This Ethereum-based coin underpins the Graph indexing protocol which was launched in late 2020. Graph is an infrastructure for querying both the Ethereum network itself and others, particularly IPFS, the distributed (decentralized) ‘filing system’ for storing, accessing and displaying any data on blockchains. Users can create and distribute their own Graph APIs, known as subgraphs, and it’s the myriad potential use cases enabled by the multiple crypto supporting platforms that utilise The Graph that ascribe notional value to GRT.

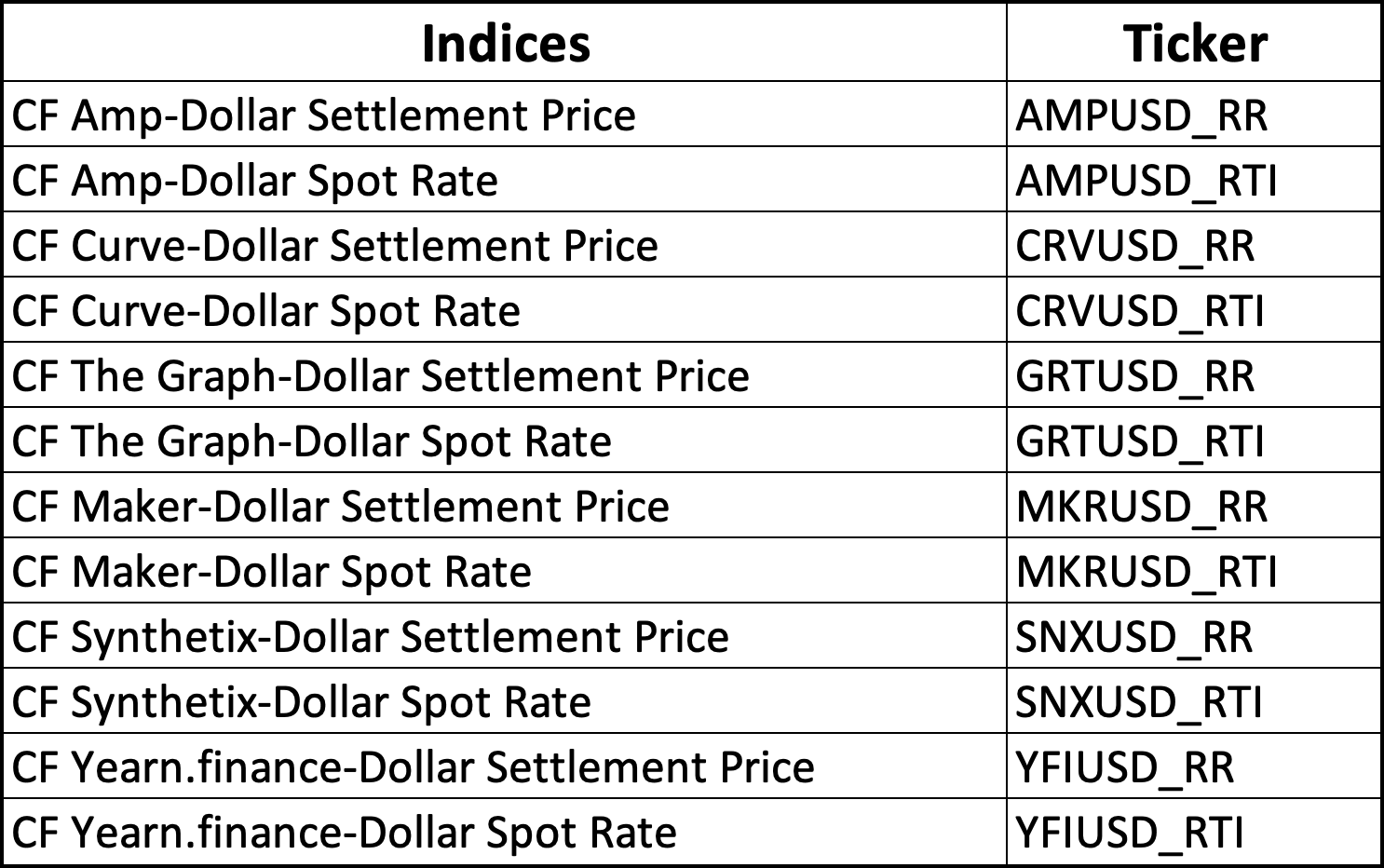

The new benchmark indices and their tickers are listed in the table below.

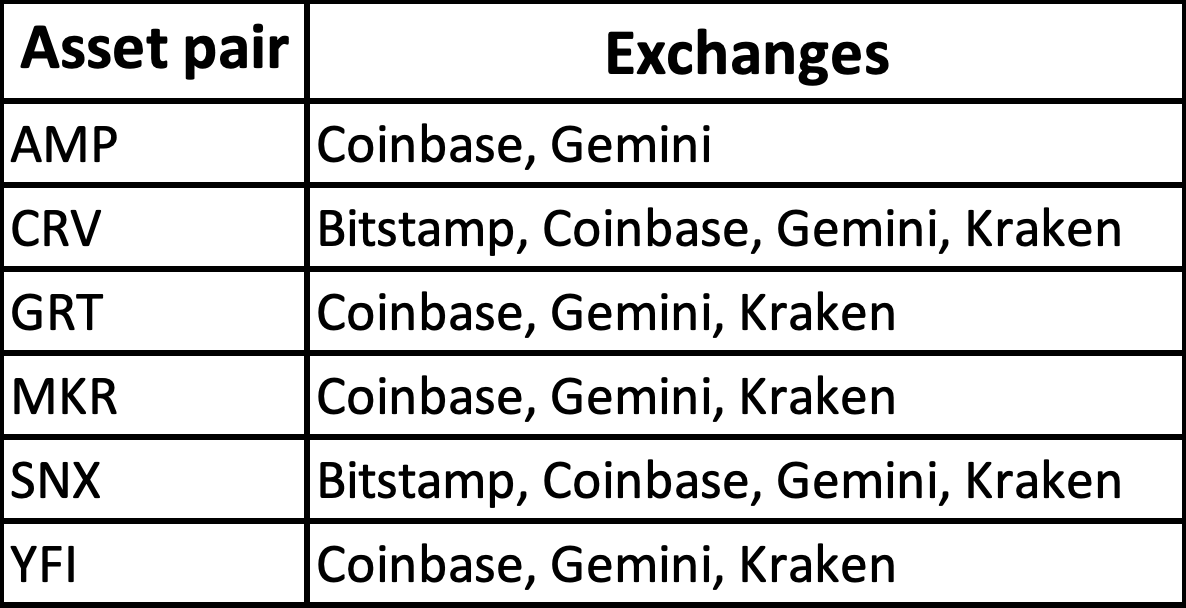

Transaction and Order Book data for each of the eight asset pairs will be drawn from the Constituent Exchanges indicated in the following table.

Get to know the symbols for these new benchmarks from the images below.

Find out more about CF Benchmarks' Benchmark Methodology:

CF Cryptocurrency Index Family – Single Asset Series

More info about AMP

Further details on Curve and CRV

Learn more about The Graph and GRT

Additional info on Maker and MKR

Explore Synthetix and SNX

An introduction to yearn.finance and YFI

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Introduces CF Factor Data, Enabling Institutional-Grade Factor-Based Crypto Investing for the First Time

The logical next step towards our goal of enabling practical deployment of our crypto factor model is executable portfolio constructions that provide targeted factor exposure.

CF Benchmarks

Policy Paralysis, Fed Fog & Shutdown Risks Extend Sell-Off

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Gabriel Selby

Weekly Index Highlights, February 2, 2026

Crypto risk appetite weakened further into the start of February, with broad-based selling hitting high-beta first: Ether slid 20% with Bitcoin -12%. Finance tokens were relatively resilient in our CF DACS universe, but BTC implied volatility rose even as USDT funding rates eased (SIRB -116.1 bp).

CF Benchmarks