Nov 06, 2020

CF Benchmarks Newsletter Issue 7

-

Ethereum news outweighs election uncertainty

-

Bitcoin $20k 'big figure' a big ask for now

-

Where, why, who of Huobi

Ethereum 2.0 vs. Elections

Think of an event, with a years-long run up amid fraught anticipation, every detail of which has been heatedly ‘debated’. Now, it’s finally happening, but it won’t be completed for an additional protracted length of time; and its far-reaching consequences will take even longer to materialise. Yes, all that applies to both the U.S. election and Ethereum 2.0. Odds for a victory by the Democratic challenger have shortened, but a definitive result could still be weeks away. Yet uncertainty hasn’t harmed crypto, for reasons explained here. News that the long-planned policy switch for the Ethereum blockchain finally has a hard launch date was arguably more important. True, Ether’s jump back above $400 may have had as much to do with the strong correlation between major digital assets and conventional ‘risk assets’ that also propelled Bitcoin above $14,000 and $15,000. But there’s little doubt that Ethereum’s transition to proof-of-stake from proof-of-work will—eventually—ease ‘gas’ (transaction) costs as scalability improves. There’s little risk of a planned or unplanned hard fork just yet though. Phase 0 of the mainnet launch is the first of many. But as per the election, much Ethereum uncertainty remains. Our Hard Fork Policy, that governs supply decisions in the event of protocol changes, is worth getting familiar with.

Bitcoin vaults $13k-15k, but $20k unlikely

Bitcoin’s peek above the $15,000 threshold on Thursday crowned its run of milestones in recent months (including 100 days above $10,000) confirming a phase of strong momentum. Sentiment continues to fuel hopes that price may eventually retake the ultimate nearby ‘big-figure’ of $20,000, for the first time since 2017. As CF Benchmarks CEO Sui Chung pointed out though, the options market begs to differ that $20k will be seen anytime soon.

Huobi talk hogwash - Huobi

Persistent talk that a senior executive of Singapore-based Huobi was arrested would continue a run of law enforcement action against crypto exchanges seen in recent months, if accurate. The seven-year old venue, which passed the $1-trillion-in-trades mark in 2018 said: “All of Huobi’s management team members have been accounted for and have not been detained or arrested.” Huobi Exchange, which is not authorised to operate in Europe or the U.S., also assured customers that their “assets are safe”. Blockchain trackers have reported both multimillion-dollar withdrawals and deposits into Huobi-related addresses in recent days.

The Returns: Bitcoin Reference Rate

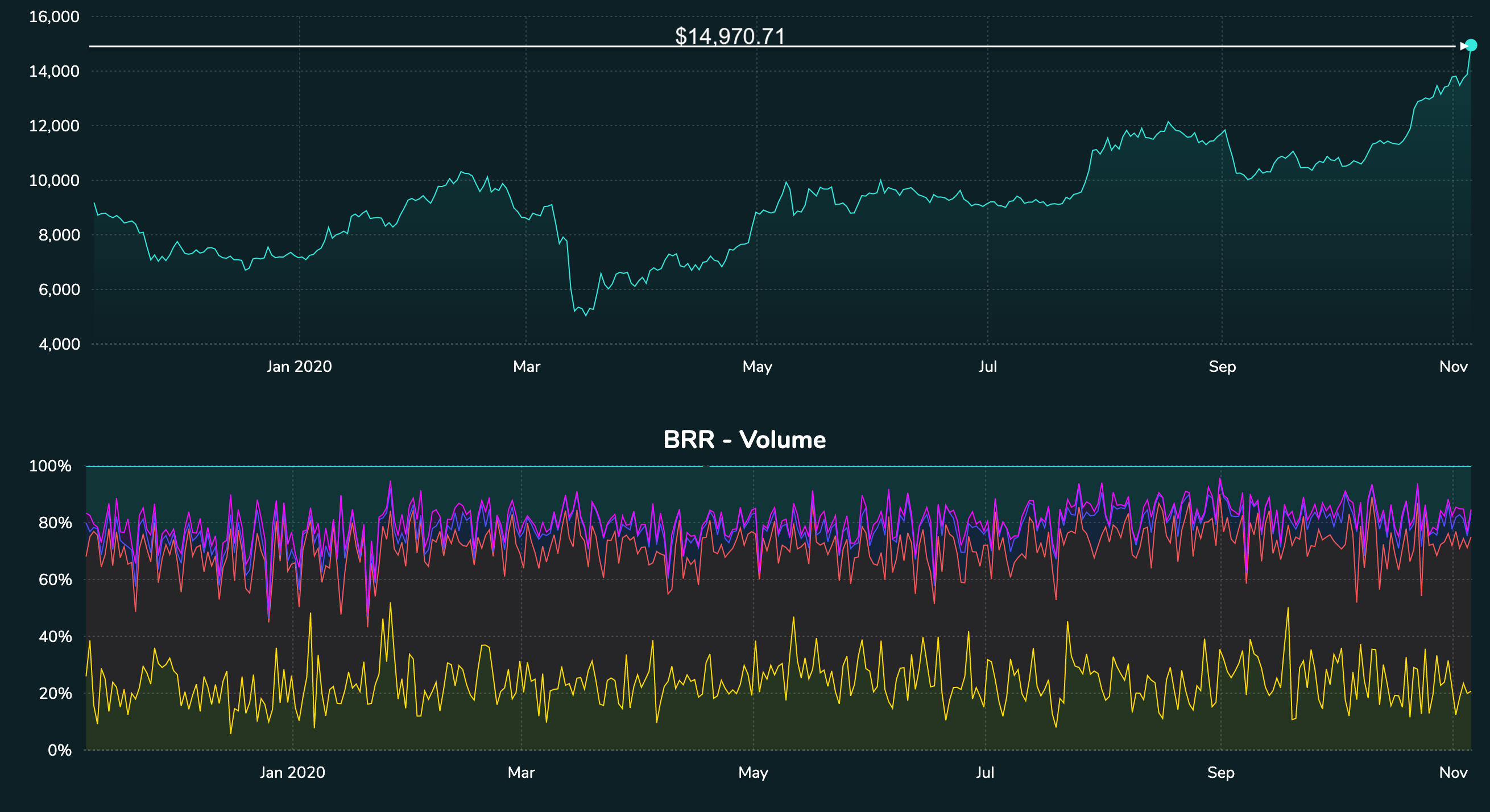

CF Benchmarks’ reference rates are particularly useful on days like Thursday, when Bitcoin vaulted key levels in quick succession, increasing the risk of disputed pricing. The regulated CME CF Bitcoin Reference Rate settled up 7.71% at $14,970.71, though did not print $15,000.

CME CF Bitcoin Reference Rate January 2020 to date Source: CF Benchmarks

Source: CF Benchmarks

###Featured benchmark: CME CF Bitcoin Real-Time Index

Not quite a crypto cliff-hanger

Crypto markets are moving swiftly on

The fraught U.S. election still looks more like a cliff-hanger than a clean sweep, though a few market truisms appear to be applying to crypto in full effect.

- First and foremost, cryptocurrencies are maintaining the strong correlation with mainstream ‘risk assets’ that’s been in evidence for most of the year

- Secondly, yes markets prefer certainty to uncertainty and much uncertainty remains, but the preference should be seen in the round. Hint: it doesn’t just apply to the overall election result

- Leading on from the ‘uncertainty principle’, the next point to remember is that like it or not, if corporate America is a top priority for mainstream markets, by extension, the likely policy impact on U.S. businesses from the election is also a priority for major crypto markets too

Crypto is 'risky assets' too

On those bases, though a clear election end point may still be days away, as votes continue to be counted, wrangled over, and possibly even argued over in court, it’s clear that stocks and other risky assets—including crypto—are taking cues from clear probabilities and a handful of certainties in the bag so far.

- Senator Joe Biden’s electoral college vote vs. President Donald Trump’s stands at 238/213. That outcome has failed to live up to strongly optimistic hopes projected by Democrats of a ‘blue wave’

- Republicans are strongly indicated to maintain Senate majority control after winning the count for the upper house 53/47. A swifter resolution of stimulus talks—even if the size of the pandemic-related package remains uncertain—now looks to be on the cards. A GOP Senate win would also read-across to reduced chances that the Dems can trigger a much-dreaded rise in corporate taxation. Consequently, stock markets have rallied throughout the day

- On the policy and regulation front, from the specific perspective of the digital asset class, this election has been all but irrelevant. Only a handful of notable candidates made crypto-related comments, let-alone run on tickets that were in any way crypto-aware. So, the policy outlook is largely neutral for crypto regardless of who win

Known knowns and known unknowns

The above said, as this article went online live, voting trends were trimming the lack of clarity to an extent. Senator Joe Biden had notched up more votes than any other Presidential candidate in history, even if the path to an electoral college victory was more ambivalent.

He had also won the critical swing state of Wisconsin, though the President held four other swing states to Biden’s 3 swing wins. Even more speculatively, signs have been emerging that—not for the first time in recent history—Wall Street is beginning to veer away from its traditional Republican bias, implying that the controversies of Trump’s Presidency are taking a toll.

Read the rest of this article on our website

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks