Jul 15, 2024

Cessation of Certain Settlement Prices and Spot Rates of the CF Cryptocurrency Index Family

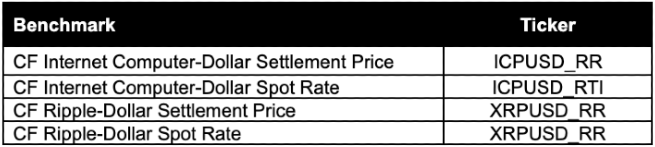

The Administrator hereby announces the cessation of the below benchmarks from the CF Digital Asset Index Family:

Rationale for Cessation

The reason for cessation of these benchmarks is commercial.

Implementation Timeline

To promote an orderly transition and minimise market impact, the benchmarks will continue to be published until provision ceases from approximately 11:00 London time on July 29th, 2024, meaning that the last values to be published will be for July 28th, 2024.

In accordance with the Administrator's policies and procedures, this cessation will not be subject to a consultation process.

Alternative Benchmarks

Alternative benchmarks to those that are the subject of this announcement will be available from the Administrator.

The alternative benchmarks will:

- Utilise input data from the same pool of Constituent Exchanges

- Utilise the same calculation methodology

- Be published at the same time – 16:00 London Time, utilising input data from the most liquid period for trading in the Asset Pairs

- Mean no loss of service for index users

Existing licensees will automatically be licensed to utilise the alternative benchmarks for all existing use cases.

The CF Oversight Function has overseen this process.

Questions or queries should be addressed to [email protected]

Should any user wish to file a complaint regarding this cessation process, they can do so confidentially by emailing [email protected]

Note: as of July 29th, 2024, XRPUSD_RR and XRPUSD_RR will begin utilising input data from LAMX Digital in addition to existing input data sources: Bitstamp; Kraken and Coinbase.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Weekly Index Highlights, February 23, 2026

Crypto's risk-off tone deepened last week, with BTC's -0.6% slide masking sharper alt weakness, e.g., XRP -6.1%. Our CF DACS universe was uniformly lower though, with Culture and Infrastructure both -7.5%. Meanwhile, implied volatility eased while realized firmed and short-term rates repriced lower.

CF Benchmarks

Tracking Bitcoin's Flows

Bitcoin is down 47% from its October high. But behind the drawdown, 13F filings reveal a structural transformation: speculative hedge fund capital is retreating while advisory firms, sovereign wealth funds, and endowments are building permanent allocations. Here's what the ownership data shows.

Gabriel Selby

Kraken MTF Lists Large Cap DTF Perp

EU-domiciled institutional investors can now access a perpetual contract based on Reserve Protocol's multi-token LCAP DTF.

CF Benchmarks