Aug 22, 2025

Addition of Constituent Exchanges for the CF Digital Asset Index Family - Single CFAsset Series

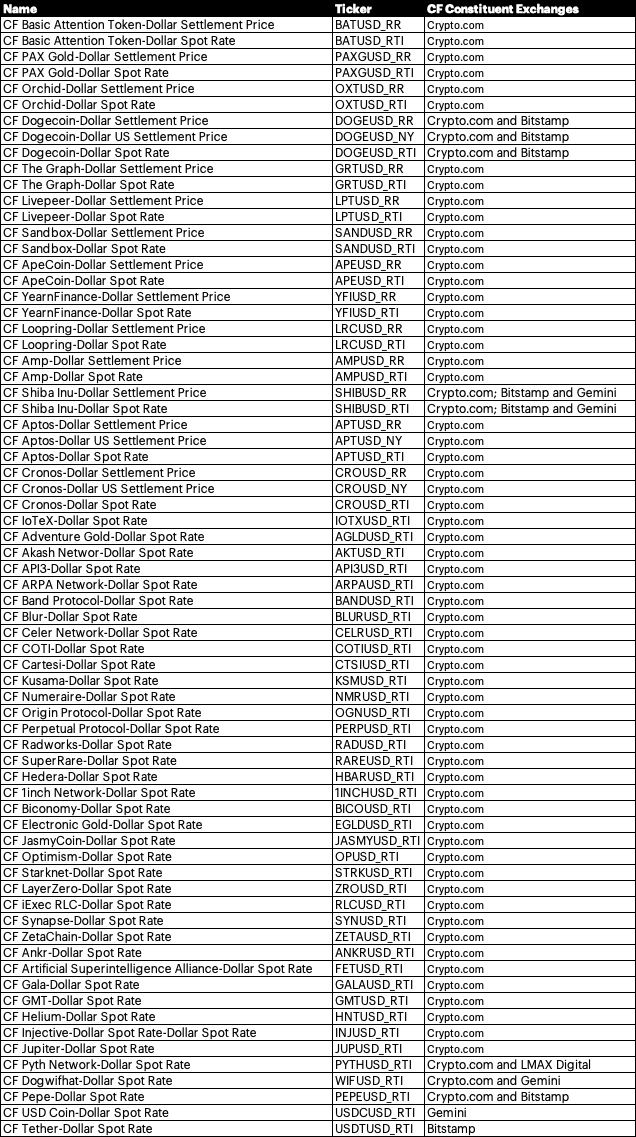

The Administrator announces the addition of CF Constituent Exchanges for the CF Digital Asset Index Family - Single Asset Series from August 29th, 2025.

From approximately 20:30 UTC on August 29th, 2025, transaction and orderbook data from CF Constituent Exchanges (outlined below) will be included as input data in the CF Digital Asset Index Family - Single Asset Series.In accordance with the Administrator's policies, the process for the approval of new Constituent Exchanges for the CF Digital Asset Index Family - Single Asset Series was overseen by the CF Oversight Function.

Questions or queries regarding this process should be directed to [email protected].

Any complaints regarding this process may be submitted confidentially by writing to [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Quarterly Attribution Reports - March 2026

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category, and segment levels during the course of each portfolio rebalance period.

Gabriel Selby

Weekly Index Highlights, March 9, 2026

Geopolitical strains kept digital assets on the defensive in the past week, with Bitcoin down 2.1% and Cardano -12.0%. Realized BTC volatility and our BVXS implied vol. index both inched higher, by 5.8 and 1.7 points, but Culture tokens in our CF DACS taxonomy were worst hit on average, at -8.7%.

CF Benchmarks

Factor Friday - March 6, 2026

The market posted its strongest weekly gain of 2026 at +4.3%, trimming YTD losses to -28.0%. Value emerged as the top factor at +1.7% weekly, turning positive YTD. Downside beta posted its first negative week of the year, signaling a potential early shift towards risk.

Mark Pilipczuk