Sep 16, 2024

Weekly Index Highlights, September 16, 2024

Stay informed with CFB's Weekly Index Highlights for a concise overview of the performance trends of our top reference rates and indices for the period September 9 to September 15, 2024.

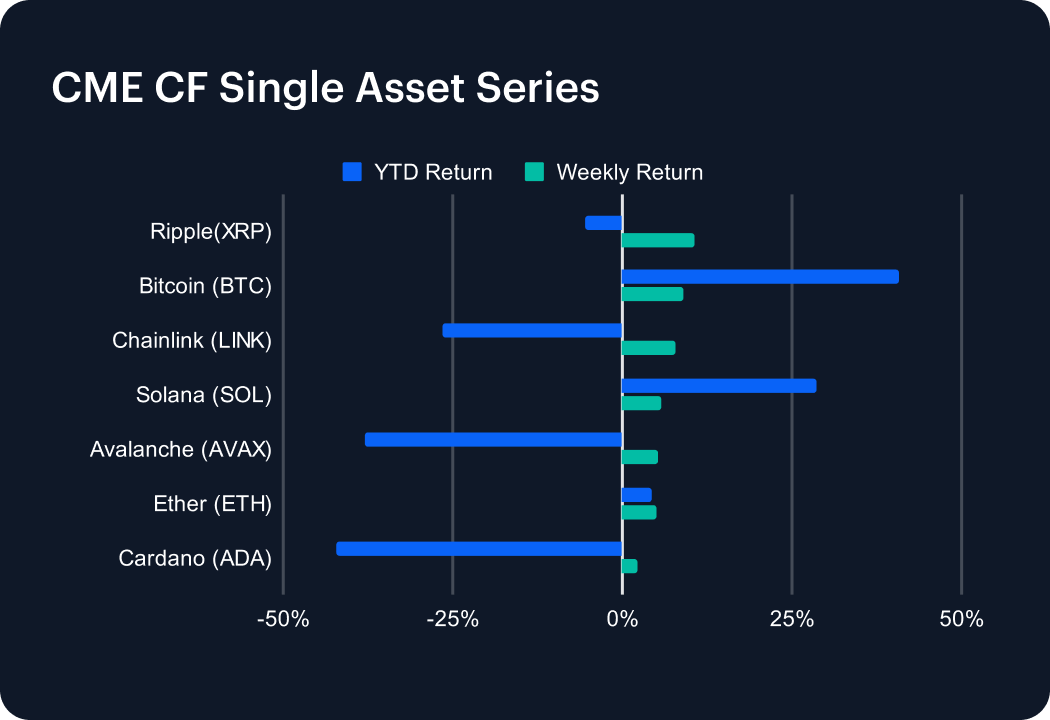

Key developments amid Ripple’s ongoing reputational rehabilitation propelled XRP +10.64% for the week, in step with an across-the-board relief rally for large caps, and certain altcoins, alike.

Heavy lifting by Gaming category token SUPER, +38.29%, accounts for the firm weekly return by the Culture sector, +7.10%. Services also stands out, underpinned by Infrastructure, +8.72%, which in turn was primarily driven by Scaling category token Celestia’s (TIA) +20.42% jump.

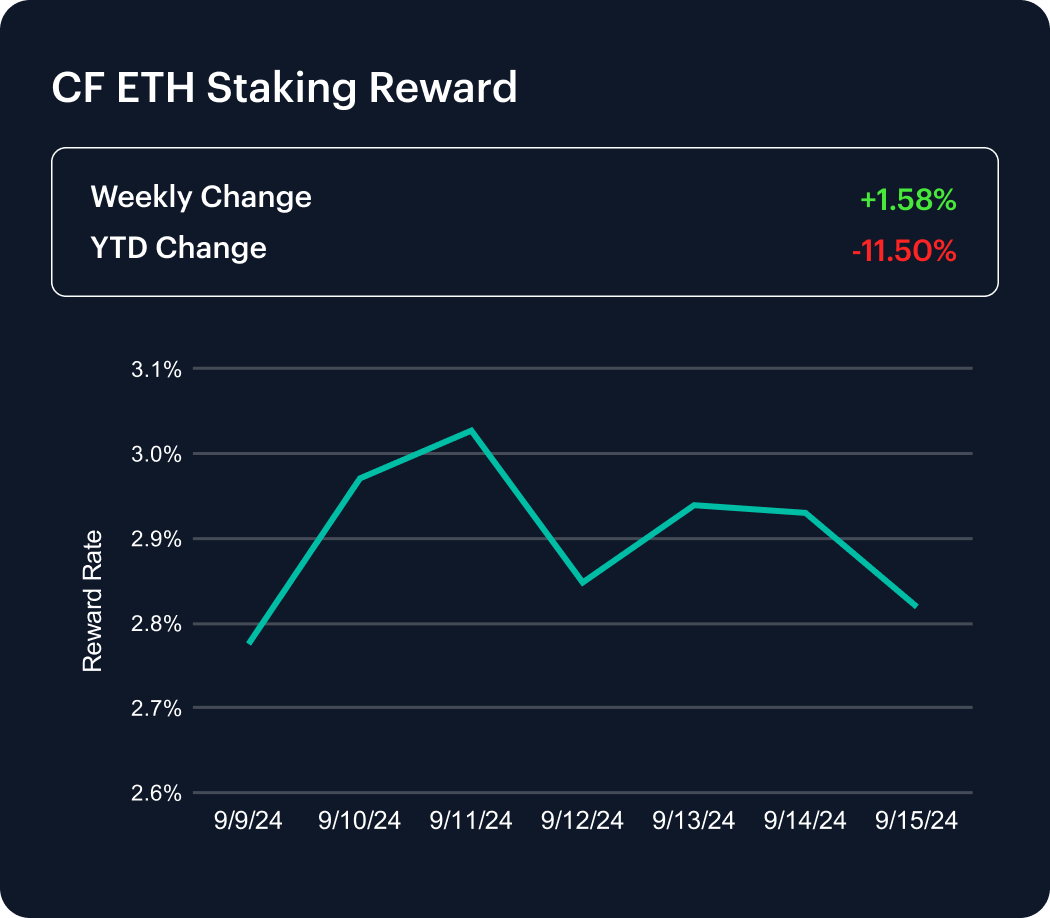

A second straight mild weekly increase for the ETH Staking Reward Rate,

+1.58%, means the negative YTD change continues to hover close to -

10% (-11.50%).

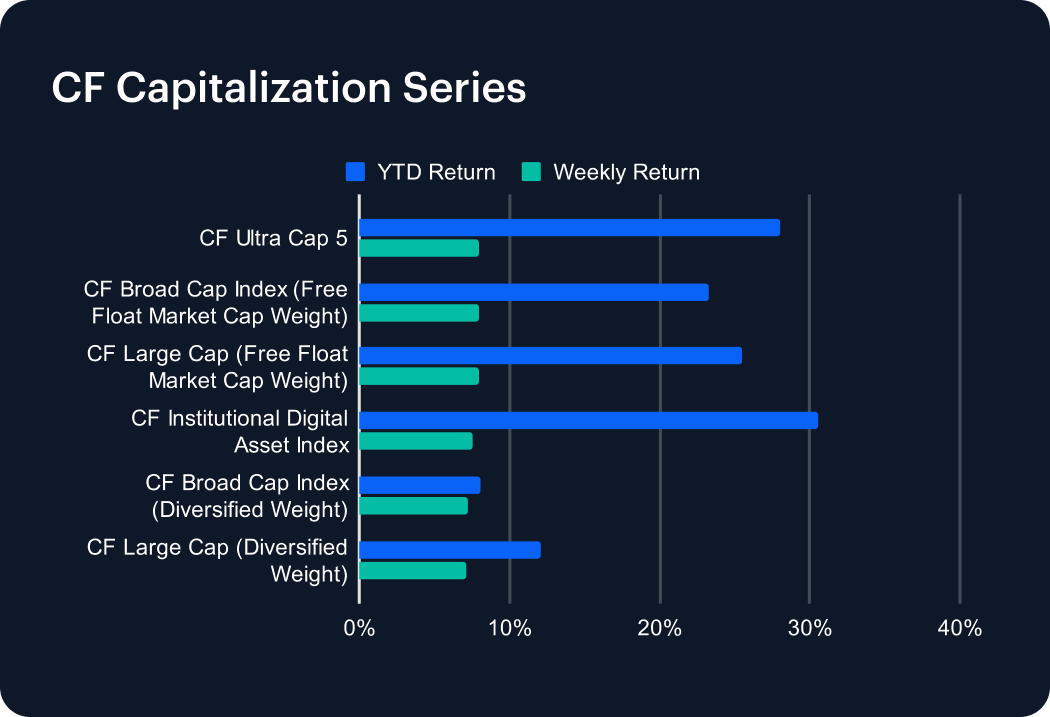

A more constructive tone during the week enabled a relatively even distribution of positive returns throughout the series, with the CF Ultra Cap 5 modestly outperforming, +7.99%, relative to +7.14% by the CF Large Cap (Diversified Weight).

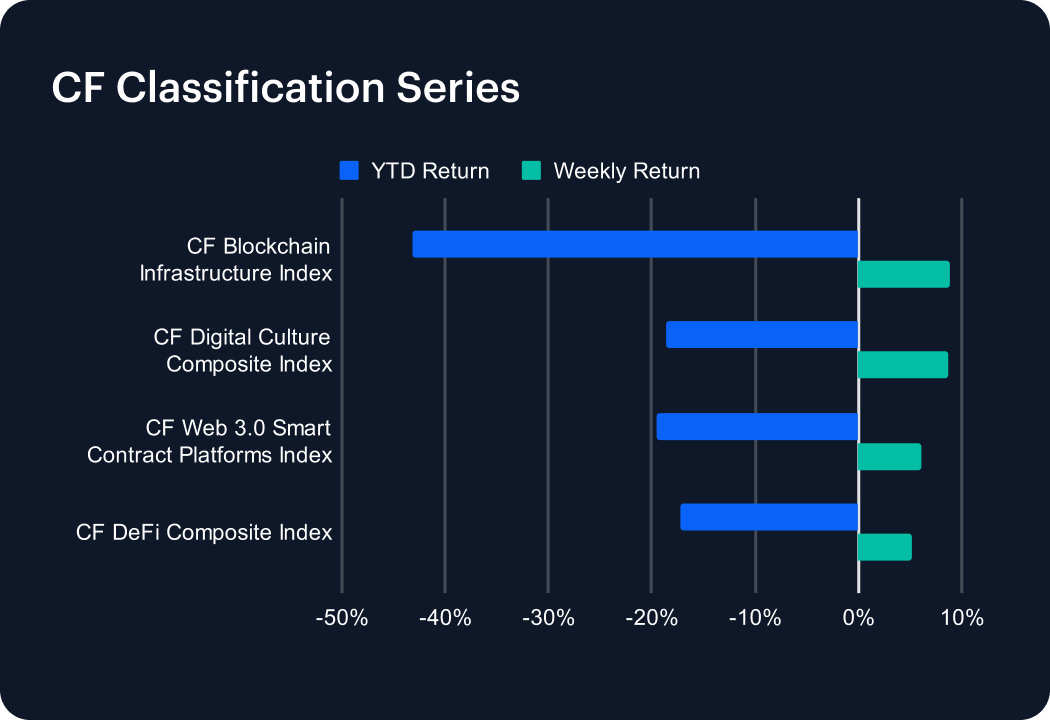

The CF Blockchain Infrastructure Index (+8.87%) vies with the CF Digital Culture Composite Index (+8.76%) for the top weekly performer spot in this series. Still, our blockchain infrastructure portfolio remains the worst YTD performer (-43.11%).

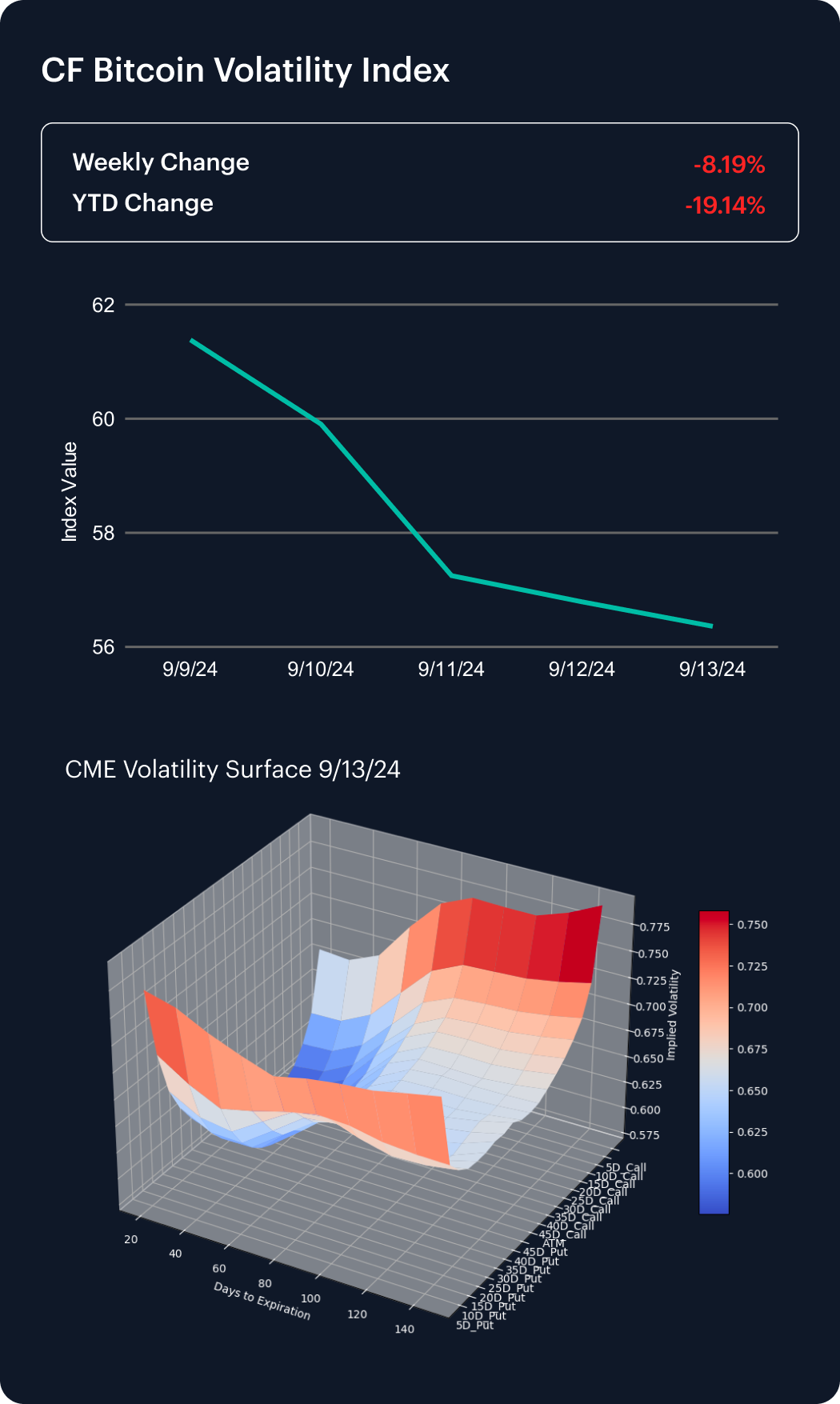

Our CF Bitcoin Volatility Index Settlement Rate (BVXS) indicates market implied BTC volatility continues to trend lower. The -8.19% weekly change eclipses a moderate rise over the prior week, leaving BVXS -19.14% YTD.

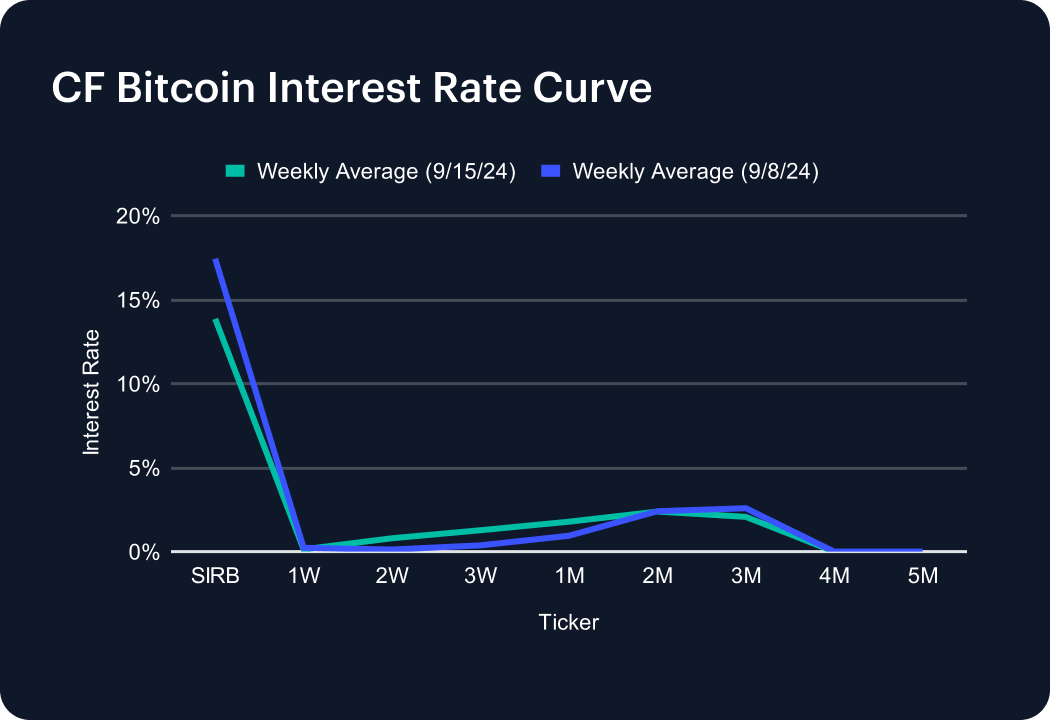

Session and weekly rates ticked marginally lower, whilst 3-week and 1-month tenors edged higher. Even so, the curve is materially unchanged, and its overall profile remains one of flattening across the term structure.

Index data based on CF Benchmarks Settlement Rates, published at 16:00 London Time

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks