Jan 11, 2024

New Era of Investing Starts Today, with Six CF Benchmarks-powered Spot Bitcoin ETFs

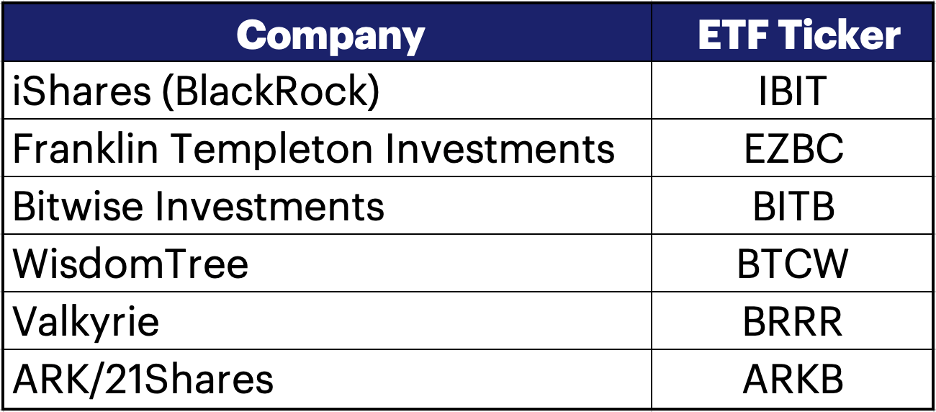

The six spot bitcoin ETFs that strike net asset value (NAV) against the CME CF Bitcoin Reference Rate – New York Variant (BRRNY) are set to be listed today.

Not a normal day, even for crypto

Although, there is certainly no shortage of hyperbole in the crypto space about many things, it is difficult for anyone to argue that this is anything but a remarkable watershed for Bitcoin, digital assets, and perhaps most importantly, the broader, mainstream sphere of investment management.

Accessibility

As we and others have highlighted several times over the last few years, whilst the exact extent and timing is as yet unknown, the impact of the new ‘skill’ that is about to be unlocked (Bitcoin exposure) for U.S. fiduciaries of several kinds, including RIAs and consultants can only be mechanically seismic.

Persistence

The moment of course also represents the culmination of the collective, individual, and corporate efforts of tens of thousands of people who are committed to both cryptocurrencies as well as to the painstaking regulatory standards and principles required for Bitcoin to become an exchange traded investment. It goes without saying that today is their ‘victory lap’.

CF Benchmarks' contribution

That done, here is also a fitting point to outline CF Benchmarks' own important participation as a member of all the above cohorts and at virtually every stage of the process of getting a spot bitcoin ETF listed (something which was often dismissed, even in quite recent years, as impossible.)

Whilst of course CF Benchmarks’ CF Bitcoin Reference Rate - New York Variant (BRRNY) index is at the heart of the six spot bitcoin ETFs that will soon be accessible to every type of investor in America, CFB’s involvement in the instigation, progression, support and ultimate manifestation of this new investment product class did not begin, nor end with simple licensing of that index.

Behind the BRRNY

First off, it’s worth noting that as the intellectual property of the first ever FCA authorized index, it follows that the BRRNY is one of the less than a handful of regulated Bitcoin prices in existence, whilst the scope of its institutional liquidity and integrity have also been demonstrated several times over the years, in numerous publications of our rigorous research.

It is also a vindication of our long-held view that our benchmark methodology has produced a pricing source with a sufficiently long, and demonstrable track record of market integrity (chiefly meaning resistance to manipulation) as well as accuracy, that is capable of satisfying the stringent framework of regulatory parameters for digital asset investment products that’s emerged through the course of the process of bringing spot Bitcoin ETFs into being.

The People

There are several other aspects of CF Benchmarks’ participation and support of this process that also should be recorded for prosperity, lest they’re overlooked.

Let’s start with the pivotal role played by the senior leadership of CF Benchmarks. The natural focus should of course fall on our CEO, Sui Chung whose ability to interweave innumerable layers of complexity inherent in establishing and helming the world’s first cryptocurrency Benchmark index Administrator speak for themselves. That said, given that CF Benchmarks is clearly at the very thin edge of cutting edge technology, that should also train the spotlight on our Chief Technology Officer, Graham MacDonald.

Additionally, the actual ‘impossible’ task of persuading some of the most risk-averse multinationals in the world to consider stepping into the cryptocurrency ring, fell to Peter Stern, Director of Sales & Business Development.

(Watch our podcast episode with Peter here.)

That team has been and is backed up by a (still relatively compact) cast of equally talented engineers, product managers and others.

CF Benchmarks Expertise

With the first attempt to list the first spot Bitcoin ETF now quite famously known to have occurred around a decade ago, it should also be known that CFB’s record of involvement covers half of that stretch – CFB was first cited as the Benchmark Administrator for a spot bitcoin ETF application in 2018.

But our role clearly went a lot further than those words suggest.

CF Benchmarks commentary and guidance documents CFB as the key (actually, often the only) service provider participating in correspondence between the applicant and the SEC, regarding critical aspects of the proposed Bitcoin ETF.

Unsurprisingly, the focus was mostly on the same key principal ‘sticking points’ that the SEC has consistently flagged as key concerns that, in its view, should make such a fund ‘unapprovable’, and which it continued to stress right up to the last few months.

Crucially as well, CF Benchmarks research demonstrating that its regulated CME CF Bitcoin Reference Rate Benchmark (BRR) is impervious to market manipulation, has often been incorporated into submissions and correspondence by applicants, beginning with that first hopeful in 2018, right up the last and, thankfully successful, batch.

Such research has been replicated with consistently high fidelity, across both the BRR itself, and its subsequent variants, including of course, BRRNY.

Next up, the future.

Finally, we’d like to congratulate our clients on the successful culmination of their long journey to the launch of their spot Bitcoin ETFs. We know that each of you shares the same commitment to painstaking accuracy, integrity and quality, on pricing, and more, as we do here at CF Benchmarks, and we wish you and your clients happy Bitcoin ETF trading!

Find out more about the CME CF BRRNY

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks