Jun 05, 2021

SEC restarts the clock on WisdomTree ETF decision

The SEC restarts the clock but there’s no cause for alarm

On the face of it, news that the SEC has delayed its decision on whether to approve WisdomTree’s WisdomTree Bitcoin Trust ETF can be interpreted as disappointing. After all, with $69.5bn in assets under management as of the end of its first quarter in April, an increase of 3.2%, and a track record in listed crypto investment funds, WisdomTree is easily one of the most credible of the prospective applicants that have filed to run the U.S.’s first Bitcoin ETF so far this year.

With two exchange-traded cryptocurrency investment funds already listed, WisdomTree has an enviable past performance of managing crypto investment vehicles. WisdomTree Bitcoin ETP (BTCW) was launched in late-2019, WisdomTree Ethereum ETP (ETHW) first traded in April of this year. What’s more, WisdomTree remains one of the few cryptoasset investment managers currently running listed funds valued daily against indices devised and administered by a regulated Benchmark Administrator, CF Benchmarks, meaning that WisdomTree’s Bitcoin and Ethereum ETPs are among a unique minority of regulated crypto investment products underpinned by regulated benchmark indices.

As such, in the event that a delayed SEC decision points to WisdomTree’s ultimate exclusion from the running, that would not only be a disappointment for the firm and indeed CF Benchmarks. By implication, the rejection of such a high-quality candidate could also have negative implications for the broader project of getting any U.S. crypto ETF over the line any time soon.

SEC Time

On the other hand, the delay is neither a surprise nor alarming in itself. As CoinDesk’s Global Policy & Regulation Managing Editor Nikhilesh De noted recently, “To date the agency has taken the full 240 days for most of the bitcoin ETF applications it has considered”.

Indeed, the pattern applies to VanEck’s VanEck Bitcoin Trust, following that asset manager’s preliminary filing at the end of last year. On 28th April, the regulator announced a 45-day extension to its review period of VanEck’s proposal. This followed an initial customary 45-day consideration that began with the SEC’s publication of a ‘proposed rule change’ notice, which usually comes shortly after the exchange on which the ETF is intended to be listed publishes the proposed rule change—AKA form 19b-4.

As we explained recently, the latter document, essentially kicks off the SEC’s ‘active’ review period for a proposed new listing. However, it’s interesting to note that whilst an initial 45-day timeline is backdated to the date when the 19b-4 was filed, any subsequent additional consideration period begins on the day the SEC publishes the proposed rule change to The Federal Register, or on any other subsequent date for which the SEC states it is giving notice.

Therefore, given that the SEC responds at its discretion to the exchange’s paperwork on behalf of its new listing client, it’s easy to see why a ‘delay notice’— like the ones the SEC published for the VanEck ETF and, this week, for WisdomTree’s—can often make a lot of sense. Quite often, the Commission simply needs to ‘restart the clock’, to afford itself more time for consideration.

Again, as we’ve noted previously, the SEC can, at its discretion, keep ‘restarting the clock’ for up to 240 days “from the date of publication of notice of the filing of a proposed rule change”.

Still not speculating (much)

Unfortunately, as Nikhilesh De also goes on to note, historically, having furnished itself with the complete time available to it for consideration of crypto ETF filings, the Commission has “then rejected every application”.

Still, there is no way of knowing whether the agency is inclined to perpetuate the trend it began with the rejection of the first known application for a Bitcoin ETF, around 4 years ago.

As we’ve indicated a number of times in this blog, speculation about the nature of the SEC’s deliberations is futile…albeit tempting. Suffice to say that much has changed since those–perhaps somewhat naïve—early Bitcoin ETF filings, both in the terms of the quality of filings and, most importantly, the maturity of the cryptoasset market.

Furthermore, for proposed U.S. Bitcoin ETF filings that include plans to strike daily NAV against regulated CF Benchmarks indices, the hallmarks of that maturity and integrity have been demonstrated by empirical research, particularly in terms of liquidity, market structure, and facilities available to guarantee the integrity of the entire market system that a Bitcoin ETF will inhabit.

Timeliness

For now, limiting ourselves to what’s clear for the filings at hand, we know that following the SEC’s ‘delay notices’ for the WisdomTree and VanEck Bitcoin ETF applications, the Commission’s typical notification schedule suggests decisions will come 45 days after those ‘delay notices’.

Alternatively, the SEC could announce further extensions that lengthen its review periods up to the maximum permitted 240 days. (Note that the SEC appears to include weekends and public holidays as part of its review time).

The SEC has stated that it currently expects to decide the fate of VanEck’s ETF proposal no later than June 17th. But it could end up doing so as much as 240 days from the date when the proposed rule change was filed, meaning Sunday, November 14, 2021.

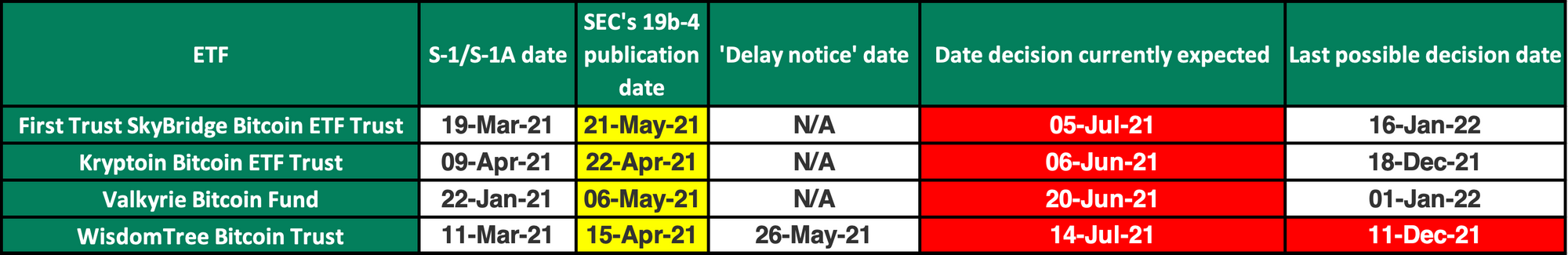

For Bitcoin ETF applications supported by one or more of CF Benchmarks’ regulated Benchmark Indices—including WisdomTree Bitcoin Trust—we summarise timelines and currently expected decision dates below.

Evidently, the long wait for the SEC to approve a Bitcoin ETF could go on for a quite a bit longer yet.

We’ll update the table with new information as and when that becomes available.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Quarterly Attribution Reports - March 2026

Thoroughly dissect and comprehend the performance of our flagship portfolio indices at the constituent, category, sub-category, and segment levels during the course of each portfolio rebalance period.

Gabriel Selby

Weekly Index Highlights, March 9, 2026

Geopolitical strains kept digital assets on the defensive in the past week, with Bitcoin down 2.1% and Cardano -12.0%. Realized BTC volatility and our BVXS implied vol. index both inched higher, by 5.8 and 1.7 points, but Culture tokens in our CF DACS taxonomy were worst hit on average, at -8.7%.

CF Benchmarks

Factor Friday - March 6, 2026

The market posted its strongest weekly gain of 2026 at +4.3%, trimming YTD losses to -28.0%. Value emerged as the top factor at +1.7% weekly, turning positive YTD. Downside beta posted its first negative week of the year, signaling a potential early shift towards risk.

Mark Pilipczuk