May 31, 2024

SEC cites CF Benchmarks in ETH ETF Pivot

How CF Benchmarks helped change the SEC's 'no' to 'yes'

New milestone, new drama

The latest milestone for the digital asset class is remarkable enough in itself, but there’s more to the SECs sudden 180° pivot to an approval stance on spot Ether ETFs than meets the eye.

Less than six months after the SEC’s decision in January that, essentially, removed a major hurdle blocking the path to the biggest investing inflection point for years, it's happened again.

The regulator has dropped its long-telegraphed objection to Ether being offered within the ETF wrapper.

As per Bitcoin, in effect, the decision inaugurates Ethereum’s status as a mainstream investment asset.

Most ETH ETF assets will be priced by CFB

For CF Benchmarks, there are other gratifying similarities between the Bitcoin ETF approval and the Ether one.

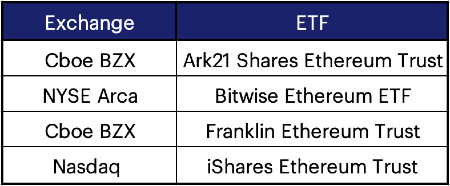

Once again, we're in the unique position of being the benchmark provider for the largest tranche of upcoming U.S. Ether ETFs, as listed below.

Given the asset gathering potential of these, it's probable that CME CF Ether-Dollar Reference Rate - New York Variant (ETHUSD_NY) will, like BRRNY (its Bitcoin counterpart), be the price referenced by most Ether ETF assets.

Admin not policy

Not quite yet though. The approval process for Public Offerings is a two-pronged one. This means the Commission must rubber stamp two sets of paperwork for complete approval: (1) undertakings from the issuer, on forms S1 or S3, and (2) undertakings from the exchange, on form 19-b4.

Staking out

And if listing proposals change, paperwork must be resubmitted. For Ethereum ETFs, a tacit quid pro quo is now clear: staking rewards must be entirely absent from their structure. As such, issuer filings are now being redone to expressly exclude staking. The SEC will then need to approve these amended filings.

Doubts

This stipulation is the main remaining source of doubt, seen in markets and the press. Still, the SEC’s tortuous arrival at its approval decision in one half of the process, argues against rejection in the other. So whilst an indeterminate period of further delay is likely, it will probably be relatively short and administrative, not long, and policy driven.

Pivot

Meanwhile, the SEC also lived up to its reputation for conflict-stricken decision making, with that dramatic and embarrassing about-turn. Just over a week ago, Bloomberg Intelligence’s ETF team, were still estimating the chance of a favourable decision by May 23rd as below 30%.

Was SAB121 behind the SEC's 180°?

Persuading the SEC

What we know for sure is that the SEC leaned extensively on CF Benchmarks’ data and reasoning as the basis of approval, as seen in a section of the approval order below.

Not only does the SEC take the unusual step of naming CF Benchmarks, it also cites the market data and arguments we submitted in our Comment Letter supporting our clients’ ETF filings.

Comment Letters are a typical part of the review procedure for securities filings.

What is highly atypical, is for the Commission to quote the assertions of a commercial entity to make its case for a regulatory ruling.

We believe this is an unprecedented acknowledgement of the veracity of our regulated benchmark methodology and the safeguards we’ve incorporated into it, to ensure the reliability, accuracy and market integrity of our pricing benchmarks.

So, why was our analysis evidently compelling enough for the regulator to adopt it wholesale?

The Argument

The purpose of the Comment Letter was to demonstrate that according to regulatory precedent set by the SEC itself, conditions required for Ether ETF listing exchanges to carry out their obligations under the Securities and Exchange Act, are already in place.

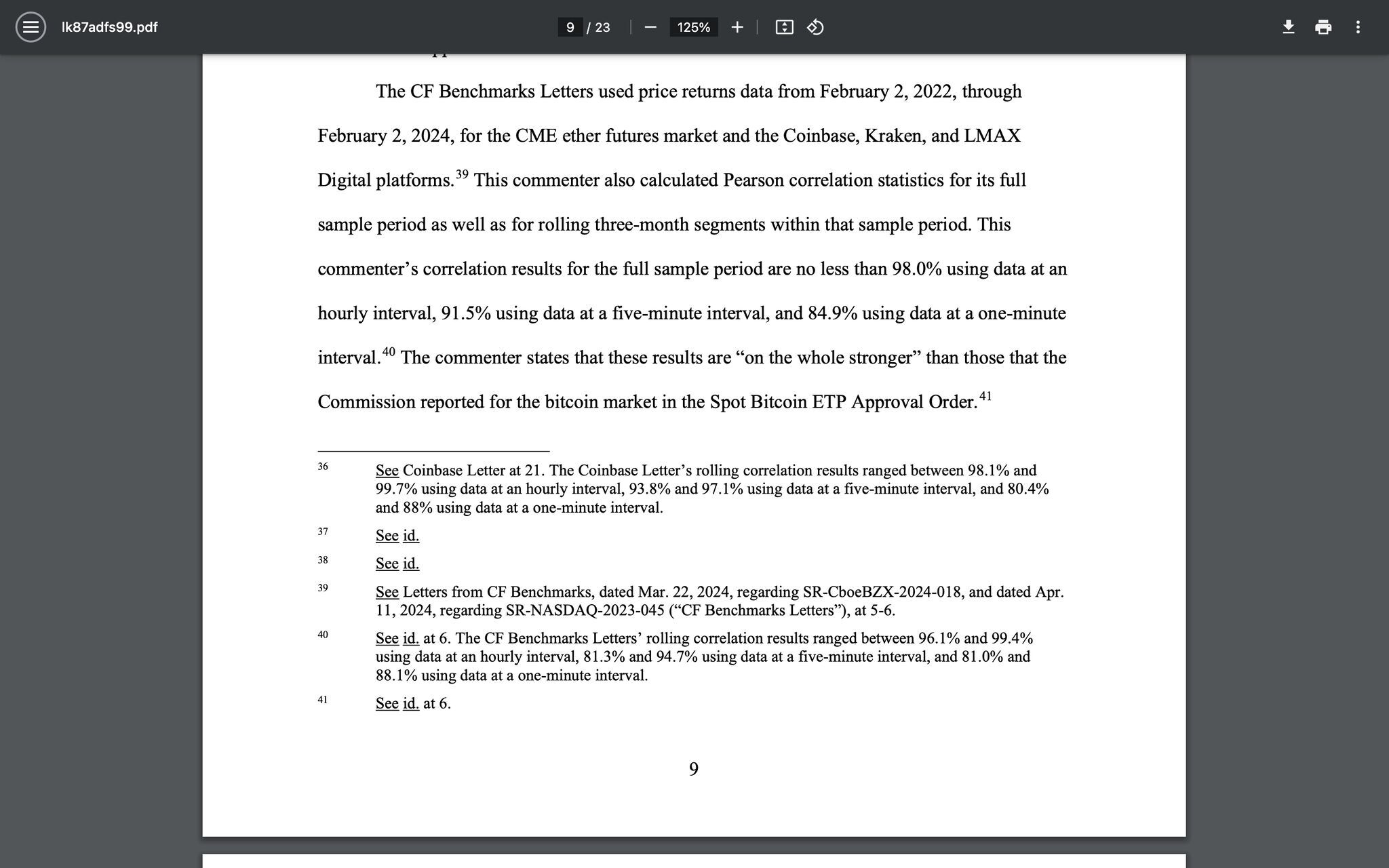

Given the weight placed by the Commission in previous statements on the need for the existence of a regulated market of “significant size” (for Ether, that would be the CME’s Ether Futures market) and the necessity for that market’s returns to be highly correlated with returns on Ether spot markets, we included our own correlation analysis.

We also provided the source code utilised for the calculation, so the Commission, or anyone else, could verify our results and conclusions for themselves.

Our main points are summarised below:

- The SEC's order approving spot Bitcoin ETFs is “the best guide" of the standards required for Ether ETF approval under the Securities and Exchange Act, 1934

- Regulatory precedent establishes ETH as a commodity. Chiefly, this is due to the existence of a Designated Contract Market (primarily the one operated by the CME Group) – cleared by Designated Clearing Organisations (DCOs) as commodity futures and options contracts, under the regulatory oversight of the CFTC. Again, as per Bitcoin, this strongly argues for the "designation of the proposed (Ether) ETP shares as commodity trust shares"

- We determined that Ether ETF exchanges can meet key standards of the Securities and Exchange Act, 1934, by noting that two critical conditions are met:

- The existence of surveillance sharing agreements between listing exchanges and the ETH "market of significant size" - the CME's Ether Futures market

- Demonstration, through correlation analysis, that major spot ETH exchange returns and CME ETH Futures returns are highly correlated

We concluded that proposals by ETH ETF clients are correctly classified as the listing of commodity trust shares.

Evidently, the SEC agrees.

The rationale that Ether has been officially categorised as a commodity is now incontrovertible following the SEC’s approval of ETH ETF exchange applications.

We look forward to the listings of our clients' Ether ETFs!

Further reading

Explainer:

‘CF Benchmarks submits Comment Letters to the SEC in support of spot Ether ETF filings’

Research:

Ether-Dollar index pages:

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks