Apr 02, 2024

Market Recap: Momentum Builds on Dovish Fed Signals

Key takeaways for the month:

- Fed's Dovish Tone and Ethereum's Latest Update: The Fed's latest dot plot suggests 75 bps in cuts for 2024, despite an extended timeline, creating a dovish tone that supported digital asset sentiment in the latter half of the month. Concurrently, Ethereum's successful "Dencun" update, aimed at lowering transaction costs and fostering mainstream adoption, coincided with asset managers filing for a spot Ether ETFs and record-high institutional interest on the CME futures market.

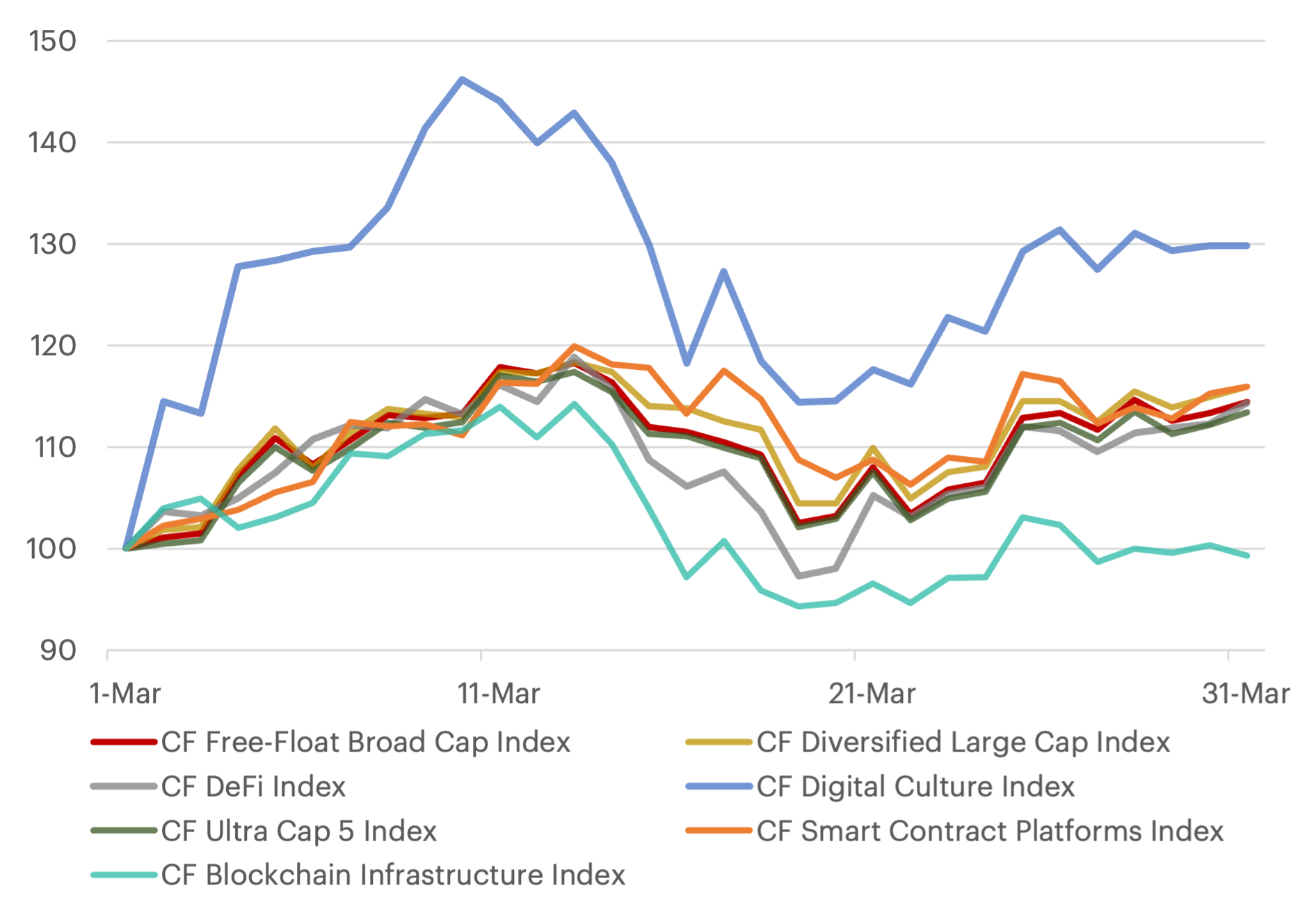

- Postive Momentum Remains Intact: Most digital assets experienced positive price action, with the CF Free-Float Broad Cap Index and CF Diversified Large Cap Index rising by 14.5% and 15.9%, respectively. The CF Digital Culture Composite Index was the top performer, rallying nearly 50% before retracing to end the month about 30% higher. The CF Blockchain Infrastructure Index, however, lagged behind with a mostly flat price performance.

- Halving Hype Propels Bitcoin Cash & Fantom's Sonic Boom: Bitcoin Cash (BCH) led the major cryptocurrencies as investor optimism grew ahead of its planned April halving. Fantom's FTM token also achieved a triple-digit gain, supported by the upcoming release of Sonic. In contrast, Polygon's MATIC, Chainlink's LINK, and Cardano's ADA were the only three major-tokens to post negative performance in March.

- Bullish Sentiment Prevails: With the anticipated Bitcoin halving in the coming weeks, futures-based investor sentiment has stayed constructive, leading to a broad-based upward shift in the CF Bitcoin Interest Rate Curve (BIRC). Nearly all tenors experienced increases, except for the one-week (1W) tenor, which saw a nominal decrease. The most substantial changes were observed in the mid to longer-term tenors, indicating cautious optimism for the future.

- Inflows Remain Strong as Futures Open Interest Hits New Highs: March saw a slight decrease in net monthly inflows, falling from $6.1 billion to $4.5 billion, though they remained near record levels. Total open interest for both Bitcoin and Ether futures continued to climb, rising 23.8% and 9.4%, respectively, from the previous month. Both CME Bitcoin and Ether open interest reached new all-time highs.

To read the complete report, kindly click on the provided link (or click here to view a PDF version). Additionally, please do not forget to subscribe to our latest news and research for the most relevant institutional insights on digital assets and the top digital assets by market cap.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks