Sep 02, 2021

How the BRR Liquidity Complex empowers big banks to create regulated Bitcoin products

Our latest whitepaper shows how BRR-powered ETFs within the BRR’s ecosystem of institutional liquidity bridge the regulatory divide to big bank Bitcoin products

What's at stake

For the largest global financial services institutions, particularly U.S.-based multinational banks, it’s no secret that increasing cryptocurrency adoption, price appreciation and demand have been an enormous headache as much as a massive opportunity.

On the one hand, signal developments affirming continued normalisation of the asset class show no let-up. Take SEC chair Gary Gensler recently intimating how cryptocurrency ETF applicants might soon obtain regulatory approval. If that happens, client enquiries clamouring for crypto access can only get louder.

On the other hand, there are specific regulatory and legal considerations militating against dominant multinational banks getting involved outright in crypto.

Meanwhile, competitive risks from remaining on the side lines are also rising. The deal between U.S. enterprise payments group NCR and digital-asset management and infrastructure firm NYDIG, that could roll out crypto services to customers of 650 U.S. community banks and credit unions, will not have escaped the attention of larger financial services firms. The ability of institutions that are generally smaller, but which can still reach deeply into the lives of consumer and commercial clients that want crypto services, is a threat that national banks can’t ignore.

Crypto isn’t ‘permissible’

Chiefly, it is the U.S. regulatory framework in which high-profile institutions like JPMorgan, Goldman Sachs, Morgan Stanley, et al, do business as bank holding companies that places convoluted prohibitions and conditions on their ability to participate in many high-risk markets, including cryptoassets.

It’s also worth remembering that the 1956 Bank Holding Company Act (BHCA) currently applies to around 30 foreign banking organizations designated as bank holding companies by the U.S. Federal Reserve Board as of March 2021. That makes restrictions on BHCAs providing crypto services a problem that reaches well beyond U.S. borders.

Whilst the Act determines whether or not a banking group can be designated as one, the BHCA also encompasses a legal framework mediating several other aspects of U.S. bank regulation: from Glass-Steagall to Dodd-Frank and ‘The Volker Rule’, bank holding companies simply face more, and more complex restrictions on the markets and other activities they’re permitted to engage in than other types of financial institutions.

In a 2016 report to Congress and the Financial Stability Oversight Council, focusing on the Dodd–Frank Wall Street Reform and Consumer Protection Act (2010), cryptocurrencies went entirely unmentioned. Effectively, that enforced the axiomatic absence of crypto from earlier legislation, like the list of “Permissible Securities Activities” defined by the Glass-Steagall Act and Gramm-Leach-Bliley Acts.

Uncertain waters – full steam ahead

All this essentially leaves bank holding companies in uncertain waters. But to be clear, the pressure to establish participation in cryptocurrency markets has been compelling enough to ensure that several of the largest U.S. financial firms have already begun to do so.

Goldman Sachs was among the first. Bloomberg reported as early as 2017 that it was setting up a crypto trading desk. GS subsequently opened one of the first fully-fledged crypto trading operations at a major Wall Street bank this May.

The important point to note with GS and other leading institutions that have begun to move forward with crypto services over the last several month—including JPMorgan, Wells Fargo and Morgan Stanley—is that these firms have been careful to avoid ownership and handling of cryptocurrencies.

- At Goldman, a May memo reportedly informed markets staff that its cryptocurrency desk had successfully executed its first trades. But it also noted: “the firm is not in a position to trade bitcoin, or any cryptocurrency on a physical basis”. Transactions were limited to “Bitcoin NDFs (non-deliverable forwards) and CME BTC Future trades”

- Citigroup was recently heard to be ‘actively recruiting’ for crypto quant specialists, though any cryptoasset trading by the team would almost certainly take the form of “CME Bitcoin Futures first and then Bitcoin exchange-traded notes (ETNs)”

- Morgan Stanley fund disclosure revealed the purchase of 6.5 million shares in Grayscale Bitcoin Trust, equating to around $240m. That follows the late-June buy of over 28,000 shares in the largest exchange-traded BTC fund, underscoring Morgan Stanley’s commitment to the asset class, whilst enabling the bank to remain on the compliant side of regulations governing permissible assets

- Meanwhile, JPMorgan and Wells Fargo opted for the closed-ended-fund route, as the way to provide accredited investor clients with access to Bitcoin

‘Hands-off’ solutions and poor tracking

These circumspect moves point to banking giants being cognisant of their dilemma, yet still looking to get off the side lines in order to begin meeting client demand for crypto and/or to participate in cryptoasset markets.

The trouble is, most hypothetical solutions for maintaining a hands-off stance from ‘physical’ Bitcoin are flawed, implying higher costs for both product providers and their clients.

The key issue is of course tracking error. There are numerous factors underlying the tendency towards costly tracking errors by ETFs and other exchange traded products. But it makes sense to assume that cryptoasset ETPs are vulnerable to enhanced tracking error—not least because of the variable quality of Bitcoin prices outside of CF Benchmarks’ regulated indices.

Beyond tracking error, the same inefficiencies that apply to many instruments that try to replicate the performance of an underlying market by trading futures of the market, apply to crypto investment products. This is largely because it is difficult to eliminate contango and backwardation.

Meet the CME CF BRR Liquidity Complex

All in, this is why demand for exchange traded products that track Bitcoin accurately is likely to increase in step with demand for access to crypto.

In turn, that’s why the ecosystem supported by the CME CF Bitcoin Reference Rate (BRR) can be immensely beneficial for institutions seeking to create regulated cryptocurrency products.

As well as being the most liquid regulated Bitcoin benchmark due to multibillion dollars’ worth of CME BTC futures and options contracts settled to the rate since its inception in late 2016, BRR assets under reference have grown steadily ever since.

The major products whose prices are powered by BRR include Evolve Bitcoin ETF (exchange code: EBIT), QR Capital Bitcoin ETF (QBTC11) and the WisdomTree Bitcoin ETP (BTCW).

How this ecosystem can be deployed by regulated product providers is the subject of our latest in-depth paper, ‘How the CME CF BRR Liquidity Complex can be utilised for the creation and management of structured products’.

The paper is essentially an exposition of the BRR ecosystem, which we have designated the CME CF BRR Liquidity Complex:

“We propose that the expansion of regulated financial products utilizing the CME CF Bitcoin Reference Rate (BRR) has established an interlocking system, comprising primary impacts and secondary effects that are beneficial to the ecosystem of products underpinned by the BRR; in other words, that the characteristics of the system generate advantageous feedback loops often referred to as network effects. We have designated this system as the CME CF BRR Liquidity Complex.”

How it works

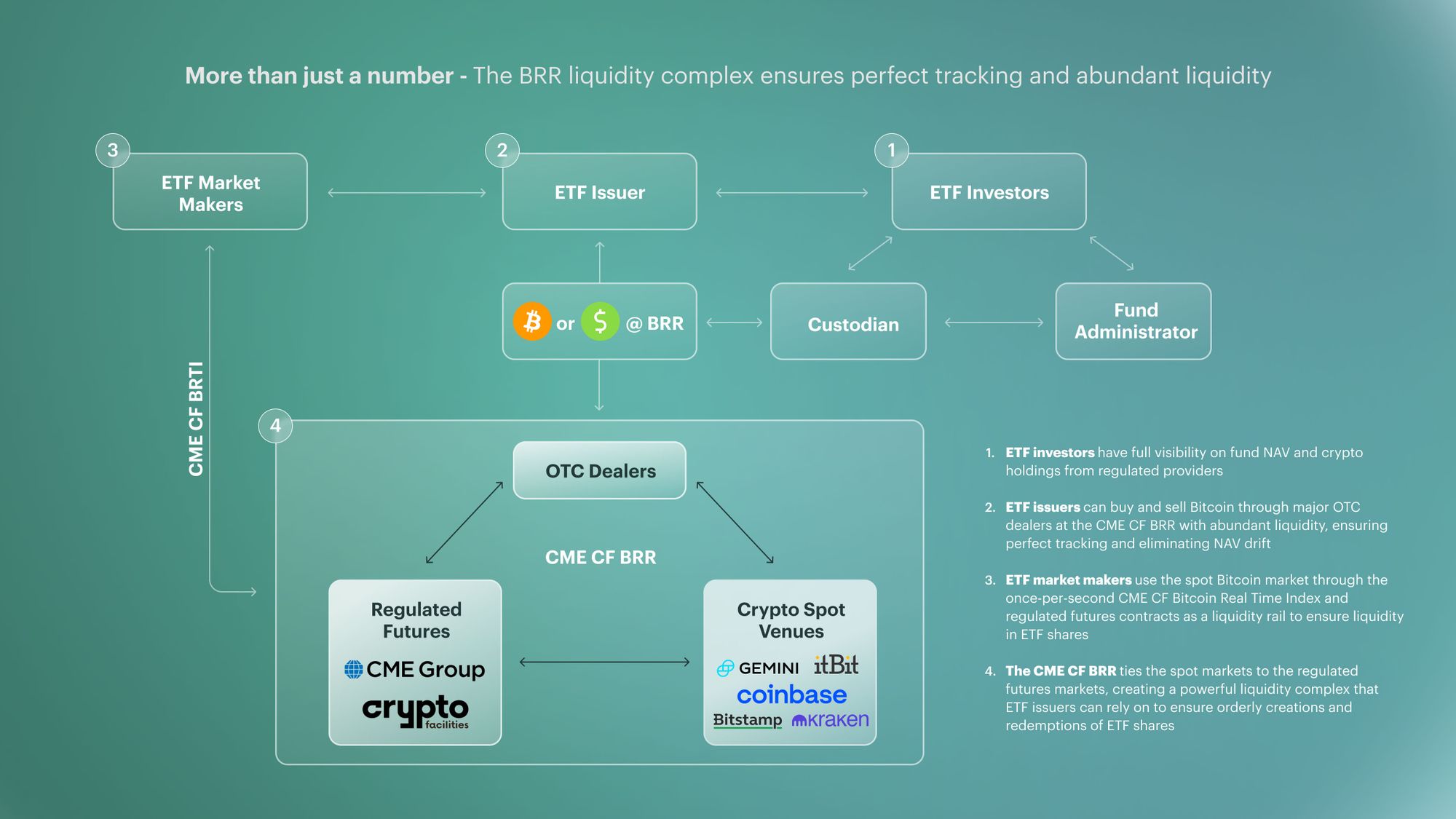

Components and details of how and why the CME CF BRR Liquidity Complex works are depicted in the diagram below.

The complex consists of participants and counterparties that utilize, contribute to, or directly reference the BRR and/or the BRR’s real-time sister index, the CME CF Bitcoin Real Time Index (BRTI). We can divide them into two broad categories.

Price formation

- Regulated futures exchanges

- CME Group and the Crypto Facilities MTF

- Spot venues (CME CF BRR Constituent Exchanges)

- Bitstamp, Coinbase, Gemini, itBit and Kraken

- OTC dealers

Downstream

- ETF market makers, issuers, investors, fund administrators, custodians

Near-perfect tracking

The essence of how the CME CF BRR Liquidity Complex enforces near-perfect tracking of the BRR is described by another excerpt:

“To carry out the function of making a market in Bitcoin ETFs with NAVs determined by the BRR, market makers (1) trade units of the ETFs (2) hedge these trades with CME Bitcoin Futures (including CME Micro Bitcoin Futures) whilst (3) closely monitoring BRTI. CME Bitcoin Futures are thereby a ‘liquidity rail’ for market makers to price Bitcoin ETF units (de facto spot Bitcoin) with no necessity of handling spot Bitcoin. At the same time, since the market-making function must restrict itself only to the BRTI to accurately price spot Bitcoin in order to make that market efficiently, and since the ETFs strike NAVs from the BRR, the CME CF BRR Liquidity Complex is a homeostatic system with consistently priced ETFs that track the BRR almost perfectly.”

The ease with which Bitcoin can be purchased at the BRR price (as denoted by our earlier paper ‘An analysis of the suitability of the CME CF BRR for the creation of regulated financial products’) is another key reason why ETFs that reference the BRR track it with exceptional accuracy.

CME CF BR Liquidity Complex: simple takeaway

As bank holding companies (BHCs) and other large institutions continue their inevitable reorientation to the world of digital assets, and as the regulatory backdrop is set to continue lagging market demand for the foreseeable future, the CME CF BRR Liquidity Complex provides bank holding companies with a way to incorporate the most trusted and liquid institutional price of Bitcoin—the BRR—into their operations, whilst remaining on the right side of regulations.

Read or download ‘How the CME CF BRR Liquidity Complex can be utilised for the creation and management of structured products’ here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks

Not All Cryptos Are the Same: How CF Factor Data Reveals Sensitivities Across the Digital Asset Taxonomy

We show how combining the CF DACS taxonomy with the CF Factor Data Series reveals sensitivities that enable institutional-grade returns attribution, risk monitoring and strategic implementation.

CF Benchmarks

Factor Friday

The defensive regime remains firmly in control. Downside Beta continues to dominate while Growth and Value have continued to lag since October. Momentum's recent surge and The Settlement category's relative resilience are the two threads worth pulling on this week.

Mark Pilipczuk