Oct 18, 2021

Incoming: U.S. Bitcoin ETF

ProShares’ Bitcoin Strategy ETF set for first SEC approval under end-to-end regulated conditions

Finally, the goal many in the crypto industry have worked towards for years, looks to be around the corner, according to multiple news reports.

The prospect of a U.S. Bitcoin ETF has been an eventuality widely perceived as a probable catalyst for the market price of Bitcoin—and consequently, bearing in mind typical market patterns—also beneficial for valuations across the cryptoasset market, for mass adoption, and in turn for the crypto industry as a whole.

With Bitcoin again spiking close to the all-time highs it marked earlier this year, it looks like at least the first two stages of these anticipated developments could be about to play out.

Our CME CF Bitcoin Reference Rate (BRTI) peaked at $62,863.99 (timestamp: 15/10/2021, 20:27 UTC), close to the BRTI’s current “max value” of $64,858.1 on 14/04/2021, at 06:14 UTC.

Here’s a summary of indications that triggered the optimistic price move:

-

News reports suggesting that an SEC approval could be imminent came swiftly after key Bitcoin futures ETF applicant ProShares filed an N1-A Registration Statement (AKA an ‘amended prospectus’) for its Bitcoin Strategy ETF (including a ticker, ‘BITO’). Such filings are an obligatory step in the process of launching open-ended funds, including Exchange Traded Funds.

(ProShares is part of the group that manages the first ever Bitcoin mutual fund with CF Bitcoin-Dollar US Settlement Price as its Performance Index) -

The N1-A confirmed that ProShares’ Bitcoin Strategy ETF will be formulated under the structure indicated by initial disclosure documents:

- It’s a Bitcoin ‘strategy fund’, i.e., it aims to provide BTC exposure by investing in CME BTC Futures contracts, continually rolling these investments into fresh contracts as prior ones expire

- The fund will be registered under the 1940 Investment Company Act as opposed to the Securities Act of 1933

- Both of the above details were tacit stipulations laid out several times throughout the year by SEC staff and the commission’s chair, Gary Gensler

- Some corroboration of the extent to which the apparent success of ProShares’ application may have been based on ‘guidance’ from the SEC: ProShares’ amended prospectus omits references to the facility for BITO to make supplementary investments in Canadian spot-based Bitcoin ETFs (initial documentation included the facility). It’s a facility that several applicants referred to in their filings. Whilst uncontroversial from a fund management perspective, the practice could still suggest a marginal risk to the success of such applications given the express prescription from the SEC to lean only on regulated BTC futures

-

It may also be significant that one of the firms whose BTC ETF filing did not include the ‘physical ETF’ facility, Valkyrie, also filed additional paperwork last week for its Valkyrie Bitcoin Strategy ETF. (Note: the document type is a generally mandated registration for any type of listed security, rather than specified for listed fund registrations)

It’s worth noting that neither the SEC nor ProShares have confirmed the news reports. Therefore, details as we understand them now are subject to change if/when confirmation is forthcoming.

The presence of the CME Group as a significant additional counterparty to any Bitcoin Futures-based ETF may also suggest the final structure of the vehicle could differ from the form in which it is currently documented.

Aside from sensible cautions to prevent us from getting ahead of ourselves, the downsides of any futures-derived investment strategy—including BTC futures—have been well discussed within the institutional cryptoasset investment space in recent months. Such misgivings could curb the market and industry enthusiasm following SEC approval of a Bitcoin futures-based ETF.

In the end, any confirmation could garner more importance from its incremental significance on the road to a possible spot-Bitcoin ETF, as well as its significance for broader cryptoasset adoption and institutional normalisation.

For CF Benchmarks, confirmation will have a similar value as the launch of pioneering crypto exchange traded assets, utilising CF Benchmarks’ regulated Benchmark Methodology, floated in Canada by Evolve ETFs, by QR Asset in Brazil, and across Europe by WisdomTree Europe.

SEC approval will provide further recognition of the regulatory safeguards on market integrity inherent in the CF Benchmarks Benchmark Methodology, given that any Bitcoin futures fund(s) will adhere to the SEC’s prescription demanding end-to-end regulation: the funds must be based on CFTC-regulated CME Bitcoin Futures that settle to the CME CF Bitcoin Reference Rate.

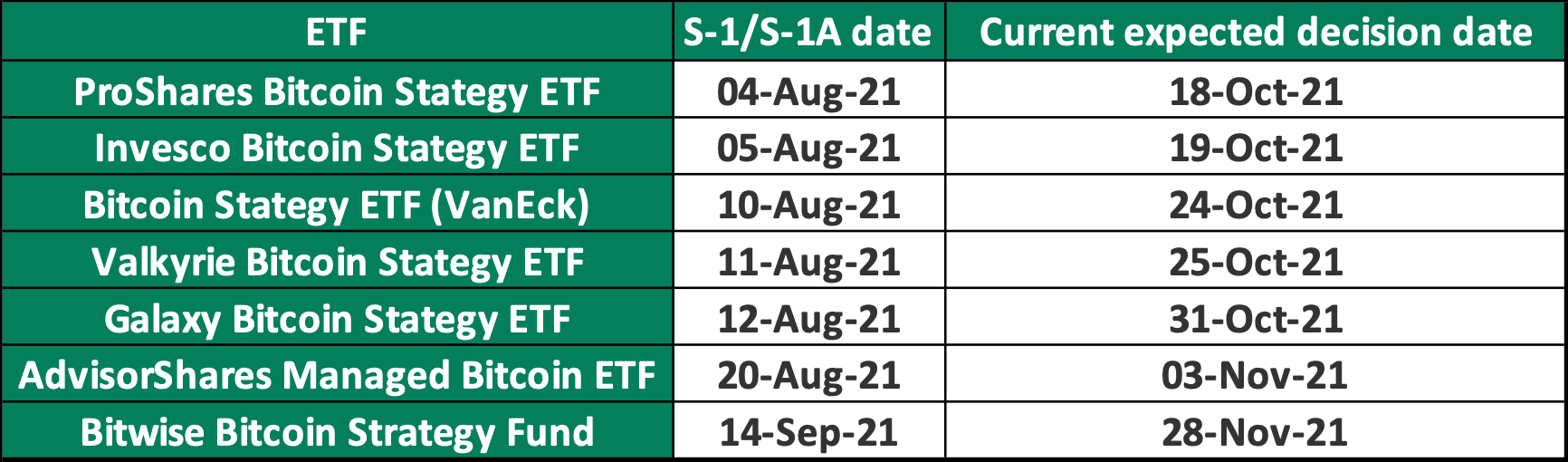

For ease of reference over the next few days and weeks, the table below summarises Bitcoin futures strategy ETF applications to the SEC registered under the ’40 Act only, extrapolating earliest dates on which the commission could publish its decisions.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks