Oct 18, 2024

Changes to Input Data and Tickers for CME CF Polygon-Dollar indices

The Administrator announces input data and ticker changes for CME CF Polygon-Dollar Reference Rates, and CME CF Polygon-Dollar Real Time Indices.

This decision follows the upgrade of MATIC across the Polygon network on September 4th, 2024, which resulted in POL becoming the native token of the network.

The Administrator has since been observing POL-USD markets operated by CME CF Constituent Exchanges, and has determined that the correct price representation of Polygon is now the POL token.

To ensure CME CF Polygon-Dollar Reference Rates and Real Time Indices best represent Polygon in a robust and reliable manner, these benchmarks will transition to observing POL-USD markets as input data.

Accordingly, tickers for these benchmarks will transition to the POL designation on October 29th, 2024.

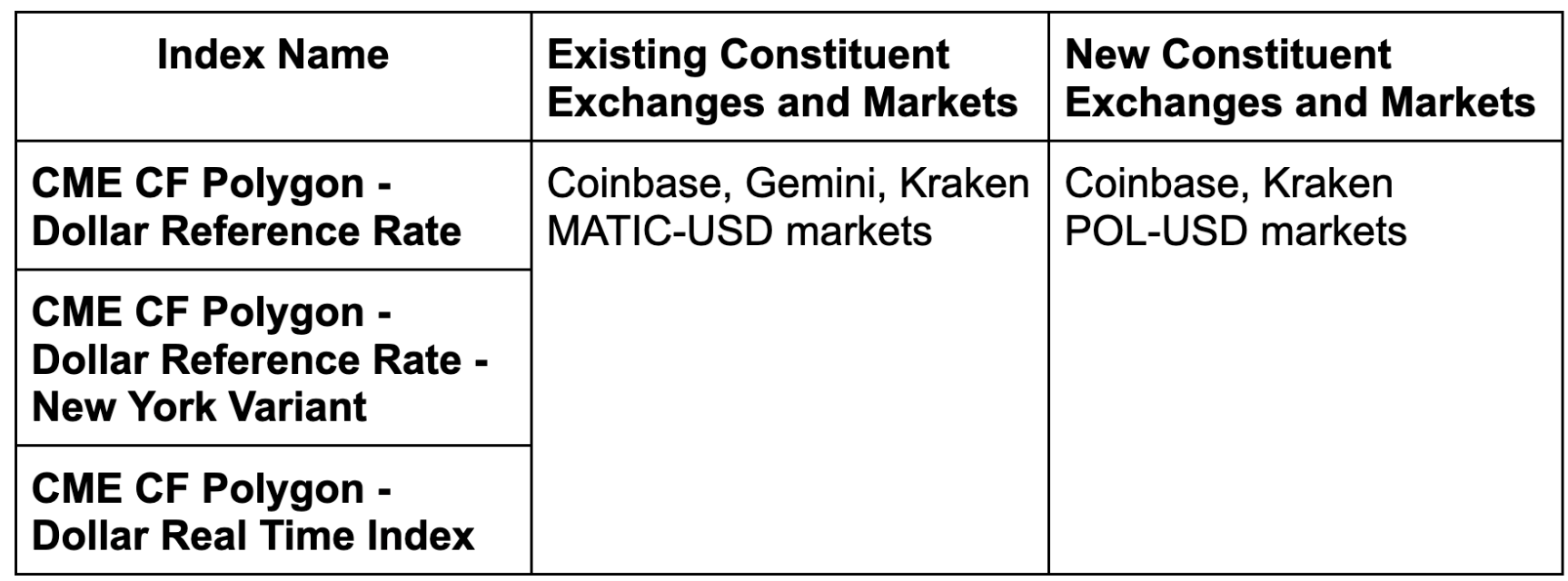

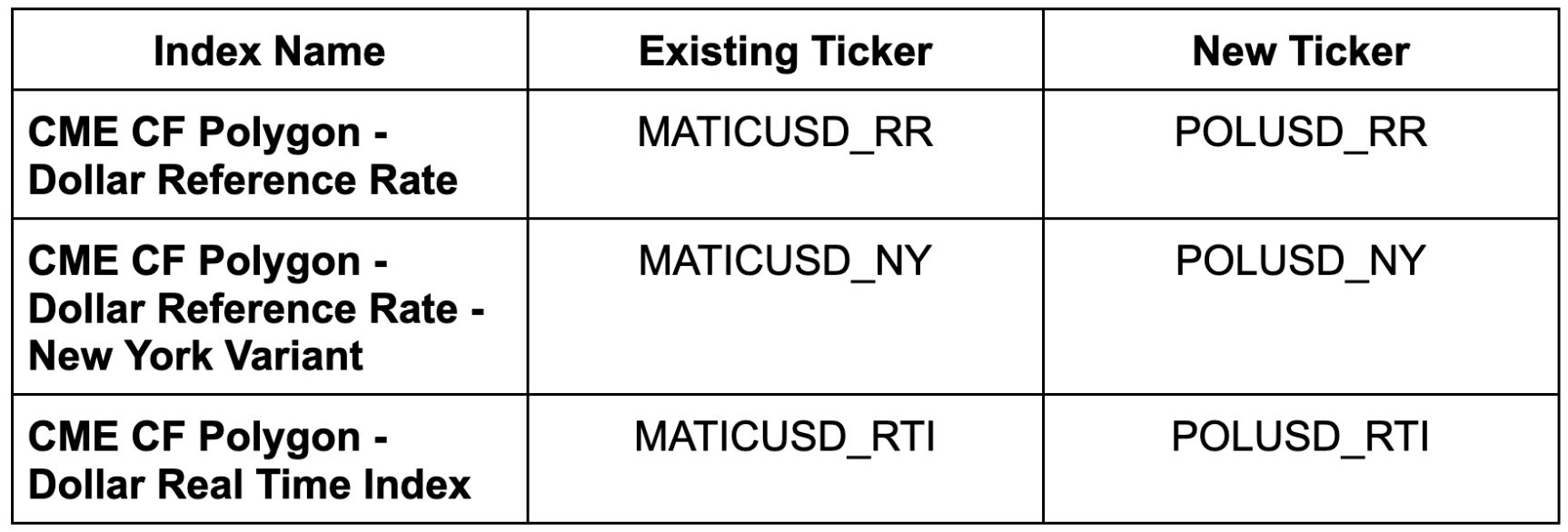

Constituent Exchange, Market, and ticker changes are summarised in the tables below.

Constituent Exchange and Market Changes

Ticker Changes

All changes were overseen by the CME CF Oversight Committee.

Implementation Timeline

These changes will be implemented at approximately 10:00:00 London Time on October 29th, 2024. This means the last CME CF Polygon-Dollar Reference Rates observing MATIC-USD markets will be published on October 28th, 2024.

Questions or queries regarding this process should be directed to [email protected].

Any user wishing to file a complaint regarding this process can do so confidentially by writing to [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Nasdaq Crypto Index Family – Free Float Supplies Announcement

The reconstitution and rebalance of the Nasdaq Crypto Index Family will take place on March 2nd, 2026.

CF Benchmarks

CF Digital Asset Index Family Multi Asset Series – Free Float Supplies Announcement

The reconstitution and rebalance of the CF Digital Asset Index Family Multi Asset Series will take place on March 2nd 2026.

CF Benchmarks

Weekly Index Highlights, February 23, 2026

Crypto's risk-off tone deepened last week, with BTC's -0.6% slide masking sharper alt weakness, e.g., XRP -6.1%. Our CF DACS universe was uniformly lower though, with Culture and Infrastructure both -7.5%. Meanwhile, implied volatility eased while realized firmed and short-term rates repriced lower.

CF Benchmarks