Jun 02, 2023

CF Benchmarks Recap - Issue 52

Institutionalization

With retail activity—markets-wise, and, anecdotally, adoption-wise, still on the back foot in the wake of that late-2022 perfect storm, institutions are now more easily observable at the forefront of participation. For instance, DigiAssets 2023: the highest profile London conference of its kind, so far this year, with CFB among the earliest sponsors, was also peppered with the support of established capital markets and investment management names.

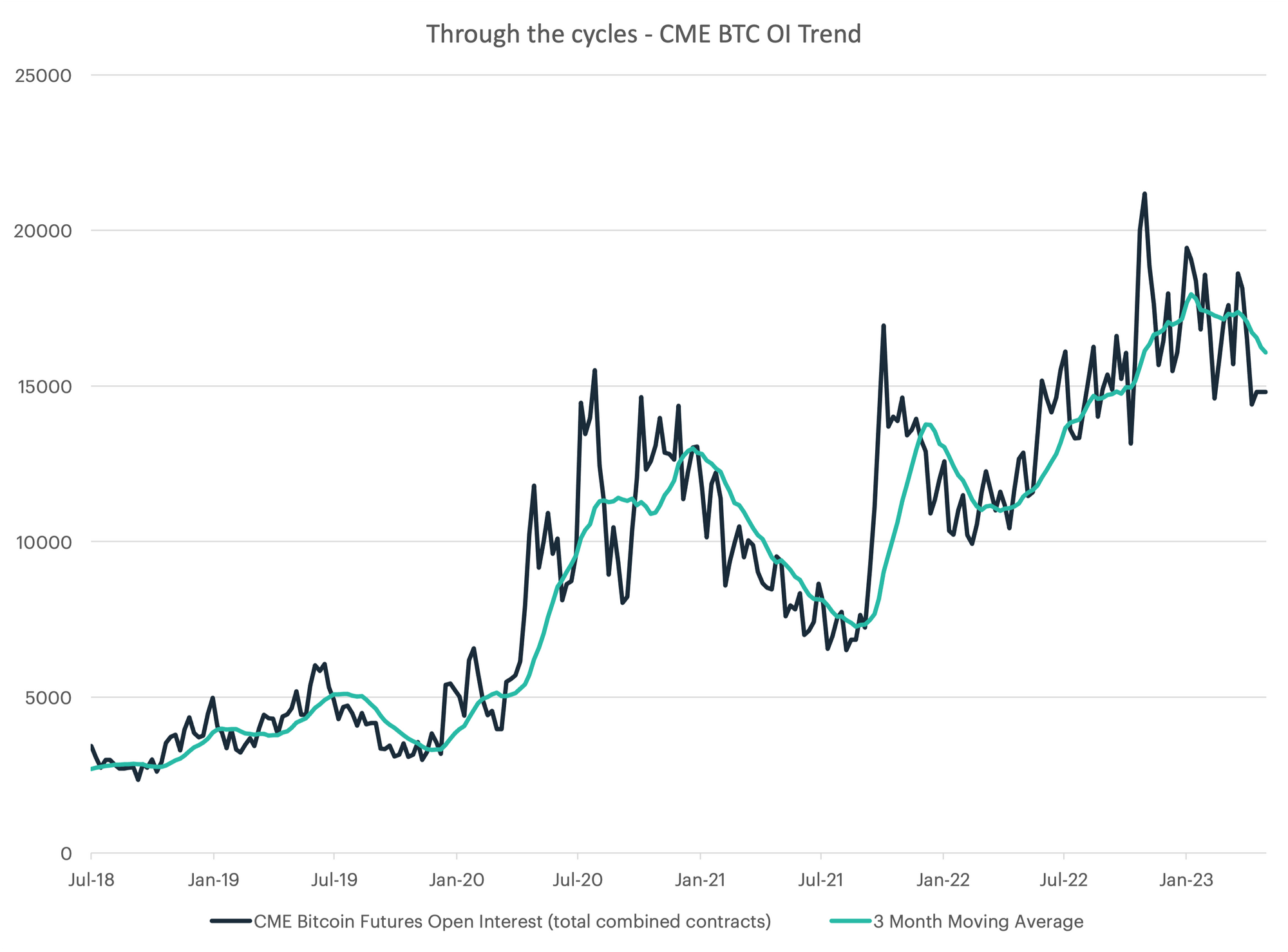

And as CF Benchmarks CEO Sui Chung noted in our recent joint webinar with digital asset ETF pioneer Hashdex (Click here for the replay): “Probably the most visible form of that [institutionalization] is through the Bitcoin and Ether futures markets, operated by the CME”. Key crypto contracts at the largest regulated Bitcoin and Ether futures market (all settling to our CME CF BRR and CME CF Ether-Dollar Reference Rate) are of course, institutionally sized at around $150,000 each. So, with “all measures” of activity rising into the 2022 market peak—“liquidity, volumes traded, contracts traded”, and others— it’s a through-the-cycle advance suggesting the beginning of price agnosticism, a leitmotif of institutional adoption.

(See the chart of CME Bitcoin Futures open interest below, from CFB’s Lead Research Analyst, Gabe Selby, for another dimension of the same trend.)

Markets: Large caps in 'patient' range

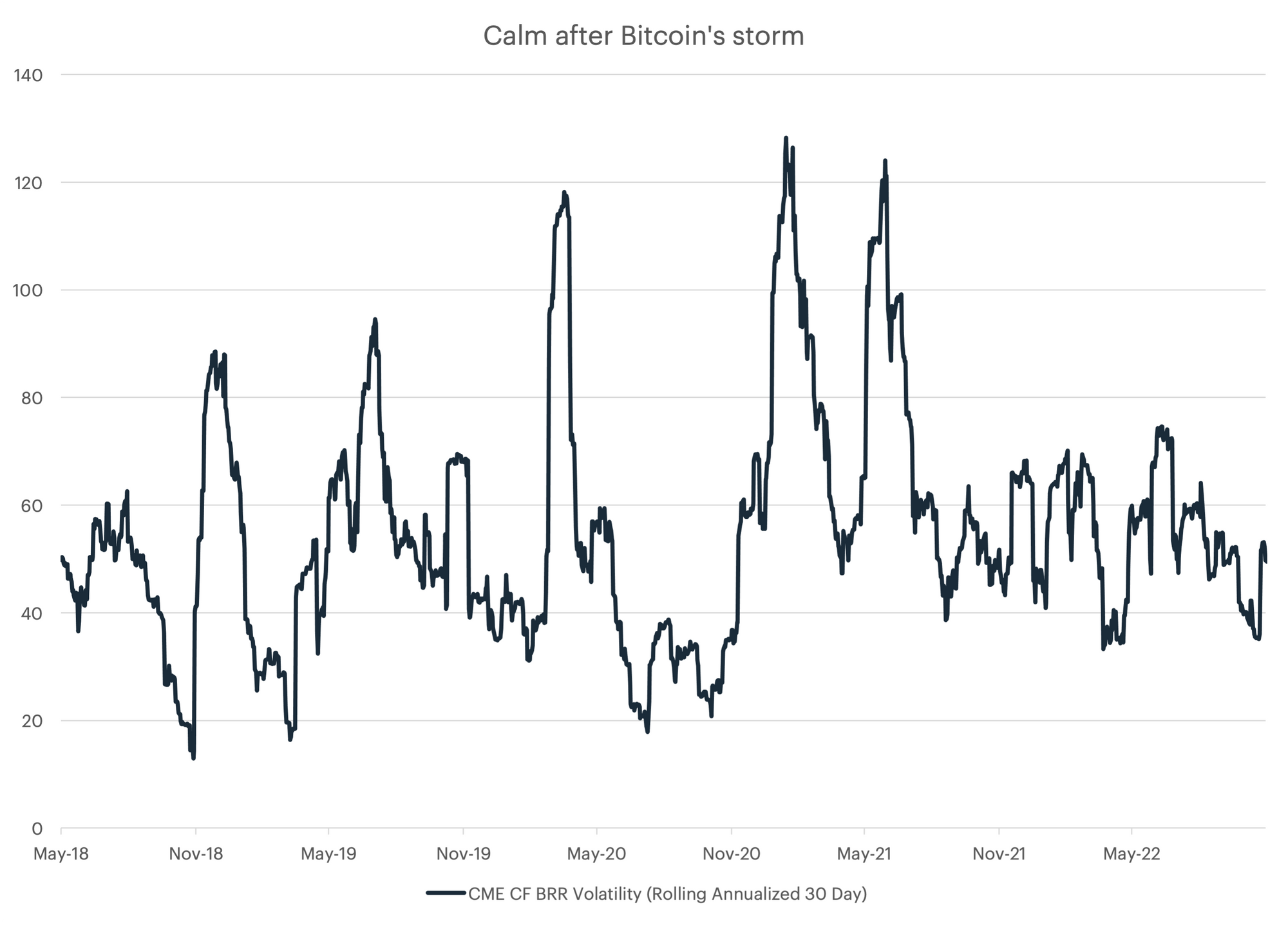

Against this qualitative backdrop, the quantitative foreground—chiefly, rangebound prices and the biggest decline of volatility in almost three years—aren’t so jarring.

The chart below of BRR’s real-time print, CME CF Real-Time Bitcoin Real Time Index (BRTI) (it’s identical to the daily BRR, but it prints every second) shows strong signs of what technicians call ‘consolidation’. That at least gives us a label for the market’s evident indecisiveness, but few indications about the potential direction of a conclusion. Having peaked for the year around $31k, BRTI marked the bottom of its current range at $25,832 on May 12th, with confirmation of this region as support from a similar bounce up from, $25,878 on May 25th. A shorter-term span also seems to be in effect, topped by May 29th’s $28,450 high.

Likewise, CME CF Ether-Dollar Real-Time Rate has been similarly constrained for a couple of months. The benchmark shows ETH has struggled to better the region bounded by $1,935 (May 7th high) and on the downside, $1,1763, first seen early in April, where buying resumed on the same handle late last month.

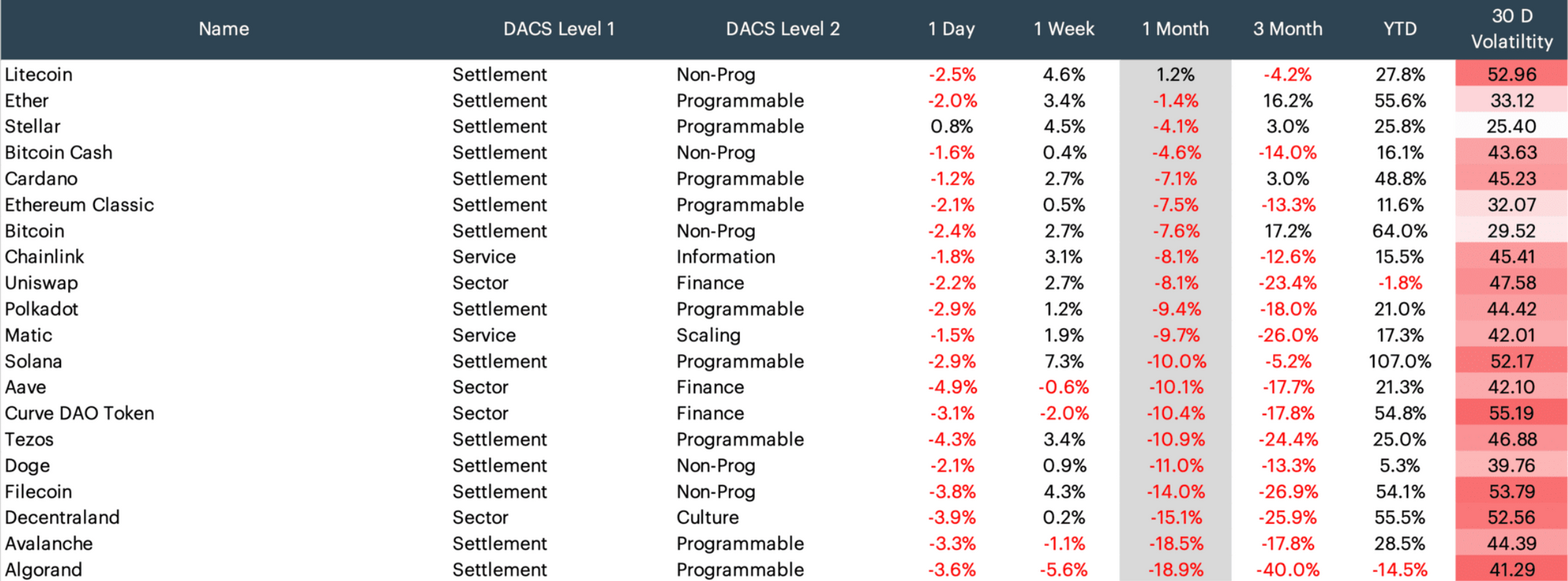

For a look at the top market, macro and on-chain trends in May, including the table of Major Crypto Pairs below, grab Gabe’s just-released Monthly Market Recap.

May malaise

As the table shows, May was a lacklustre month for returns across digital asset categories and segments defined by our comprehensive CF Digital Asset Classification Structure (CF DACS) taxonomy. Check out the CF DACS Token Explorer.

Look out for Gabe’s upcoming Quarterly Attribution Report (QAR) for a comprehensive assessment of the digital asset categories, subcategories and segments driving the most recent market trends, standout winners and losers, fund flows, on-chain highlights and more.

Volatility slumps

The 5-year chart of the BRR’s volatility – suggesting bitcoin remains almost as ‘stable’ as it’s been in three years – backs an assessment of current price action as lacklustre, though not necessarily threatening.

CME Bitcoin Futures Open Interest Buoyed

As indicated earlier, open interest in the most liquid, regulated exchange traded, crypto-related instruments belies any narrative that might be predicated on the slump in prices that has, admittedly, yet to be fully recouped. The chart below, from CF Benchmarks' Lead Research Analyst, Gabe Selby, CFA, is a five-year view of changes in the total open interest (OI) of combined Bitcoin Futures Contracts offered by the CME. By nature, open contract interest is a volatile measure. However, the long-term progression of what we can term 'regimes of participation' is clear. Although OI has dipped from the peak seen late in 2022, it's fair to state that on a historical basis, the hurdle for long-term open interest would appear to be more challenging towards the downside from here, than towards the upside.

Macro Outlook

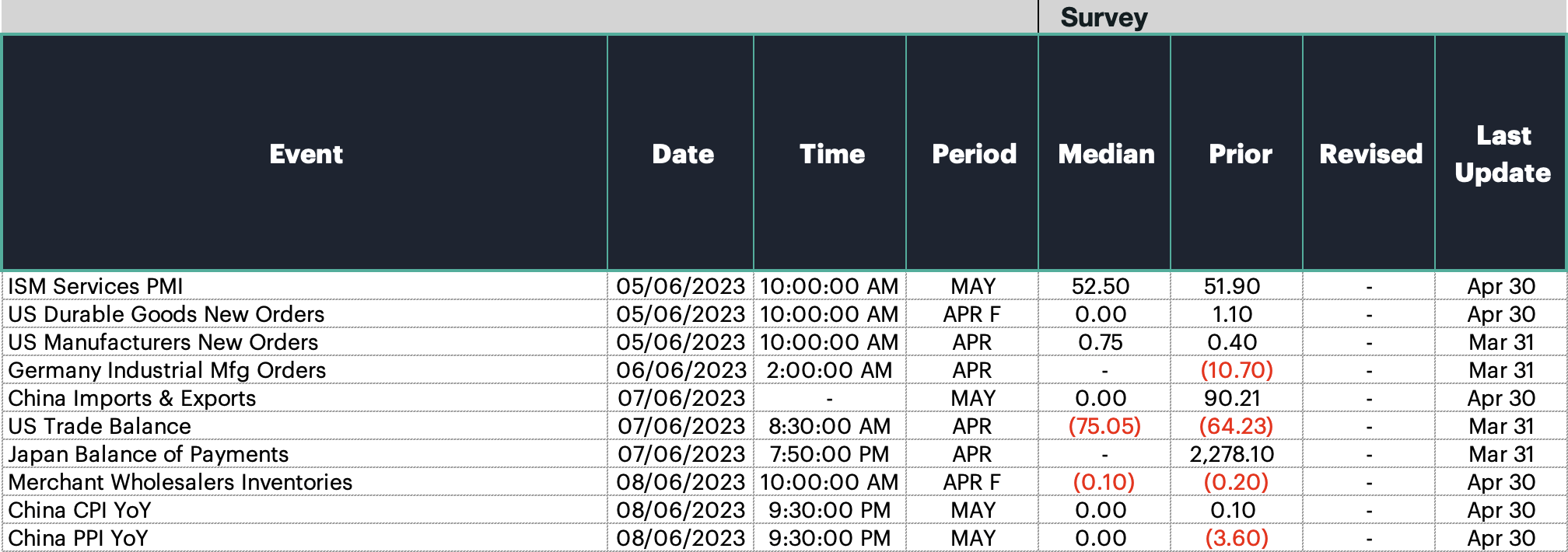

Investors will start the week ahead by analyzing the latest U.S. Services PMI data, specifically focusing on the Prices Paid sub-index, to gain insights into inflation trends. It is also important to highlight updates on manufacturing data, including the release of the final Durable Goods report for April and New Orders. In Asia, Japan's Balance of Payments for April will be published, along with the most recent inflation data from China.

Gabe Selby

Featured Benchmark: CME CF Bitcoin Reference Rate (BRR)

VIDEO: CFB Talks Digital Assets Episode 12, with Monochrome Asset Management CEO, Jeff Yew

Our guest on the latest CFB Talks Digital Assets is Jeff Yew, founder and CEO of Monochrome — and one of the most influential and respected leaders of Australia’s institutional crypto industry.

The main topic was Monochrome Bitcoin Trust (IBTC), the only fund authorised under Australia’s crypto product licensing rules.

Highlights of our stimulating and educational chat:

- Why did Monochrome choose the CME CF Bitcoin Reference Rate (BRR) as IBTC’s benchmark?

- What makes IBTC Australia’s first, and only, authorised crypto fund?

- Although IBTC is a retail-targeted fund, it’s seeing a lot of institutional interest - how come?What makes the BRR’s 4:00 PM London calculation time ideal for striking IBTC’s NAV?

Click below to watch the episode

BRR Research Update

The latest update of the long-running empirical research paper covering all aspects of our flagship benchmark, the CME CF Bitcoin Reference Rate, was released last month. ‘Suitability Analysis of the CME CF BRR as a Basis for Regulated Financial Products’ is based on a refreshed data set, now including BRR/BRTI prices and volumes covering the two years since the previous iteration of the research. The new paper also notes the inclusion of an additional CME CF Constituent Exchange, LMAX.

Once again, the paper comprehensively demonstrates the integrity, replicability and representativeness of the BRR with, among other exercises, a statistically quantified illustration of the Regulated Benchmark’s manipulation resistance, dozens of simulated capital markets-sized purchases of bitcoin at the BRR price, without moving the market, and thorough yet concise breakdowns of the index's methodology, our Benchmark Surveillance and corporate governance policies, and much more. Click here, to read the paper.

Additional Resources

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks