Oct 24, 2022

CF Benchmarks Recap - Issue 50

- CF Benchmarks launches CF Bitcoin Interest Rate Curve (BIRC)

- CFB is only crypto Benchmark Administrator to pass a SOC1 Audit ... (again)

- Mango Markets heist post-mortem

Not so bleak mid-winter

TradFi institutions shrug off ‘winter’ chill • CF Bitcoin Interest Rate Curve (BIRC) goes live • CF Benchmarks operations pass second Deloitte audit in 2 years • ‘Winter’ continues to cast a malaise over prices, at least the cadence of counterparty implosions and market dislocations has slowed lately. Plus, a month on from Ethereum’s ‘Merge’, the absence of tell-tale follow-up patches underlines how remarkably smooth the network upgrade was. Ironically, another sign of a qualitative return to ‘normality’ is a resumed focus on the seemingly interminable series of DeFi exploits and hacks. October has already taken the ignominious record of the most crypto heists in one month, according to Chainalysis, putting 2022 on track for a second-straight annual peak. Meanwhile, the bilking of $100m from Solana-based Mango Markets was the second SOL-linked ‘incident’ in as many weeks, underscoring that some DeFi providers still haven’t learned some key fundamentals of watertight pricing methodologies. (MNGO post-mortem excerpted below.) More positively, fears of institutional flight were busted (again) by key moments like BlackRock’s CF Benchmarks-powered Bitcoin Private Trust, the highlight of a string of high profile providers’ forays into the space. (See also Fidelity’s $5m private ETH fund filing and NYDIG’s fresh $720m raise for its institutional offering; despite layoffs and C-Suite exits).

Latest CME CF expansions; LEDN snaps up Arxnovum; Meet CF Bitcoin Interest Rate Curve (BIRC)

Among CFB partners and licensees, the clearest broad trend is towards deepening entrenchment, rather than retrenchment. The CME is rolling-out more regulated CFB indices: AVAX, FIL, XTZ Real-Time Indices and Reference Rates will be available (though not tradeable) on the marketplace from Oct 31. CME’s ETHUSD_RR-settled ETH options launch is just as emblematic and consequent. Nasdaq’s entrance into institutional custody represents the initiation of a broader set of digital asset services that may eventually include trading. Elsewhere, FINTRAC/FINCEN-registered LEDN has acquired Canada’s Arxnovum, whose BTC, Ether, DeFi and Multi-crypto funds all strike NAV against regulated CFB indices. LEDN was in the running to acquire BlockFI earlier this year, and becomes the first digital asset loans platform eligible to offer yield products under Canada’s Exempt Securities Market regime. In a potentially timely development, CF Benchmarks recently incepted its CF Bitcoin Interest Rate Curve (CF BIRC), bringing institutional standards of interest rate discovery to fast-growing collateralised crypto lending and DeFi markets for the first time. (Factsheet here; announcement excerpted below).

ICYMI: get our first Quarterly Attribution Analysis reports

Alongside new products, here’s a good place to remind regular readers (or inform more occasional visitors) of our key new content collateral in the form of Quarterly Attribution Analysis reports, by CF Benchmarks’ Lead Research Analyst Gabe Selby, CFA. These utilise CF Digital Asset Classification Structure (CF DACS) as the basis for attribution of returns over the previous quarter for key CFB portfolio indices:

Quarterly Attribution Analysis: CF Web 3.0 Smart Contract Platforms Index

Quarterly Attribution Analysis: CF Cryptocurrency Ultra Cap 5

Quarterly Attribution Analysis: CF Diversified Large Cap Index

Quarterly Attribution Analysis: CF Digital Culture Composite Index

Quarterly Attribution Analysis: CF DeFi Composite Index

Quarterly Attribution Analysis: CF Blockchain Infrastructure Index

These are the first formal cryptoasset market returns analysis of their kind you’re likely to have read. For the comprehensive, compiled report and summary, click here.

For shorter-term ‘winter’ snapshots from Gabe Selby’s, read on below.

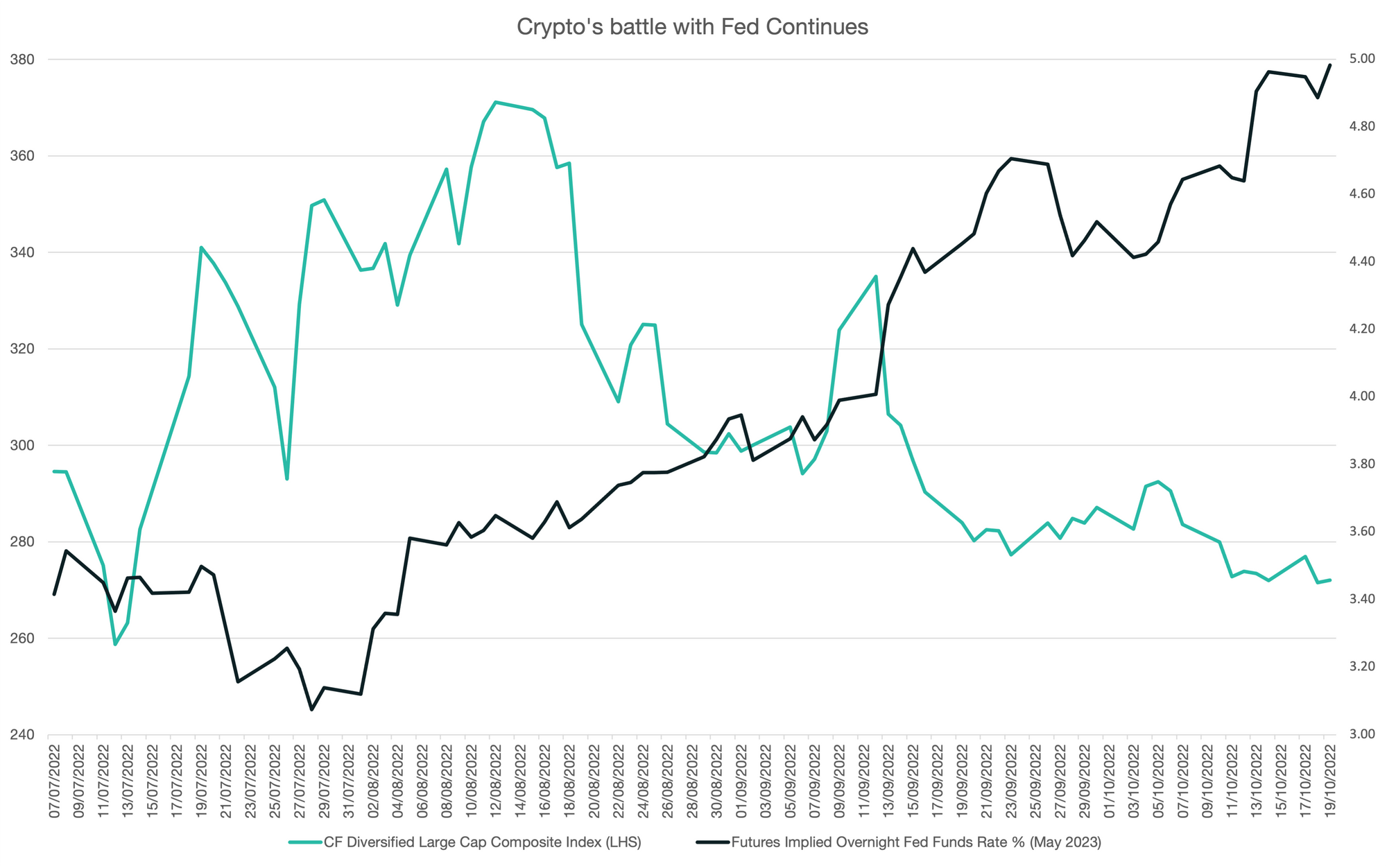

Inflation, rate hikes, still dominate

With the recent U.S. inflation update coming in hotter than anticipated, market attention remains focused on central bank tightening to bring prices under control - which may impact risky assets, including crypto. The September release of the Consumer Price Index indicated a month-over-month rise of 0.4% for the headline figure and 0.6% for core. The upside surprise has had a profound impact on the market's expectation for the terminal Fed Funds, which is now pricing in a peak policy rate range of 4.75-5.00% for the May 2023 meeting. Crypto markets continue to be dominated by the challenging inflationary environment, given the broadly negative correlation between interest rates and digital assets. The CF Real-Time Bitcoin Index fell briefly below the $19K USD mark before paring losses. Since the prior August CPI report, market pricing for the May 2023 Fed funds rate has risen almost 100 bps. Meanwhile, the CF Diversified Large Cap Index continues to face pricing pressure from higher interest rates and more hawkish Fed policy, leading the index to levels the lowest levels since mid-July. Gabe Selby

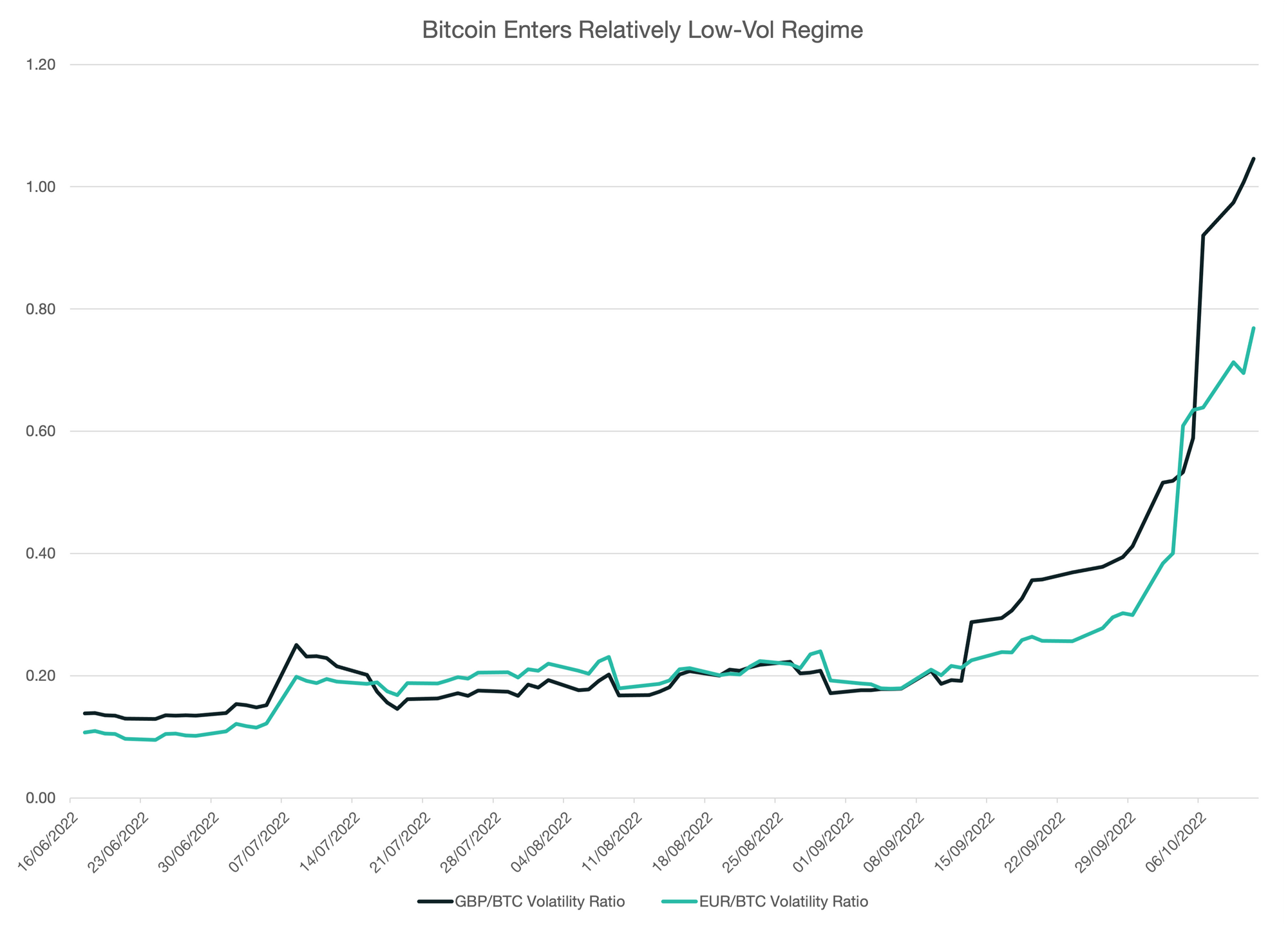

Bitcoin keeps calm and carries on

Crypto investors are experiencing a relatively benign reaction to the recent FX market-turmoil. Over the past two years, the volatility experienced in the GPB/USD and EUR/USD fiat pairs has consistently ranged from just 10% to 20% of Bitcoin's rolling 30-day average. However, recent selloffs have profoundly increased the volatility in the fiat-forex markets, with volatility now ranging from approximately 75% to over 100% that of bitcoin's. The volatility ratios highlighted below illustrate the growing economic uncertainty surrounding the UK and Eurozone's currency pairs. Meanwhile, investor demand for BTC in GPB and EUR markets has seen a marginal uptick in trade volume, which may represent an advantage for investors who are interested in diversifying into BTC's store of value feature. Gabe Selby

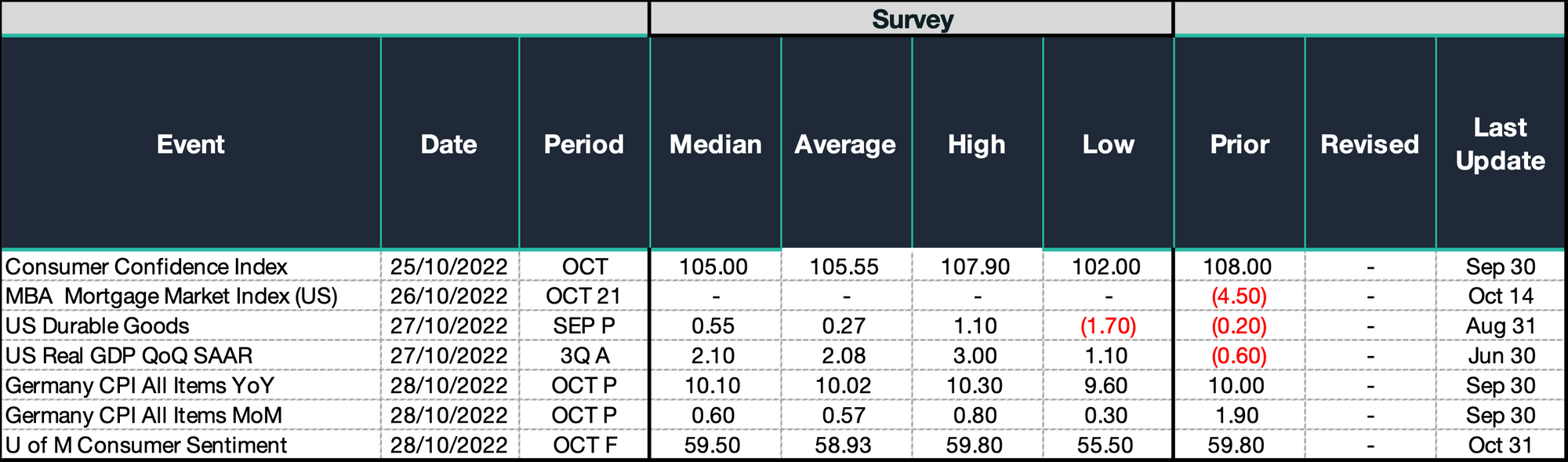

Macro Outlook

For the key macroeconomic data for cryptoasset markets, participants will be focused on the latest consumer confidence and sentiment data, more specifically, the inflation expectations which are being closely monitored by central bank officials. We have seen the preliminary data continue to suggest that near-term expectations remain elevated, however, longer-term inflation concerns remain subdued. Meanwhile, inflation data in Germany is expected to remain hot, with the ECB set to increase their policy rate 75 bps higher. Lastly, third quarter economic output in the US is expected to rebound after two consecutive quarters of negative growth. Gabe Selby

Featured benchmarks: CF Bitcoin Interest Rate Curve • CME CF Bitcoin Reference Rate

CF Benchmarks launches CF Bitcoin Interest Rate Curve

CF Benchmarks is excited to launch the first comprehensive interest rate curve for the Bitcoin lending market, the CF Bitcoin Interest Rate Curve, in association with blockchain oracle network Chainlink

CF Bitcoin Interest Rate Curve Basics

The CF Bitcoin Interest Rate Curve (CF BIRC), the first index of its kind published by CF Benchmarks, measures the underlying economic reality of Bitcoin borrowing and lending, whether on an outright basis or an implied basis in tradeable instruments.

The curve is comprised of an institutional-standard Bitcoin interest rate index, derived from thousands of transactional inputs contributed by leading crypto futures exchanges, DeFi lending protocols and OTC crypto lenders.

Denominated in Bitcoin, CF Bitcoin Interest Rate Curve encompasses common interest rate tenors – session, weekly, fortnightly, monthly and so on – up to a maximum 5-month maturity.

The index is published daily at 16:30 London Time, having printed its first value on July 11th, 2022. Full introduction here.

We need to talk about crypto oracles

CF Benchmarks’ index methodology makes attacks like the one that juiced Mango Markets virtually impossible

What happened: the TL;DR

- Two accounts controlled by an attacker, funded with stablecoin USDC, took sizeable, long and short positions in Mango (MNGO) perps on the Mango Markets DEX

- The attacker then manipulated the price of MNGO on spot markets from which oracle network Pyth draws data to produce the MNGO price. (Note: Mango Markets sources its MNGO price from the Pyth network.)

- The attacker manipulated the Pyth MNGO price from around $0.04 to as high as $0.91

- Unrealised profits from the perp trades were then deployed on the Mango lending platform as collateral for a loan

- The attacker then withdrew funds amounting to c. $100m denominated in several tokens – the whole process appears to have taken half an hour to complete

- The net result is that the “incident has effectively resulted in a total draining of all equity available” for depositors on the platform, according to Mango itself

Read the rest of this article on our website.

Why CME CF BRR and Coindesk XBX are far from "nearly identical"

Whilst CME CF BRR and Coindesk XBX prices may closely resemble each other, as indices, they are mathematically and characteristically far from “nearly identical”. CF Benchmarks CEO Sui Chung explains why

There has been much comment on the recent rejection of the proposed Grayscale Spot Bitcoin ETF by the SEC. CF Benchmarks, like many market observers and participants is a strong believer that the time for a US spot Bitcoin ETF has come.

Furthermore, from its near decade long experience of managing the biggest fund in GBTC we believe Grayscale to be a fitting manager for such a spot Bitcoin ETF.

However, during the course of the analysis as to the rights and wrongs of the SEC's decision, an assertion has been made that we believe needs to be corrected. Namely that the Coindesk XBX and the CME CF BRR are "nearly identical". They are not.

Sui Chung’s comment continues here.

CF Benchmarks passes independent Deloitte audit for second time

CF Benchmarks is the only Regulated cryptocurrency Benchmark Administrator to voluntarily seek an audit and pass – twice

CF Benchmarks is proud to announce that it has passed a thorough independent audit of its operations by Big Four firm Deloitte for the second time.

This extends CF Benchmarks unique status as the only cryptocurrency Benchmark Administrator to submit itself to such an examination and be assessed as sound.

The audit was an evaluation of CF Benchmarks’ compliance with the UK Benchmarks Regulation (BMR) covering our Operational, Governance and Technology Policies, Processes and Methods in the form of an ISAE (UK) 3000 report.

CF Benchmarks was already the only global cryptocurrency index provider to have passed an audit, having done so previously in July 2020.

Read the rest of this post here.

Download Deloitte LLP’s latest ISAE (UK) 3000 audit of CF Benchmarks

Don’t expect a regulated ETHPoW Benchmark

To distribute, or not to distribute?

There are now competing forked ‘versions’ of Ethereum - separate blockchains, in fact.

The best known is EthereumPoW (ETHW). As widely expected, post fork, prices of ETH forks tanked harder than the foundation token.

ETHW fell 35% within 24 hours and was quoted by Kraken at time of writing as $11.84, compared with almost $24 just after splitting from Ethereum. Volumes are minuscule vs. ETH’s and there may be fewer than two dozen pools mining it.

The bifurcation also triggered the usual ‘forking dilemma’ for exchanges, investment services (like ETFs) and others: ‘to distribute or not to distribute?’

Since ETHW holders are entitled to defined compensations and rights this should apply to anyone who elected to continue owning ETHW that resulted from the ETH fork.

The problem is that typically, decisions on whether to undertake distributions of such rights (AKA ‘airdrops’) are arbitrary.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks