Dec 22, 2020

CF Benchmarks Recap - Issue 13

-

Bitcoin Reference Rate achieves ‘Holy Grail’ of Replicability

-

CME unveils Ether Futures

-

Coinbase files IPO application

The Road to Replicability

The CME CF Bitcoin Reference Rate (BRR) marked its latest all-time high at $23,688.55, on 20th December. The other regulated Bitcoin benchmark, CME CF Bitcoin Real Time Index, peaked at $24,024.7 on the same day, at 20:01 UTC. This spread may appear superficially important given that CME Bitcoin contracts are settled with BRR prices. In reality, there’s no clear visibility into realized P&L or returns. For one thing, the multiplicity of strategies deployed by institutional participants to manage risk or speculate means things aren’t that simple. That returns us to a persistent theme of this newsletter. Whilst of critical importance, the price of Bitcoin—as remarkable as its string of milestones in recent weeks has been—is just one significant aspect of the asset in 2020. Accelerating institutional adoption—a signal of broadening interest that goes beyond Wall Street—is just as momentous. In turn, as we’ve also noted, the world’s biggest derivative exchange, the CME Group, has surpassed unregulated rivals to record the highest Bitcoin futures open interest, further evidence of increasing institutional flows. Elsewhere we highlight one reason why the BRR is so critical for institutional participation: our latest proprietary research shows that the BRR achieves a quality that’s like a Holy Grail for institutional traders and providers of regulated products (like ETFs): replicability. More broadly, the CME announced the launch of Ether futures. (Yes, they will also be settled with one or our Reference Rates). This underscores that it’s not just Bitcoin that embarked on a journey of adoption across Wall Street towards Main Street in 2020. By varying degrees, the entire digital asset class did too. The trend can only deepen in 2021.

CME airs Ether Futures plan

It’s interesting to note that the CME Group’s partnership with CF Benchmarks has convened around regulated Ether benchmarks since 2018, as well as the better-known Bitcoin benchmarks since 2016. Two years after the inception of CME CF Ether Reference Rate and CME CF Ether Real Time Index, the largest derivatives exchange by volume has announced the launch of Ether contracts in February 2021. Like its BTC futures, CME’s ETH will be the only fully regulated ETH contract, underpinned by the only authorised ETH benchmark.

No let-up: Coinbase IPO, XRP suit, Bitwise ETP, more…

If crypto will see a seasonal wind-down, it hasn’t started. A selection of points: Coinbase followed-up plans flagged in July by filing a stock listing application. Bitwise’s news needs careful wording. It’s not about an ETF; and like Grayscale‘s fund, BITW trades at a hefty premium. Ripple expects harsher and more direct SEC regulation in the shape of a lawsuit. The Commission has long argued that XRP is an unregistered security. UK-based EXMO is among the latest exchanges to be hacked. In a previous drama (in 2017), its CEO was reportedly released by kidnappers after paying a $1 million ransom in BTC. (Next newsletter in January)

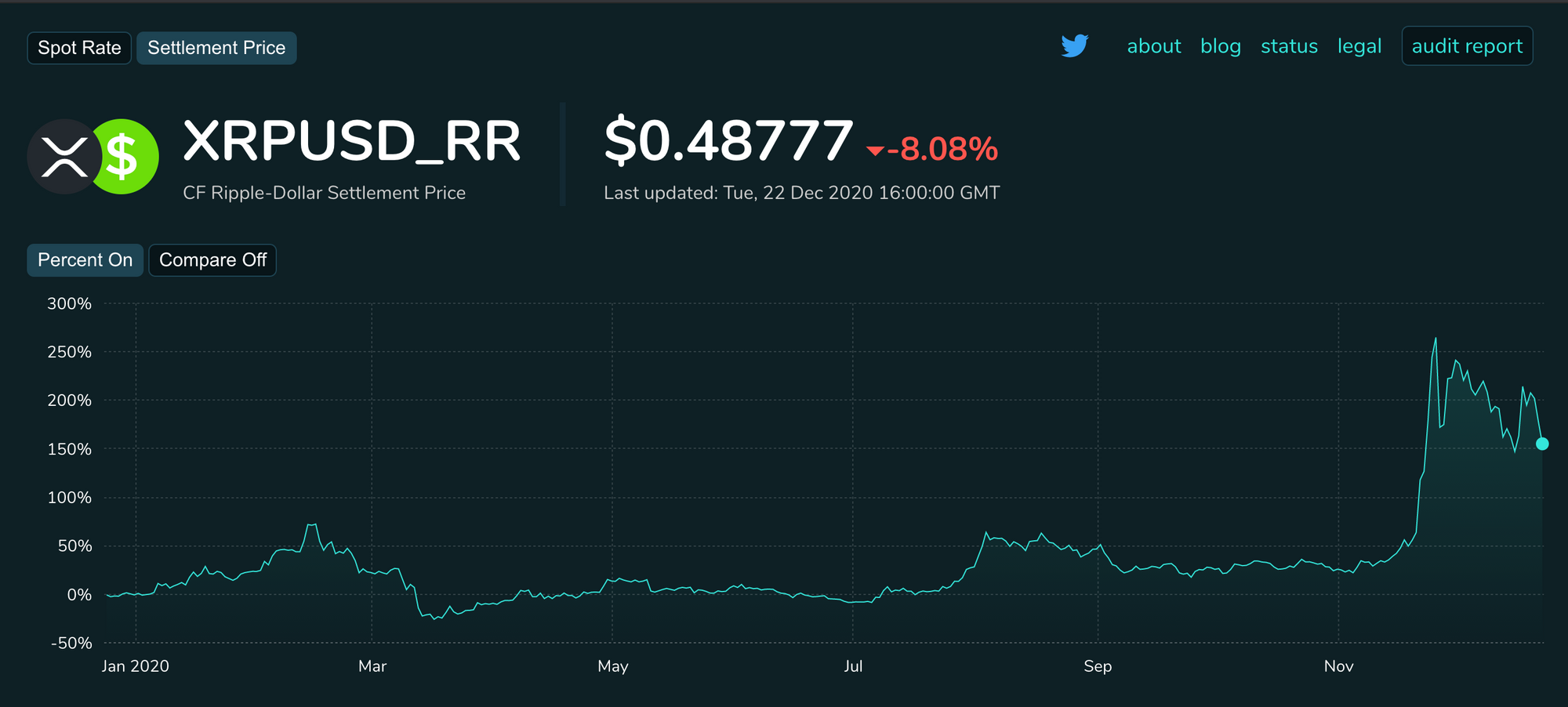

The Returns: XRP loses spark on SEC news

Predictably, Ripple’s legal warning hit XRP, partially erasing gains posted amid news of Flare’s Spark airdrop. CF Ripple-Dollar Settlement Price was at $0.48777 on Tuesday, down 30% from the $0.69699 2020 high marked on 25th November. The rate was up 155.79% for the year.

Featured benchmark: CME CF Bitcoin Reference Rate

CF Benchmarks’ latest proprietary research proves that its Bitcoin Reference Rate is replicable. This satisfies the critical need of regulated-product providers for a regulated Bitcoin price that can be achieved on the open market.

The following is an excerpt from a paper based on proprietary research by CF Benchmarks. A link to the full paper can be found below. The entire contents of the paper will be published on CF Benchmarks websites in due course.

An analysis of the suitability of the CME CF BRR for the creation of regulated financial products

Abstract

Increasing Bitcoin adoption has drawn concerns that institutions have about active participation in the Bitcoin market into sharp focus. Chiefly, for firms looking to create and manage financial products, there are doubts over price discovery, market integrity and the perception that a lack of capital markets regulation in Bitcoin trading venues implies risks inherent to the process of participation that are too material to tolerate. This paper proposes a framework through which regulated financial product providers can overcome these risks by utilising the CME CF Bitcoin Reference Rate (BRR) as the settlement, valuation and performance benchmark for Bitcoin products. This paper will first outline the risks, then describe in detail how they are mitigated through the use of the BRR. The paper will then describe a practical application of the BRR by demonstrating that the slippage that is likely to be incurred relative to the BRR when trading Bitcoins at scale would be low. The qualities of the BRR and tracking error analysis outlined herein will thereby demonstrate how to deploy the BRR as the benchmark for Bitcoin financial products in a way that keeps those risks to a satisfactory minimum.

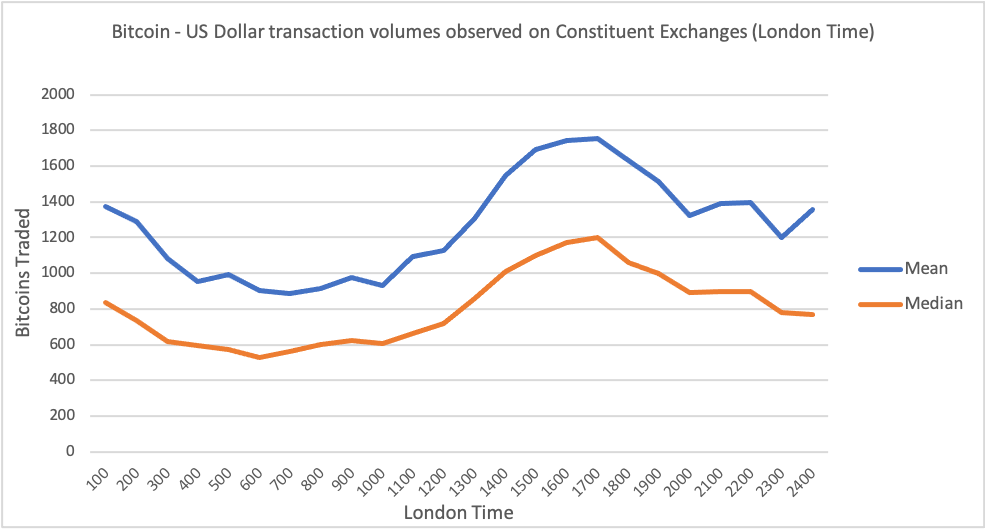

Suitability of 16.00 London Time as CME CF Bitcoin Reference Rate calculation time

The graph in Figure 1 illustrates the rationale of calculating the CME CF Bitcoin Reference (BRR) rate at 16.00 London Time. For the data set illustrated, Bitcoin-U.S. dollar transaction volumes on Constituent Exchanges were measured over an observation period of January 1st, 2019 to November 22nd, 2020.

Figure 1

Please download the full research paper from this link: https://docsend.com/view/kizk7rarzaba6jxf

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks