Oct 30, 2020

CF Benchmarks Recap - Issue 6

-

JPMorgan's crypto conversion is complete

-

CME Bitcoin futures eye first place

-

Harvest loses $34m in latest DeFi 'hack'

180° turn

180° turn

JPM embraces that BTC “scam”

When the history of cryptocurrencies’ slow but steady progress to the mainstream is written, it may contain a section covering former sceptics who underwent a damascene conversion. JPMorgan would probably be the highest-profile corporate name on the list. CEO Jamie Dimon, who once called Bitcoin “a scam”, might thereby merit two mentions. The biggest U.S. bank by assets has recently crystallised a public stance that’s an about-face vs. historical pronouncements. Chiefly, JPM Global Markets Strategy published a note titled ‘Bitcoin’s competition with gold’, projecting “considerable upside” on the basis that BTC “would have to rise 10 times from here to match the total private sector investment in gold”. Elsewhere the lender’s deepening commitment was demonstrated by a new blockchain and digital asset unit, Onyx, together with flagship project JPM Coin. Wall Street is just beginning its crypto capitulation, but it bodes well that one of its most influential institutions is leading the wave in unabashed fashion. Meanwhile, Avanti Financial became the second crypto- focused start-up to win a license from Wyoming’s State Banking Board after Kraken’s first in September.

Harvest exploit reaps $34m

Ethereum’s ERC20-based DeFi boom has deflated of late, partly pressured by frequent ‘hacks’, many of which are protocol exploits. Total Value Locked fell 12% this week alone to $10.9bn. This follows the draining of $34m from yield-farming platform Harvest by an attacker who used flash loans to manipulate Tether and USD Coin. Whilst admitting an “engineering error”, Harvest has so far not detailed plans on compensation or protocol remediation that might plug the pricing methodology loopholes that enabled the grift.

Ethereum 2.0's high-stake risks

Aside from risks that DeFi’s links to Ethereum may eventually undermine network security, DeFi platform yields continue to outstrip Ether staking incentives, presenting an indirect security concern. ConsenSys, the blockchain technology leader, [warns](https://f.hubspotusercontent10.net/hubfs/4795067/ConsenSys Q2 2020 DeFi Report.pdf) that the looming launch of Ethereum 2.0 could be hampered if potential stakers are dissuaded from depositing sufficient Ether to initiate the transition from proof-of-work to proof-of stake. The crypto press’ running commentary suggests reasonable chances that the network upgrade itself may still occur in 2020. However, a central Ethereum Foundation figure last week acknowledged that a critical audit won’t be complete before mid-November, earliest. Many other engineering details remain unclear. Here is CF Benchmarks’ Hard Fork Policy.

The Returns: Ether remains buoyant

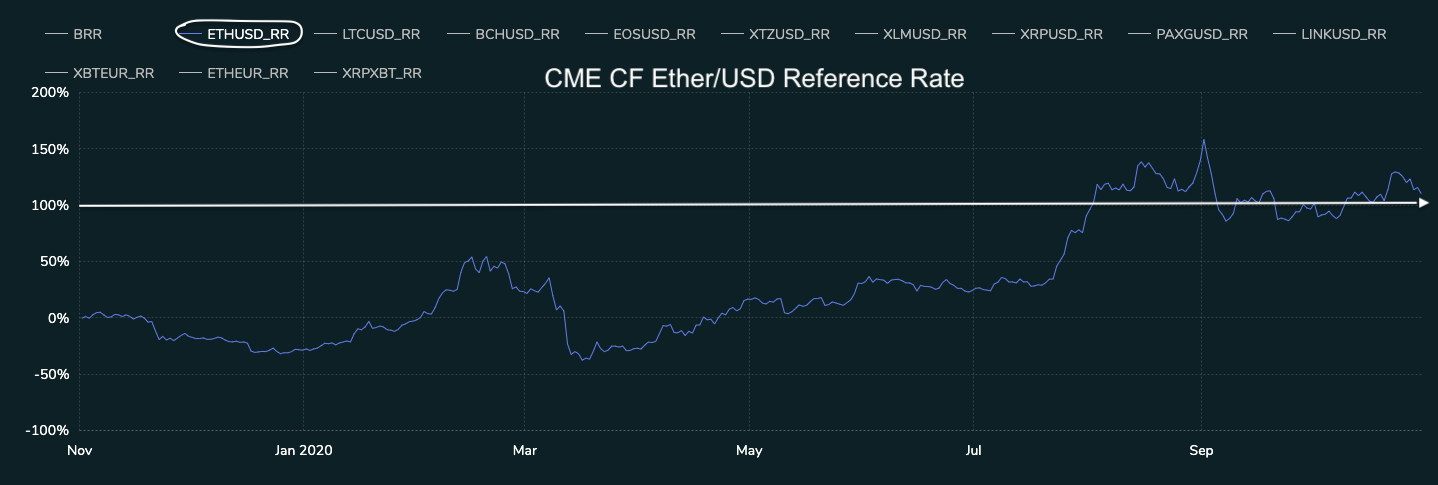

For ETH/USD, market interest continues to overpower uncertainty as its 111% YTD advance trumps Ultra Cap 5 index constituents ahead of Q4.

Featured benchmark: CME CF Bitcoin Reference Rate

CME‘s Bitcoin growth is a low-key big splash

Open interest in CME’s Bitcoin futures contract—defined by our CF Bitcoin Reference Rate—has risen 70% over a year

Big-growth, low-key

Eclipsed by news of PayPal’s massive Bitcoin capitulation, Square and Stoneridge’s outsize investments and, less positively, the OKEx freeze plus BitMEX arrests, some low-key Bitcoin developments have flown under the radar of later.

Whilst more ‘inside baseball’ in nature than, for instance, last week’s PayPal headlines, news about changes in the distribution of open interest in Bitcoin futures was nevertheless just as significant for the financial side of the crypto sphere as eye-catching developments were for the mass adoption narrative.

In the futures

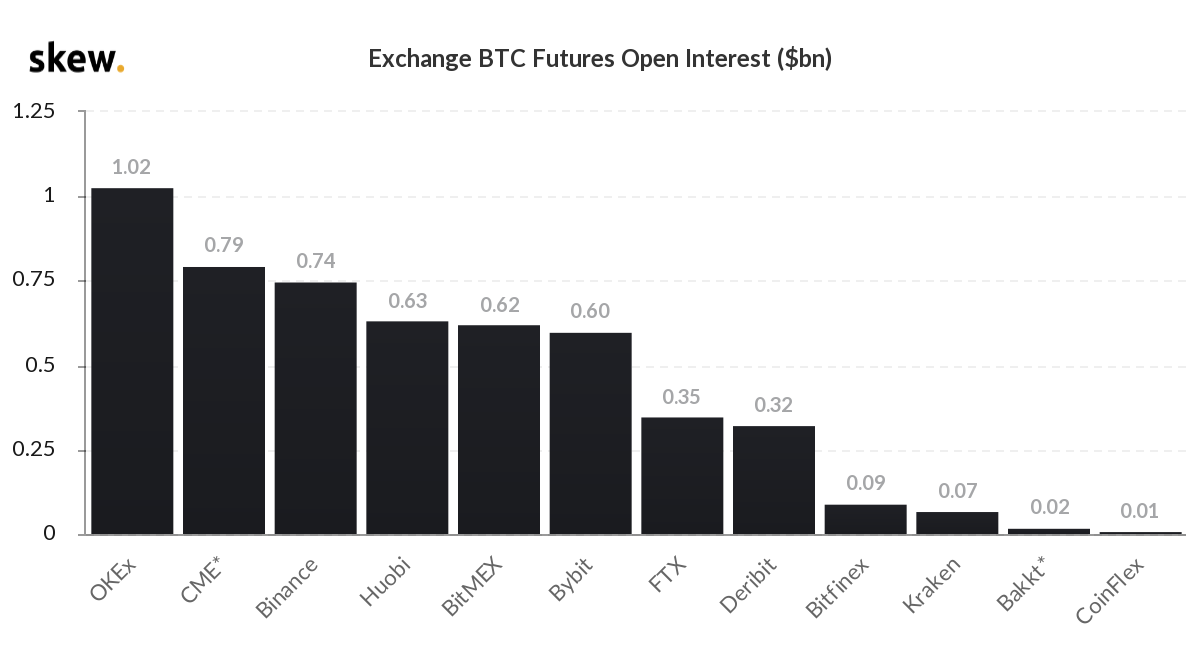

Essentially, the low-key news concerns the chief derivative product of professional financial markets—futures contracts. Whilst cryptocurrencies have been a part of the enormous global futures market for about four years now, there are still perishingly few regulated crypto derivatives venues. Such services are critically important because it is problematic for institutional financial market participants to actively trade on unregulated exchanges. Given such restrictions, although crypto derivatives marketplaces have proliferated over the last few years, institutional participation has remained a small subset of the market. And without the presence of the financial establishments of Wall Street, The City, Tokyo and beyond, crypto futures trading has largely been dominated by sophisticated though legally unfettered firms like OKEx and BitMEX. Though recently in the spotlight for less salubrious reasons, by dint of their first-mover advantage and aggressive market-share tactics, the pair for many years accounted for respectively around 30% and 60% of the crypto futures market. That left regulated exchanges, including the largest by trading volume and one of the oldest in the world, CME, trailing far behind.

In turn, relatively low activity by the established traditional trading industry has been emblematic of a key obstacle on the road towards widening crypto adoption.

CME interest advances

Data from skew.com charted below depict open interest in CME Bitcoin futures relative to the other leading crypto futures venues as it stood on Monday (Figure 1.) and the trend of CME’s futures trading volume and open interest over a year Figure 2.)

Figure 1. – Bitcoin Futures Open Interest – 26-10-2020 Source: skew.com

Source: skew.com

Read the rest of this article on our website.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks

Not All Cryptos Are the Same: How CF Factor Data Reveals Sensitivities Across the Digital Asset Taxonomy

We show how combining the CF DACS taxonomy with the CF Factor Data Series reveals sensitivities that enable institutional-grade returns attribution, risk monitoring and strategic implementation.

CF Benchmarks

Factor Friday

The defensive regime remains firmly in control. Downside Beta continues to dominate while Growth and Value have continued to lag since October. Momentum's recent surge and The Settlement category's relative resilience are the two threads worth pulling on this week.

Mark Pilipczuk