Jun 24, 2023

CF Benchmarks Newsletter - Issue 55

Refiles fly

It’s been a mixed half-year for ETFs, with few surprises as to why. Dissonant financial conditions, spurred by an increasingly ambivalent policy outlook; against a macro backdrop surreally discontinuous with typical patterns; precipitated a dramatic reversal of equity ETF inflows (according to Natixis among others) whilst fixed income funds, particularly long duration, were supported. And true to 2023 flux, that scenario has begun to invert in recent weeks. Great uncertainty and inconclusiveness remain, but that snapshot married with BlackRock’s iShares Bitcoin ETF Trust filing (citing our regulated CME CF Bitcoin Reference Rate - New York Variant for NAV-calculation) offers additional colour to the resurgent spate of similar applications in its wake.

Trendsetters return

Re-filings, in fact, in most cases. Quite a few of those applicants were even further ahead of the curve than the dominant asset manager, recognising the need for objectively secured benchmarks. The ‘amended S1’ by CF Benchmarks client WisdomTree for WisdomTree Bitcoin Trust, retains the original name of CME CF Bitcoin Reference Rate – New York Variant, from the initial filing: ‘CF Bitcoin US Settlement Price’. (WisdomTree EU’s physical BTC ETP was launched in Europe in 2019, with the assurance of reliable, high-integrity iNAV calculation from its use of CME CF BRR). Valkyrie also re-joined the list of the most prudent would-be issuers. Shares of Valkyrie Bitcoin Fund, ticker, pending regulatory approval, ‘BRRR’, aim “to reflect the performance of the value of a bitcoin as represented by the CME CF Bitcoin Reference Rate - New York Variant”.

- Some colour from Decrypt on the Valkyrie paperwork, here, while Bitwise confirms its spot BTC ETF resubmission to Blockworks here

- Meanwhile, more cognitive dissonance as the SEC approves Volatility Shares’ 2x levered CME Bitcoin Futures-based ETF, the first of its kind

- Among larger managers, $1.5 trillion Invesco also threw its hat back into the ring, whilst $4.2 trillion Fidelity, (owner of Fidelity Digital Assets) at least led the rumour stakes

'Winter' update

Indications of a slow-motion inflection point are further reinforced by ‘Crypto Winter’ contradictories emerging in capital markets and banking. EDX Markets is a new venue jointly owned by Citadel Securities, Fidelity Digital Assets and Charles Schwab, offering only four of the least contentious cryptoassets for trading, BTC, ETH, Litecoin and Bitcoin Cash. Elsewhere, Deutsche Bank applied to its country regulator, BaFin for a ‘digital asset license’, aiming to offer custody and, potentially, exposure, according to Bloomberg.

Markets: lower flows, higher prices

The broad sweep of events has been a positive reaction to that outbreak of apparent confidence among institutional issuers, albeit there are signs of rational uncertainty among crypto holders more broadly. The Bitcoin information site lookintobitcoin.com notes that both of the key cohorts it tracks – addresses with balances of at least one bitcoin and addresses with more than 10 – are running at or near record highs. Perhaps inevitably, this is reflected in the collapse of overall exchange flows, the largest decrease in 64 days among exchanges tracked by Chainalysis, whilst the platform’s data also suggests BTC held on exchanges, historically pointing to selling pressure, is moderately above 90-day trend, after a massive withdrawal coinciding with the SEC’s lawsuits against Coinbase and Binance. Meanwhile, tepid volumes and the tamest volatility since 2019 should also moderate interpretations of the rebound in sentiment that lifted CME CF BRTI, the most liquid, streaming institutional Bitcoin price, above $30k, for the first time since April. Albeit BTC did mark a somewhat signal new 2023 high of $31,407.95, looking at hourly intervals below. Still, it’s worth noting buyers have demurred pretty much at the longstanding major resistance that’s been in place for months.

Macro Outlook

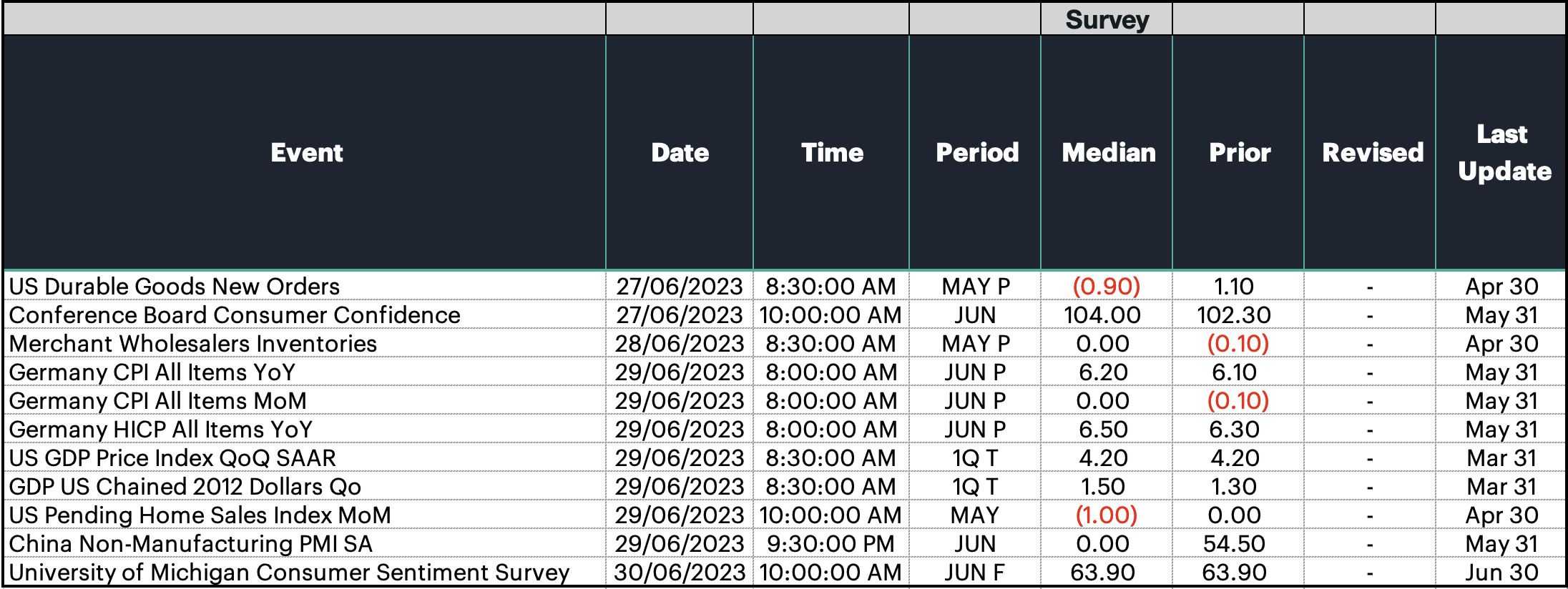

The crypto market did not appear concerned with Jerome Powell's comments this week regarding the need for additional rate hikes. Instead, the news of prominent asset managers applying to list spot bitcoin funds has sparked renewed optimism among digital asset investors. Next week's economic releases will kick off with the latest preliminary data on durable goods, which are expected to moderate after aircraft-related orders boosted the figure back in April. Consumer Confidence is likely to stabilize following a previous report indicating a cooling in labor-market conditions. Fresh inflation data from Germany may show that pricing pressures will remain persistently high for Europe's largest economy. In the U.S., the University of Michigan's Consumer Sentiment survey will finalize its June reading, which has so far indicated improvements in longer-term inflation expectations.

Gabe Selby

Featured utility: CF Digital Asset Classification Structure (CF DACS)

VIDEO: CFB Talks Digital Assets Podcast

Join CF Benchmarks' Lead Research Analyst Gabe Selby, CFA, and Head of Content Ken Odeluga, on CFB Talks Digital Assets, as they spotlight Gabe's Quarterly Attribution Report for the quarter ending in June.

- Learn how narrow ‘market leadership’ has been, with the two largest-capitalized — and least centralized — assets, Bitcoin and Ether outperforming as crypto declined overall

- Hear why, despite higher volatility on a risk-adjusted basis, the asset class continues to show asymmetric upside returns through the cycle

- Discover why the positive impact of BTC's new BRC-20 token standard on mining revenue could turn out to be more important than NFTs

- Pinpoint why Algorand was the worst performer in our CF DACS Universe … and why it’s likely to stay tilted towards the downside for now

Click below to watch

Additional Resources

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks