Apr 11, 2024

CF Benchmarks launches CF Bitcoin Volatility Index, first direct measure of CME Bitcoin implied volatility

The CF Bitcoin Volatility Index enables expanded institutional participation within the only primary CFTC-regulated Bitcoin options market

Sections

- One measure, two variants

- Who needs a Bitcoin volatility index?

- CF Bitcoin Volatility Settlement Rate Methodology

- How robust is the Methodology?

- Uses of the CF Bitcoin Volatility Index

- Conclusion

One measure, two variants

Responding to the need for a singular, comprehensive gauge of volatility, based solely on the CME’s CFTC-regulated Bitcoin options market—and therefore specifically designed to complement it—CF Benchmarks is launching the CF Bitcoin Volatility Index, the first comprehensive benchmark of CME Bitcoin Options implied volatility.

The index is comprised of two variants:

- CF Bitcoin Volatility Index Settlement Rate (BVXS) – derived from published BVX data and calculated daily at 16:00 London Time

- CF Bitcoin Volatility Real Time Index (BVX) – a real-time measure calculated and published every second between 07:00 to 16:00, U.S. Central Time, on all CME Trading Days

Daily settlement, or real-time values

Technically speaking, the index represents a 30-day constant-maturity measure of implied volatility in the CME Bitcoin Options market. In other words, BVX and BVXS, respectively, represent interpolated real-time and daily rates of CME CF Bitcoin implied volatility.

As such, BVX and BVXS represent the first streamlined and accurate gauges of implied volatility for CME Bitcoin Options, the only CFTC regulated primary Bitcoin options market.

Streamlined

As we’ll explain in more detail below, these facilities open the way to several previously unavailable deployment opportunities, avoiding the inefficiencies and risks of strategies that try to synthesise CME Bitcoin implied volatility over time.

Meanwhile, institutional participants that elect to trade CME Bitcoin Options, at least partly due to the market integrity engendered by CFTC oversight, can now extend participation with instruments specifically designed for the CME Bitcoin options market.

Who needs a Bitcoin volatility index?

Volatility in TradFi markets...

To better illustrate the necessity of an index specific to CME Bitcoin options implied volatility, we now outline some key differences between how implied volatility typically manifests in traditional markets, and its trend in Bitcoin.

For a simple heuristic of how implied volatility tends to manifest in traditional markets, we need only recognise the long-established relationship between the best-known volatility index, the CBOE Volatility Index (VIX) and the S&P 500 index. Based on S&P 500 (SPX) options trading, the VIX represents market participants’ forward 30-day expectations of SPX volatility.

Typically, VIX readings exhibit an inverse relationship to the S&P 500 Index. That is, the VIX generally rises when the U.S. stock market turns sharply lower. When the stock market is stable, with steady, positive returns, the VIX will generally be flat, or even in decline.

This tendency has been observed consistently enough to have been provided with a term in academic research: Asymmetric Volatility Phenomena. Still, it’s worth bearing in mind that whilst this is the typical pattern, exceptions occur quite frequently.

Volatility in Bitcoin...

By contrast, Bitcoin’s implied volatility often moves in step with its price. That is, it has been frequently observed that when BTC rises sharply, so does volatility, and when BTC falls, its volatility also falls.

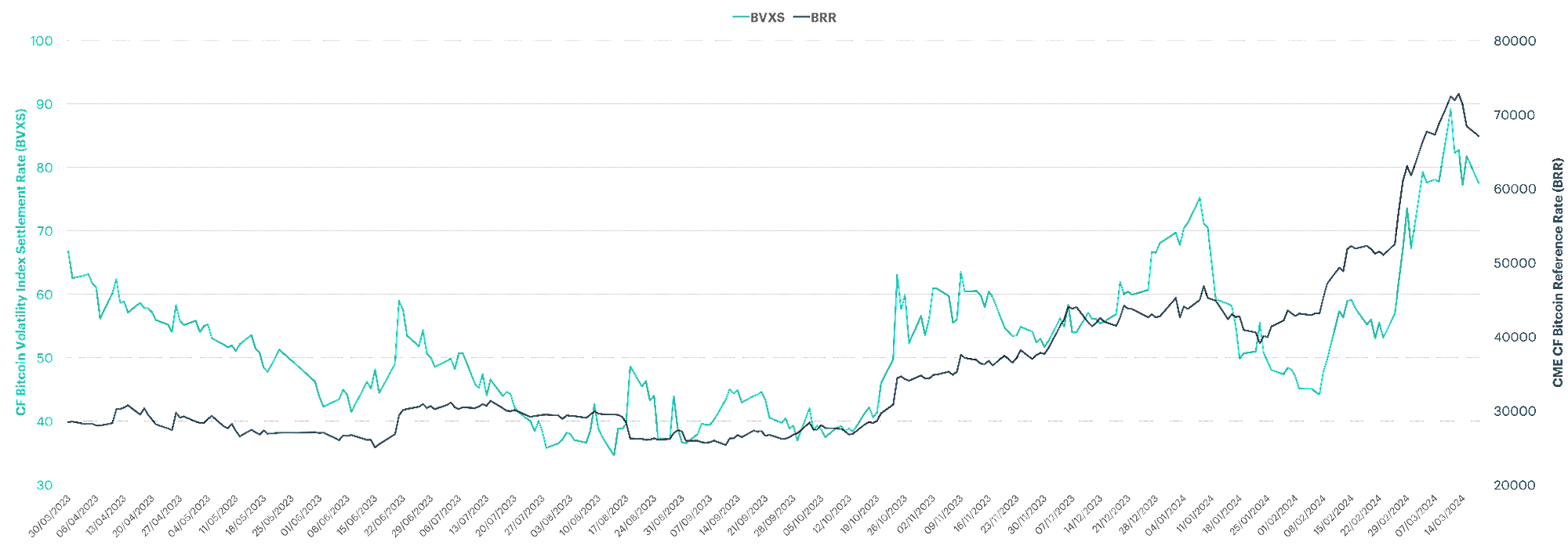

This relationship is depicted by the chart below showing returns of CF Benchmarks’ CME CF Bitcoin Reference Rate (BRR) alongside CF Bitcoin Volatility Index Settlement Rate readings, spanning just under one year.

An optical examination of the association between BVXS and BRR alone reveals a visible positive correlation during the relatively short window illustrated. Again, to be clear, this oft observed pattern between Bitcoin and volatility has not been historically irrevocable.

CF BVXS's roots in BRR

Note that the BRR is the same rate against which all CME Bitcoin contracts, both options and futures, are settled. CME Bitcoin Options were launched in January 2020. Given that the BRR is a regulated Benchmark under the UK Benchmarks Regulation framework, the BRR is the most liquid regulated institutional Bitcoin price, and the CF Bitcoin Volatility Index is the most cogent measure of its implied volatility.

CF Bitcoin Volatility Settlement Rate (BVXS) Methodology

As a first step towards demonstrating that the CF Bitcoin Volatility Index is a valid measure of Bitcoin’s unusual implied volatility patterns, we will outline its calculation methodology.

The Basics

Simple summary

The index measures how dispersed (or variable) price movements in the underlying market (Bitcoin) are expected to be in 30 days’ time, based exclusively on CME Bitcoin Options orderbook data.

Variants

- CF Bitcoin Volatility Settlement Rate (BVXS) - calculated and published daily at 16:00 London Time on all CME Trading Days

- CF Bitcoin Volatility Real Time Index (BVX) - calculated and published every second between 07:00 to 16:00, U.S. Central Time, on all CME Trading Days

Index standards

The index methodology adheres to the same stringent standards of market integrity, governance, accuracy and reliability that CF Benchmarks applies to all of its pricing sources, as encapsulated by the ‘Three Rs’:

- Indices must be Representative of Economic Reality;

- Replicable by market participants;

- and Resistant to manipulation.

Methodology Objective (BVX)

A 30-day constant maturity index derived from a portfolio of ‘front’ and ‘next’ contracts, comprising different strikes and expiries. The BVX represents the fair strike of a variance swap.

Calculation Overview

CF Bitcoin Volatility Index Settlement Rate values are calculated on the basis of CF BVX Real Time Index values that have been calculated and published during a 30-minute TWAP Period designated as 15:30 to 16:00 London Time.

Calculation steps

- Relevant CF Bitcoin Volatility Real Time Index values and associate volumes are added to a joint list

- The list is partitioned into 6 equally-sized time intervals

- The volume-weighted average of each separate partition is calculated

- The CF Bitcoin Volatility Index Settlement Rate is given by the equally-weighted average of the volume-weighted averages of all partitions

Replicability and Stability Safeguards

- Contracts with deltas below a given threshold are excluded

- CF Bitcoin Volatility Real Time Index observations are excluded from the CF Bitcoin Volatility Index Settlement Rate calculation if the associated liquidity of those observations is poor

Contingency and Integrity

A number of additional rules are applied to ensure the index is reliable and resistant to manipulation. In general, contingency rules are as listed in the CF Spot Rates Methodology. One key exception is that instead of the 30-second limit on delayed Spot Rate orderbook data, a 10-minute limit is applied for options orderbook data.

Further rules include the application of a Potentially Erroneous data designation to any at-the-money-strike that does not have at least two out-of-the-money strikes with viable spot prices on either side of it.

The full methodology is published at the following links:

- CF Bitcoin Volatility Real Time Index Methodology Guide

- CF Bitcoin Volatility Index Settlement Rate Methodology Guide

How robust is the Methodology?

Now that we’ve outlined the CF Bitcoin Volatility Index’s calculation methodology, we’ll examine a key data set which demonstrates that the index achieves its stated aim.

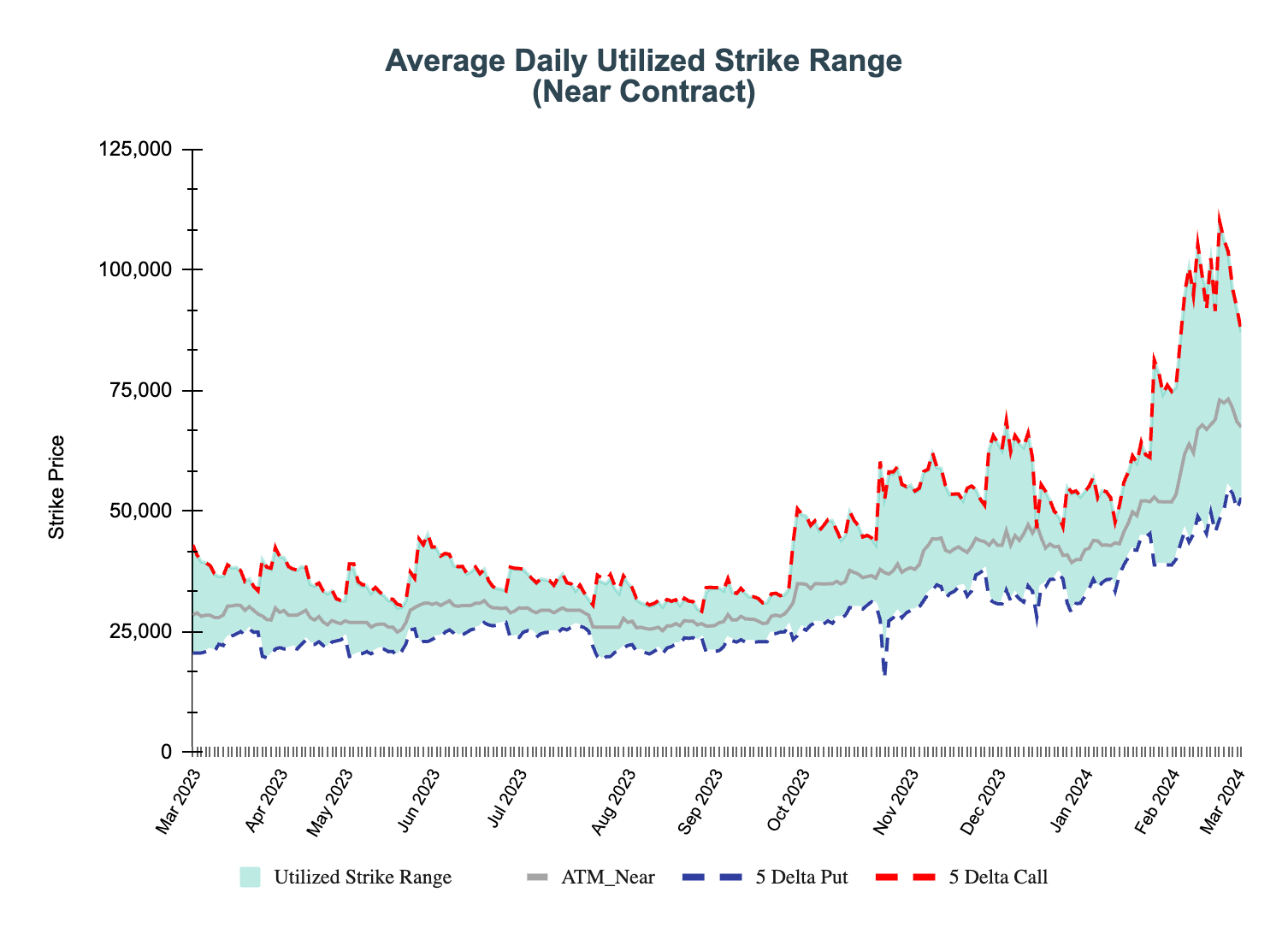

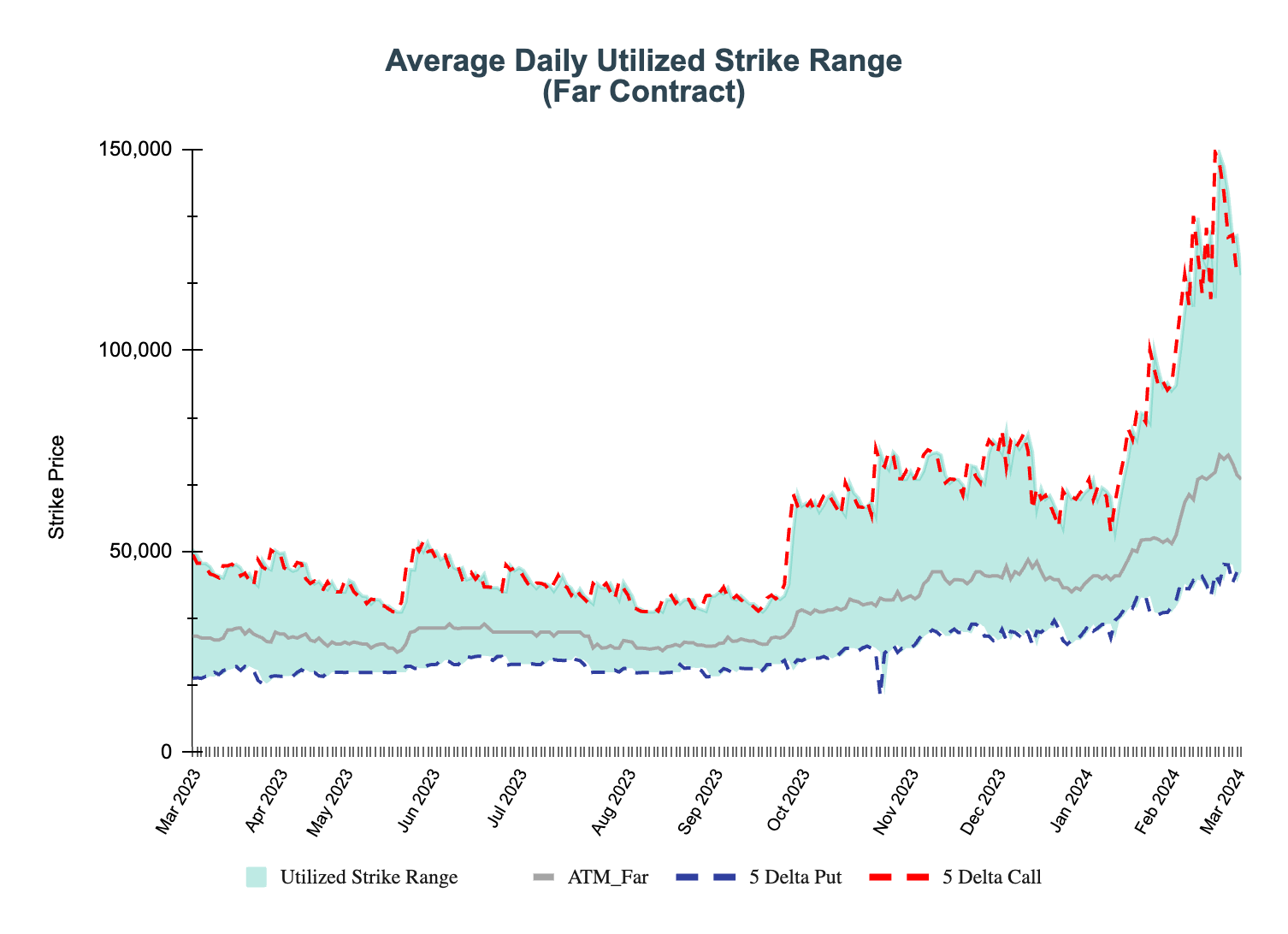

The charts below show the range of put and call strikes capable of being utilized within the index calculation over a one year period between March 2023 and March 2024. They depict a sufficient amount of both ‘near contracts’ (typically expiring in one month) and ‘far contracts’ (those expiring in more than a month).

The range of put and call contracts eligible for calculation based on the index methodology extends reasonably far out of the money (5-delta).

Meanwhile, given that a 5-delta strike represents both a relatively low probability of an option expiring in the money, and a relatively low risk profile for speculative or hedge trades, the range of put and call strikes that meet the methodological parameters, in both near and far contracts, strongly indicates the availability of market data for stable and sufficient index calculation over time.

Uses of the CF Bitcoin Volatility Index

Volatility instruments

To be clear, there are, as yet, no instruments available for trading the BVXS directly. However, it should be clear from the foregoing that the design and implementation of the index enables its use as a settlement rate for financial instruments, such as volatility futures and options, and exchange traded products, like ETFs.

Speculation

Assuming the eventual availability of such products as described above, the BVXS will almost certainly be deployed as a more convenient means of instigating strategies typical of fast-money participants (speculators with high risk tolerance; for example, hedge funds) to express forward-looking stances on Bitcoin volatility.

Specialised options trading

Meanwhile, the precise elaboration of the CME Bitcoin volatility surface from a single source that BVXS enables for the first time, makes the index an ideal tool for trades expressing a strategic view on the Bitcoin volatility surface.

Hedging

As well, so-called ‘buy side’ institutions, e.g., investment management firms, etc., are likely to implement BVXS-based products to hedge portfolio tail risk (downside protection).

Sentiment Data

It's anticipated that CF Bitcoin Volatility Real Time Index data could also be utilised by product providers for the creation of trading signals, and also those that indicate a view of the general state of the crypto economy, as in the case of 'fear/greed' indicators.

Conclusion

To summarise, the CF Bitcoin Volatility Real Time Index (BVX), and CF Bitcoin Volatility Index Settlement Rate (BVXS) fulfil, for the first time, the longstanding need for streamlined measures of Bitcoin implied volatility, based on the only institutionally focused and regulated Bitcoin options market. Meanwhile, the BVXS methodology upholds the same stringent standards of integrity, accuracy and reliability as all other CF Benchmarks pricing sources. The index remains demonstrably robust across a broad range of put and all contracts, with strikes far enough out of the money to cover most Bitcoin options objectives.

More information

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks