Sep 30, 2022

CF Benchmarks launches CF Bitcoin Interest Rate Curve

CF Benchmarks is excited to launch the first comprehensive interest rate curve for the Bitcoin lending market, the CF Bitcoin Interest Rate Curve, in association with blockchain oracle network Chainlink

CF Bitcoin Interest Rate Curve Basics

The CF Bitcoin Interest Rate Curve (CF BIRC), the first index of its kind published by CF Benchmarks, measures the underlying economic reality of Bitcoin borrowing and lending, whether on an outright basis or an implied basis in tradeable instruments.

The curve is comprised of an institutional-standard Bitcoin interest rate index, derived from thousands of transactional inputs contributed by leading crypto futures exchanges, DeFi lending protocols and OTC crypto lenders.

Denominated in Bitcoin, CF Bitcoin Interest Rate Curve encompasses common interest rate tenors – session, weekly, fortnightly, monthly and so on – up to a maximum 5-month maturity.

The index is published daily at 16:30 London Time, having printed its first value on July 11th, 2022.

Further key details are provided in the tables below.

| Tenor | Instruments Utilized |

|---|---|

| Session Rate | PERPS, DeFi, OTC |

| 1, 2, 3 Weeks | Term Futures, OTC |

| 1, 2, 3, 4, 5 Months | Term Futures, OTC |

Contributing Sources

| Source | Market |

|---|---|

| CME | Term Futures |

| BitMex | PERPS, Term Futures |

| Binance | PERPS, Term Futures |

| OKX | PERPS, Term Futures |

| ByBit | PERPS |

| AAVE | DeFi |

| Compound | DeFi |

| CeFi Platforms | OTC |

Why is the CF Bitcoin Interest Rate Curve needed?

The curve brings institutional standards of interest rate discovery to fast-growing collateralized crypto lending and DeFi markets for the first time.

It is also a superior, reliable Bitcoin interest rate index for the ever-increasing range of institutional lending products and services available from crypto prime brokers.

All published individual interest rates that, as a whole, constitute the interest rate curve, represent transparent indicators and build on CF Benchmark’s experience, to accelerate the professionalisation of cryptocurrency trading and associated borrowing and lending activity.

Each point on the interest rate curve aims to be representative, replicable and efficient, to facilitate the creation of financial products such as interest rate derivative contracts.

Transactions can be priced as a spread to this rate to add transparency and unlock risk management solutions at scale.

Providers of Bitcoin loans and lending platforms, or Bitcoin derivatives that incorporate a Bitcoin Interest Rate into their products, should seek out CF Bitcoin Interest Rate Curve as an optimal solution.

Understanding the CF Bitcoin Interest Rate Curve

The CF Bitcoin Interest Rate Curve is similar in principle to conventional Overnight Indexed Swap (OIS) rate curves. Like SOFR, EONIA and SONIA interest rate curves, BIRC's calculation is based on executed transactions.

Therefore, reading the quantitative details of the CF Bitcoin Interest Rate Curve and understanding how its values are applicable to Bitcoin lending markets should pose no difficulties to those familiar with traditional interest rates markets.

Methodology overview

The CF Bitcoin Interest Rate Curve is constructed over a fixed set of tenors.

Tenors are categorised as Intraday, Short Term and Medium Term, where each category is informed by a predefined set of instruments.

Categories, Tenors and Instruments are shown in the table below.

| Category | Relevant Tenors | Instruments |

|---|---|---|

| Session Interest Rate | Intraday | Perp. Futures, DeFi Lending, OTC Loans |

| Short Term | 1 - 3 Week / 1 - 5 Month | Fixed Maturity Futures, OTC Loans |

| Medium Term | 6 - 12 Month | Fixed Maturity Futures, OTC Loans |

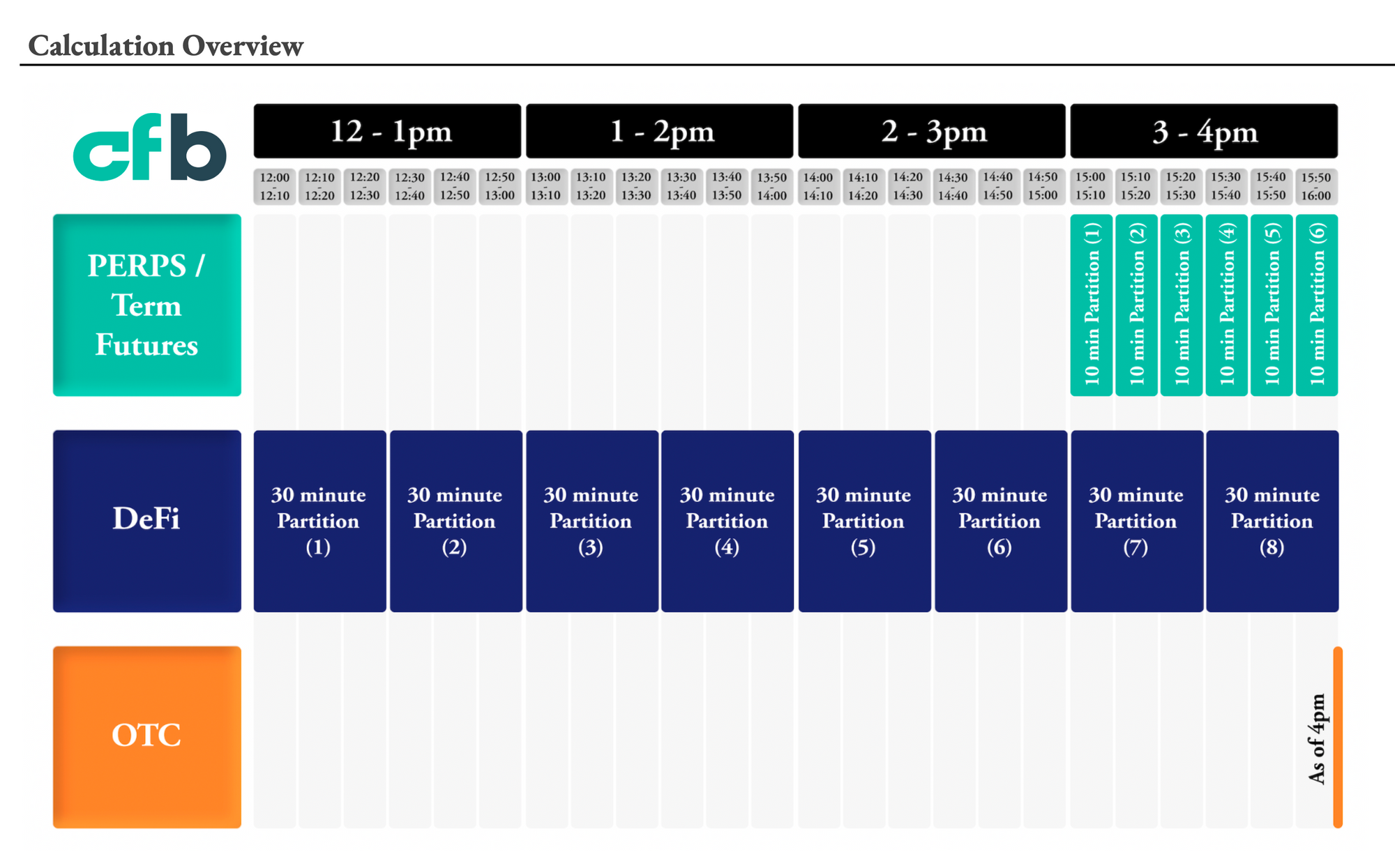

A graphic illustrating the calculation windows allotted to each type of contributor of transactional data to CF Bitcoin Interest Rate Curve is provided below.

The full CF Bitcoin Interest Rate Curve Methodology Guide is available here.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks