Nov 11, 2020

Bitcoin’s Open Interest Question

Do bullish Bitcoin volumes point to a virtuous circle for prices?

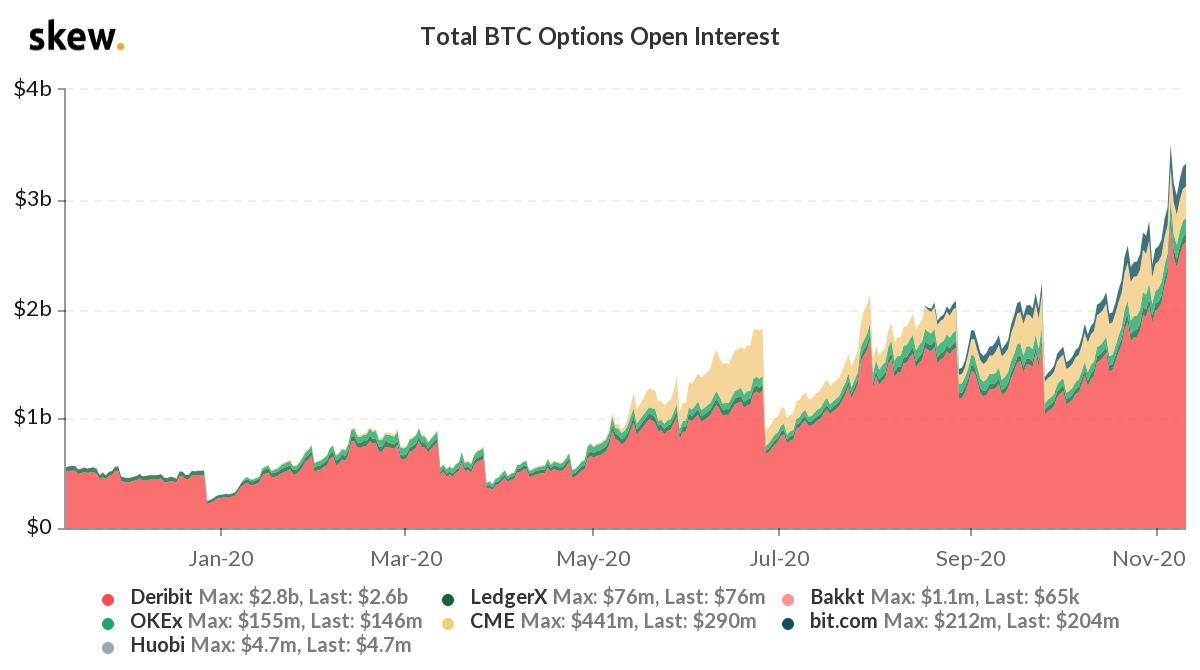

Open interest – the volume of unsettled futures contracts – in Bitcoin, continues to run at highs for the year as shown in the multi-exchange chart below.

Figure 1 - Bitcoin Open Interest - year to date Source: skew.com

Source: skew.com

Though sentiment in the biggest cryptocurrency by market capitalisation shows every sign of a buoyancy that’s in-step with cheer tied to global stock markets and other ‘risky assets’, the blistering pace of BTC/USD’s advance—blowing through milestones ranging from $13,000 to almost $16,000 (according to CF Benchmarks’ regulated Bitcoin Reference Rate index)—has been eye-catching.

Even in one of the most stable years ever for an asset that has historically been the epitome of volatility (for instance, price last week breezed to a new record of 100 days above $10,000) the question is, ‘how much longer can bullish sentiment continue?’. For traders, BTC’s proximity to the $20,000 level is tantalising. The price remains imbued with a psychological charge following its shock-and-awe peak there in 2017; not to mention the harrowing collapse that followed. As CF Benchmarks’ CEO Sui Chung recently pointed out, volatility implied by patterns of trade in Bitcoin options indicated little expectation among sophisticated market of participants that prices would reach $20,000 by year end. Even so, anticipation across the broader market hasn’t entirely diminished.

What’s more, in many ways, stakes are higher for the asset class than three years ago. In the wake of Bitcoin’s numerous adoption milestones this year, interest in crypto assets among institutional investors who aren’t already participating has seldom seemed higher. (See MicroStrategy, Square investments, PayPal’s consumer offer, Kraken Bank, The U.S. Office of the Comptroller’s custody clarification, for starters.) A high-profile price reversal, with follow-through, would be particularly inopportune right now, for the continuation of a smoother path towards greater crypto acceptance.

This intersection of attention makes continuing highs for the year in Bitcoin open interest volumes (OI) potentially important. A general rule of thumb in the modern futures market is that relatively elevated OI may be bullish for price going forward—provided that certain other market parameters are also present. In fact, long-standing statistics from more established asset classes imply that Bitcoin requires both OI and underlying volume to rise in unison with firm prices for the highest probability that prices can remain on an upward path for the time being.

Though CF Benchmarks’ Bitcoin Real-Time Index and Bitcoin Reference Rate depicts prices edging to their latest 2020 highs on Wednesday, they first approached these values last week, amid uncertainty on Main Street around the extraordinary U.S. election. As we noted at the time, despite confusing optics, there were firm reasons for BTC to rally along with mainstream markets. And the run of strong positive sentiment has extended amid an apparent breakthrough in the search for a COVID-19 vaccine. Though the current U.S. President has failed to concede to the probable incoming one, there are clear signs from all markets that investors and traders became convinced enough of the challenger’s victory to drop residual wavering several days ago.

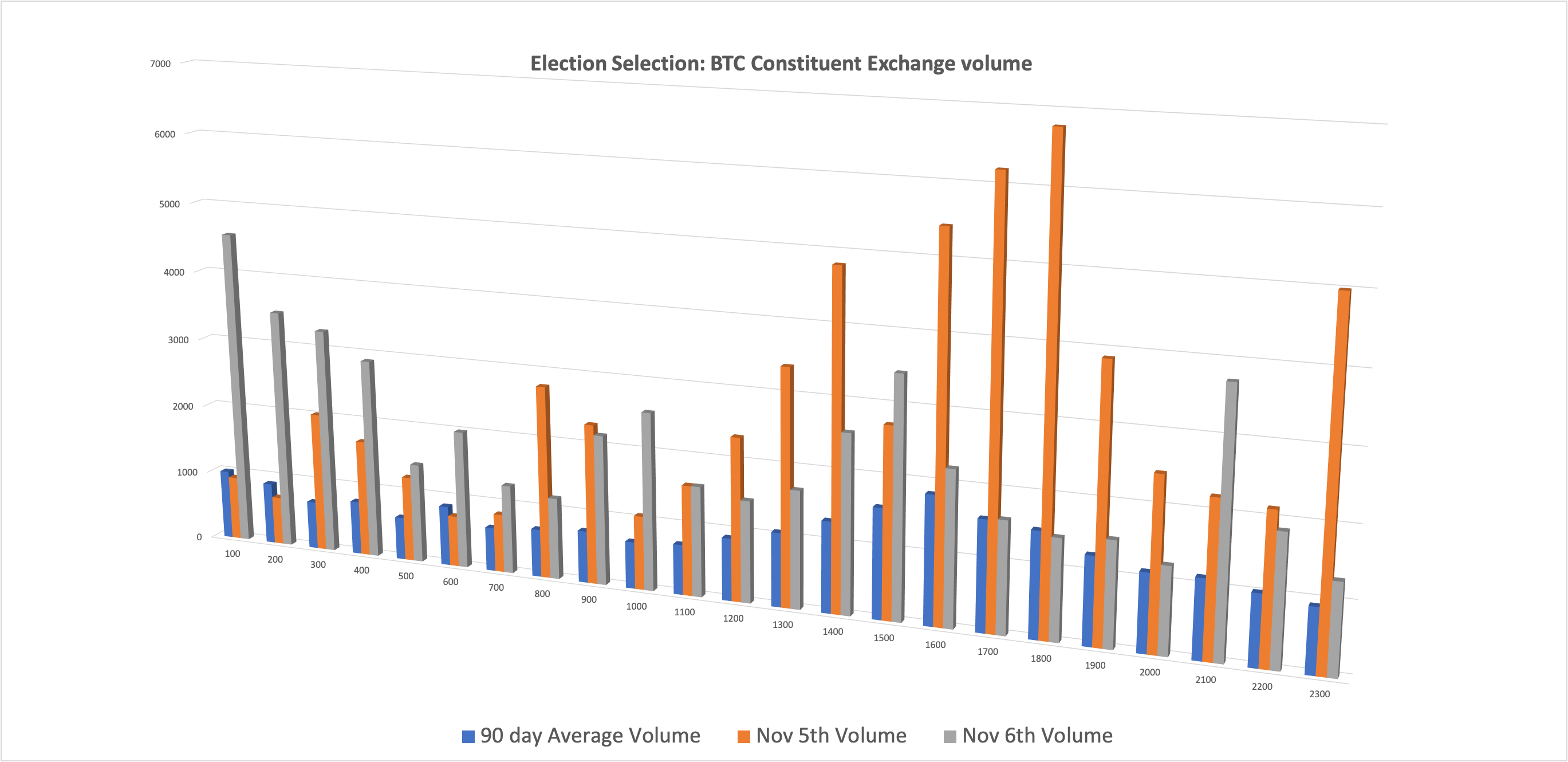

Zeroing in on Bitcoin trading volume from the 5th and 6th November, two days after the election, as we do in the chart below, there’s no mistaking that an intensification of turnover peaked during the hour of 6 PM UTC on the 5th November. The surge was 4½ times higher than the 90-day rolling average turnover of Bitcoin traded on CF Benchmarks Constituent Exchanges.

Figure 2 - Bitcoin Constituent Exchange Volume - 05-11-2020 to 06-11-2020 Source: CF Benchmarks

Source: CF Benchmarks

Curiously, CF Benchmarks’ Bitcoin Reference Rate, an indicative benchmark published daily, settled at $14,970.71 on 5th November. Note that the settlement price on 6th was $15,473.41.

Whilst Bitcoin prices on non-constituent exchanges may have printed higher, gains on exchanges contributing to our authorised benchmarks corroborate the run of gains and general rising trend. That includes a short-lived dip back to $15,183 on 10th November.

As such, the highest-quality data back the set of conditions widely regarded to be positive at any given time for futures prices—in this case, Bitcoin’s:

- Unequivocal influxes of volume (check)

- Corroborated by price advancement (check)

- Elevated open interest (check)

The obvious question now is how long the ideal state in this snapshot can last. Furthermore, regardless of how long, these conditions alone predict little about the extent of any gains to come. We’d have to go way out of the scope of this article and drill down into the forward curve and perhaps options OI to get close to an answer – and then it wouldn’t be a definitive one.

What is clear is that optimism currently reflected in Bitcoin futures provides the best backdrop seen all year that positive sentiment can continue to be a self-fulfilling prophecy for the time being.

Note: The CME CF Bitcoin Real Time Rate (BRTI) and CME CF Bitcoin Reference Rate (BRR) are constituted of price data from 5 rigorously screened exchanges. The data are then subjected to multiple computations and tests to eliminate anomalies and potential manipulation before being admitted to our indices. The methodology is an obligation enforced by CF Benchmarks’ authorisation as an official Benchmark Administrator from the FCA. In other words, BRTI and BRR price and volume data are standard benchmarks for crypto markets.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Factor Friday - March 6, 2026

The market posted its strongest weekly gain of 2026 at +4.3%, trimming YTD losses to -28.0%. Value emerged as the top factor at +1.7% weekly, turning positive YTD. Downside beta posted its first negative week of the year, signaling a potential early shift towards risk.

Mark Pilipczuk

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk