May 16, 2024

Announcement of Consultation on Changes to the Index Methodology of certain Benchmarks within the CF Digital Asset Category

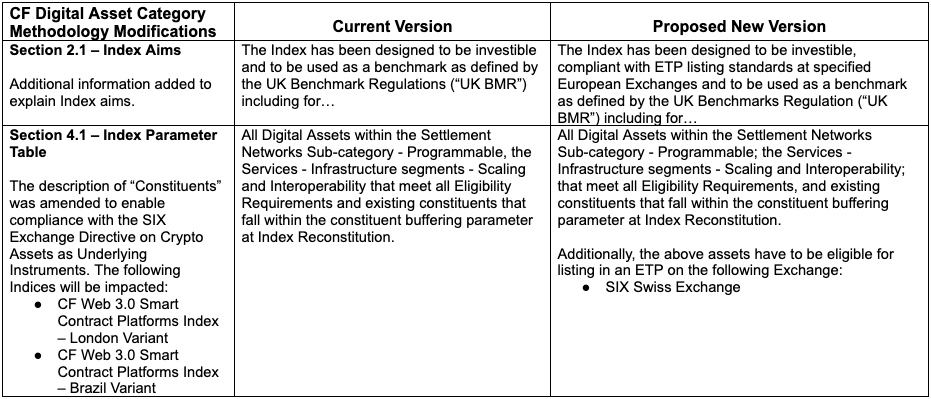

The Administrator announces that it is launching a consultation on proposed changes to the Index Methodology of the CF Digital Asset Category. The Administrator proposes changes relating only to the sections of the Methodology below:

- Section 2.1 – Index Aims

- Section 4.1 – Index Parameter Table (applicable only to the CF Web 3.0 Smart Contract Platforms Index – London and Brazil Variants)

The proposed methodology changes mean that product providers that replicate or utilize the CF Web 3.0 Smart Contract Platforms indices (both Spot Rates and Settlement Prices) may need to factor these changes into their processes and products when transacting in instruments that are linked to Spot Rates and Settlement Prices of the CF Web 3.0 Smart Contract Platforms Index. The financial value of contracts, instruments and funds that directly reference or are settled using these indices may be impacted by the proposed changes.

Implementation Timeline

The Administrator proposes to implement the proposed changes to the CF Digital Asset Category Index Methodology at 1100 London Time on May 24th, 2024, meaning that constituents of CF Web 3.0 Smart Contract Platforms indices (London and Brazil Variants) will be selected using the new parameters outlined above from that date forward.

Consultation Process

The consultation will begin on May 16th, 2024, ending on May 23rd, 2024 at 1600 London Time. All responses will be treated confidentially in accordance with the Administrator’s policies and procedures, and will be overseen by the CF Oversight Function, in accordance with UK BMR.

Questions or queries should be sent to [email protected].

Any users wishing to file a complaint regarding this consultation process can do so confidentially by writing to [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Kraken MTF Lists Large Cap DTF Perp

EU-domiciled institutional investors can now access a perpetual contract based on Reserve Protocol's multi-token LCAP DTF.

CF Benchmarks

Notice of the Demising of Three Indices Within the Token Market Price Benchmarks Series

The Administrator announces that three Token Market Price Benchmarks Series indices are to be demised.

CF Benchmarks

Suspension of Kraken as CF Constituent Exchange from CF Adventure Gold-Dollar Spot Rate

The Administrator announces the suspension of Kraken as a CF Constituent Exchange for the CF Adventure Gold-Dollar Spot Rate.

CF Benchmarks