Mar 21, 2025

Announcement of a Consultation on Methodology Changes to the CF Rolling CME Bitcoin Ether Basket Futures Index

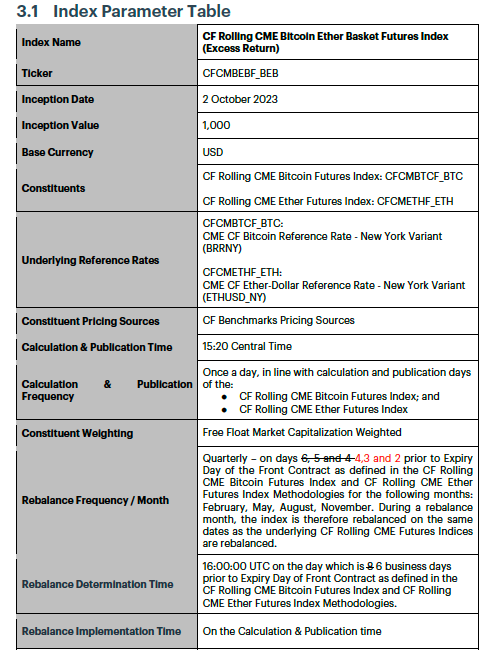

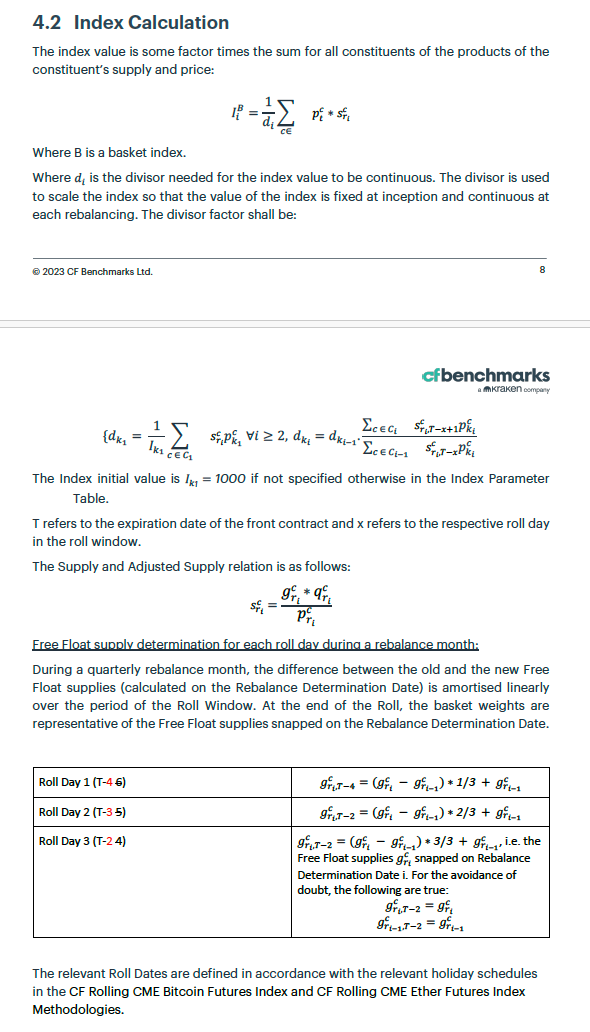

The Administrator announces a consultation on proposed changes to the CF Rolling CME Bitcoin Ether Basket Futures Index (CFCMEBEF_BE), within the CF Digital Asset Index Family - Rolling CME Futures Indices. This index is currently calculated in accordance with the CF Rolling CME Bitcoin Ether Basket Futures Index Methodology.

The Administrator proposes changes relating only to the Sections 3.1 and 4.2 of the methodology.

The proposed methodology changes mean that product providers that replicate or utilize the CF Rolling CME Bitcoin Ether Basket Futures Index may need to factor these changes into their processes and products when transacting in instruments that are linked to these indices. The financial value of contracts, instruments and funds that directly reference or are settled using these indices may be impacted by the proposed changes.

Implementation Timelines

The Administrator proposes to implement the proposed changes to the CF Rolling CME Bitcoin Ether Basket Futures Index methodology at approximately 11:00 London Time on March 28th, 2025; meaning that the index will begin to utilize the new Roll Days outlined above from that date forward.

Consultation Process

The consultation will begin on March 21st, 2025, and end on March 28th, 2025, at 16:00 London Time. Any responses will be treated confidentially, in accordance with the Administrator’s policies and procedures, and will be overseen by the CF Oversight Function, in accordance with the Administrator’s Consultation Process and Procedures.

In case of questions or queries, please do not hesitate to contact [email protected].

Any user wishing to file a complaint regarding this consultation process can do so confidentially by writing to [email protected].

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks