Jan 23, 2025

2025 Inflection Points are just beginning

This week's inauguration of President Donald Trump is widely seen as symbolically kicking off one of the most significant inflection points for digital asset regulation, possibly since the first bitcoin was mined.

If the assumption is proves to be even just partially accurate, the consequences for adoption, the blockchain economy, and in turn, for returns, could be profound.

As pivotal as it is though, the 'regulatory reset' isn't the only significant evolutionary aspect mooted for crypto in 2025.

A comprehensive slate of the most salient and highest probability points of progression were detailed by CF Benchmarks' Head of Research Gabe Selby, CFA, and Research Analyst, Mark Pilipczuk, in their Market Outlook 2025 report; more descriptively titled: 'Inflection Points: Macro Pressures, Regulatory Clarity, and Mass Adoption'.

If you missed or skipped it, you're reading a polite nudge to be sure to download your copy now.

Though published in late December, as a rough estimate, 95% of the report's content remains forward-looking.

It includes a section on the Macro Backdrop, containing forecasts and commentary on the outlook for growth and inflation; monetary, fiscal and economic policy, as well as the legislative agenda.

At the very least, current misgivings about the fate of a Bitcoin Strategic Reserve, are placed in context; suggesting it might not be the administration's most critical crypto initiative, whether it materializes or not.

Just as importantly, the Secular Themes section takes an informed and quantified look into the near-term blockchain economic and technological outlook.

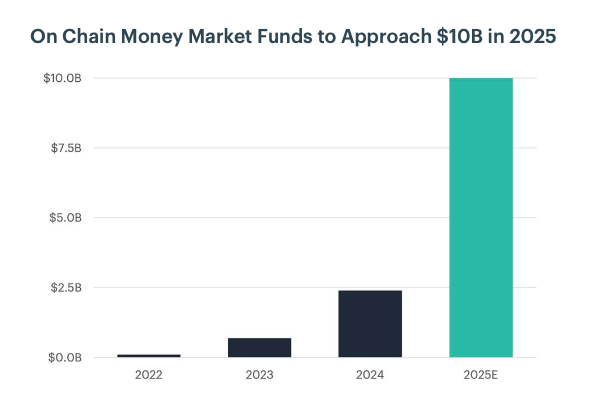

Ranging from the On-chain Money Market Fund growth forecast visualized at the start of this piece, to an expectation that AI Agents will account for over 10% of all on-chain activity by end-2025, the report is a thorough survey of digital asset opportunities all institutions ought to be aware of.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

CF Benchmarks Newsletter Issue 101

CFB-Powered xStocks Surpass $25 Billion • CFB Analysts' Report on Crypto ETF Holdings: Advisors Still Buying • CFB Factors Research Published by Springer

Ken Odeluga

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks