Sep 29, 2025

Weekly Index Highlights, September 29, 2025

Market Performance Update

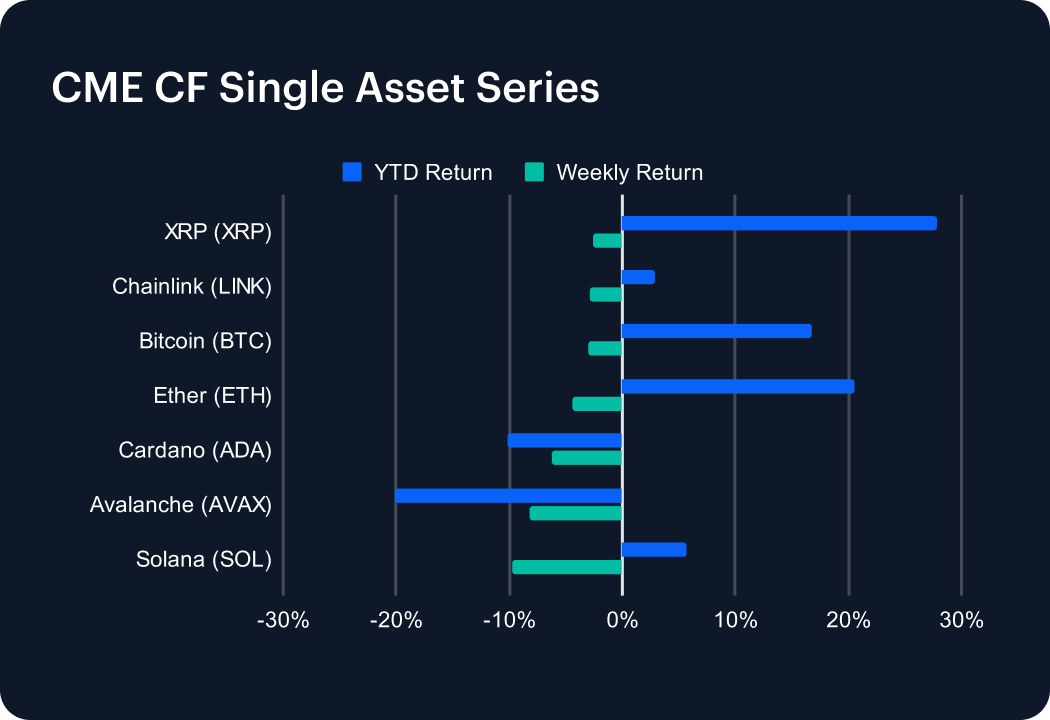

Digital assets declined steadily over the recent week, with losses led by higher-beta majors. Bitcoin again anchored the mega caps with a relatively contained −3.1% week-on-week fall, while Ether dropped −4.4%, and Solana tumbled −9.7%. Among other large caps, Avalanche dropped −8.2%, Cardano −6.3%, Chainlink −2.8%, and XRP edged −2.6% lower. Despite the setback, Bitcoin maintains a mid-teens year-to-date (YTD) performance, while XRP is still ahead by approximately 28% YTD. By contrast, Avalanche and Cardano remain negative YTD, underscoring the year’s top-heavy leadership. Liquidity thinned into the weekend, and breadth narrowed, a familiar pattern in de-risking phases where altcoins typically lag Bitcoin.

Sector Analysis

Sector returns were broadly negative and tightly grouped: Finance, ticking +1.3% higher, was the lone gainer, while Culture lagged with a −4.6% fall. Most other sectors posted modest week-on-week declines, indicating risk reduction rather than a style or factor shock. The profile is consistent with investors favoring balance-sheet strength and transactional activity over attention-driven themes.

CF Staking Series

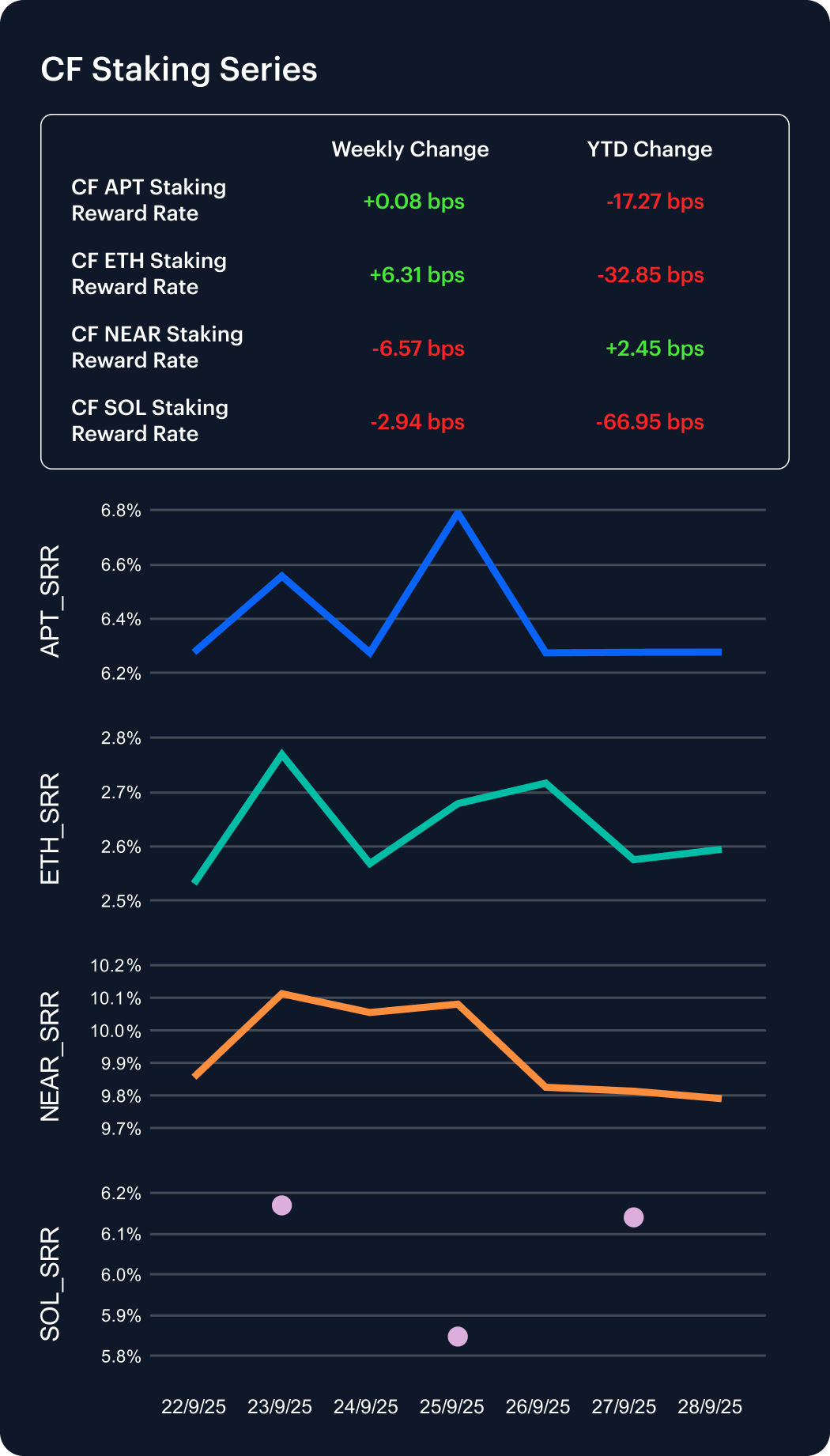

Staking indices were mixed: the ETH staking index rose 2.49% week-on-week with the associated reward rate up 6.31 bps, while the APT staking index was essentially flat at +0.01% (+0.08 bps). By contrast, the NEAR staking index declined 0.67% (−6.57 bps) and the SOL staking index fell 0.48% (−2.94 bps). On a year-to-date basis, NEAR remains slightly positive (approximately +0.25%), whereas APT, SOL, and ETH are negative YTD, highlighting that this section reflects staking carry and reward-rate dynamics, not token price performance.

Market Cap Index Performance

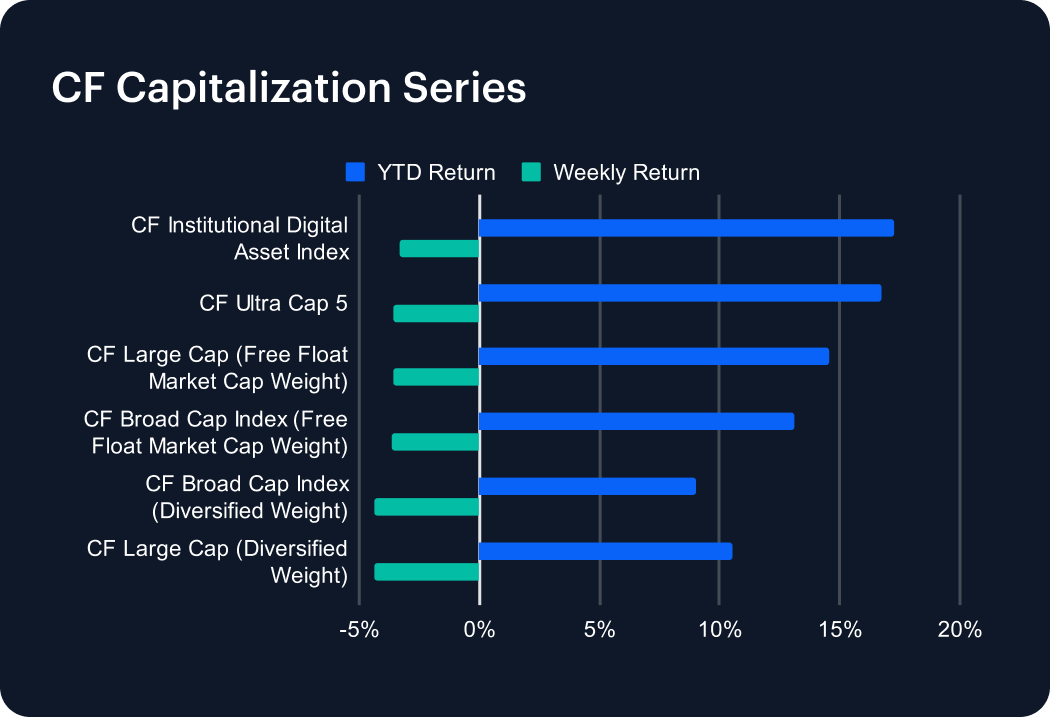

Moves were orderly across size tiers. CF Broad Cap Index (Diversified Weight) ground −4.3% lower week-on-week, while CF Large Cap (Diversified Weight) similarly, retreated −4.4%, trailing the most liquid composites. Meanwhile, CF Ultra Cap 5 fell −3.6%, and the CF Institutional Digital Asset Index was down −3.3%. Broad Cap and Large Cap continue to show year-to-date leadership concentrated at the top end. The relative resilience of the largest composites seems to be pointing, currently, to a preference for liquidity and index heavyweights during drawdowns.

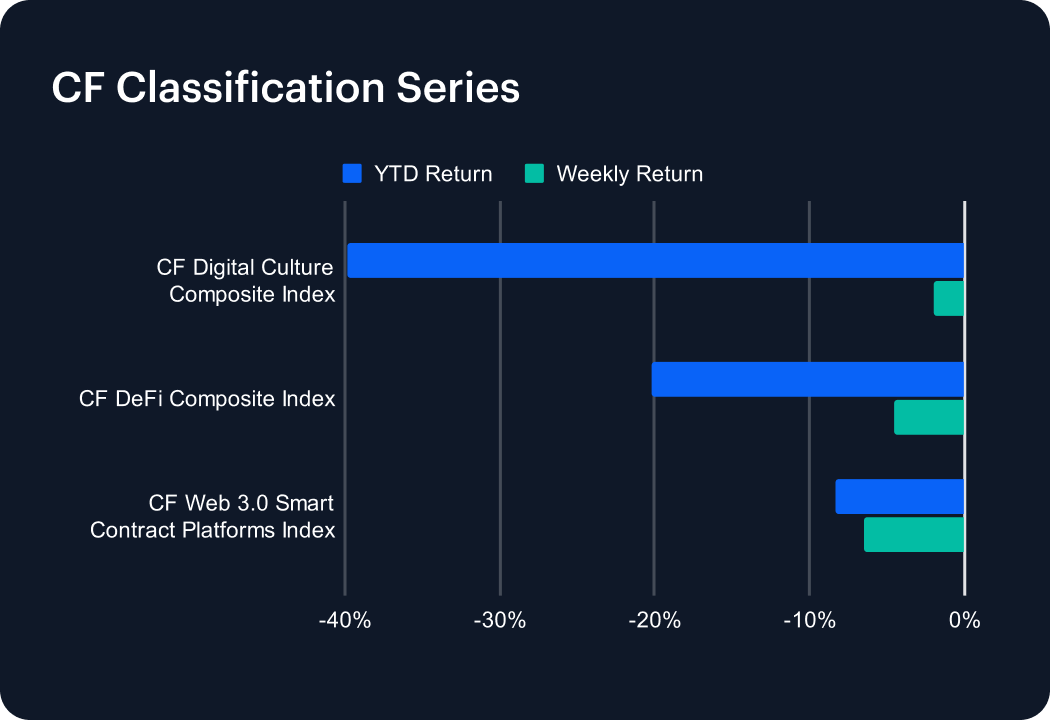

Classification Series Analysis

Thematics softened across the board: CF Web 3.0 Smart Contract Platforms Index slid −6.5% week-on-week, CF DeFi Composite Index fell −4.5%, and CF Digital Culture Composite Index nudged −2.0% lower. Digital Culture remains deeply negative YTD (approximately −40%), and DeFi is still down by roughly a fifth YTD, signaling ongoing skepticism toward cashflow-light narratives. Momentum turned lower after a short-lived rebound in the prior week, leaving these cohorts more sensitive to funding pullbacks.

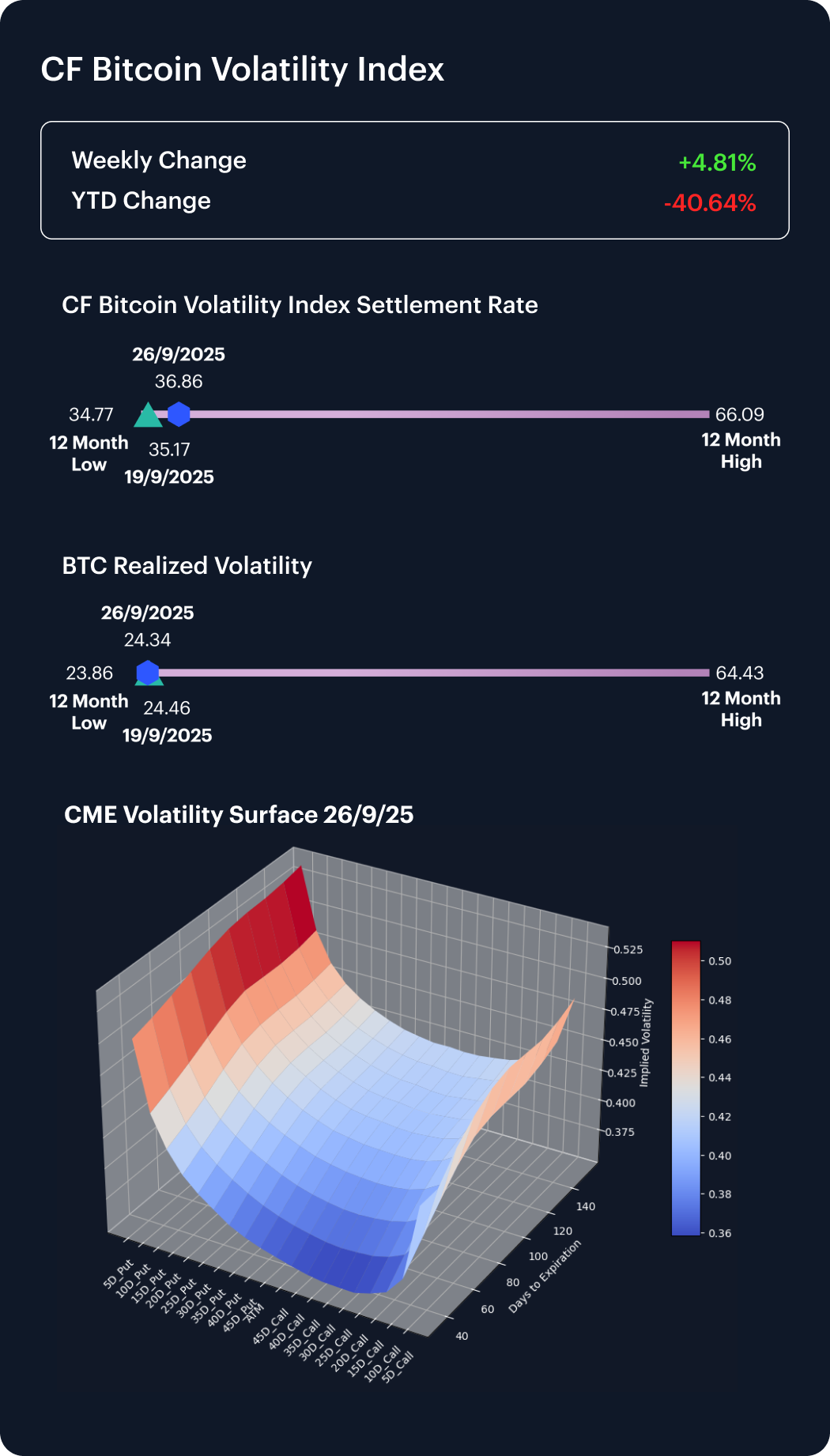

Volatility Analysis

Bitcoin implied volatility firmed whilst realized softened slightly: BVX rose by +1.69 points to 36.86, while realized slipped by −0.12 points to 24.34; widening the implied–realized gap. The move is consistent with a downside-skewed week, suggesting higher hedging demand rather than a volatility shock. This backdrop indicates participants are currently finding option carry to be relatively expensive for short-volatility positions, so instead they’re favoring selective hedges over outright vol selling.

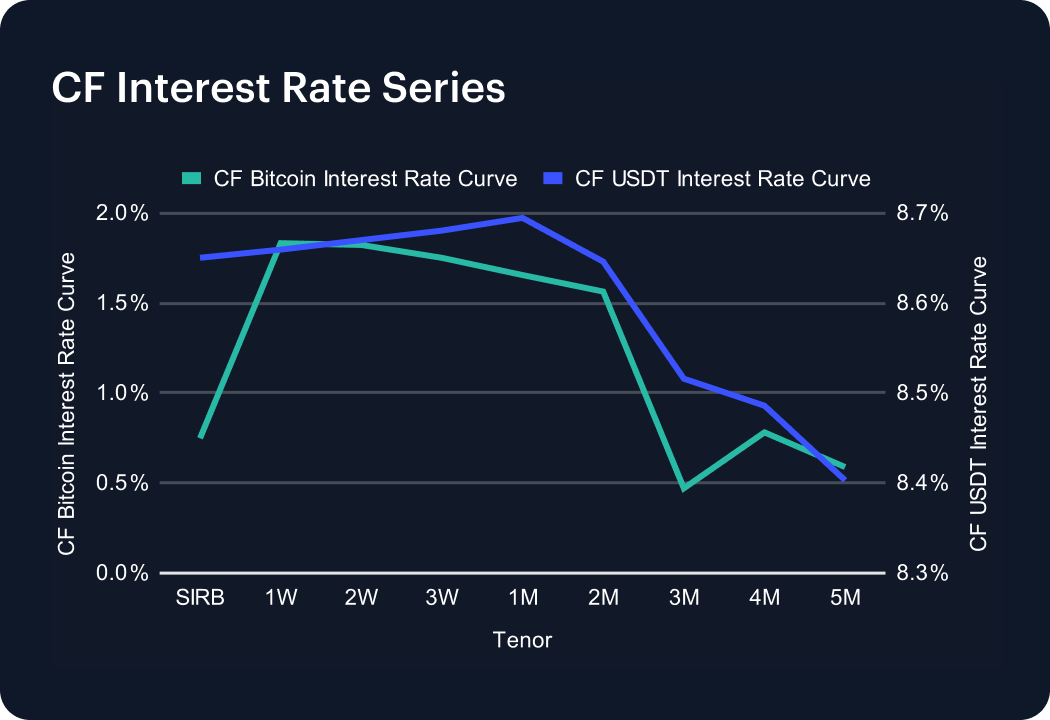

Interest Rate Analysis

The data point to a moderate divergence of funding distribution across the curve over the week. The CF Bitcoin Interest Rate Curve eased at the front, with SIRB falling from 3.9% to 0.7%, and 1-month (1M) dropping from 2.1% to 1.7%. Potentially, that can be read as indicating some relief in crypto-native funding. The CF USDT Interest Rate Curve shifted higher, with 1-week moving from 7.0% to 8.7% and 1M rising from 6.9% to 8.7%. Again, potentially, this can be read as tighter dollar-stablecoin carry across short to intermediate tenors. In practice, tentatively, the overall mix can support participants seeking basis compression on BTC-linked rates, while it raises the hurdle for leveraged USDT funding strategies.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Tracking Bitcoin's Flows

Bitcoin is down 47% from its October high. But behind the drawdown, 13F filings reveal a structural transformation: speculative hedge fund capital is retreating while advisory firms, sovereign wealth funds, and endowments are building permanent allocations. Here's what the ownership data shows.

Gabriel Selby

Kraken MTF Lists Large Cap DTF Perp

EU-domiciled institutional investors can now access a perpetual contract based on Reserve Protocol's multi-token LCAP DTF.

CF Benchmarks

Notice of the Demising of Three Indices Within the Token Market Price Benchmarks Series

The Administrator announces that three Token Market Price Benchmarks Series indices are to be demised.

CF Benchmarks