Sep 23, 2024

Weekly Index Highlights, September 23, 2024

Explore the latest performance insights of CFB's leading reference rates and indices. This report covers the key movements from September 16 to September 22, 2024.

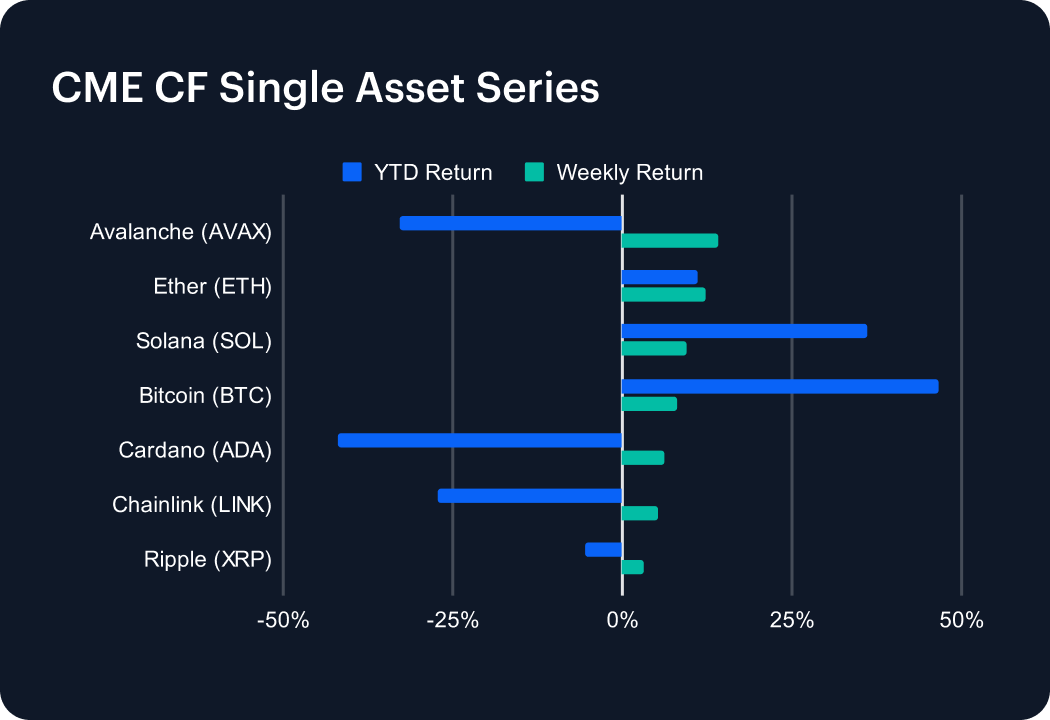

Avalanche (AVAX) saw the most benefit, +14.23%, among altcoins, as a ‘risk-on’ week lifted all boats in this series. However, AVAX is faring second-worst in this group on a YTD basis, -32.87%; only somewhat better off than ADA, -41.97%, YTD.

The Culture sector remained firm, with a +11.28% weekly rise, again propelled by Gaming; this time led by IMX, +31.30%. The General Purpose Smart Contract Platforms category also shone, amid a +39.16% weekly surge by Aptos (APT), and +38.17% by Sui (SUI). The programmable sub-category gained +14.43% overall, vs +5.44% by the non-programmable sub-category.

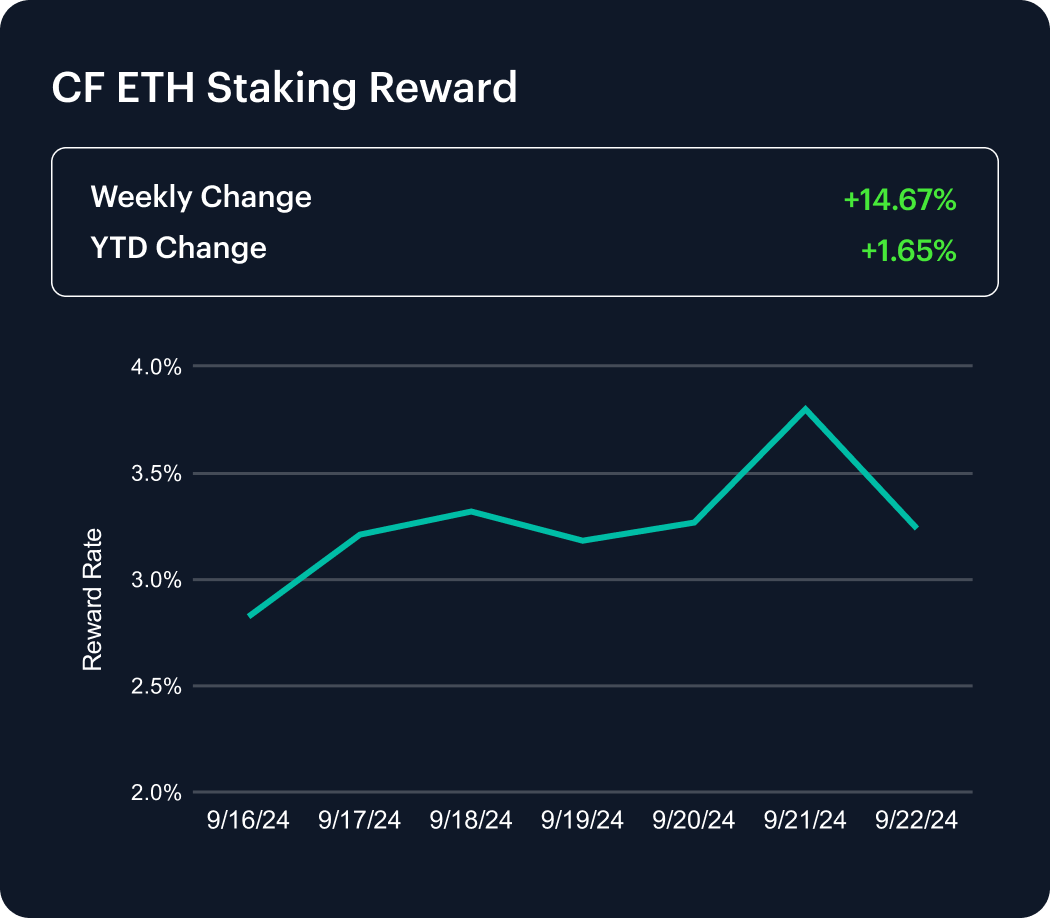

The ETH Staking Reward Rate’s YTD change turned positive during the week to stand at +1.65%, in step with the weekly change swinging firmly higher by 14.67%.

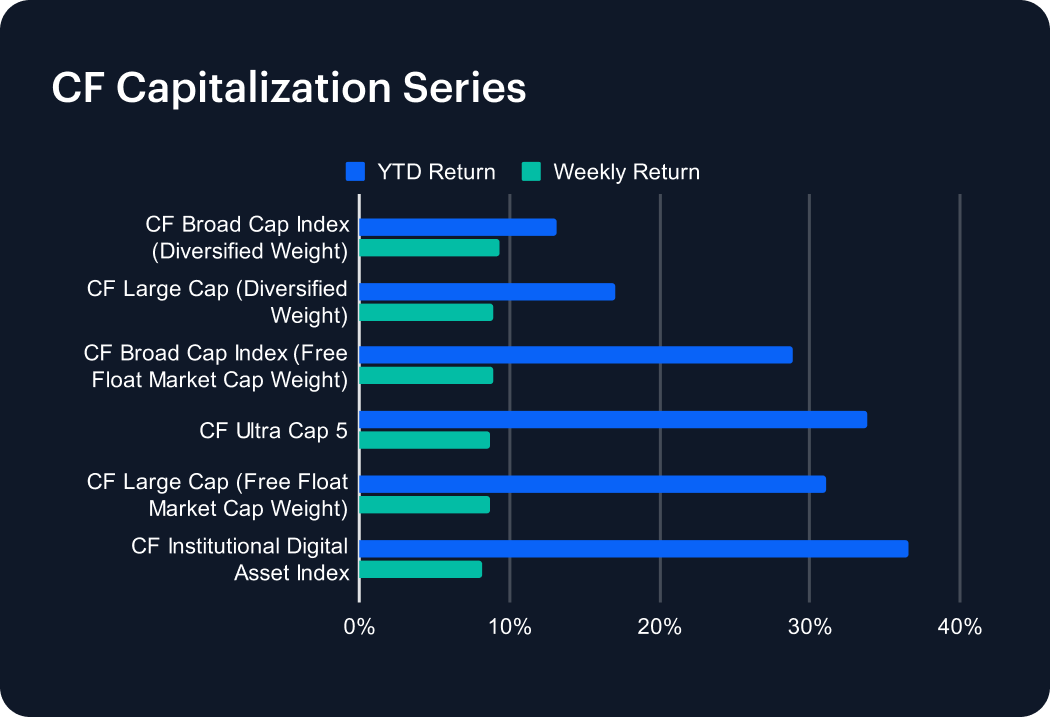

Another week of relatively evenly distributed positive returns across the series, reflecting unequivocally improved sentiment for large caps. The CF Broad Cap Index (Diversified Weight) notionally outperformed, gaining +9.29%, compared with this week’s relative series underperformer, the CF Institutional Digital Asset Index, +8.15%.

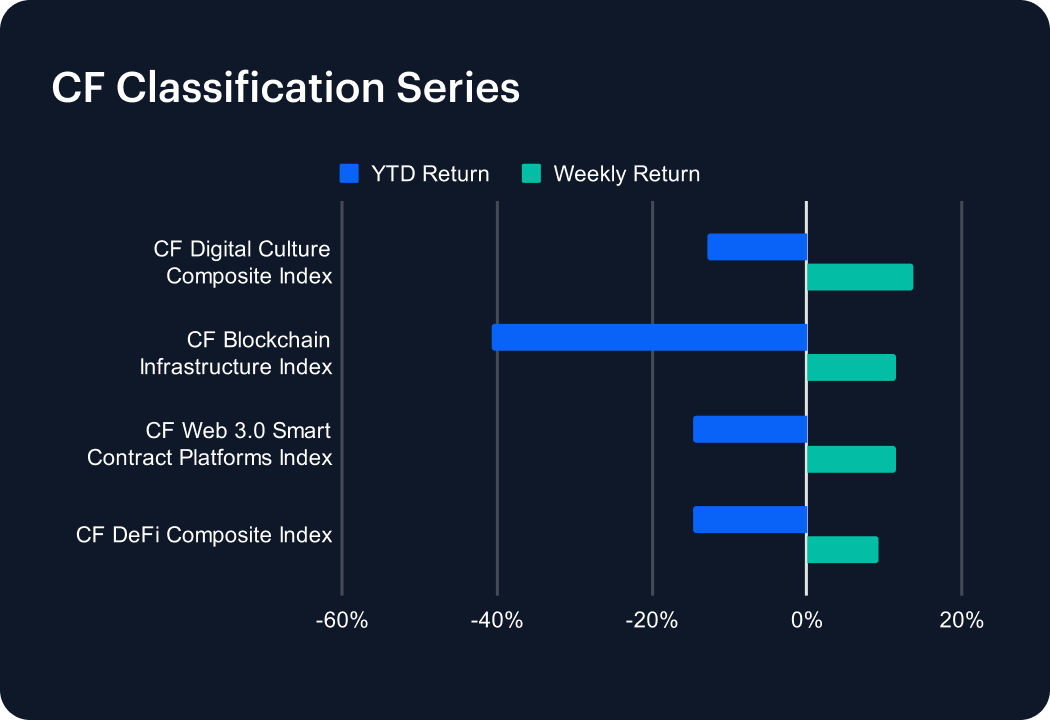

The CF Classification Series posts a similarly positive profile as our Capitalization Series, with all indices rising. The context for CF Digital Culture Composite Index’s +13.79% weekly rise is provided in the CF DACS section of this report.

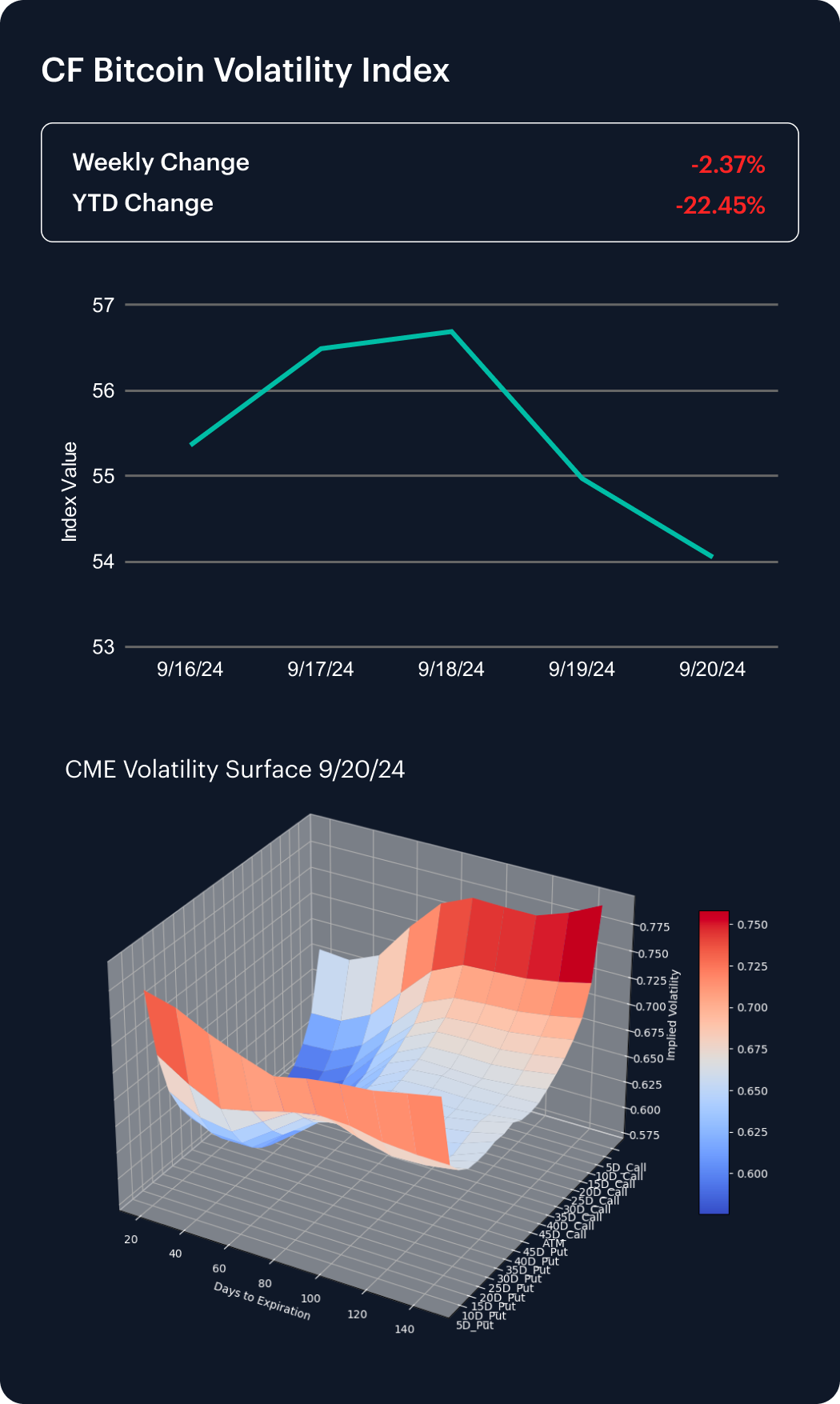

Perhaps symptomatically, widespread gains across large cap cryptos and altcoins, coincided with the continued dispersal of bitcoin implied volatility. The CF Bitcoin Volatility Index Settlement Rate (BVXS) eased -2.37% lower, meaning BVXS’s YTD change worsened to -22.45%.

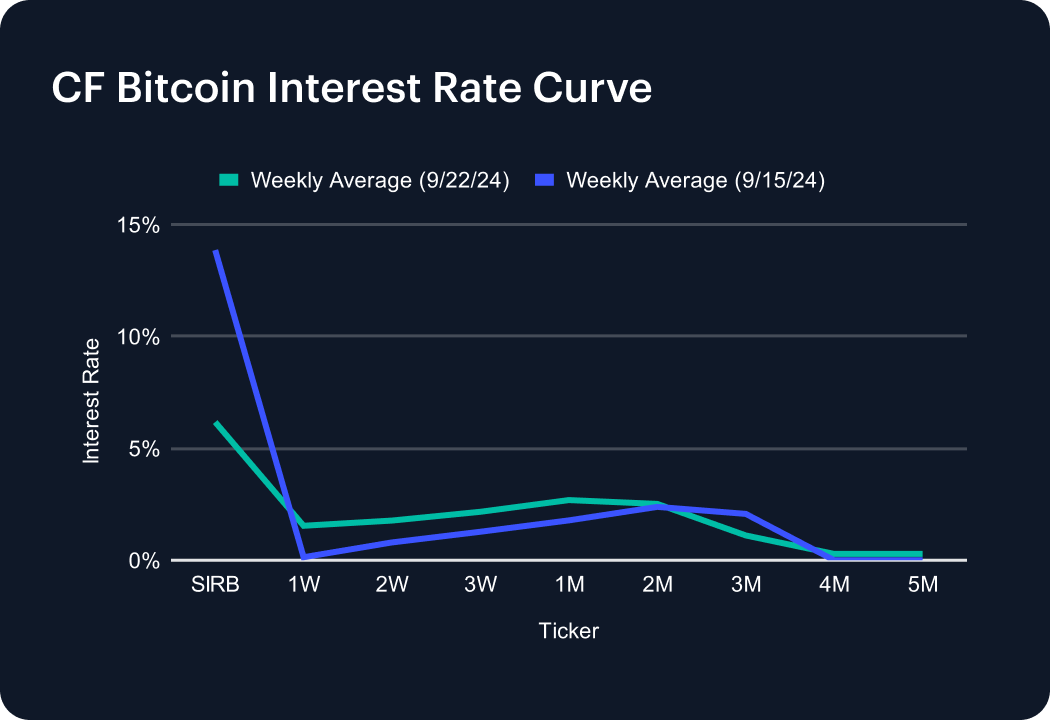

Weekly evolution of the term structure is still mostly inert, though 4-month and 5-month readings were finally discernible following several weeks of inactivity. Most attention remains at the shorter end, with the session rate falling roughly 8 basis points (bp) and the 1-week tenor rising 1.5bp.

Index data based on CF Benchmarks Settlement Rates, published at 16:00 London Time

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks

Not All Cryptos Are the Same: How CF Factor Data Reveals Sensitivities Across the Digital Asset Taxonomy

We show how combining the CF DACS taxonomy with the CF Factor Data Series reveals sensitivities that enable institutional-grade returns attribution, risk monitoring and strategic implementation.

CF Benchmarks

Factor Friday

The defensive regime remains firmly in control. Downside Beta continues to dominate while Growth and Value have continued to lag since October. Momentum's recent surge and The Settlement category's relative resilience are the two threads worth pulling on this week.

Mark Pilipczuk