Sep 15, 2025

Weekly Index Highlights, September 15, 2025

Market Performance Update

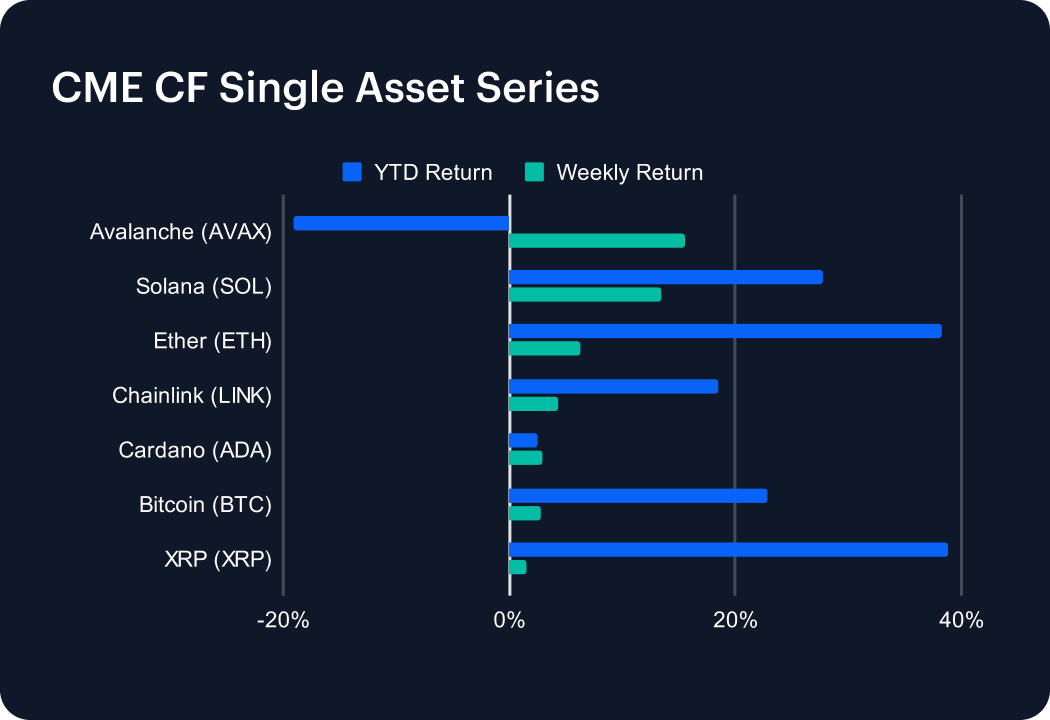

In another constructive week for digital assets, major tokens posted broad-based gains, with several delivering outsized returns. Avalanche surged 15.51%, sharply trimming its 2025 deficit to –19.04%, while Solana advanced 13.46%, lifting its year-to-date performance to 27.76%. Ether added 6.35% to extend its impressive climb to 38.28%, and Chainlink’s 4.31% gain pushed its annual return to 18.52%. Cardano rose 2.97%, edging into positive territory at 2.46% YTD, while Bitcoin’s steady 2.76% rise brought it to 22.87% for the year. XRP maintained leadership with a 1.56% weekly gain, taking its year-to-date rally to 38.87%. The week’s rotation highlighted strength across the board, signaling resilient momentum.

Sector Analysis

The DACS landscape showed robust breadth this week as capital flowed into all the DACS sub-categories. In Finance, Borrowing & Lending stood out, led by Ondo’s 11.43% rally and supported by Compound (+3.09%), while Aave slipped (–0.14%). Trading was generally positive, with Balancer (+4.88%) and 1inch (+3.56%) pacing gains, though Uniswap (–2.67%) and Loopring (–3.23%) lagged. Programmable Settlement was the strongest sub-category, driven by Avalanche’s 15.51% surge and Solana’s 13.46% advance, with Ethereum (+6.35%) also contributing. Non-Programmable Settlement was steadier, with Bitcoin (+2.76%) leading modest gains across majors. Infrastructure and Utility showed selective strength, highlighted by Helium’s 12.47% jump, The Graph (+6.37%), and Render (+6.00%). Culture regained momentum, propelled by Immutable (+21.64%) and Dogecoin (+17.56%), alongside solid showings from Pepe (+11.04%) and Bonk (+10.21%).

CF Staking Series

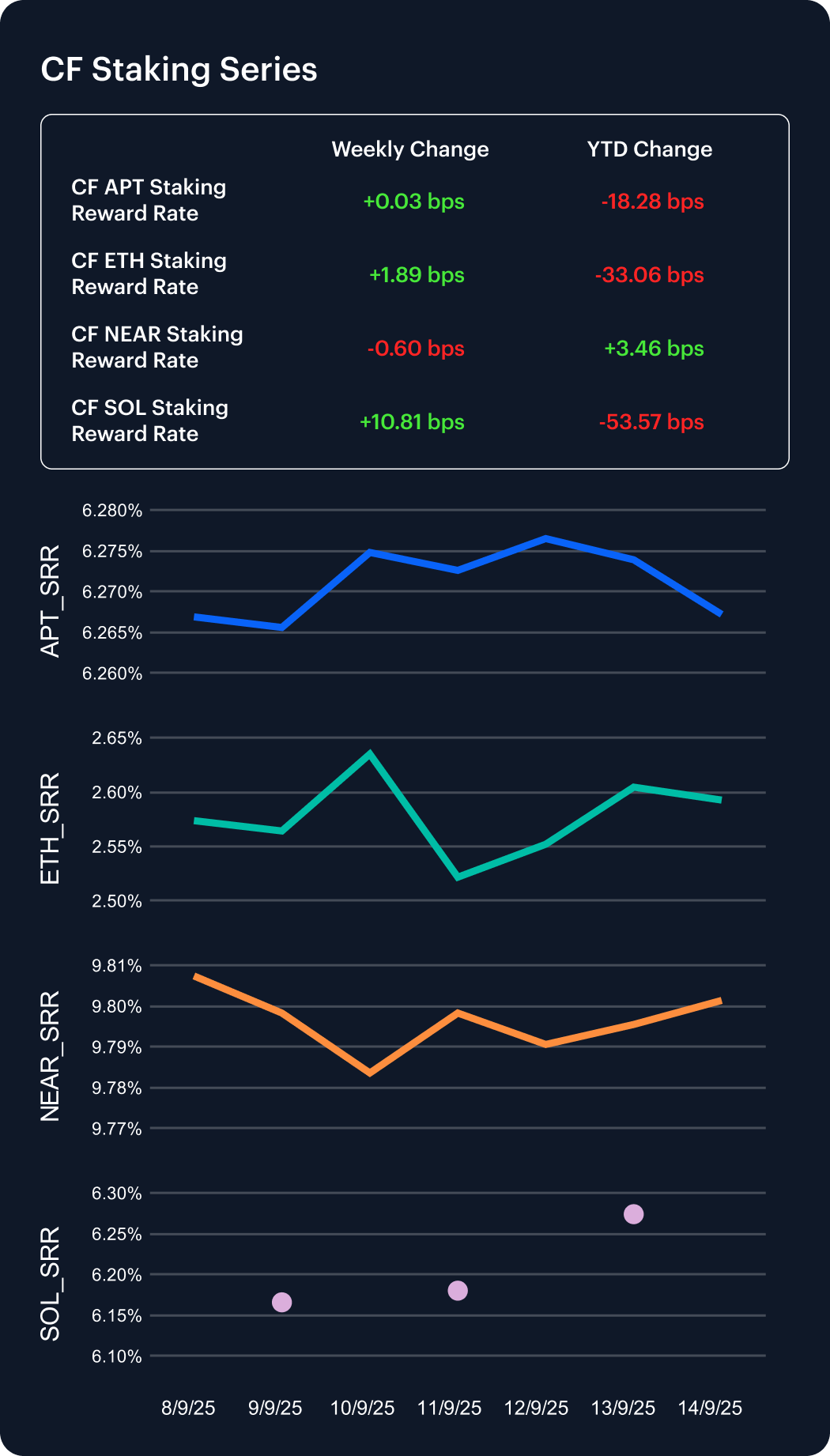

Validator economics were uneven this week, with majors showing clear dispersion as yield sustainability remains a 2025 challenge. Solana rebounded strongly, with its annualized reward rate jumping 10.81 bps to 6.27%, though it still carries a steep 53.57 bps erosion (–7.87%) YTD. Ethereum also improved, rising 1.89 bps to 2.59%, but remains the weakest overall with cumulative losses of 33.06 bps (–11.31%). Aptos was nearly flat at 6.27%, with a modest 0.03 bps uptick that leaves it down 18.28 bps (–2.83%) this year. NEAR softened slightly, slipping 0.60 bps to 9.80%, though it continues to stand out as the only network in positive territory year-to-date, with a 3.46 bps gain (+0.35%).

Market Cap Index Performance

The CF Capitalization Series extended its rally last week, reflecting broad strength across digital assets. The CF Broad Cap (Diversified Weight) advanced 5.10%, lifting its YTD gain to 21.14%, while the CF Large Cap (Diversified Weight) outperformed with a 5.24% rise, now up 22.52% for the year. Free-float measures also delivered solid results: the CF Broad Cap Index climbed 3.87% to 22.23% YTD, and the CF Large Cap (Free Float) gained 3.86%, securing the strongest return in the group at 23.60%. Among flagship benchmarks, the CF Ultra Cap 5 rose 3.68%, extending its rally to 25.65%. The CF Institutional Digital Asset Index gained 3.39%, bringing its year-to-date performance to 25.27%, underscoring the continued leadership of large-cap assets in 2025.

Classification Series Analysis

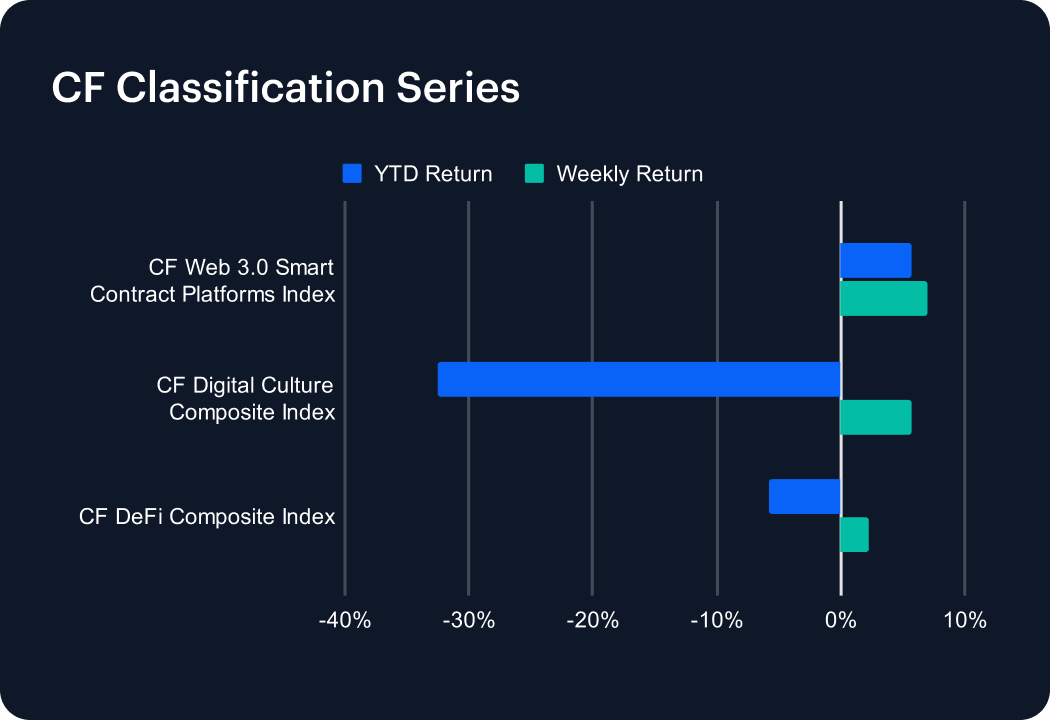

The CF Classification Series advanced last week, reflecting improving sentiment across speculative segments. The CF Web 3.0 Smart Contract Platforms Index led with a 7.02% surge, lifting its year-to-date return into positive territory at 5.75%. The CF Digital Culture Composite Index also gained 5.71%, trimming its annual decline to –32.51% as risk appetite tentatively returned to high-beta tokens. Meanwhile, the CF DeFi Composite Index added 2.23%, easing its loss to –5.74% YTD but still lagging peers. Overall, the rebound highlighted broader stabilization, though conviction remains uneven across digital asset themes.

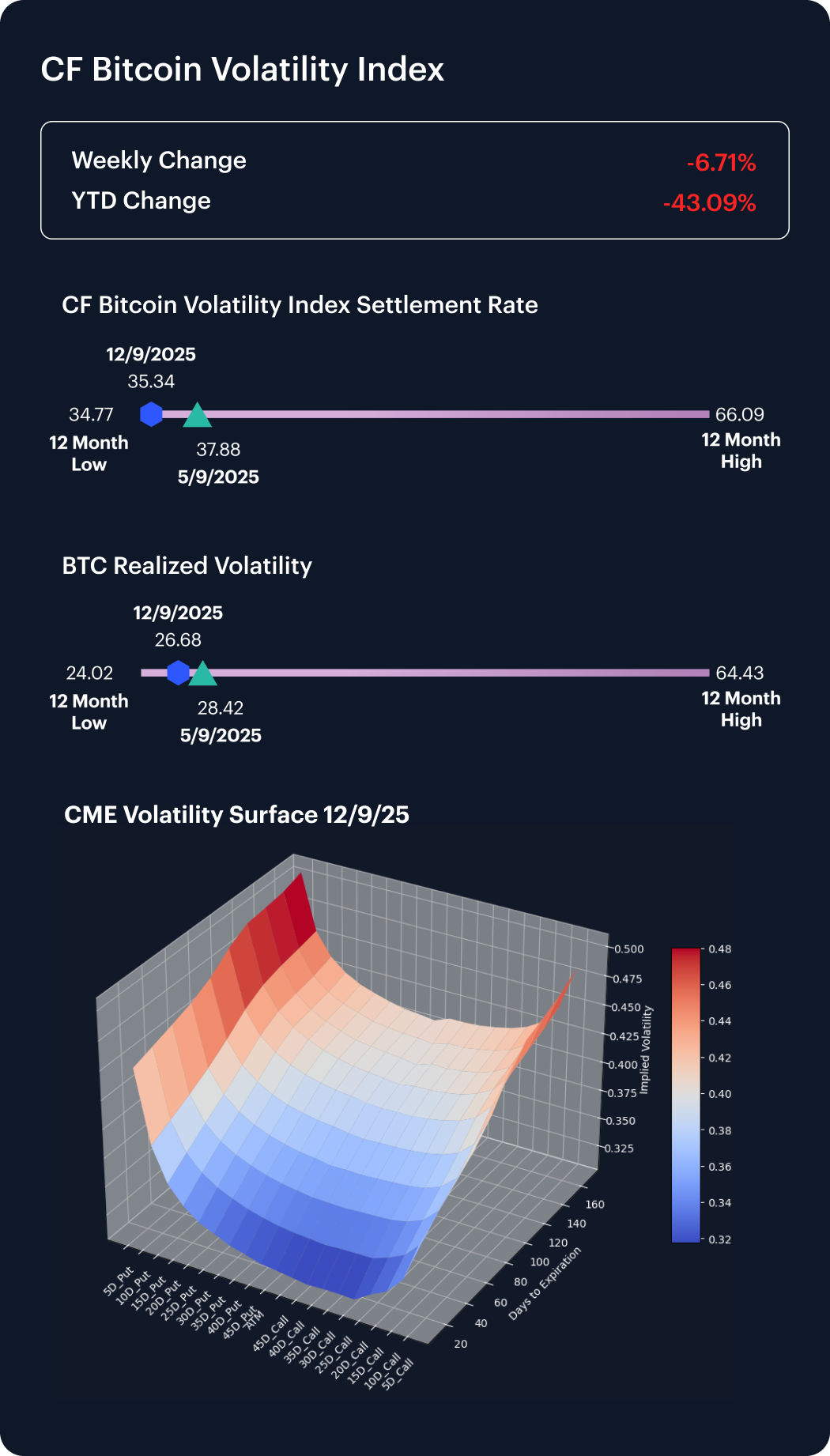

Volatility Analysis

The CF Bitcoin Volatility Index Settlement Rate (BVXS) fell 6.71% last week, declining from 37.88 to 35.34, and now stands 43.1% below its January level while hovering just above the 12-month low of 34.77. Realized volatility tracked lower as well, easing from 28.42 to 26.68, though it remains comfortably above this year’s trough of 24.02. Notably, skew flipped positive across maturities, marking a shift in positioning, even as the term structure preserved its convexity profile—shorter-dated implied volatility stayed softer while longer tenors commanded higher premiums. The setup suggests hedging activity is moderating, with market participants gradually rebalancing away from concentrated downside protection.

Interest Rate Analysis

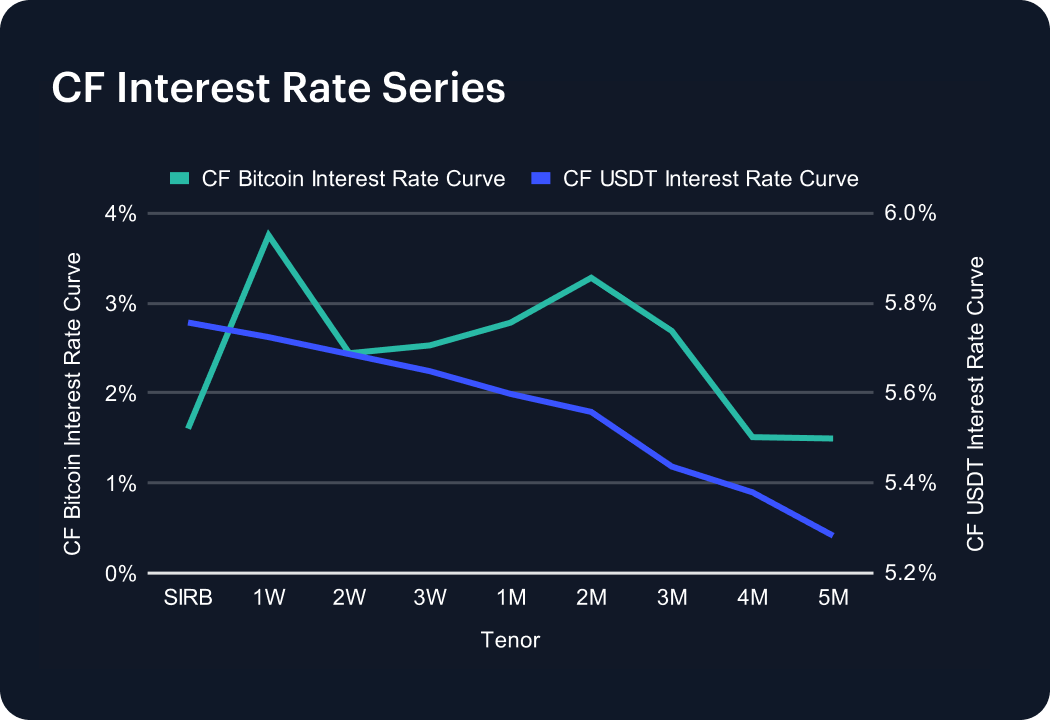

USDT funding remained firm, with the curve anchored between 5.76% at the spot-implied rate and 5.60% at one month before easing to 5.28% at five months. The modestly downward-sloping structure reflects continued demand for stablecoin liquidity, with a short-end premium underscoring appetite for immediate access. In contrast, Bitcoin funding was softer and more volatile, peaking at 3.75% at one week before sliding to 1.50% beyond four months. The divergence highlights the differentiated role of stablecoins as stable collateral for leverage, while BTC rates remain more sensitive to shifts in directional positioning and risk appetite.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks