Oct 06, 2025

Weekly Index Highlights, October 6, 2025

Market Performance Update

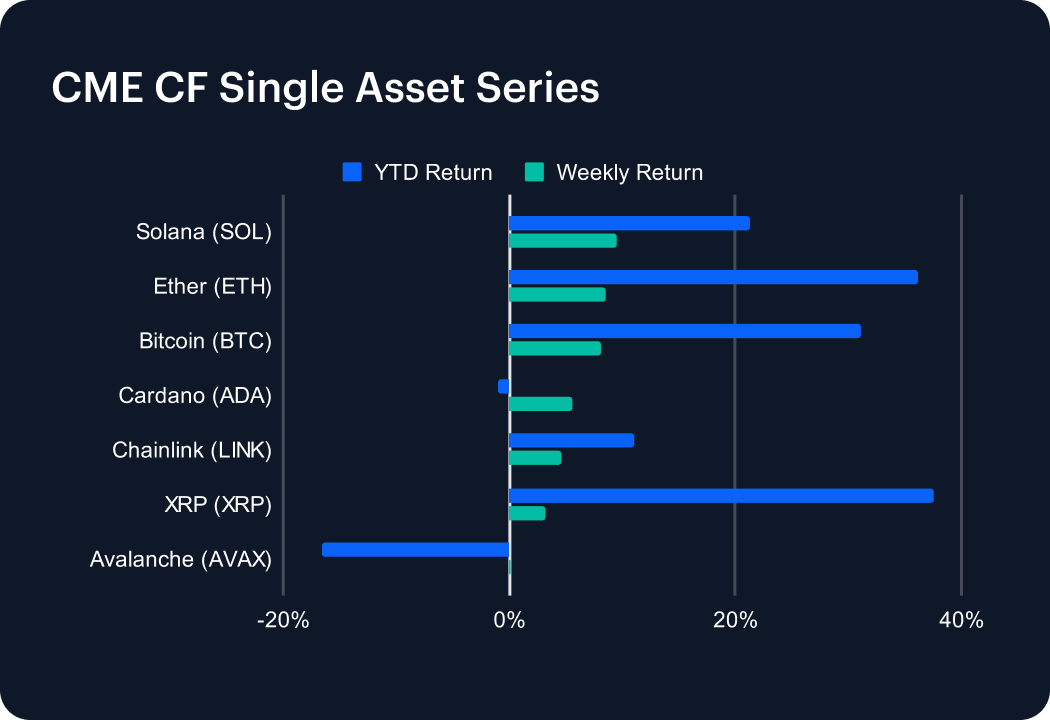

Digital assets rallied week-on-week, led by higher-beta majors. Bitcoin advanced +8.12%, Ether gained +8.55%, while Solana (SOL) rebounded +9.46%, setting the tone. Meanwhile other large caps also climbed, sealing a broad-based rally at the higher-capitalized end. Cardano (ADA) +5.53%, Chainlink (LINK) +4.58%, XRP (XRP) +3.26%. Only Avalanche (AVAX) +0.09%, lagged the move in this series. The pattern points to a risk-on bid with breadth skewed to the top end, albeit still somewhat selective moving down the capitalization strata. Follow-through into early week sessions is likely to hinge on whether flows persist beyond leaders.

Sector Analysis

Sector performance was broadly constructive week-on-week, with dispersion contained and no discernibly outsized rotations - looking through our CF Digital Asset Classification Structure (CF DACS) prism. Leadership appeared balanced across core Infrastructure and Services cohorts, consistent with a market biased to liquidity and transactional activity rather than narrow, attention-led themes. In short, this was a “beta first” week; with little disruption to ‘style’ narratives, and sector breadth improved versus recent de-risking phases. Standouts included: the Payment & Store of Value Segment (within the Settlement category) +12.5% week-on-week, the Culture Sub-Category’s Gaming segment, +8.2% w/w, Scaling (an Infrastructure Sub-Category) +4.6% w/w, and Meme Coins in Culture +3.5% w/w.

CF Staking Series

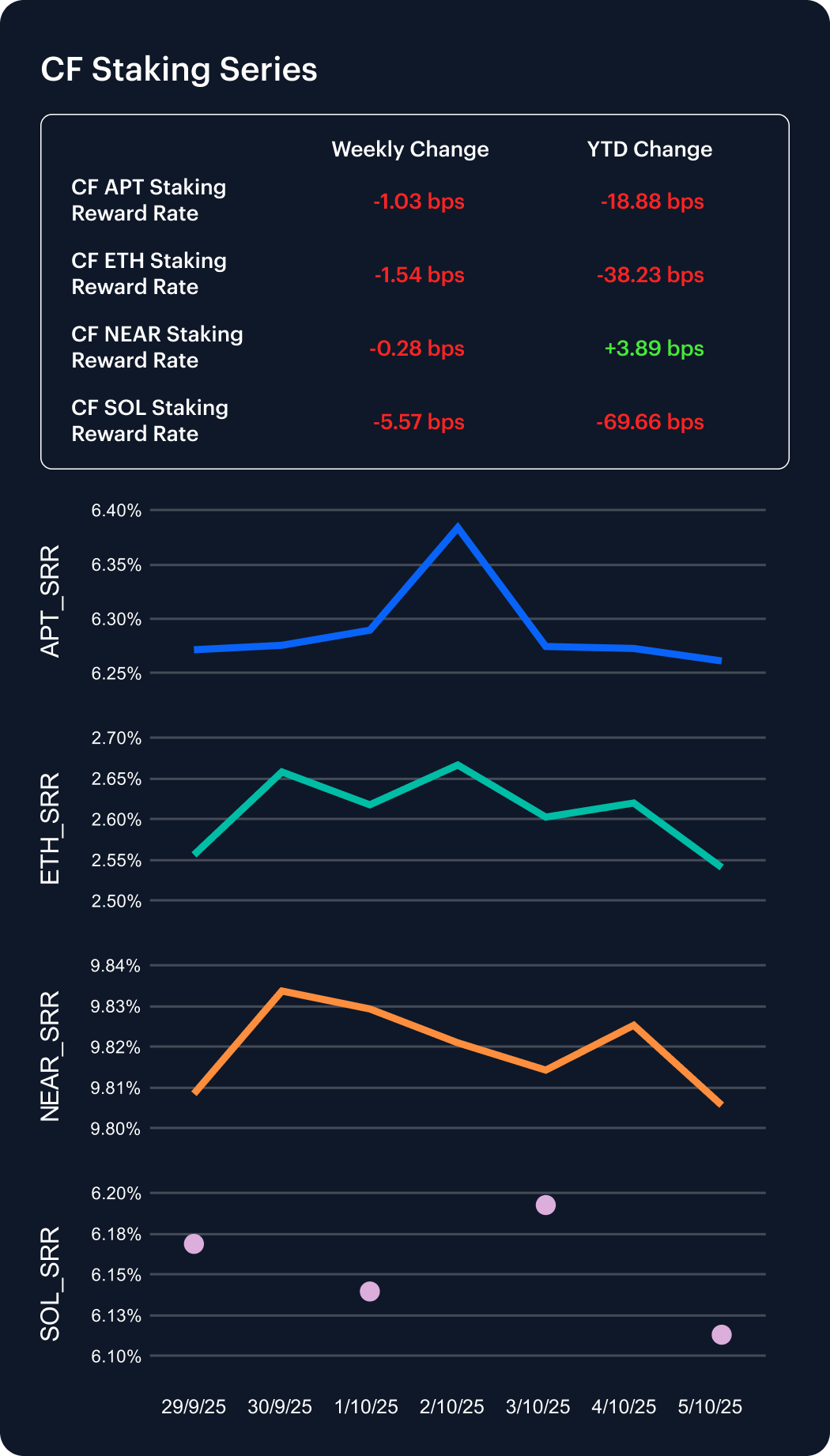

Staking indices were softer week-on-week even as spot rallied: APT staking edged −0.16% lower, equating to a −1.03 bps reward-rate move. ETH staking retreated −0.60%, or −1.54 bps, while NEAR was almost static, ticking down −0.03% (−0.28 bps). Meanwhile, SOL staking showed the most definitive reversal, falling −5.57 bps, or −0.90%. The slight drift lower in reward rates points to a marginal easing in staking carry, week-on-week, with SOL bearing the brunt.

Market Cap Index Performance

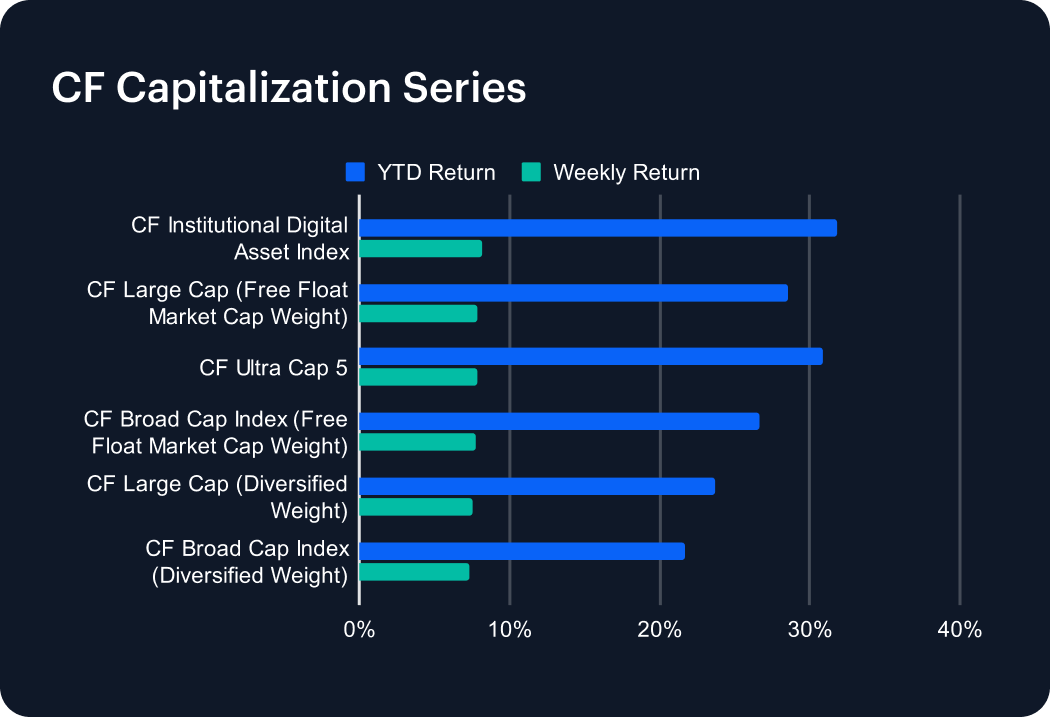

Moves were orderly across size tiers week-on-week. The CF Broad Cap Index (Diversified Weight) advanced +7.34%, CF Large Cap (Diversified Weight) gained +7.53%, CF Ultra Cap 5 rose +7.87%, and the CF Institutional Digital Asset Index climbed +8.19%. The rank order suggests buyers prioritized depth and liquidity, reflected by Ultra Cap and Large Cap edging Broad Cap for the week. That pattern is consistent with systematic and benchmark-aware inflows.

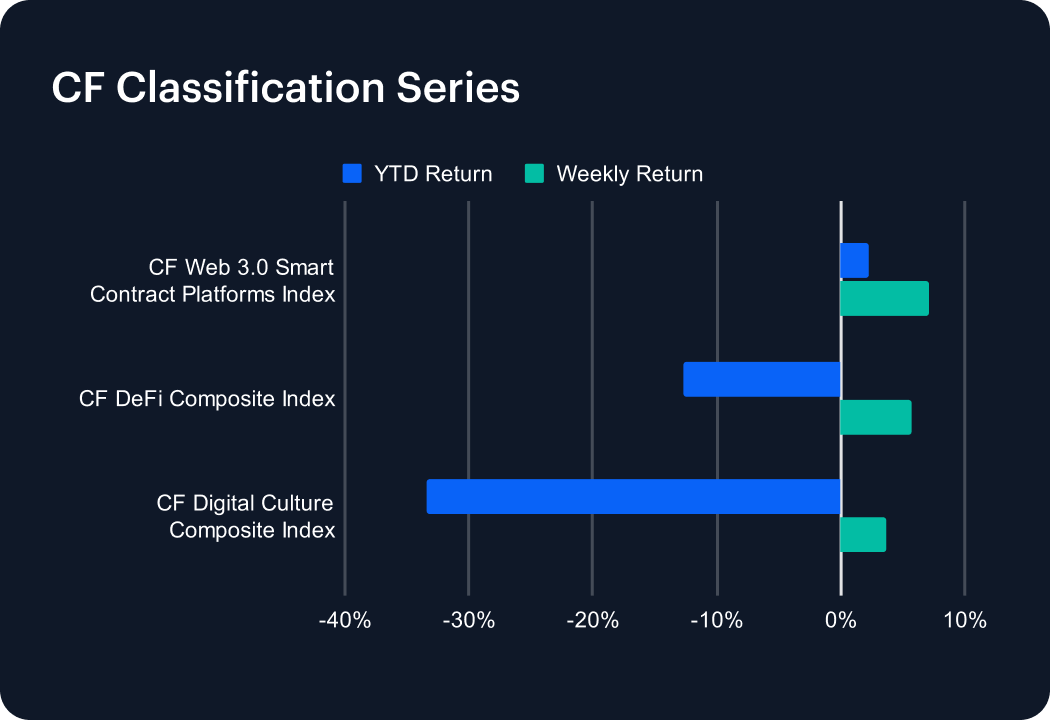

Classification Series Analysis

Thematics firmed week-on-week. The CF Web 3.0 Smart Contract Platforms Index rose +7.16%, the CF DeFi Composite Index gained +5.67%, and the CF Digital Culture Composite Index added +3.68%. The rebound was led by platforms and DeFi, with Culture participating but trailing; a profile typical of up-weeks where utility and liquidity screens draw incremental demand. Momentum improved versus the prior de-risking stretch, though leadership remains concentrated in higher-quality constituents.

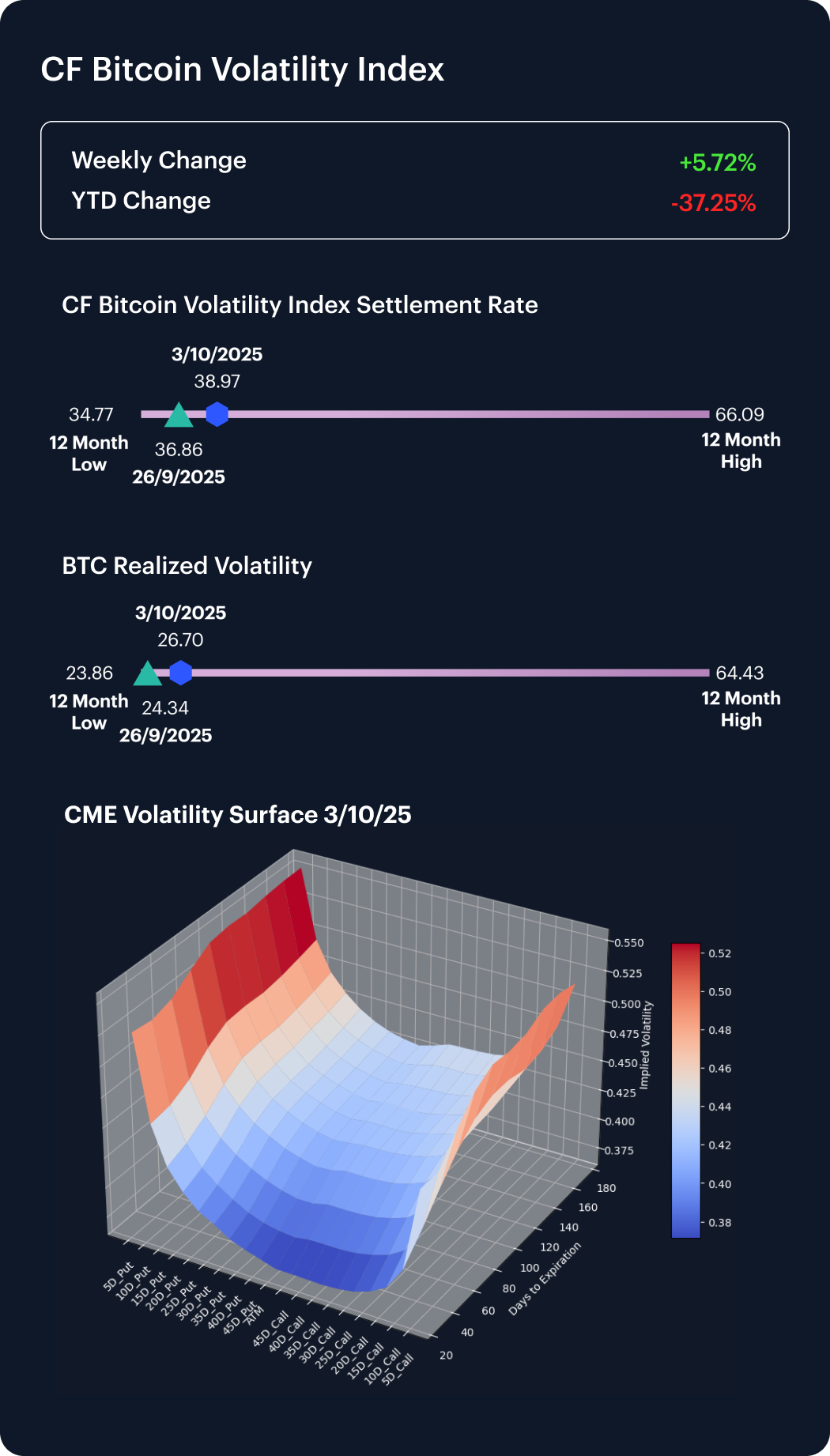

Volatility Analysis

Bitcoin implied and realized volatility both rose week-on-week: BVX advanced 2.11 points to 38.97, while realized increased +2.36 pts to 26.70. With realized up a touch more than implied, the implied vs. realized vol. gap narrowed slightly, indicating follow-through in underlying returns rather than a pure hedging bid. The surface remains orderly; this was an adjustment higher in vol. levels, like the prior week, bereft of major nasty surprises.

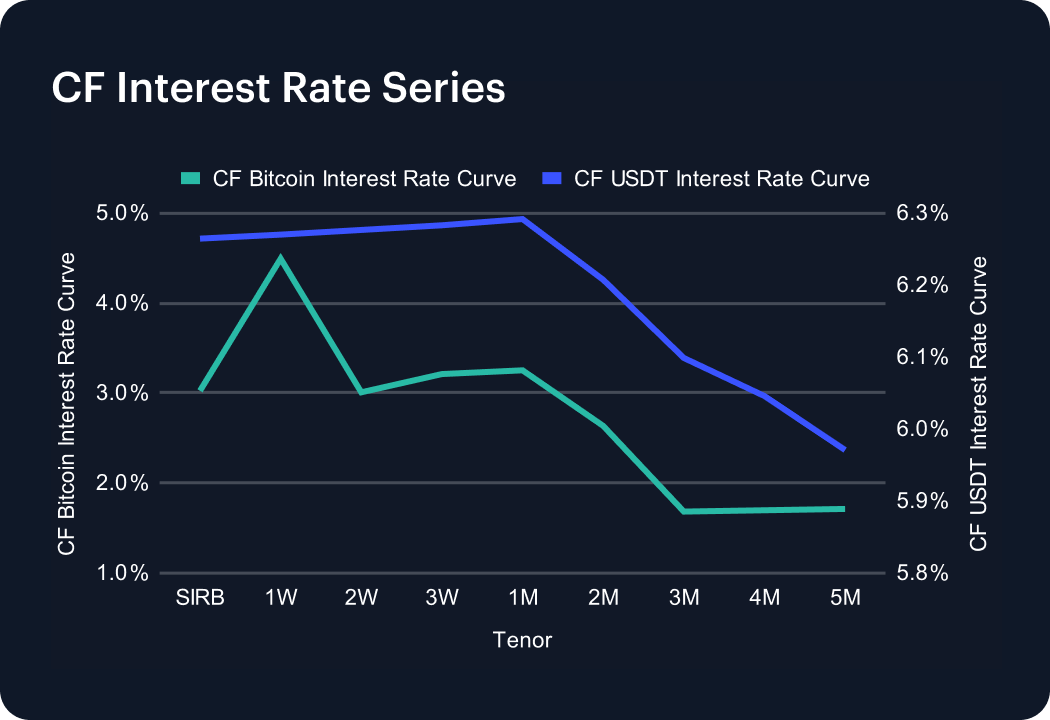

Interest Rate Analysis

Funding curves diverged week-on-week. On the Bitcoin side, SIRB firmed with a +2.28-percentage point gain to 3.03%, while 1M rose +1.60 pp to 3.25%, pointing to tighter BTC-linked funding. By contrast, the USDT curve eased, with 1W contracting from 8.66% to 6.27% (−2.39 pp) and 1M from 8.69% to 6.29% (−2.40 pp). This mix implies improving basis on BTC tenors even as dollar-stablecoin carry compresses at the front and belly of the curve, week-on-week.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks