Nov 11, 2024

Weekly Index Highlights, November 11, 2024

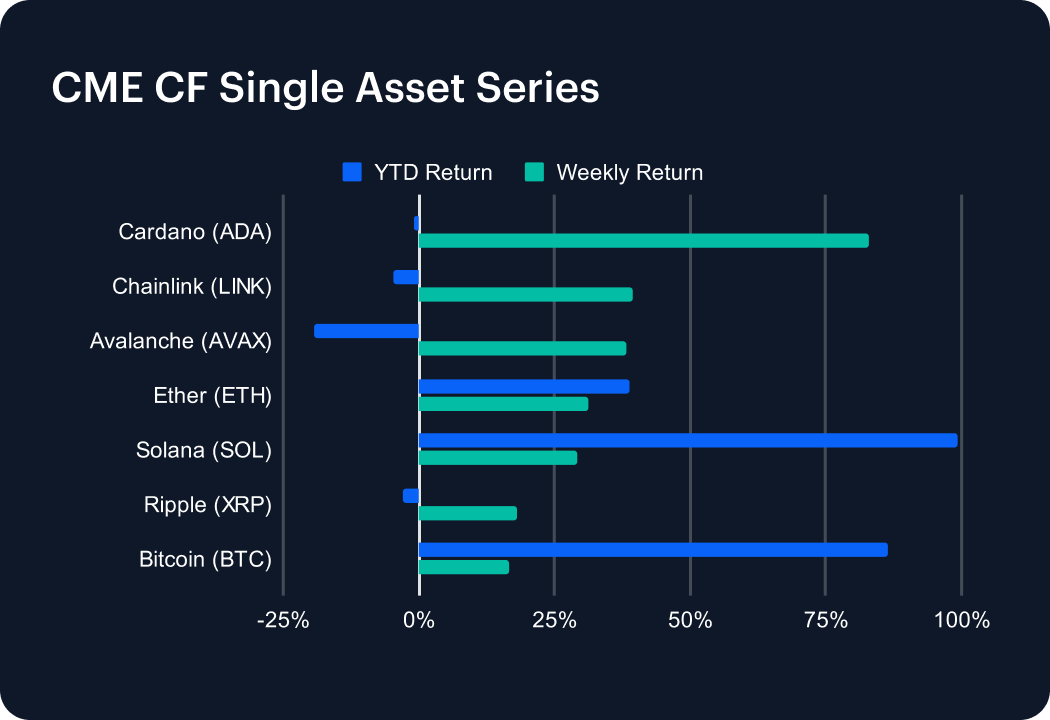

Large cap indices within the CME CF Single Asset series predictably posted their best gains for weeks in reaction to the re-election of Donald Trump, who’d pledged to foment a more accommodative regulatory regime for digital assets. Outperformance skewed towards highly capitalized altcoins, partly on the basis of a potential path towards inclusion within exchange traded investment products, predicated on leadership and ethos changes at the SEC. Erstwhile outliers for ETP prospects duly rose the most. Cardano (ADA) surged +82.82%, followed distantly by Chainlink (LINK), +39.53%, and Avalanche (AVAX), +38.24%.

The sizeable jump by Cardano (ADA) on a weekly basis, mentioned above, resulted in a revival of the General Purpose Smart Contract Platforms segment of the Programmable sub-category, enabling the latter to outperform, rising 38.36% on average. The Culture sub-category was relatively close behind, advancing an average +34.62%, led by persistently resilient gaming protocols, such as GALA, +43.39%, and SuperVerse (SUPER), +34.52%. The spotlight also swung back around to meme coins, as they rose in the slipstream of Elon Musk favourite, DOGE, +56.51%; triggering jumps by SHIB, +53.57%, and PEPE, + 52.32%.

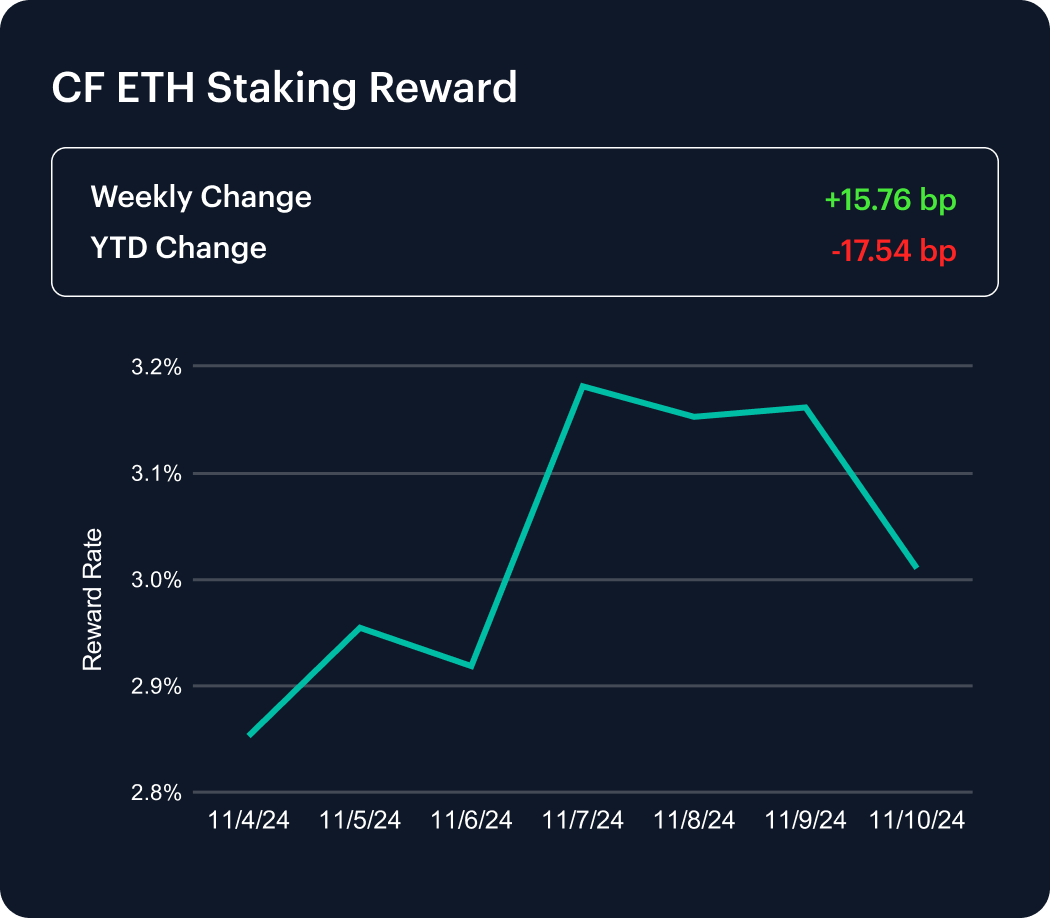

The key story for ETH staking rewards appears to be shown as much by their daily changes as their cumulative weekly outcome. The CF ETH Staking Reward Rate (ETH_SRR) accelerated higher into U.S. Election Day, before culminating on November 7th, followed by a quickening retracement by the end of that week. The ETH_SRR change still managed a week-on-week rise of +15.76 bp, bringing the year-to-date decline of -17.54 bp tantalizingly close to being erased.

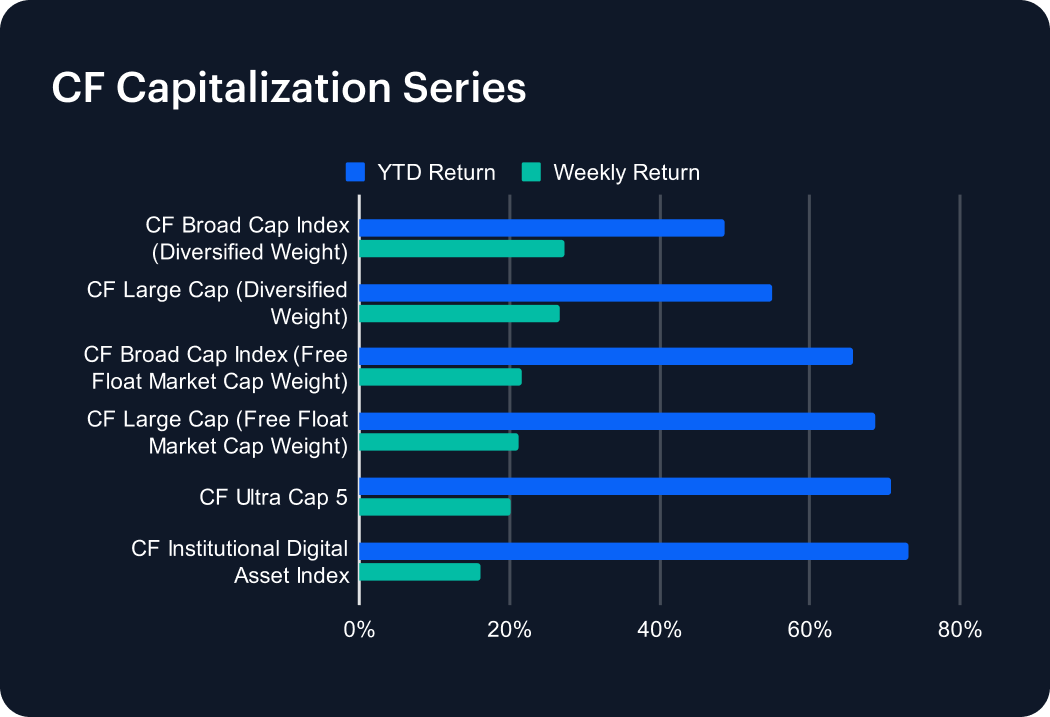

Mechanically, with altcoins in the ascendant over the past week, the ‘mega cap’-dominated CF Ultra Cap 5, +20.23%, and CF Institutional Digital Asset Index, +16.09%, relatively underperformed within this series. Note the +27.43% advance by the CF Broad Cap Index (Diversified Weight) index, and a +26.62% jump by the CF Large Cap (Diversified Weight) index. The largest tokens in market cap terms may still be unstoppable on a yearly basis, given the year-to-date progressions of the CF Ultra Cap 5, and the CF Institutional Digital Asset Index; up +70.84% and +73.17% respectively.

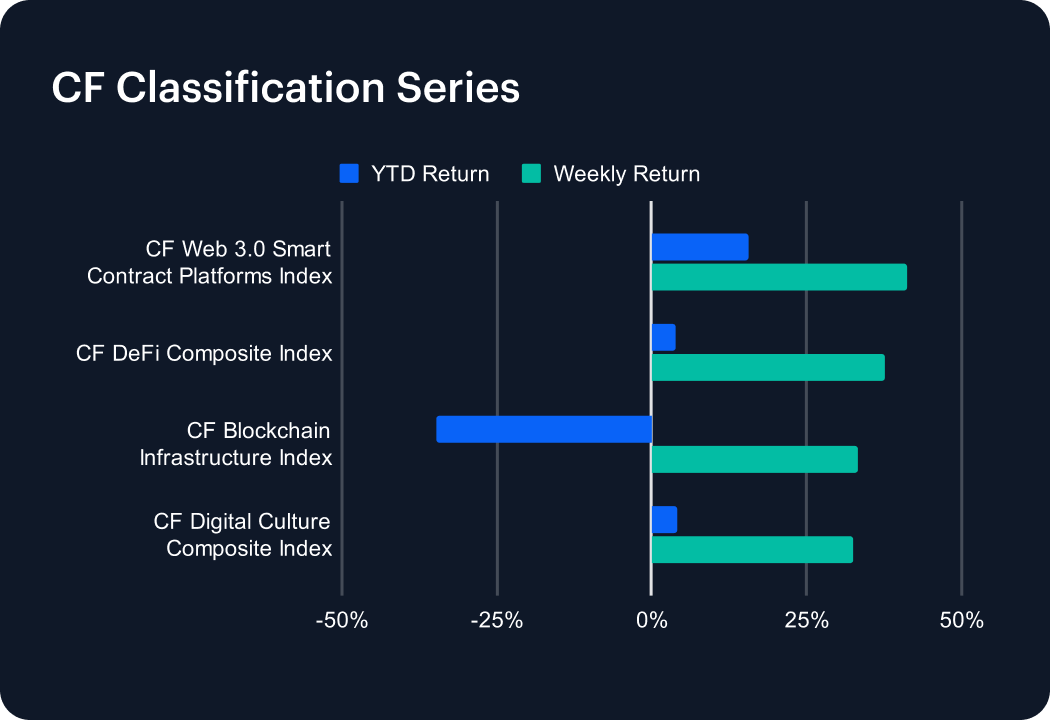

The ‘up only’ week was also in full effect for the CF Classification Series, led by the CF Web 3.0 Smart Contract Platforms Index. That rose +41.07%, with strong help from Cardano (ADA), as outlined in the CF DACS section. Notable benchmarks in the series whose returns have now turned to mildly positive for the year: the CF DeFi Composite Index, +3.93% on a year-to-date (YTD) basis, after leaping +37.56% for the week; and the CF Digital Culture Composite Index, +3.97% so far this year, following a +32.49% weekly melt up.

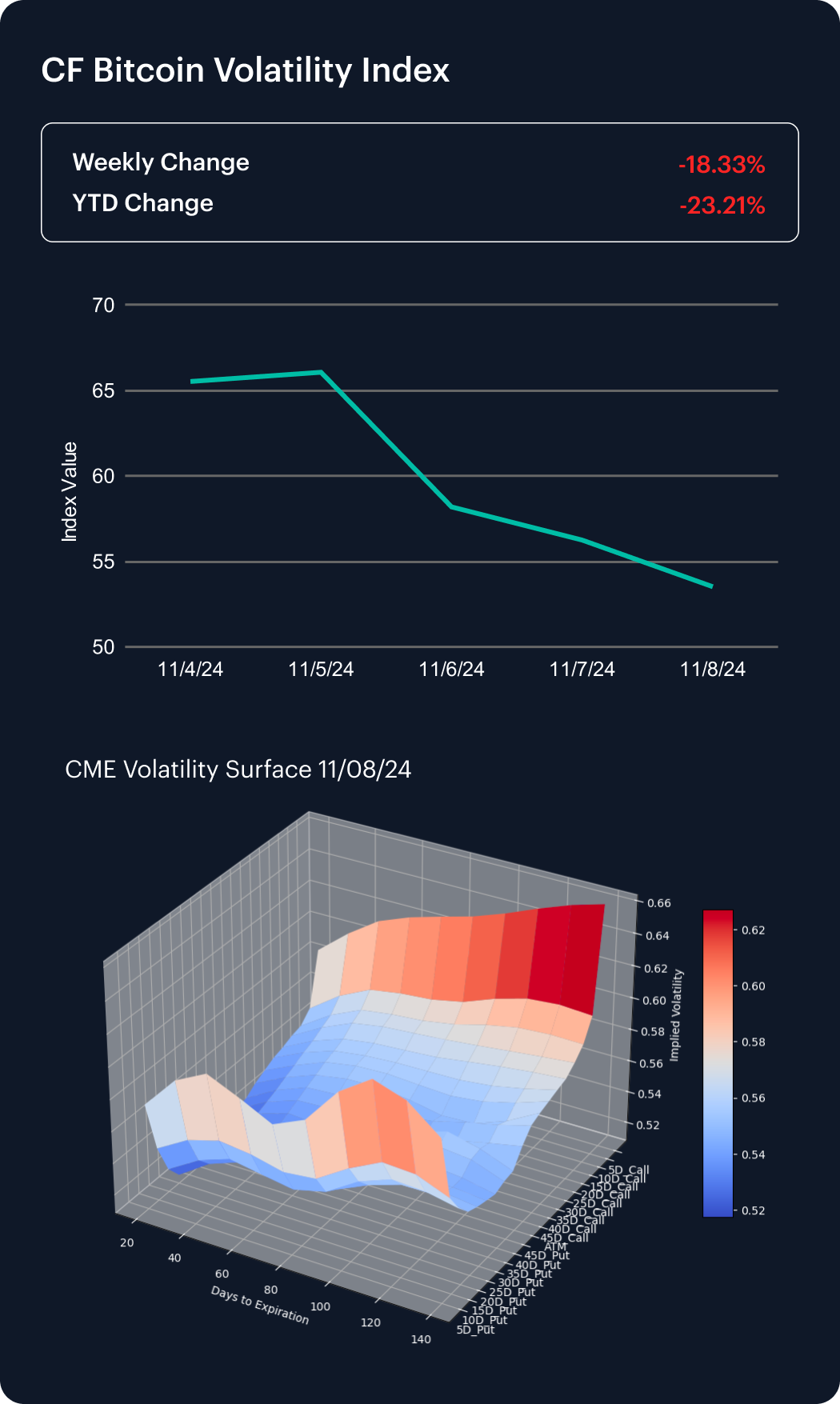

It’s axiomatic that diminishing uncertainty – perhaps even anxiety – in the digital asset class, would equate to a further retreat of CME Bitcoin implied volatility. The change of our CF Bitcoin Volatility Index Settlement Rate (BVXS) edged higher on November 4th, but had plunged -18.33% by the end of the week. Still, with BVXS’s year-to-date change less than 5 percentage points worse, at -23.21%, the summation of sentiment on Bitcoin so far in 2024 could still be characterized as quite balanced.

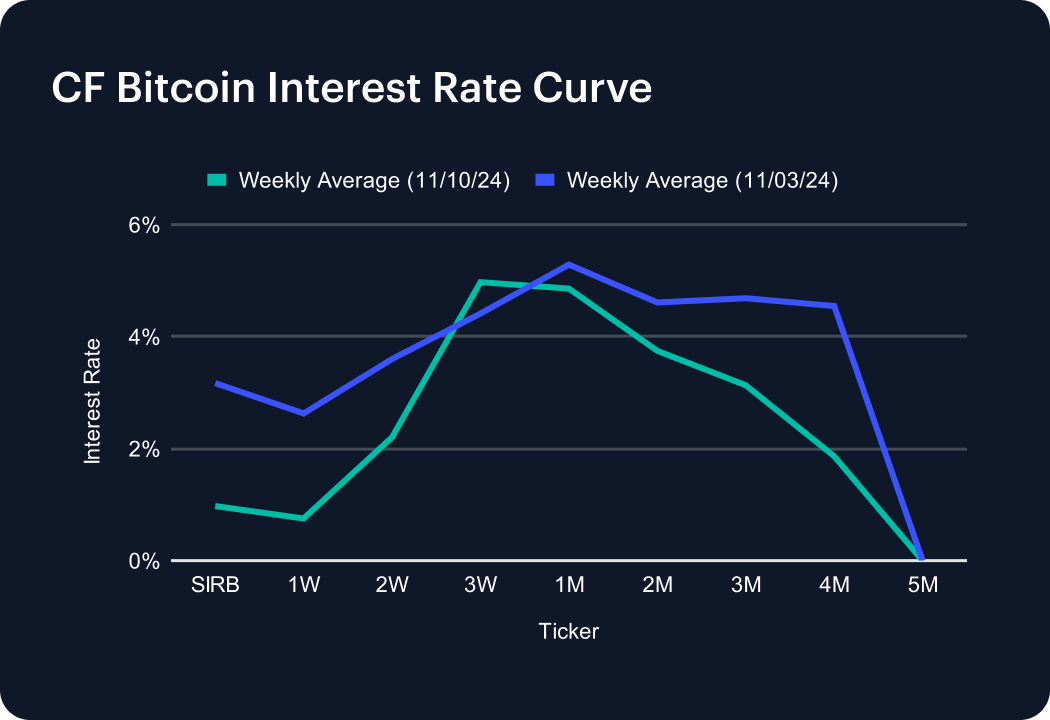

We’d like to spotlight the addition of the Bitcoin Futures Basis to the CF Bitcoin Interest Rate Curve (CF BIRC) page. It depicts daily changes of the front contract basis of the fixed maturity futures contract data utilized within the CF BIRC. The module can be found below the main CF BIRC term structure graphic, with a summary of its methodology available by hovering over the ‘info’ logo. As for the CF BIRC, it saw a rather nondescript week, with participants potentially in a holding pattern. For instance, the session rate dipped from circa 3 basis points to below 1 bp (~0.009%). The 3-week tenor edged slightly less than 0.5 bp higher to about 5 bp, and the 5-month rate was apparently completely untouched, remaining at zero.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Regulatory Gridlock and Geopolitical Shock

Our market recap offers a concise overview of key blockchain categories and their recent price action within the broader market context, providing valuable insights for investors and industry practitioners.

Mark Pilipczuk

Weekly Index Highlights, March 2, 2026

Digital assets rallied up to the end of the prior business week before abruptly retreating at the weekend. Earlier, SOL led +8.2% with ETH +5.6% and BTC +1.9%, enabling Programmable tokens to average +5.2%. Realized volatility proved sensitive to geopolitics, rising despite BVXS implied vol's fall.

CF Benchmarks

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks