Sep 12, 2022

Pre-Merge Dynamics Rippling Through Markets

The world's most popular programmable blockchain is set for a major upgrade this week: the Ethereum blockchain will switch over its process for executing transactions and mining to a Proof-of-Stake (PoS) consensus mechanism. This change may seem to be superficial at first glance, but it has so far had a profound impact on crypto markets.

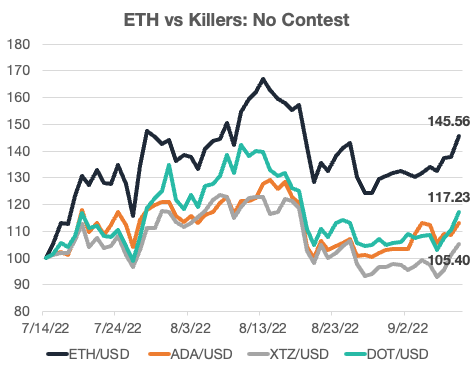

Firstly, we have seen ETH dominate its competitors since the Ethereum Foundation publicly announced their planned 'Merge' timeline in mid-July. So-called ETH Killers, such as Cardano (ADA), Tezos (XTZ), and Polkadot (DOT), have underperformed their blue-chip competitor by 34 percentage points on average and in absolute terms. The ETH Killers cohort has historically set themselves apart by utilizing more advanced protocol mechanisms (such as PoS). Lately, investors seem to be discounting this historical 'edge' given that ETH will now have mostly the same features that make these competitors faster and more efficient, but without ETH's much larger, more established user-base.

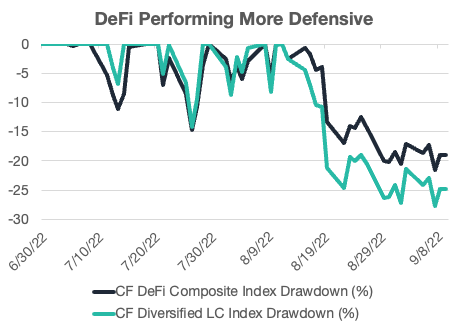

This bullish ETH sentiment has helped the crypto market stabilize much quicker during the most recent August pullback. Taking a closer look, price action in the DeFi space has been especially resilient. This is due to that fact that the Ethereum blockchain remains the most critical for Finance protocols. Currently, DeFi tokens running on Ethereum attribute to $35B of the $60B in total value locked (TVL), according to defillama.com.

Outside of the obvious benefits of higher speed and bandwidth, the decision to adopt a PoS blockchain will allow environmentally conscious institutions to utilize Ethereum at a much larger scale, pathing the way for mass institutional adoption. When comparing the max drawdown over the current quarter, we have seen the relative outperformance of DeFi protocols fend off the 20% threshold much better than the broader market.

If you are interested in learning more about how the upcoming merge has been impacting crypto markets, then please click here to read our latest attribution report on our flagship indices.

The information contained within is for educational and informational purposes ONLY. It is not intended nor should it be considered an invitation or inducement to buy or sell any of the underlying instruments cited including but not limited to cryptoassets, financial instruments or any instruments that reference any index provided by CF Benchmarks Ltd. This communication is not intended to persuade or incite you to buy or sell security or securities noted within. Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Please contact your financial adviser or professional before making an investment decision.

Note: Some of the underlying instruments cited within this material may be restricted to certain customer categories in certain jurisdictions.

Changes to the Potentially Erroneous Data Provisions in the CF Volatility Series Methodology

The Administrator announces changes to the potentially erroneous data provisions of the CF Volatility Series methodology.

CF Benchmarks

Not All Cryptos Are the Same: How CF Factor Data Reveals Sensitivities Across the Digital Asset Taxonomy

We show how combining the CF DACS taxonomy with the CF Factor Data Series reveals sensitivities that enable institutional-grade returns attribution, risk monitoring and strategic implementation.

CF Benchmarks

Factor Friday

The defensive regime remains firmly in control. Downside Beta continues to dominate while Growth and Value have continued to lag since October. Momentum's recent surge and The Settlement category's relative resilience are the two threads worth pulling on this week.

Mark Pilipczuk